HMRC Payslip Check: Unclaimed Refunds For Millions

Table of Contents

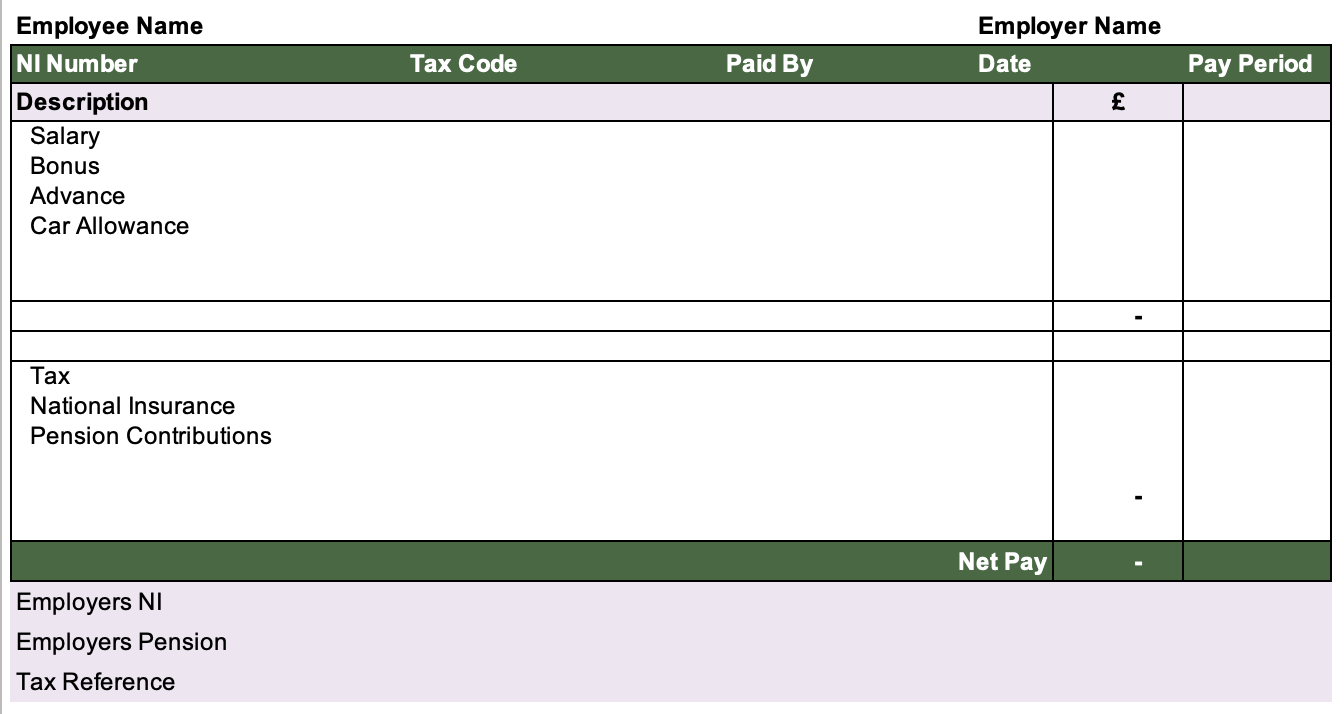

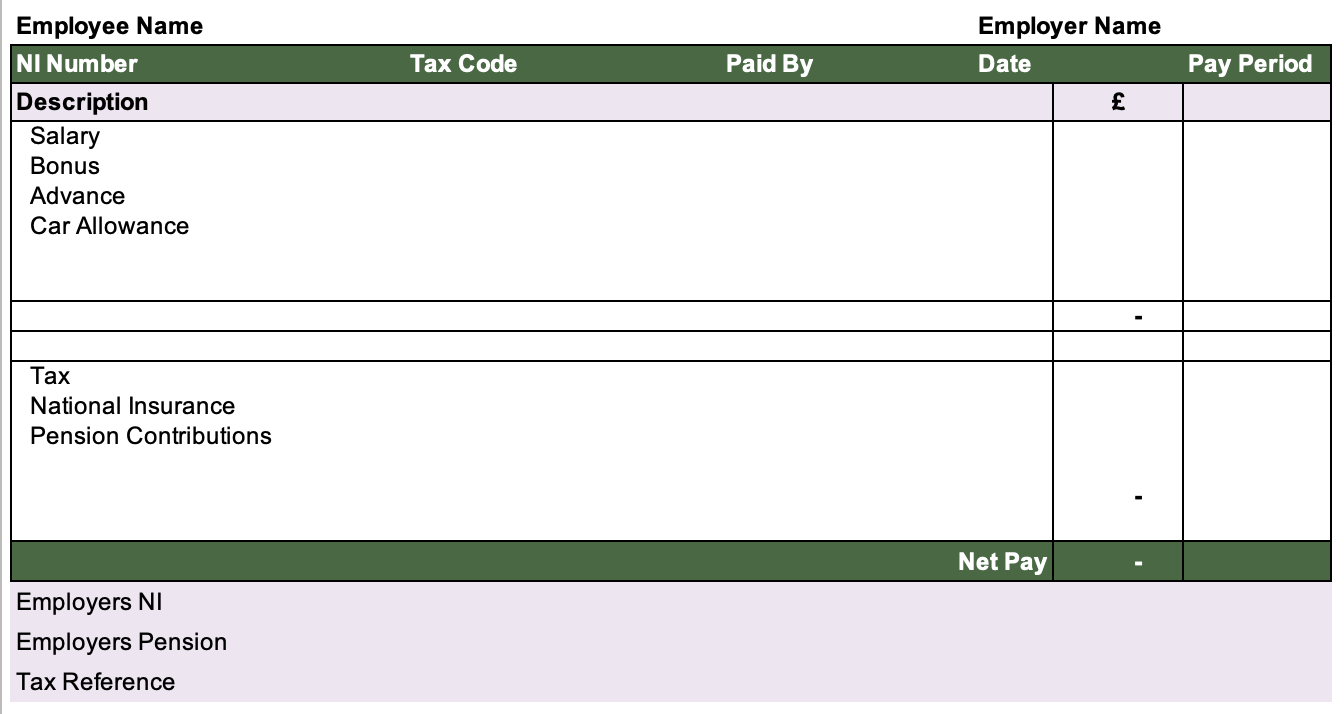

Understanding Your HMRC Payslip

Understanding your HMRC payslip is the first step towards identifying potential tax refunds. A thorough HMRC payslip analysis can reveal overpayments and help you reclaim your unclaimed money.

Deciphering Key Information

Your payslip contains crucial information about your earnings and tax deductions. Understanding components like your tax code, PAYE (Pay As You Earn) deductions, and National Insurance contributions is essential for accurate HMRC payslip analysis.

- Tax Code: This code determines how much tax is deducted from your earnings. An incorrect tax code can lead to overpayment.

- PAYE Deductions: This shows the amount of income tax deducted. Compare this to your expected tax liability based on your earnings and tax code.

- National Insurance Contributions: This contribution funds the UK's social security system. Check for any discrepancies here as well.

- Gross Pay: Your total earnings before deductions.

- Net Pay: Your earnings after all deductions.

Potential discrepancies might include:

- Inconsistent tax codes across multiple payslips.

- PAYE deductions significantly higher than expected.

- Incorrectly reported earnings or benefits.

- Missing or inaccurate National Insurance contributions.

Watch out for any inconsistencies or values that seem unusually high or low. These could indicate errors that warrant further investigation via a PAYE refund check.

Identifying Potential Errors

Spotting errors on your HMRC payslips is crucial for claiming a tax refund. Common mistakes include:

- Incorrect Tax Codes: A wrong tax code is a frequent cause of overpayment.

- Under-reported Expenses: If you're entitled to tax relief on certain expenses (e.g., childcare, work-related travel), ensure these are correctly reflected.

- Incorrectly Calculated Tax: Manual calculations can sometimes lead to errors. Always cross-reference with online HMRC tools.

Examples of incorrect tax codes might include:

- A code that doesn't reflect your marital status or allowances.

- A code assigned due to a previous job that’s no longer applicable.

How to Conduct an Effective HMRC Payslip Check

Conducting a thorough HMRC payslip check involves careful organization and utilization of available resources.

Gathering Your Payslips

Collecting all relevant payslips for the tax year is paramount. Ideally, keep payslips for at least three years for potential audits or tax reclaim.

- How Many Years? Keep payslips for at least three years, ideally six, to cover potential tax adjustments and reclaim opportunities.

- Organization: Use a filing system (physical or digital) to keep your payslips organized by tax year.

- Digital vs. Paper: Digital copies are convenient, but ensure you keep secure backups.

Utilizing Online HMRC Tools

The HMRC website provides valuable tools to verify your tax information and conduct an effective HMRC payslip check.

- Accessing Your Online Account: Log in to your personal tax account to access your tax statements and payslip information.

- Downloading Tax Statements: Download your Self Assessment tax return and P60 to compare with your payslip data.

- Understanding Online Portals: Familiarize yourself with the online portals to efficiently navigate tax information.

Seeking Professional Help

If you encounter difficulties understanding your payslips or navigating the HMRC online services, consider seeking professional help.

- Benefits of Professional Guidance: Tax advisors and accountants provide expertise in tax regulations and can streamline the claim process.

- When to Seek Assistance: If you're unsure about any aspect of your payslip or the tax refund claim process, seek professional advice.

- Cost Considerations: Professional fees vary depending on the complexity of your case.

Claiming Your Unclaimed Tax Refund

Once you've identified a potential overpayment, it's time to file your claim.

The Claim Process

Filing a tax refund claim with HMRC is usually straightforward.

- Necessary Documentation: You will likely need your payslips, P60, and possibly other supporting documentation.

- Online Submission: The HMRC website offers online submission forms for tax refund claims.

- Expected Processing Time: The processing time varies; allow several weeks for a response.

- Rejected Claims: If your claim is rejected, understand the reasons and address them before resubmitting.

Understanding Time Limits

There are time limits for claiming tax refunds.

- Statute of Limitations: Generally, you have a certain number of years (usually four) to claim a tax refund from the time the tax year ends.

- Penalties for Late Claims: Missing the deadline can result in penalties or the loss of your entitlement.

Conclusion

Regularly checking your HMRC payslips is vital for identifying potential overpayments and claiming unclaimed tax refunds. Millions of pounds go unclaimed each year – don't let yours be one of them. Take control of your finances today! Conduct your HMRC payslip check now and reclaim what's rightfully yours. Don't delay – start your refund claim process today. Learn more about how to optimize your HMRC payslip review for maximum refund potential.

Featured Posts

-

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025 -

Sezon Baslamadan Sok Ayrilik Tadic Fenerbahce Ye Veda Ediyor

May 20, 2025

Sezon Baslamadan Sok Ayrilik Tadic Fenerbahce Ye Veda Ediyor

May 20, 2025 -

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Sti Dimokratiki

May 20, 2025 -

Ealm Ajatha Krysty Mn Khlal Edst Aldhkae Alastnaey

May 20, 2025

Ealm Ajatha Krysty Mn Khlal Edst Aldhkae Alastnaey

May 20, 2025 -

Znakomstvo S Mirroy Andreevoy Biografiya I Put K Uspekhu V Tennise

May 20, 2025

Znakomstvo S Mirroy Andreevoy Biografiya I Put K Uspekhu V Tennise

May 20, 2025