HMRC Tax Code Changes: A Guide For Workers With Savings

Table of Contents

Understanding Your HMRC Tax Code

What is a Tax Code?

Your tax code is a number assigned by HMRC that determines how much Income Tax is deducted from your earnings through PAYE (Pay As You Earn). It essentially dictates your tax-free allowance. The code reflects your personal allowance and other factors affecting your tax liability.

- Examples of tax codes: 1257L, 1100L, 1060L, BR, K

- Understanding the numbers and letters: The numbers represent your taxable income, while the letters indicate any adjustments or additional allowances. For example, 'L' often signifies a tax code for a lower earner. 'BR' means basic rate only.

- PAYE vs. Self-Assessment: PAYE is for employees, where tax is deducted at source. Self-assessment applies to the self-employed and those with complex income streams, requiring them to file a tax return.

How Savings Affect Your Tax Code

Interest earned on savings and investments is taxable income and can affect your tax code. The amount of tax you pay depends on your tax band and the amount of interest earned.

- Interaction between savings interest and your tax band: Savings interest is added to your other income to determine your overall tax liability. This might push you into a higher tax band.

- Starting rate for savings and higher rates: The starting rate for savings is a lower rate of tax applied to the first portion of your savings income, helping low-income savers. Higher rates apply to interest above certain thresholds.

- Tax implications of different savings accounts: ISAs (Individual Savings Accounts) offer tax-free savings, while Premium Bonds offer tax-free prizes. Other savings accounts typically have interest taxable as income.

Identifying Potential Tax Code Changes

Life events can trigger HMRC tax code adjustments. It's crucial to notify HMRC of any changes promptly to prevent tax discrepancies.

- Events leading to tax code changes: Marriage, a new job, a significant change in income, a substantial increase in savings, starting a pension, changes in childcare arrangements, and moving house can all cause your tax code to be amended.

- Importance of notifying HMRC: Failure to inform HMRC of changes can lead to underpayment or overpayment of tax, resulting in penalties. Use the HMRC online portal or contact them directly to notify any changes.

Common HMRC Tax Code Changes Affecting Savers

Changes Due to Increased Savings Income

Higher savings interest can lead to higher tax liability and a tax code adjustment.

- Scenarios leading to increased tax: Larger investment returns, increased interest rates on savings accounts, or substantial inheritance received that generates investment income can all push you into a higher tax bracket.

- Higher tax code or additional tax: HMRC may adjust your tax code to reflect the increased taxable income, or you might receive a tax bill for the additional tax owed.

Changes Related to Pension Contributions

Pension contributions reduce your taxable income, potentially leading to a lower tax code or a larger tax refund.

- Tax relief on pension contributions: The government provides tax relief on pension contributions, meaning you only pay tax on the net amount contributed.

- Impact on tax code: This can result in a lower tax code reflecting reduced taxable income, or potentially a tax refund at the end of the tax year. Accurate reporting of pension contributions is vital.

Errors and Corrections in Your Tax Code

If you suspect an error in your tax code, take immediate action.

- Steps to contact HMRC: Use the HMRC website, phone, or write to them to report suspected errors. Keep records of all communication.

- Requesting a tax code correction: Explain the error and provide supporting documentation.

- Resolving discrepancies: HMRC will investigate and adjust your tax code if necessary. Accurate record-keeping is crucial for efficient resolution.

Resources and Further Support

Contacting HMRC

- HMRC website: www.gov.uk/government/organisations/hm-revenue-customs

- HMRC phone number: Check the HMRC website for the most up-to-date contact information as numbers can change.

- HMRC online portal: Access your personal tax account online to manage your tax affairs.

Seeking Professional Advice

Seeking help from a qualified accountant or financial advisor can be beneficial, particularly in complex situations.

- When professional help is advisable: Complex savings portfolios, significant changes in income, self-employment, and large inheritance received all benefit from the expertise of a financial professional.

Conclusion

Understanding HMRC tax code changes is crucial for workers with savings to manage their finances effectively and avoid tax penalties. By staying informed about potential changes resulting from increased savings income, pension contributions, or other life events, you can ensure accurate tax calculations and maintain a healthy financial standing. Remember to keep accurate records and promptly notify HMRC of any significant changes to your circumstances. If you're unsure about any aspect of your tax code, don't hesitate to seek professional advice or contact HMRC for clarification. Take control of your finances by staying informed about all HMRC tax code changes and variations.

Featured Posts

-

How Brexit Is Hindering Uk Luxury Exports To The European Union

May 20, 2025

How Brexit Is Hindering Uk Luxury Exports To The European Union

May 20, 2025 -

Gonka Ferrari Prichiny Diskvalifikatsii Leklera I Khemiltona

May 20, 2025

Gonka Ferrari Prichiny Diskvalifikatsii Leklera I Khemiltona

May 20, 2025 -

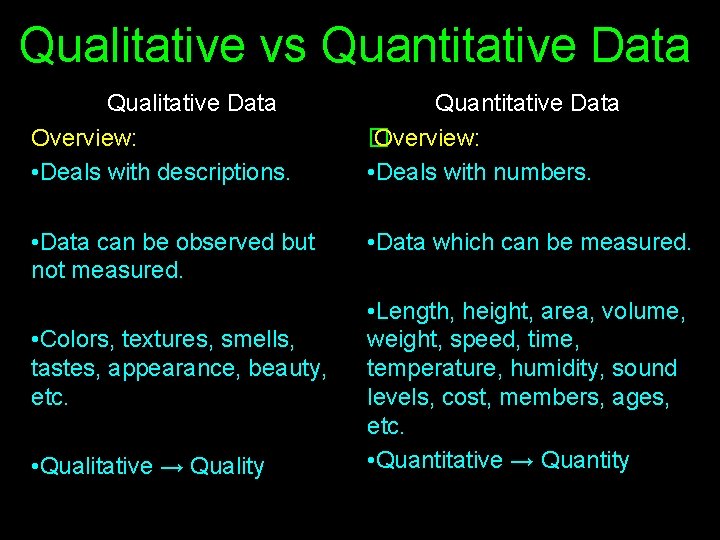

Trumps Aerospace Deals A Quantitative And Qualitative Analysis

May 20, 2025

Trumps Aerospace Deals A Quantitative And Qualitative Analysis

May 20, 2025 -

Mark Rylance On Music Festivals And The State Of Londons Parks

May 20, 2025

Mark Rylance On Music Festivals And The State Of Londons Parks

May 20, 2025 -

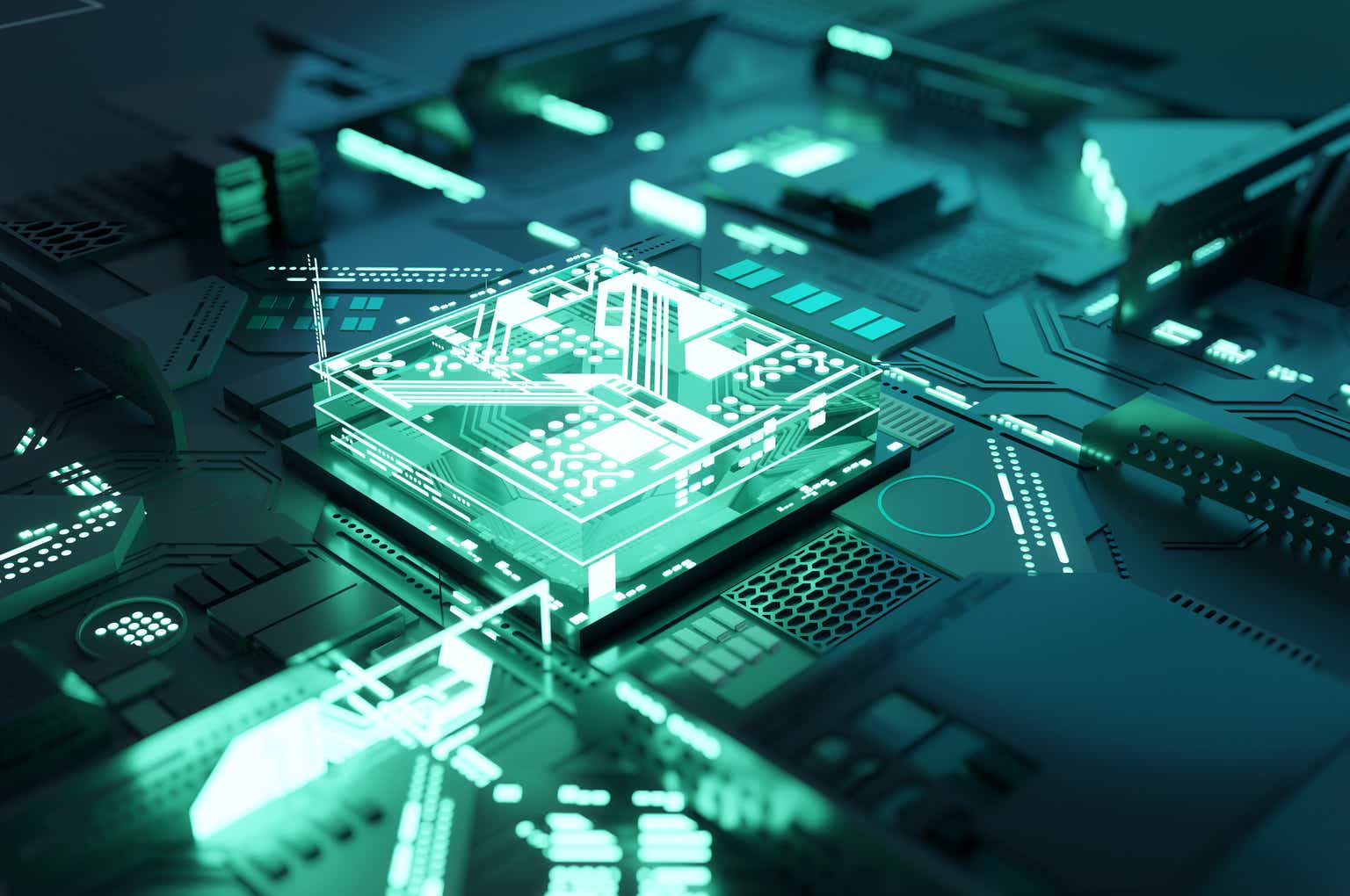

Analyzing The Factors Contributing To D Wave Quantum Qbts Stock Growth

May 20, 2025

Analyzing The Factors Contributing To D Wave Quantum Qbts Stock Growth

May 20, 2025