House Plan Slaps Harvard And Yale With Significant Endowment Tax Increases

Table of Contents

Details of the Proposed Endowment Tax Increase

The proposed plan details a substantial percentage increase in taxes levied on the investment returns of university endowments. While the exact percentage is still under debate (and may vary depending on the final version of the legislation), early proposals suggest a significant jump, potentially reaching [Insert Proposed Percentage]% on annual investment income. This is a departure from the current tax structure, which offers more favorable treatment to nonprofit organizations like universities.

- Proposed Tax Rate on Endowment Earnings: [Insert Specific Percentage or Range]. This means a significant increase from the current [Insert Current Rate or Explain Current Tax Structure].

- Types of Endowment Assets Subject to Tax: The tax is likely to apply to a broad range of endowment assets, including stocks, bonds, real estate, and private equity investments. [Further clarify any nuances or exceptions based on the proposed legislation].

- Exemptions and Exceptions: [Specify any proposed exemptions or exceptions. For instance, are there specific types of investments or grants exempt from the increased tax? Are there any provisions for smaller endowments?]. The lack of clarity around these details contributes to the ongoing debate surrounding this legislation.

Harvard and Yale's Response to the Proposed Tax Increase

Both Harvard and Yale have responded forcefully to the proposed tax increase. Statements from university officials have emphasized the potential negative consequences for financial aid programs, research initiatives, and overall institutional operations. They argue the tax increase would disproportionately affect their ability to provide financial assistance to students and invest in vital research projects that benefit society as a whole.

- Statements from University Officials: [Summarize official statements, citing specific quotes if available. Focus on the key concerns raised by the universities].

- Potential Legal Challenges and Lobbying Efforts: Both institutions are expected to explore all legal avenues to challenge the tax increase and are likely to engage in significant lobbying efforts to influence legislators. [Detail any ongoing legal actions or lobbying campaigns, citing sources].

- Impact on University Financial Aid Programs: A major concern highlighted by both universities is the potential for reduced financial aid for students. The decreased investment income directly impacts the university's ability to support its need-blind admissions policy and offer generous financial aid packages to deserving students.

Potential Wider Implications for Higher Education

The proposed tax on Harvard and Yale's endowments has far-reaching implications for higher education. It sets a potential precedent for similar tax increases on other universities with large endowments, jeopardizing the financial stability of many institutions and potentially triggering a ripple effect across the entire sector.

- Impact on University Research and Development Funding: Reduced endowment income could lead to significant cuts in research funding, potentially hindering innovation and progress in various fields. This would have serious consequences for scientific breakthroughs and societal advancement.

- Effect on Tuition Costs, Student Financial Aid, and Faculty Salaries: The tax increase could necessitate tuition hikes to compensate for lost revenue, potentially making higher education less accessible. This could also affect faculty salaries and the university's ability to attract and retain top talent.

- Potential for Legal Challenges from Other Universities: Other universities with substantial endowments may face similar tax increases in the future, potentially leading to a wave of legal challenges and a significant shift in how higher education is funded.

Political and Economic Context of the Endowment Tax Increase

The proposed tax increase isn't occurring in a vacuum. It's part of a broader political discussion surrounding wealth inequality and the taxation of large endowments. Proponents argue that universities with vast endowments have a responsibility to contribute more significantly to public services, citing the potential for these funds to address social and economic disparities.

- Political Motivations: [Analyze the political motivations behind the proposed tax, including the potential influence of political parties and interest groups].

- Economic Arguments Supporting the Tax Increase: Supporters point to the vast wealth accumulated by these institutions and argue that a portion of this wealth should be used to fund essential public services, particularly given concerns about wealth inequality.

- Counter-Arguments Against the Tax Increase: Critics argue that the tax increase could stifle philanthropy, discourage future donations, and ultimately harm the universities' ability to support research, education, and financial aid. They also highlight the potential negative impact on the overall economy.

Conclusion

The proposed House plan to significantly increase taxes on the endowments of Harvard and Yale represents a watershed moment for higher education. The significant financial implications for these institutions and the potential ramifications for other universities with large endowments are substantial. Reduced investment income could lead to cuts in research funding, increased tuition costs, and decreased financial aid for students. The debate surrounding this plan highlights the complex interplay between wealth, taxation, and the future of higher education funding. Stay informed about the developments surrounding the "House Plan Slaps Harvard and Yale with Significant Endowment Tax Increases" and its potential consequences for the future of higher education funding. Research the bill further and contact your representatives to voice your opinions on university endowment tax, higher education funding, wealth tax, and nonprofit taxation policies.

Featured Posts

-

Japans Cherry Blossom Season Your Springwatch Itinerary

May 13, 2025

Japans Cherry Blossom Season Your Springwatch Itinerary

May 13, 2025 -

The Gaza Hostage Crisis A Continuing Tragedy For Families

May 13, 2025

The Gaza Hostage Crisis A Continuing Tragedy For Families

May 13, 2025 -

Cineplex Q1 Loss Theatre Attendance Decline Impacts Results

May 13, 2025

Cineplex Q1 Loss Theatre Attendance Decline Impacts Results

May 13, 2025 -

Is Nba Tankathon The Next Big Thing For Miami Heat Fans

May 13, 2025

Is Nba Tankathon The Next Big Thing For Miami Heat Fans

May 13, 2025 -

White House Minimizes Auto Industrys Uk Trade Deal Concerns

May 13, 2025

White House Minimizes Auto Industrys Uk Trade Deal Concerns

May 13, 2025

Latest Posts

-

Broadcoms Proposed V Mware Price Increase A 1 050 Jump Says At And T

May 14, 2025

Broadcoms Proposed V Mware Price Increase A 1 050 Jump Says At And T

May 14, 2025 -

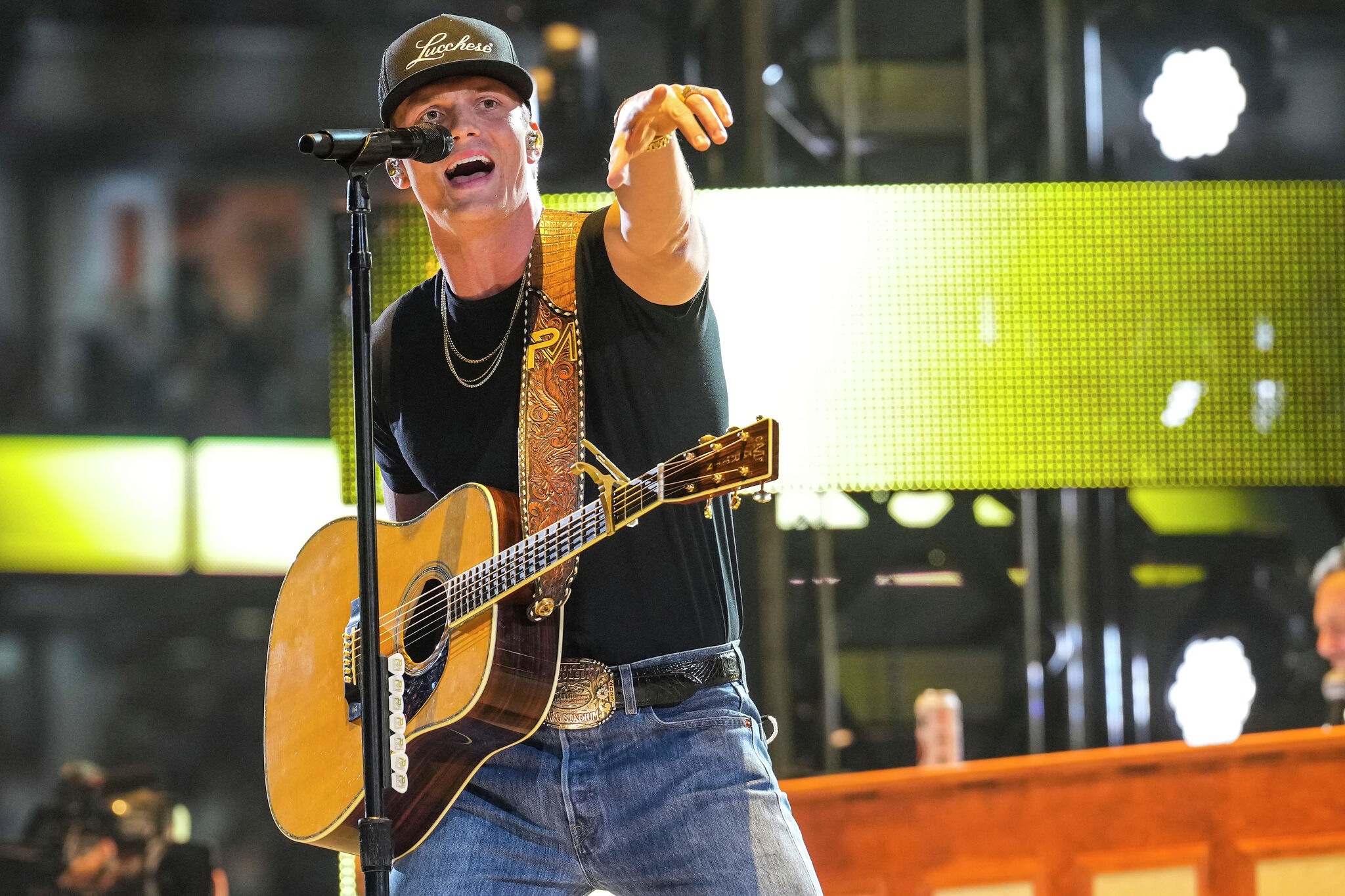

Why Fans Are Comparing Parker Mc Collum To George Strait

May 14, 2025

Why Fans Are Comparing Parker Mc Collum To George Strait

May 14, 2025 -

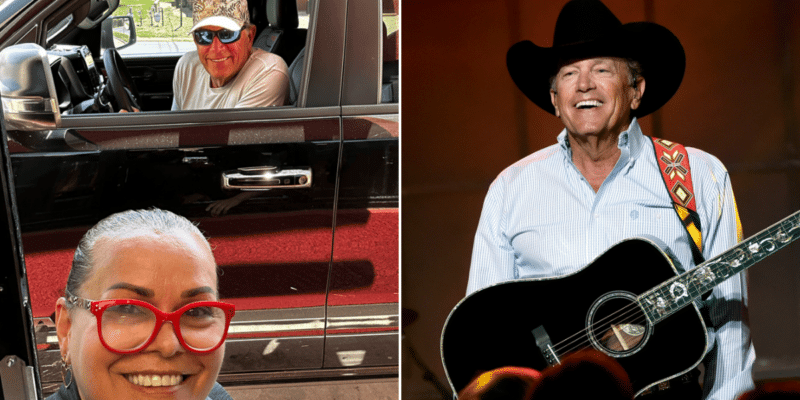

George Strait At Dairy Queen Country Stars Unexpected Drive Thru Visit

May 14, 2025

George Strait At Dairy Queen Country Stars Unexpected Drive Thru Visit

May 14, 2025 -

Extreme Price Hike Concerns At And T On Broadcoms V Mware Acquisition

May 14, 2025

Extreme Price Hike Concerns At And T On Broadcoms V Mware Acquisition

May 14, 2025 -

Is Parker Mc Collum The Next George Strait Comparing Their Careers

May 14, 2025

Is Parker Mc Collum The Next George Strait Comparing Their Careers

May 14, 2025