How Student Loans Impact Your Ability To Buy A House

Table of Contents

The Impact of Student Loan Debt on Your Credit Score

Your credit score is a crucial factor in securing a mortgage. Student loan payments, whether on-time or late, directly influence your credit score. A consistent history of on-time payments demonstrates responsible financial behavior, leading to a higher credit score. Conversely, late or missed payments can severely damage your score, making it harder to qualify for a mortgage. A higher credit score translates to better mortgage interest rates, potentially saving you thousands of dollars over the life of your loan. A lower credit score, on the other hand, may result in a higher interest rate or even loan denial.

- Late payments severely damage your credit score. Even a single late payment can negatively impact your score and remain on your report for several years.

- A higher credit score qualifies you for better mortgage terms. This includes lower interest rates, better loan-to-value ratios, and potentially more favorable loan options.

- Credit score impacts your ability to secure a loan. Lenders use credit scores as a primary indicator of risk. A poor credit score significantly reduces your chances of getting approved for a mortgage.

- Tools to monitor your credit score and improve it. Regularly checking your credit report through services like AnnualCreditReport.com and utilizing credit-building strategies can help you maintain a healthy score.

Debt-to-Income Ratio (DTI) and Student Loan Repayments

Your debt-to-income ratio (DTI) is a critical factor lenders consider when evaluating your mortgage application. DTI represents the percentage of your gross monthly income that goes towards debt repayment, including student loans, credit cards, and other loans. Significant student loan payments can substantially increase your DTI, reducing your chances of mortgage approval. Lenders prefer borrowers with lower DTIs, as it indicates a greater capacity to manage debt and repay the mortgage.

- Lenders use DTI to assess your ability to manage debt. A high DTI suggests you may struggle to make your mortgage payments alongside other debt obligations.

- High DTI reduces your chances of mortgage approval. Many lenders have DTI thresholds, and exceeding them often leads to loan rejection.

- Strategies for lowering your DTI before applying for a mortgage. Consider making extra student loan payments, paying off high-interest debts, and exploring different student loan repayment options to reduce your monthly payments.

- Explore different repayment options for student loans. Income-driven repayment plans, for instance, can adjust your monthly payments based on your income, potentially lowering your DTI.

How Student Loans Affect Your Savings for a Down Payment

Saving for a down payment is a significant hurdle for many aspiring homeowners, especially those burdened with student loan debt. The substantial monthly student loan payments can significantly reduce your ability to save money for a down payment. Furthermore, the interest paid on student loans diminishes the amount available for savings, further extending the time required to reach your down payment goal.

- The longer it takes to save for a down payment, the longer you delay homeownership. This delay can lead to missed opportunities in the real estate market.

- Strategies for budgeting and saving effectively with student loan debt. Create a detailed budget, prioritize savings, and explore opportunities to increase your income.

- Exploring options for smaller down payments or government-backed loans. FHA loans, for example, often require smaller down payments than conventional loans.

Strategies for Managing Student Loan Debt and Buying a House

Managing student loan debt while aiming for homeownership requires careful planning and strategic action. Several options exist to alleviate the financial burden and enhance your chances of securing a mortgage.

- Refinancing student loans can reduce monthly payments. Refinancing to a lower interest rate can significantly lower your monthly payments, freeing up funds for savings.

- Income-driven repayment plans can make student loan payments more manageable. These plans adjust your monthly payments based on your income, potentially lowering your DTI and improving your chances of mortgage approval.

- Seek professional advice from a financial advisor. A financial advisor can offer personalized guidance on debt management, budgeting, and financial planning for homeownership.

- Create a detailed budget to track expenses and savings. This allows for better financial management and ensures you're allocating sufficient funds towards your down payment and debt reduction.

Conclusion

Student loan debt presents a significant hurdle for many aspiring homeowners. Understanding how it affects your credit score, DTI, and savings is crucial for successful homeownership planning. Don't let student loans derail your dream of owning a home. By carefully managing your debt, improving your credit score, and strategizing your savings, you can increase your chances of securing a mortgage. Start planning your financial future today and learn more about how to navigate the complexities of buying a house while managing your student loan debt.

Featured Posts

-

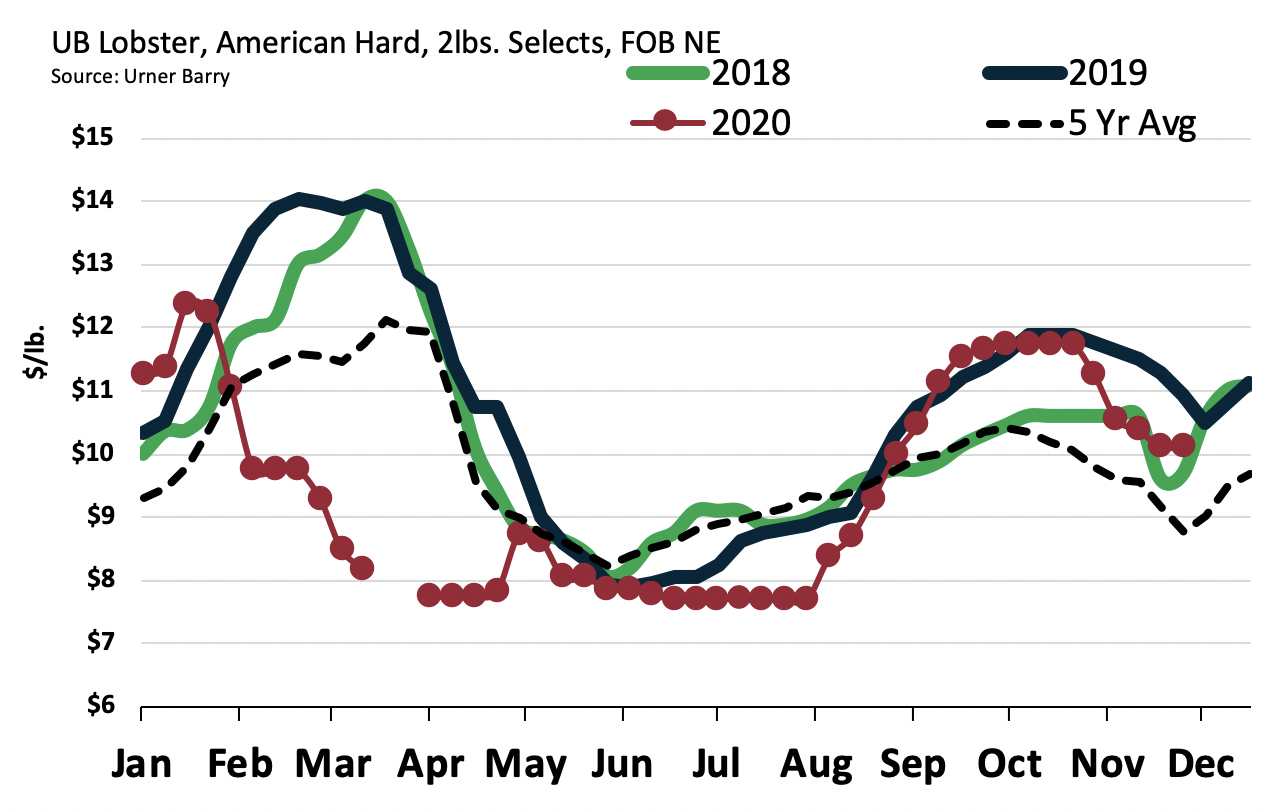

Low Lobster Prices And Global Economic Turmoil Impact Atlantic Canadas Fishing Industry

May 17, 2025

Low Lobster Prices And Global Economic Turmoil Impact Atlantic Canadas Fishing Industry

May 17, 2025 -

Live Network18 Media And Investments Share Price April 21 2025 Nse Bse Data And Expert Opinion

May 17, 2025

Live Network18 Media And Investments Share Price April 21 2025 Nse Bse Data And Expert Opinion

May 17, 2025 -

Jenis Jenis Laporan Keuangan Yang Penting Untuk Bisnis

May 17, 2025

Jenis Jenis Laporan Keuangan Yang Penting Untuk Bisnis

May 17, 2025 -

Segundo Mandato De Trump Impacto En Los Deudores De Prestamos Estudiantiles

May 17, 2025

Segundo Mandato De Trump Impacto En Los Deudores De Prestamos Estudiantiles

May 17, 2025 -

Celebrating Local Stem Scholars Achievements And Impact

May 17, 2025

Celebrating Local Stem Scholars Achievements And Impact

May 17, 2025

Latest Posts

-

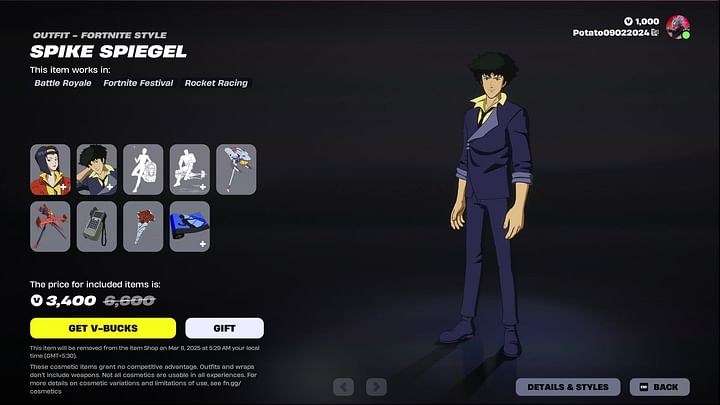

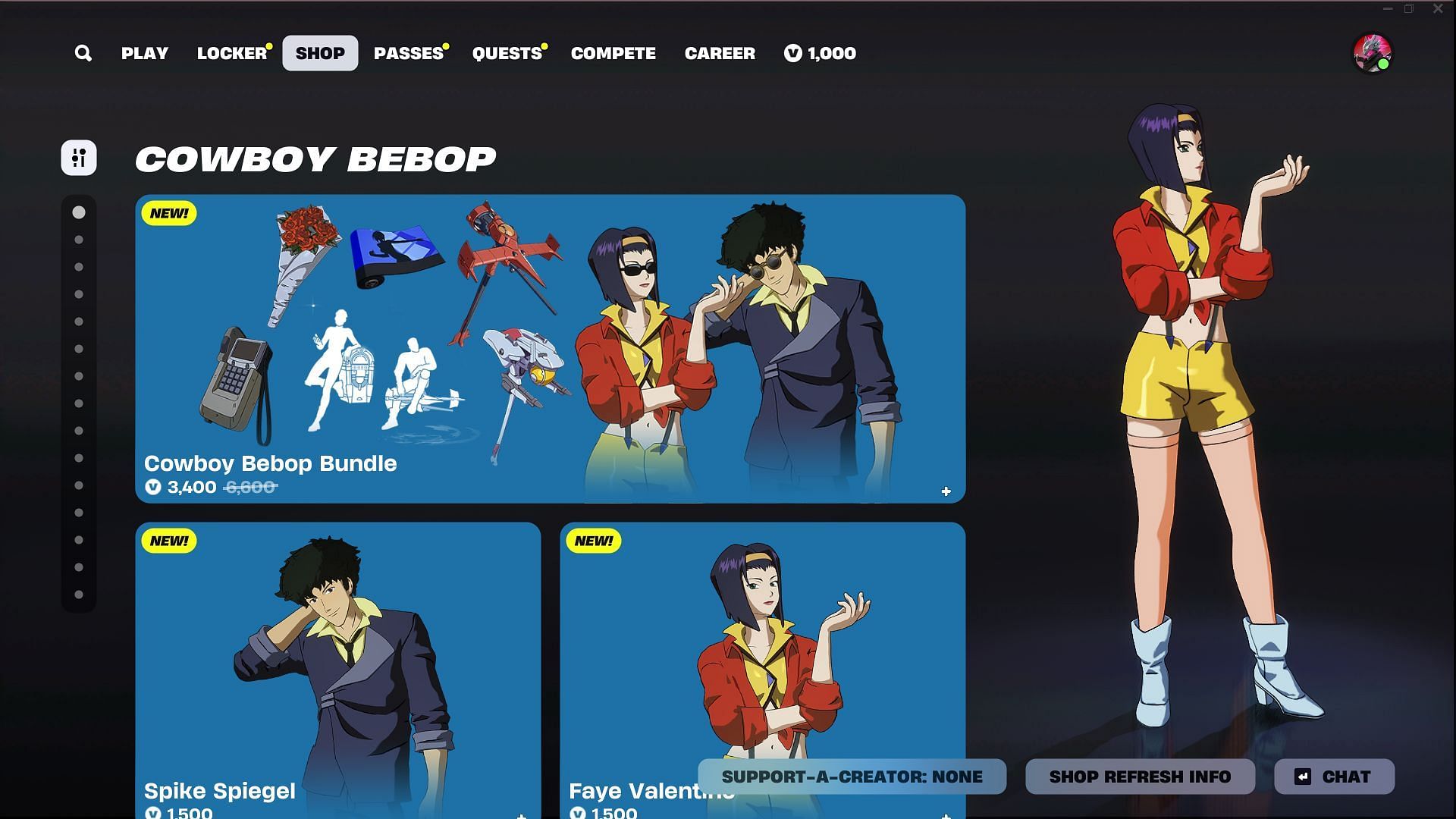

Are The Faye Valentine And Spike Spiegel Fortnite Skins Worth The Price

May 17, 2025

Are The Faye Valentine And Spike Spiegel Fortnite Skins Worth The Price

May 17, 2025 -

Faye Valentine And Spike Spiegel Fortnite Skins Bundle Price And Where To Buy

May 17, 2025

Faye Valentine And Spike Spiegel Fortnite Skins Bundle Price And Where To Buy

May 17, 2025 -

Fortnite Item Shop Update The Return Of Classic Skins After 1000 Days

May 17, 2025

Fortnite Item Shop Update The Return Of Classic Skins After 1000 Days

May 17, 2025 -

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025 -

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025