How To Interpret The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) is simply the value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it represents the net worth of the ETF per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this calculation becomes slightly more complex due to the currency hedging.

The ETF invests in a globally diversified portfolio of stocks, primarily reflecting the MSCI World Index. The "USD Hedged" aspect means the fund aims to minimize the impact of fluctuations between the euro (the base currency of the UCITS ETF) and the US dollar. While this hedging reduces exposure to currency risk, it doesn't eliminate it entirely. The calculation itself remains the same: total assets (in USD after hedging) less liabilities (expenses, etc.), all divided by the number of outstanding shares.

- NAV reflects the intrinsic value of the ETF's holdings. This is distinct from the market price, which can fluctuate throughout the trading day.

- Daily NAV changes reflect market movements of the underlying assets. A rising market generally leads to a higher NAV, while a falling market leads to a lower NAV.

- Currency hedging minimizes exposure to exchange rate fluctuations. However, some residual currency risk remains.

- The Amundi MSCI World II UCITS ETF NAV is typically published daily. This allows investors to track the fund's performance closely.

Factors Affecting the Amundi MSCI World II UCITS ETF NAV

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF. Understanding these is crucial for interpreting NAV changes effectively.

The primary driver is the performance of the underlying assets—the global equities that make up the MSCI World Index. Positive performance in global markets generally leads to a higher NAV, while negative performance leads to a lower NAV.

Currency fluctuations, even with the USD hedging, can still exert a small influence. While the hedging aims to neutralize currency risk, unforeseen movements can subtly affect the final USD NAV.

Management fees and other expenses are deducted from the ETF's assets, resulting in a slightly lower NAV. These are typically small, but they cumulatively impact the NAV over time.

Finally, corporate actions such as dividends and stock splits within the underlying companies can impact the NAV. Dividends increase the cash component of the assets, while stock splits adjust the number of outstanding shares, indirectly affecting the NAV per share.

- Global market trends significantly influence the ETF's NAV. Strong global growth typically leads to higher NAVs.

- Residual currency risk despite hedging can slightly affect the NAV. This is generally minimized but not entirely eliminated.

- Management fees are deducted from the assets, slightly impacting NAV. These costs are a standard part of ETF investing.

- Corporate actions of underlying companies (dividends, stock splits) affect the NAV. These events can lead to short-term fluctuations.

How to Use NAV Information for Investment Decisions

Tracking the Amundi MSCI World II UCITS ETF NAV over time provides a clear picture of the ETF's long-term performance. Comparing the NAV to the market price (the price at which you can buy or sell the ETF) can reveal potential arbitrage opportunities, though these are often fleeting. The NAV acts as a benchmark for assessing the ETF's intrinsic value, helping you determine if the market price accurately reflects the underlying holdings.

- Monitor NAV trends to assess long-term performance. Consistent upward trends indicate healthy growth.

- Compare the NAV to the market price to identify potential arbitrage opportunities. This requires vigilance and a good understanding of market mechanics.

- Use the NAV as a benchmark for evaluating the ETF's value. It helps gauge whether the ETF is fairly priced in the market.

- Consult financial advisors for personalized investment strategies. A professional can help you integrate NAV data into a broader investment plan.

Accessing Amundi MSCI World II UCITS ETF NAV data

Reliable NAV data is readily available from various sources. You can typically find it on the official Amundi website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage platform. Always prioritize reputable sources to ensure the accuracy of your information.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for successful investing. By consistently monitoring Amundi MSCI World II UCITS ETF NAV changes, recognizing the factors influencing it, and using credible data sources, you can effectively track your investment's progress and make well-informed buy and sell decisions. Remember to always consult with a financial advisor before making significant investment choices related to the Amundi MSCI World II UCITS ETF NAV. Regularly reviewing the Amundi MSCI World II UCITS ETF NAV is a key element of responsible ETF investing.

Featured Posts

-

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 24, 2025

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 24, 2025 -

Escape To The Countryside A Comprehensive Relocation Guide

May 24, 2025

Escape To The Countryside A Comprehensive Relocation Guide

May 24, 2025 -

Escape To The Country Considerations Before Relocating To The Countryside

May 24, 2025

Escape To The Country Considerations Before Relocating To The Countryside

May 24, 2025 -

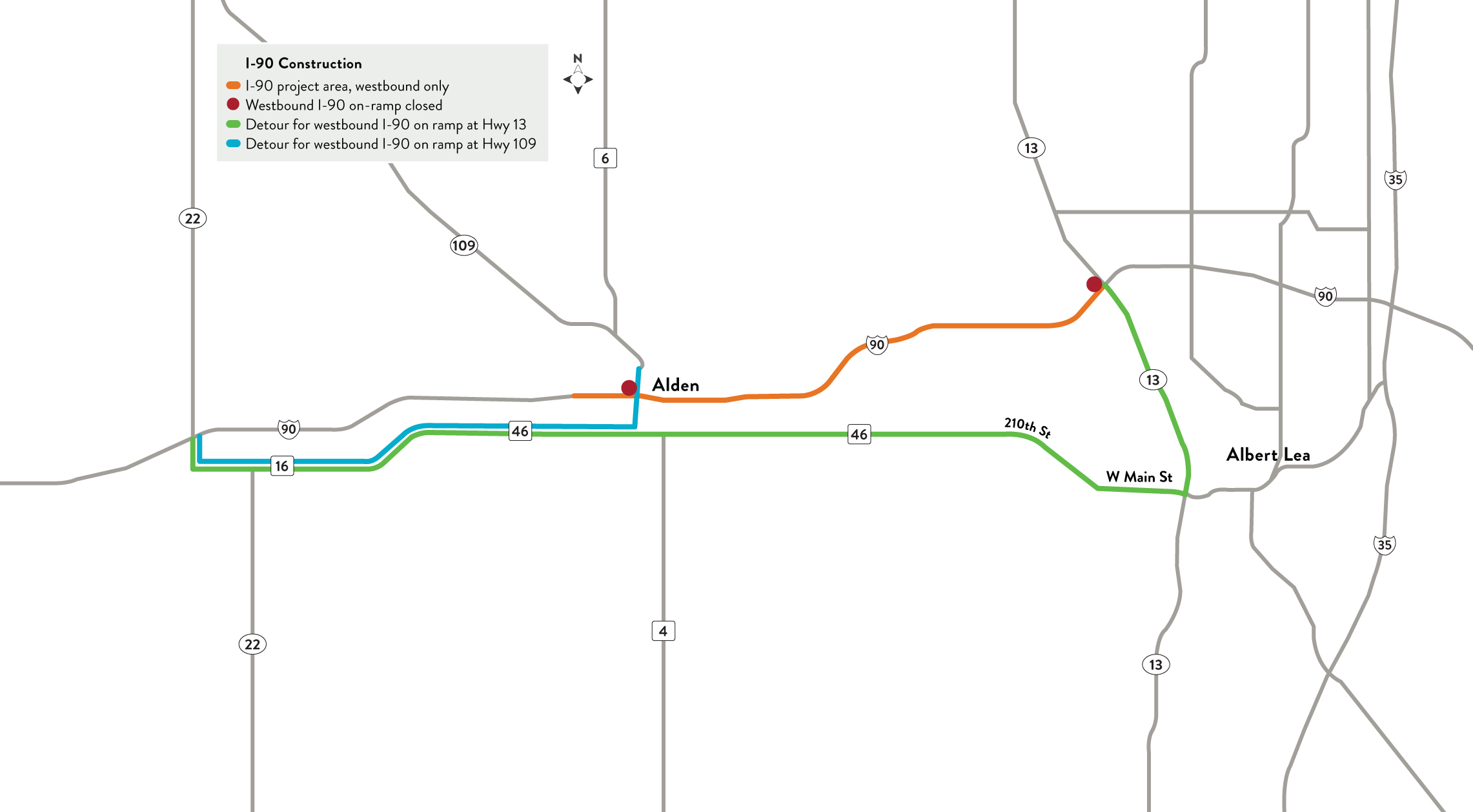

M62 Westbound Resurfacing Road Closure Manchester To Warrington

May 24, 2025

M62 Westbound Resurfacing Road Closure Manchester To Warrington

May 24, 2025 -

New Matt Maltese Album Her A Deep Dive Into Intimacy And Personal Growth

May 24, 2025

New Matt Maltese Album Her A Deep Dive Into Intimacy And Personal Growth

May 24, 2025

Latest Posts

-

Serious M56 Motorway Collision Car Overturn And Casualty Care

May 24, 2025

Serious M56 Motorway Collision Car Overturn And Casualty Care

May 24, 2025 -

Casualty Treated After Car Overturns On M56

May 24, 2025

Casualty Treated After Car Overturns On M56

May 24, 2025 -

The M62 Relief Road And Bury Examining A Failed Infrastructure Project

May 24, 2025

The M62 Relief Road And Bury Examining A Failed Infrastructure Project

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

The M62 Relief Road Burys Unrealised Transport Plan

May 24, 2025

The M62 Relief Road Burys Unrealised Transport Plan

May 24, 2025