Ignoring The Recession? Why Stock Investors Are Optimistic

Table of Contents

Strong Corporate Earnings and Resilient Businesses

Robust corporate earnings reports are a key factor defying recessionary predictions. Many companies are exceeding expectations, demonstrating the resilience of the business world. This strong economic performance is not uniform across all sectors, however.

- High-Performing Sectors: The technology and healthcare sectors, for example, continue to show remarkable strength, driven by innovation and consistent demand.

- Drivers of Strong Earnings: Companies are employing various strategies to maintain profitability, including strategic pricing power and efficient cost-cutting measures. This demonstrates adaptability and financial strength in the face of economic headwinds.

- Data-Driven Evidence: For instance, Company X reported a 15% increase in Q3 earnings, exceeding analyst predictions by 5%, highlighting the overall strength in corporate earnings. This strong economic performance is a significant contributor to investor confidence and stock market optimism.

These resilient businesses are a testament to the enduring nature of some industries and contribute significantly to the prevailing stock market optimism.

The Influence of Federal Reserve Policy and Inflation Expectations

The Federal Reserve's monetary policy plays a crucial role in shaping investor sentiment. The ongoing efforts to combat inflation through interest rate hikes significantly impact stock valuations. However, the market is also carefully considering the potential for a "soft landing"—a scenario where inflation is brought under control without triggering a severe recession.

- Interest Rate Hikes and Stock Valuations: Higher interest rates generally increase borrowing costs for businesses, potentially slowing economic growth and impacting stock prices. However, the market volatility resulting from these changes is not solely negative.

- The "Soft Landing" Scenario: The possibility of a soft landing, where inflation gradually decreases without causing a significant economic downturn, is a source of optimism for some investors. This scenario is carefully monitored by assessing the impact of interest rates and inflation on various economic indicators.

- Market Reaction to Inflation Data: The market's reaction to each inflation data release offers crucial insights into investor sentiment and expectations. Positive surprises regarding inflation can lead to increased stock market optimism, while negative surprises can increase market volatility.

Long-Term Growth Potential and Technological Innovation

Many investors are focusing on the long-term growth potential of specific sectors, mitigating concerns about short-term recessionary risks. Technological innovation is a key driver of this optimism.

- High-Growth Technologies: Artificial intelligence (AI), renewable energy, and biotechnology are just a few examples of sectors poised for significant long-term growth, creating exciting investment opportunities.

- New Investment Opportunities: These technologies are not only expected to drive future economic growth but are also creating new and innovative business models, presenting compelling investment prospects.

- Long-Term Perspective: Many investors are taking a long-term perspective, believing that the current economic uncertainty is a temporary setback in the face of substantial long-term growth potential fueled by technological advancements. This long-term growth outlook contributes to overall stock market optimism.

The Role of Investor Sentiment and Market Psychology

Investor sentiment and market psychology significantly influence market movements. This involves understanding concepts like "fear of missing out" (FOMO) and the impact of media narratives.

- Fear of Missing Out (FOMO): FOMO can lead to impulsive investment decisions, potentially driving up asset prices even in uncertain times.

- Market Speculation and Momentum Trading: Market speculation and momentum trading can amplify market swings, contributing to both upward and downward trends. This aspect of market psychology is crucial to understanding stock market optimism.

- Media Narratives and Investor Confidence: The media's portrayal of economic events can significantly shape investor confidence, impacting overall market sentiment and influencing investment decisions. Therefore, investor confidence is closely tied to media coverage and the prevailing narratives.

Understanding Stock Market Optimism in Uncertain Times – A Call to Action

In summary, several factors contribute to the persistent stock market optimism despite looming recessionary fears. Strong corporate earnings, the potential for a soft landing guided by Federal Reserve policy, the long-term growth potential of innovative technologies, and the influence of investor sentiment all play a role. It's crucial to remember that both short-term risks and long-term growth potential must be carefully considered.

The current economic climate demands a well-informed investment strategy. While stock market optimism offers potential upside, understanding the complexities of a potentially recessionary environment is paramount. Conduct thorough research, diversify your portfolio, and consider working with a financial advisor to develop a strategy aligned with your risk tolerance and long-term financial goals. Only through careful stock market analysis can you make informed investment decisions and navigate the current market conditions effectively.

Featured Posts

-

Are We In A Recession A Look At Investor Sentiment In The Stock Market

May 06, 2025

Are We In A Recession A Look At Investor Sentiment In The Stock Market

May 06, 2025 -

Sin Arnolda Svarcenegera Patrik O Izazovima Glumacke Karijere

May 06, 2025

Sin Arnolda Svarcenegera Patrik O Izazovima Glumacke Karijere

May 06, 2025 -

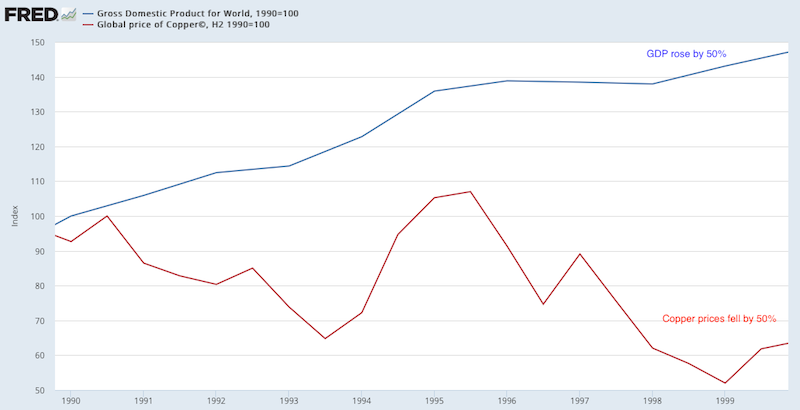

Rising Copper Prices Impact Of China Us Trade Negotiations

May 06, 2025

Rising Copper Prices Impact Of China Us Trade Negotiations

May 06, 2025 -

Addressing Nepotism Patrick Schwarzeneggers White Lotus Experience

May 06, 2025

Addressing Nepotism Patrick Schwarzeneggers White Lotus Experience

May 06, 2025 -

How Trumps Tariffs Reshaped The Us Manufacturing Landscape

May 06, 2025

How Trumps Tariffs Reshaped The Us Manufacturing Landscape

May 06, 2025

Latest Posts

-

Boston Celtics Playoff Schedule 2024 Magic Series Dates And Times

May 06, 2025

Boston Celtics Playoff Schedule 2024 Magic Series Dates And Times

May 06, 2025 -

2025 Nba Playoffs Your Guide To Watching Knicks Vs Celtics

May 06, 2025

2025 Nba Playoffs Your Guide To Watching Knicks Vs Celtics

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Details

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Details

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Nba Prediction Celtics Vs 76ers Expert Picks And Betting Odds February 20 2025

May 06, 2025

Nba Prediction Celtics Vs 76ers Expert Picks And Betting Odds February 20 2025

May 06, 2025