Increased Retail Sales Reduce Pressure For Bank Of Canada Interest Rate Reduction

Table of Contents

Strong Retail Sales Indicate Economic Resilience

H3: Consumer Spending as a Key Economic Indicator

Retail sales figures serve as a vital barometer of consumer confidence and the overall health of the Canadian economy. A surge in spending indicates optimism and a willingness to purchase goods and services, boosting economic growth. Recent reports from Statistics Canada show a significant increase in retail sales, exceeding expectations for the [Insert Month and Year] period. This upward trend suggests a resilient consumer base and a relatively healthy economy.

- Durable goods (e.g., furniture, appliances) experienced strong growth, suggesting long-term consumer confidence.

- Sales of non-durable goods (e.g., clothing, groceries) also increased, indicating consistent spending across various sectors.

- The rise in retail sales is partly attributable to a robust employment market and sustained consumer confidence, factors that underpin increased spending power.

Inflation Remains a Concern, Despite Strong Sales

H3: The Inflation-Interest Rate Relationship

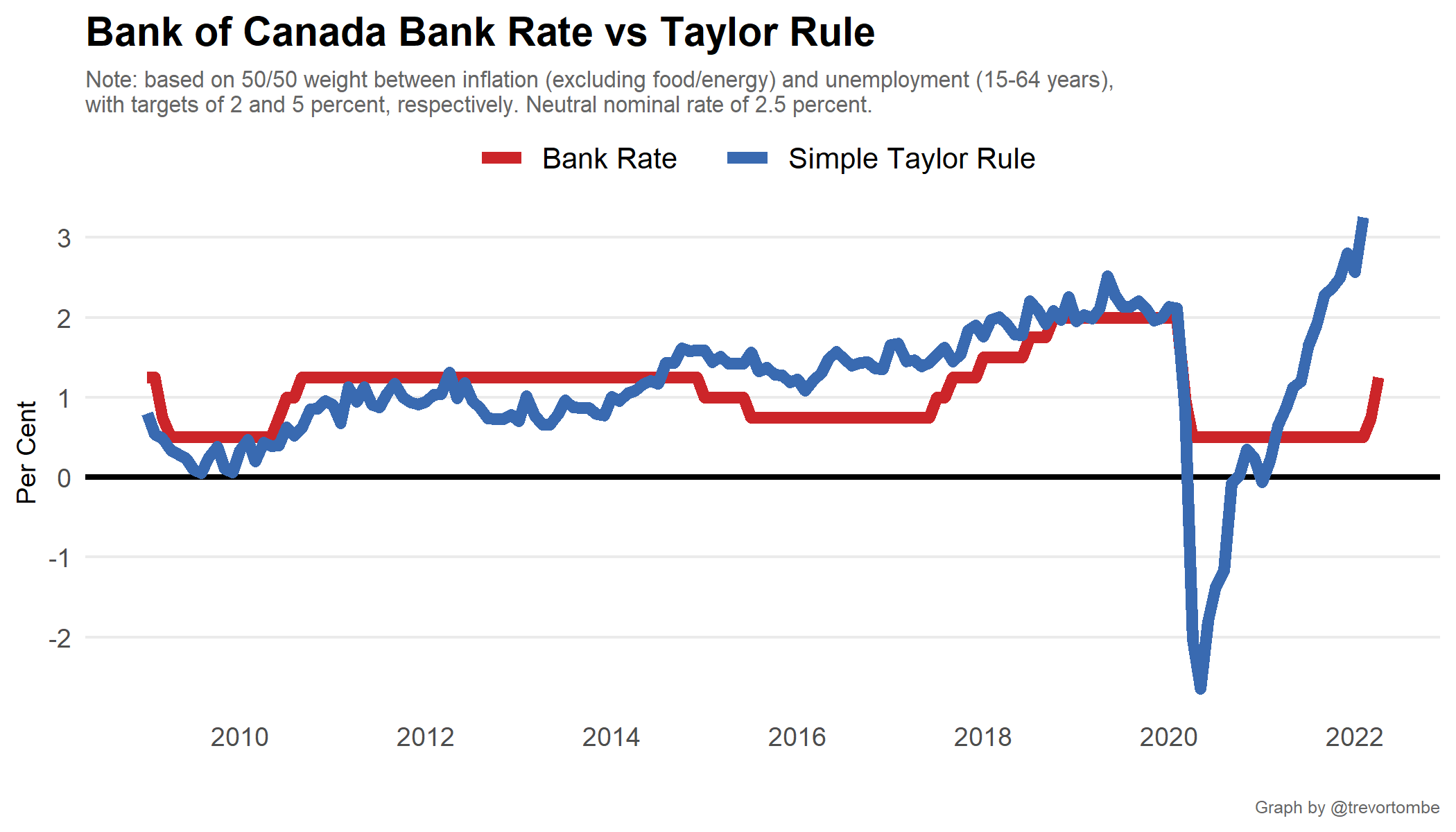

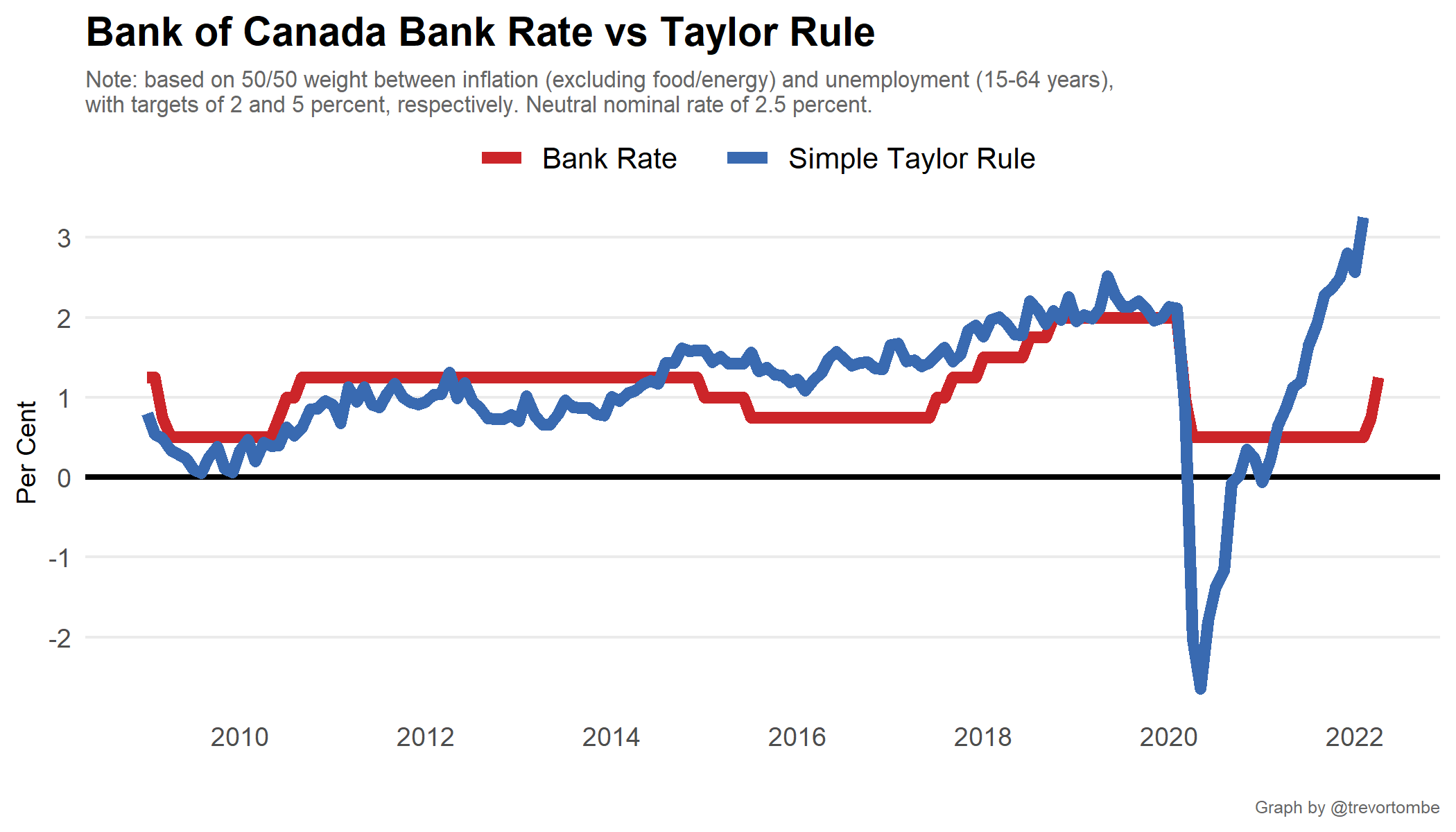

Inflation and interest rates share an inverse relationship. High inflation typically prompts central banks, like the Bank of Canada, to increase interest rates to cool down an overheating economy. This is done to curb spending and reduce demand, thereby mitigating inflationary pressures. While strong retail sales point to economic strength, they also contribute to inflationary pressures by increasing demand.

- Canada's current inflation rate stands at [Insert Current Inflation Rate]% (Source: Statistics Canada). While this is [higher/lower] than the previous period, it remains above the Bank of Canada's target of [Insert Inflation Target]%.

- The Bank of Canada aims to maintain price stability by keeping inflation within its target range. Exceeding this target necessitates intervention through monetary policy adjustments.

- The robust retail sales figures might exacerbate inflationary pressures in the coming months if not managed effectively. Increased demand can lead to higher prices across various goods and services.

Bank of Canada's Monetary Policy and Future Rate Decisions

H3: Analyzing the Bank's Recent Statements

The Bank of Canada has recently [Summarize the Bank's recent statements on monetary policy and their assessment of the economy. Include specific quotes if possible]. Their pronouncements suggest a cautious approach, balancing the positive impact of strong retail sales against the persistence of inflation.

- Based on current economic indicators, the likelihood of a near-term interest rate cut seems [low/high], although future rate hikes remain [likely/unlikely]. The decision will depend on the evolution of inflation and other economic factors.

- The Bank of Canada's future decisions will hinge on a multitude of factors, including inflation data, employment figures, economic growth projections, and global economic developments.

- Keep an eye out for the Bank of Canada's next interest rate announcement scheduled for [Insert Date]. This announcement will provide further insights into their monetary policy strategy.

Potential Risks and Uncertainties

H3: Factors that could still impact interest rates

Despite the positive retail sales figures, several uncertainties could influence the Bank of Canada's future interest rate decisions.

- A potential global economic downturn or a significant slowdown in the Canadian economy could prompt a shift towards interest rate reductions.

- Geopolitical events and their impact on global supply chains and energy prices represent a considerable risk to price stability and could influence the Bank's decisions.

- Other relevant factors, such as changes in the housing market, shifts in consumer sentiment, and wage growth, will also play a role in shaping future monetary policy.

Conclusion

Strong retail sales demonstrate resilience in the Canadian economy, but the persistence of inflation continues to influence the Bank of Canada's approach to interest rate adjustments. While recent data suggests reduced pressure for immediate interest rate reductions, the Bank remains vigilant, carefully monitoring inflation and other key economic indicators. The interplay between strong consumer spending and inflationary pressures remains a crucial factor determining the direction of future monetary policy. To stay informed about the Bank of Canada's monetary policy and its implications for interest rates, regularly monitor Bank of Canada interest rates and follow the latest developments in Canadian economic policy. Understanding the nuances surrounding Bank of Canada interest rates is crucial for navigating the complexities of the Canadian economic landscape.

Featured Posts

-

Your Guide To Thursday Night Tv Top 10 Streaming And Broadcast Picks

May 26, 2025

Your Guide To Thursday Night Tv Top 10 Streaming And Broadcast Picks

May 26, 2025 -

Essaie De Parler Pour Toi La Reponse Cash D Ardisson A Baffie

May 26, 2025

Essaie De Parler Pour Toi La Reponse Cash D Ardisson A Baffie

May 26, 2025 -

Understanding The Hells Angels A Look Inside

May 26, 2025

Understanding The Hells Angels A Look Inside

May 26, 2025 -

Prediksi Klasemen Moto Gp 2025 Bisakah Marc Marquez Menang

May 26, 2025

Prediksi Klasemen Moto Gp 2025 Bisakah Marc Marquez Menang

May 26, 2025 -

Hands On With The Fujifilm X Half Whimsical Design And User Experience

May 26, 2025

Hands On With The Fujifilm X Half Whimsical Design And User Experience

May 26, 2025

Latest Posts

-

Liverpool Transfer News Rayan Cherki Exit From Lyon Imminent

May 28, 2025

Liverpool Transfer News Rayan Cherki Exit From Lyon Imminent

May 28, 2025 -

Liverpool Transfer News 25m Stars Agent Contacts Man Utd

May 28, 2025

Liverpool Transfer News 25m Stars Agent Contacts Man Utd

May 28, 2025 -

Man United Leads Liverpool In Pursuit Of Rayan Cherki

May 28, 2025

Man United Leads Liverpool In Pursuit Of Rayan Cherki

May 28, 2025 -

Seven Players Targeted By Man United Amorims Transfer Wish List Unveiled

May 28, 2025

Seven Players Targeted By Man United Amorims Transfer Wish List Unveiled

May 28, 2025 -

Manchester United Makes Move For Lyon Starlet Rayan Cherki

May 28, 2025

Manchester United Makes Move For Lyon Starlet Rayan Cherki

May 28, 2025