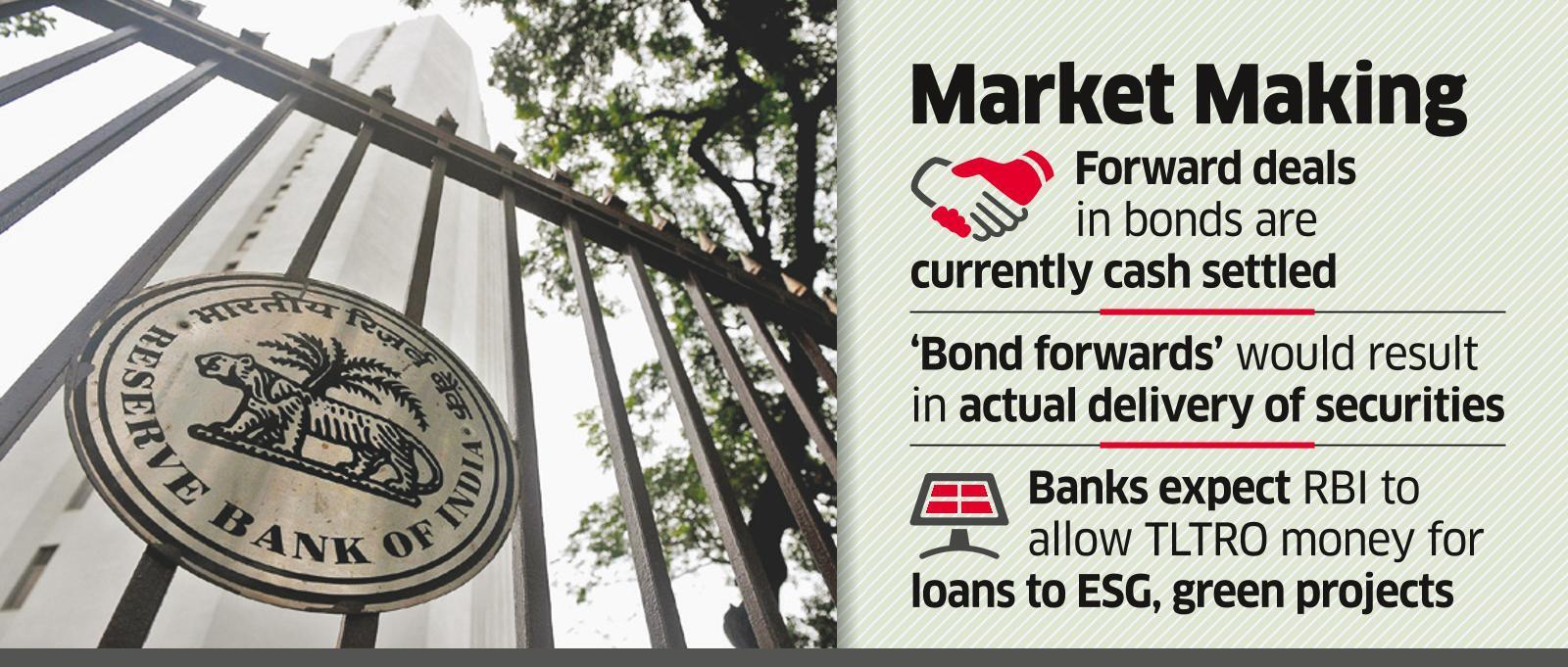

Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations and Their Impact

Current regulations governing bond forward investments for Indian insurers are quite restrictive. These limitations significantly impact their ability to manage risk and optimize returns.

-

Restrictions on the types of bonds: Insurers face limitations on the types of bonds they can invest in through forward contracts, reducing diversification opportunities. This often restricts investment to government securities, limiting exposure to higher-yielding, albeit riskier, options.

-

Investment amount limitations: Strict caps on the amount insurers can invest in bond forwards constrain their ability to effectively hedge against interest rate risk and manage their liabilities. This limits their capacity to take on larger, potentially more profitable, projects.

-

High capital adequacy requirements: The high capital adequacy ratios required for bond forward investments tie up significant capital that could otherwise be used for business expansion or to enhance policyholder benefits. This increases the cost of doing business for Indian insurers.

-

Impact on risk management and returns: The inability to effectively utilize bond forwards as a hedging tool exposes insurers to greater interest rate risks, hindering their ability to generate stable and consistent returns. This impacts profitability and shareholder value.

-

Negative impact on global competitiveness: Compared to their global counterparts, Indian insurers operate under stricter bond forward regulations, putting them at a competitive disadvantage in attracting foreign investments and expanding their international footprint.

Arguments for Relaxation of Regulations by Indian Insurers

Indian insurers contend that a relaxation of the current bond forward regulations would unlock numerous benefits, boosting both their profitability and the overall health of the Indian economy.

-

Increased investment flexibility and diversification: Relaxed regulations would allow insurers to diversify their investment portfolios, reducing reliance on government securities and potentially increasing returns. This includes investing in corporate bonds, thereby supporting corporate growth.

-

Enhanced risk management capabilities: Greater access to bond forwards would empower insurers to implement sophisticated hedging strategies, effectively mitigating interest rate risks and protecting policyholder funds.

-

Improved returns and shareholder value: By optimizing their investment strategies, insurers could achieve higher returns, enhancing their profitability and increasing shareholder value. This will attract more investment into the sector.

-

Attracting greater foreign investment: A more liberal regulatory environment would attract significant foreign investment into the Indian insurance sector, boosting economic growth and creating employment opportunities.

-

Alignment with global best practices: Relaxing regulations would bring Indian insurance investment regulations in line with international best practices, fostering greater confidence among global investors and improving the sector's competitive standing.

Concerns Regarding Relaxation and Potential Mitigation Strategies

While the benefits of relaxed regulations are compelling, potential risks need careful consideration and mitigation. Unfettered access to bond forwards could increase systemic risk if not properly managed.

-

Enhanced regulatory oversight and monitoring: Strengthened regulatory oversight and real-time monitoring are crucial to prevent misuse of bond forwards and maintain financial stability. This includes robust data analytics and early warning systems.

-

Strengthening risk management frameworks: Insurers need to enhance their internal risk management frameworks, including stress testing and scenario planning, to adequately assess and manage the risks associated with increased bond forward investments.

-

Robust reporting and disclosure requirements: Stricter reporting and disclosure requirements would ensure transparency and accountability, enabling regulators to effectively monitor the activities of insurers.

-

Gradual relaxation of regulations: A phased approach to relaxing regulations, starting with a pilot program for specific insurers or asset classes, would allow regulators to assess the impact and make necessary adjustments before a full-scale deregulation.

Government's Perspective and Potential Policy Changes

The Indian government walks a tightrope, balancing the need to promote economic growth with the imperative of maintaining financial stability. While the government recognizes the need for a dynamic and competitive insurance sector, it remains cautious about the potential risks associated with relaxing regulations.

-

Potential for policy changes: The government is likely to consider policy changes based on the insurers' compelling arguments and the potential economic benefits.

-

Focus on financial sector stability: The government’s primary concern remains the stability of the financial sector. Any relaxation of regulations will be carefully calibrated to minimize systemic risk.

-

Balancing growth and risk management: The government's approach will focus on finding a balance between fostering growth in the insurance sector and effectively managing potential risks associated with increased bond forward investment.

-

Possible timeline for regulatory adjustments: The timeline for any regulatory adjustments is uncertain, depending on ongoing discussions between the government, regulatory bodies, and the insurance industry. Detailed impact assessments and risk mitigation strategies will likely inform the process.

Conclusion

The debate surrounding the relaxation of bond forward regulations for Indian insurers highlights the complex interplay between growth, risk, and regulatory oversight. While increased investment flexibility, improved risk management, and enhanced competitiveness are compelling arguments for change, the potential for increased systemic risk necessitates a cautious and phased approach. Continued dialogue and collaboration between the Indian insurance industry and the government are crucial to develop a regulatory framework that promotes sustainable growth while safeguarding financial stability. The future of the Indian insurance sector hinges on a balanced approach to Indian insurer bond forward regulations. Staying informed about updates regarding changes in bond forward regulations for Indian insurers is essential for all stakeholders.

Featured Posts

-

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025

Report Uk Plans To Restrict Visas For Certain Nationalities

May 09, 2025 -

Bao Ve Tre Em Bai Hoc Kinh Nghiem Tu Vu Viec O Tien Giang

May 09, 2025

Bao Ve Tre Em Bai Hoc Kinh Nghiem Tu Vu Viec O Tien Giang

May 09, 2025 -

Real Id Enforcement Summer Travel Guide And Checklist

May 09, 2025

Real Id Enforcement Summer Travel Guide And Checklist

May 09, 2025 -

Attorney General Uses Fake Fentanyl To Illustrate Drug Crisis

May 09, 2025

Attorney General Uses Fake Fentanyl To Illustrate Drug Crisis

May 09, 2025 -

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Shares

May 09, 2025

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Shares

May 09, 2025