India's Ultra-High-Net-Worth Individuals Explore International Investment Opportunities

Table of Contents

Driving Factors Behind International Investment by Indian UHNWIs

The surge in international investments by Indian UHNWIs is driven by several key factors, all pointing towards a need for sophisticated wealth management strategies extending beyond India's borders.

Portfolio Diversification

Risk mitigation is paramount for UHNWIs. Diversifying a portfolio across various global markets significantly reduces exposure to any single market's volatility. This "global portfolio diversification" strategy involves spreading investments across different asset classes and geographical regions.

- Asset Classes: Real estate in thriving global cities, equities in established and emerging markets, private equity for higher returns, and hedge funds for sophisticated risk management.

- Geographic Diversification: Investing in both developed markets (e.g., the US, UK, Europe) and emerging markets (e.g., Southeast Asia, Latin America) to balance stability and growth potential.

- Currency Diversification: Holding assets in multiple currencies helps to hedge against fluctuations in the Indian Rupee.

Seeking Higher Returns

While the Indian market offers opportunities, international markets often present higher growth potential. Limitations in the domestic market, including sector-specific regulations and slower growth in certain sectors, push UHNWIs to explore global market opportunities for significant capital appreciation.

- High-Growth Sectors: Technology, renewable energy, and certain emerging industries globally provide higher returns compared to some sectors in India.

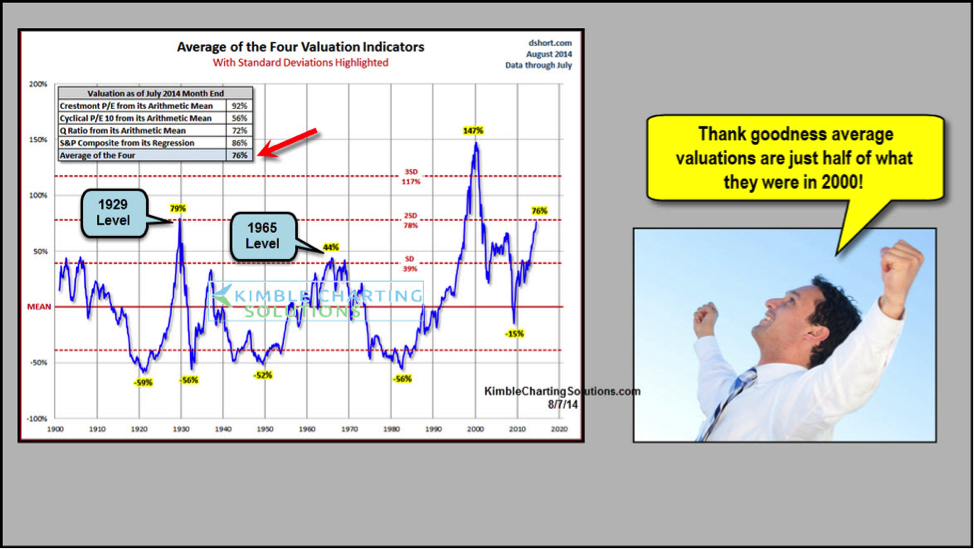

- Return Comparison: A comparative analysis of historical returns in Indian vs. international markets often reveals the allure of global investment.

- Capital Appreciation: International investments frequently offer a greater potential for substantial long-term capital appreciation.

Access to Global Investment Opportunities

India may have limited access to certain exclusive investment opportunities and cutting-edge investment strategies. International markets offer a wider range of alternative investments and global market trends.

- Exclusive Opportunities: Private equity and venture capital investments in innovative startups and established businesses are often more readily available internationally.

- Cutting-Edge Technology: Access to investments in the latest technological advancements is facilitated through international markets.

- Global Market Trends: UHNWIs can capitalize on global market trends and emerging opportunities not readily available within India.

Popular International Investment Destinations for Indian UHNWIs

Several locations consistently attract investments from Indian UHNWIs. These destinations offer varying benefits based on the specific investment goals and risk appetite.

The United States

The US remains a favored destination, offering a vast and mature market with diverse investment opportunities.

- Real Estate: High-value properties in major US cities offer both capital appreciation and rental income.

- Technology Stocks: Investments in leading technology companies provide exposure to significant growth potential.

- Private Equity: Access to US-based private equity funds offers opportunities in various sectors.

- US Bonds: US Treasury bonds provide a relatively safe and stable investment option.

The United Kingdom

The UK also remains attractive, particularly for real estate and infrastructure investments.

- Real Estate: London and other major cities offer prime real estate opportunities.

- Infrastructure Projects: Investments in UK infrastructure projects, such as renewable energy or transportation, provide both returns and societal impact.

- Private Equity: Similar to the US, the UK offers access to a robust private equity market.

Other Key Destinations

Other significant destinations include:

- Canada: Attractive for its stable political environment, robust economy, and real estate opportunities.

- Singapore: Known for its business-friendly environment, low taxes, and strong infrastructure, making it ideal for offshore investments.

- Switzerland: A traditional haven for wealth preservation, favored for its political stability and banking secrecy.

Challenges and Considerations for Indian UHNWIs Investing Internationally

While the opportunities are significant, navigating international investments requires careful consideration of various challenges.

Regulatory Compliance

International tax laws and regulations are complex. Understanding and adhering to regulations such as FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) is crucial to avoid penalties. Professional advice is essential.

- FATCA & CRS: Compliance with these international tax reporting standards is mandatory.

- Other Relevant Regulations: Various other country-specific regulations must be understood and followed.

- Professional Advice: Engaging qualified tax advisors and lawyers is crucial for navigating the complexities of international tax compliance.

Geopolitical Risks

International investments are exposed to geopolitical risks. Understanding and managing these risks is vital.

- Political Instability: Political instability in a particular country can significantly impact investments.

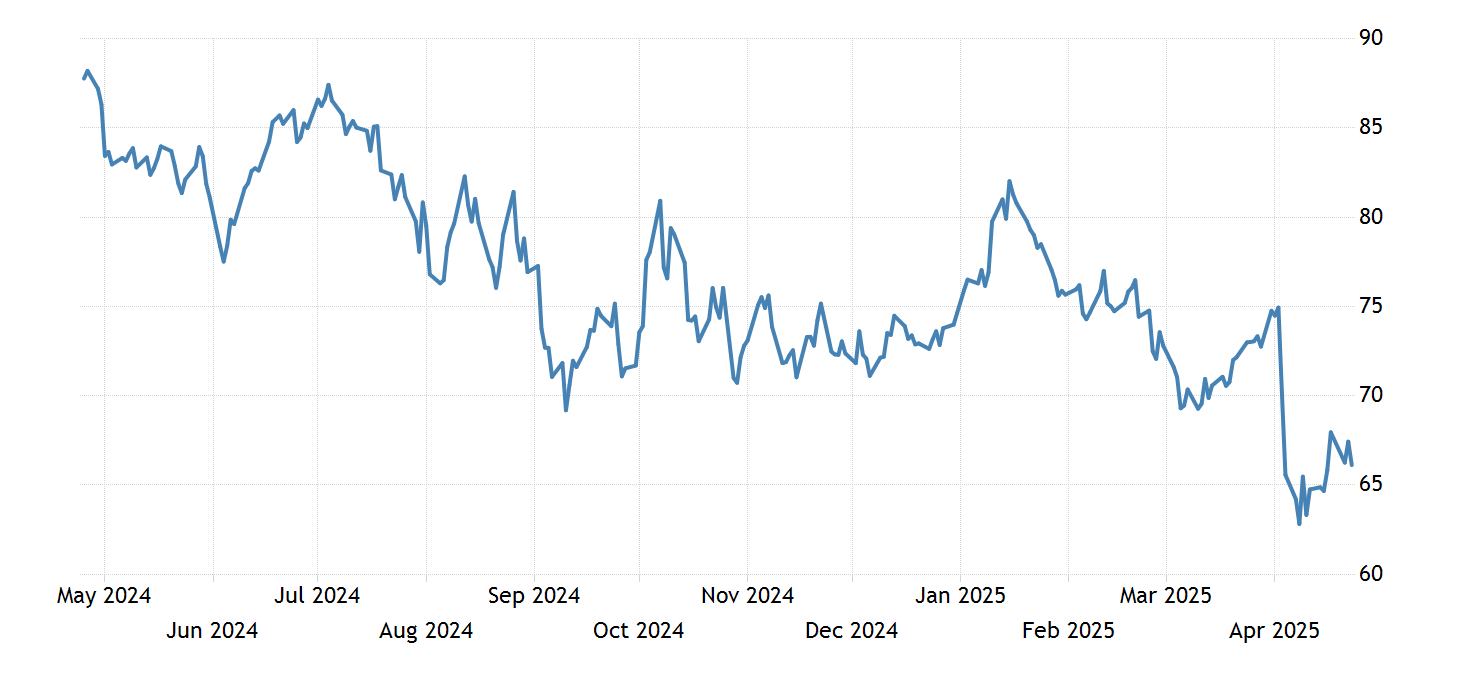

- Currency Fluctuations: Changes in exchange rates can affect the value of investments.

- Trade Wars: International trade disputes can negatively affect certain investment sectors.

Due Diligence

Thorough due diligence is paramount before committing to any international investment.

- Professional Advisors: Financial advisors, lawyers, and other specialists can help with due diligence.

- Thorough Research: Conducting independent research on potential investments is vital.

- Risk Assessment: Carefully assessing potential risks associated with each investment opportunity is crucial.

Conclusion

The increasing number of Indian UHNWIs exploring international investment opportunities reflects the desire for diversification, higher returns, and access to a wider range of global assets. Popular destinations include the US, UK, Canada, Singapore, and Switzerland, each offering unique advantages and challenges. However, navigating this complex landscape requires careful planning, thorough due diligence, and expert advice. To successfully leverage the benefits of international investments, seek professional advice to develop comprehensive international investment strategies for Indian UHNWIs and ensure effective global wealth management for Indian high-net-worth individuals. Diversify your portfolio with international investments wisely and securely.

Featured Posts

-

Foreign Funding Of Universities Under Trump Administration Scrutiny Harvard As A Case Study

Apr 25, 2025

Foreign Funding Of Universities Under Trump Administration Scrutiny Harvard As A Case Study

Apr 25, 2025 -

Las Vegas Raiders Scout At Boise State Pro Day For Ashton Jeanty

Apr 25, 2025

Las Vegas Raiders Scout At Boise State Pro Day For Ashton Jeanty

Apr 25, 2025 -

Oil Price Analysis And Forecast For April 24 2024

Apr 25, 2025

Oil Price Analysis And Forecast For April 24 2024

Apr 25, 2025 -

Bota De Oro 2024 25 Tabla De Goleadores Sin Messi Ni Ronaldo

Apr 25, 2025

Bota De Oro 2024 25 Tabla De Goleadores Sin Messi Ni Ronaldo

Apr 25, 2025 -

Evangelistas Mastectomy Scars A Raw And Honest Account

Apr 25, 2025

Evangelistas Mastectomy Scars A Raw And Honest Account

Apr 25, 2025

Latest Posts

-

Understanding High Stock Market Valuations A Bof A Perspective

Apr 30, 2025

Understanding High Stock Market Valuations A Bof A Perspective

Apr 30, 2025 -

Jalen Hurts And The Eagles Analyzing The White House Visit Controversy

Apr 30, 2025

Jalen Hurts And The Eagles Analyzing The White House Visit Controversy

Apr 30, 2025 -

Eagles White House Celebration Jalen Hurts Absence And Trumps Comments

Apr 30, 2025

Eagles White House Celebration Jalen Hurts Absence And Trumps Comments

Apr 30, 2025 -

Bof As Analysis Addressing Investor Concerns About High Stock Valuations

Apr 30, 2025

Bof As Analysis Addressing Investor Concerns About High Stock Valuations

Apr 30, 2025 -

4 Reasons Why Trumps Tariff Income Tax Swap Is Unlikely

Apr 30, 2025

4 Reasons Why Trumps Tariff Income Tax Swap Is Unlikely

Apr 30, 2025