Interest Rate Cuts: Why The Federal Reserve Is Lagging Behind

Table of Contents

Inflationary Pressures: A Major Obstacle to Interest Rate Cuts

The most significant hurdle preventing immediate and substantial interest rate cuts is the persistent threat of inflation. The current inflation rate, measured by indices like the Consumer Price Index (CPI) and the Producer Price Index (PPI), remains stubbornly elevated above the Fed's target of 2%.

- CPI: Currently at [Insert current CPI data], reflecting increased costs for goods and services.

- PPI: Currently at [Insert current PPI data], indicating rising prices at the producer level.

- Core Inflation: [Insert data on core inflation, excluding volatile food and energy prices].

The Fed's primary mandate is to maintain price stability. Aggressive interest rate cuts, while potentially boosting economic growth in the short term, risk exacerbating inflationary pressures. This forces the Fed to carefully weigh the benefits of stimulating growth against the potential harms of fueling further inflation. Alternative strategies to combat inflation, such as targeted fiscal policies and supply-side interventions, are being considered alongside, or instead of, interest rate adjustments.

Employment Data and the Fed's Cautious Approach

The labor market, while showing some signs of cooling, remains relatively strong. Recent employment reports indicate [Insert recent unemployment rate data].

- Current Unemployment Rate: [Insert data]

- Historical Comparison: [Compare current rate with historical lows and highs]

While a reduction in unemployment is generally positive, the Fed is wary of prematurely implementing interest rate cuts that could trigger a surge in wage inflation. This could create a wage-price spiral, where rising wages lead to higher prices, further fueling inflation and potentially undermining the Fed's long-term goals. The delicate balance between supporting employment and controlling inflation necessitates a cautious approach to monetary policy.

Global Economic Uncertainty and its Influence on the Fed's Decisions

The global economic landscape is far from stable. Geopolitical instability, ongoing supply chain disruptions, and the lingering effects of the pandemic continue to pose significant challenges.

- Geopolitical Risks: [Mention specific geopolitical events and their impact on the US economy, e.g., the war in Ukraine]

- Supply Chain Issues: [Highlight persistent supply chain bottlenecks and their contribution to inflation]

- Global Growth Slowdown: [Discuss the slowdown in global economic growth and its implications for the US]

This global uncertainty makes the Fed hesitant to make drastic moves. Aggressive interest rate cuts in the US could have unintended consequences for the global economy, potentially destabilizing financial markets and further complicating the already challenging international economic situation. The potential ripple effects necessitate a more measured approach to monetary policy.

The Effectiveness of Interest Rate Cuts in the Current Economic Climate

The effectiveness of interest rate cuts in addressing the current economic challenges is a subject of ongoing debate. One key consideration is the concept of monetary policy lags – the time it takes for interest rate changes to impact the broader economy. These lags can be significant, meaning that the full impact of a rate cut may not be felt for several months or even years.

Furthermore, relying solely on monetary policy, through interest rate cuts, might prove insufficient. Fiscal policy, involving government spending and taxation, may play a more significant role in stimulating demand and addressing specific economic challenges. In some cases, interest rate cuts could even exacerbate existing problems, such as increasing already elevated asset prices.

Potential Consequences of the Fed's Delayed Action on Interest Rate Cuts

The risk of delaying interest rate cuts is substantial. Prolonged inaction could lead to:

- Recessionary Pressures: A prolonged period of high interest rates could stifle economic activity, potentially leading to a recession.

- Reduced Consumer Spending: High interest rates discourage borrowing and spending, negatively impacting consumer demand.

- Decreased Investment: Businesses may postpone investments due to higher borrowing costs.

- Political Backlash: The Fed's actions, or lack thereof, can have significant political ramifications, especially if economic conditions worsen.

Conclusion: Understanding the Lag in Interest Rate Cuts and What’s Next

The Federal Reserve's cautious approach to interest rate cuts reflects a complex interplay of inflationary pressures, employment concerns, and global economic uncertainty. Balancing the need for economic growth with the imperative to maintain price stability is a challenging task. The future trajectory of interest rates will depend heavily on the evolving economic data and the Fed's assessment of the risks and benefits of further monetary policy adjustments. Stay informed about the latest developments concerning interest rate cuts and the Fed's future decisions by subscribing to our updates or following reputable financial news sources. Understanding the intricacies of interest rate cuts is crucial for navigating the complexities of the current economic landscape.

Featured Posts

-

Handhaven Van De Band Brekelmans Inzet Voor Een Sterke Relatie Met India

May 09, 2025

Handhaven Van De Band Brekelmans Inzet Voor Een Sterke Relatie Met India

May 09, 2025 -

Wynne Evans Faces Criticism From Joanna Page On Bbc Program

May 09, 2025

Wynne Evans Faces Criticism From Joanna Page On Bbc Program

May 09, 2025 -

New Agreement To Boost Capital Market Cooperation Among Pakistan Sri Lanka And Bangladesh

May 09, 2025

New Agreement To Boost Capital Market Cooperation Among Pakistan Sri Lanka And Bangladesh

May 09, 2025 -

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 09, 2025

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 09, 2025 -

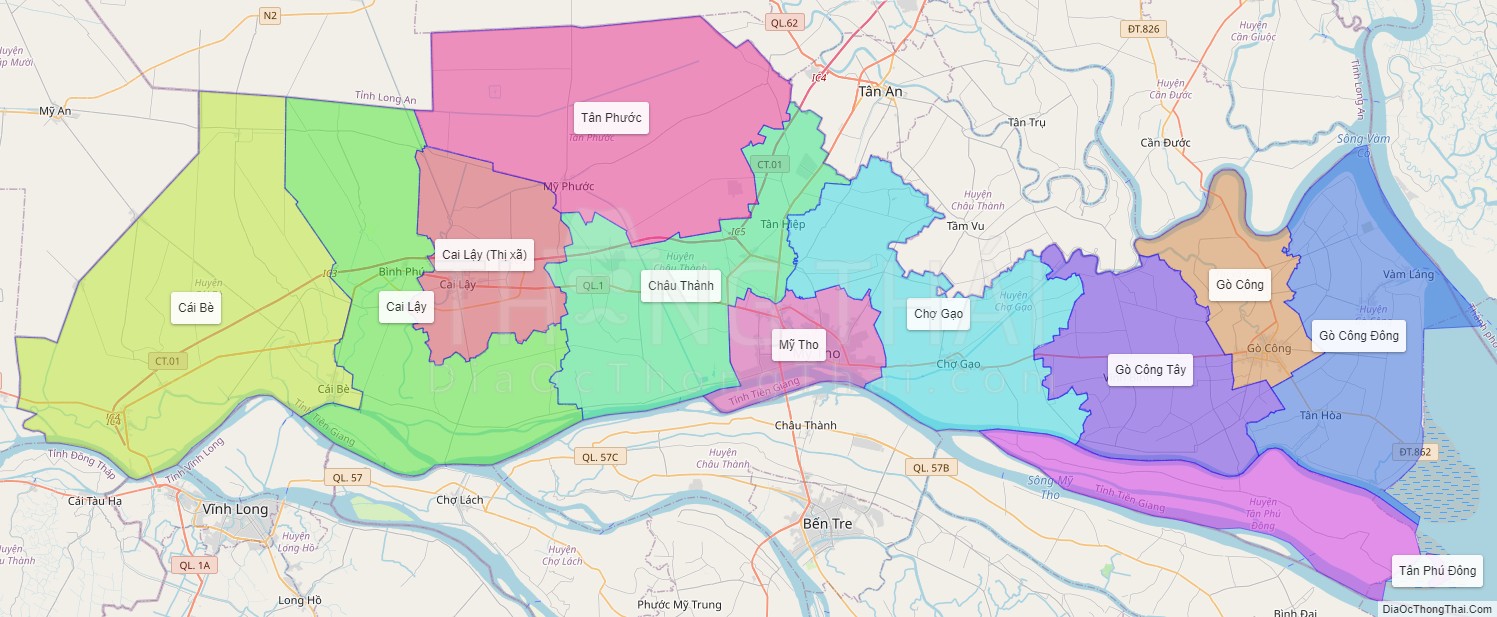

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025