Investing In BigBear.ai: Is It The Right Time?

Table of Contents

BigBear.ai's Business Model and Competitive Advantage

BigBear.ai leverages advanced AI and machine learning to deliver cutting-edge solutions across various sectors. Understanding its business model and competitive advantages is crucial for any potential investor.

Revenue Streams and Growth Potential

BigBear.ai's revenue streams are diverse, providing a degree of resilience. They primarily consist of government contracts, particularly within the national security and intelligence communities, and increasingly, commercial partnerships. The growth potential is significant, fueled by the expanding demand for sophisticated AI solutions.

- Key Contracts: BigBear.ai has secured numerous substantial contracts with various government agencies, demonstrating its capabilities and market credibility. These contracts represent a reliable revenue base.

- Commercial Partnerships: The company is actively expanding its partnerships with leading commercial organizations, opening avenues for new revenue streams and market penetration.

- Expansion into New Markets: BigBear.ai is actively exploring and entering new markets, aiming for diversification and enhanced growth opportunities. This proactive approach suggests a strong commitment to future expansion.

Analyzing "BigBear.ai revenue" and "BigBear.ai growth" trends alongside "BBAI stock performance" is vital for a complete picture. Historical data, readily available through financial news sources, can illuminate past performance and inform future expectations.

Competitive Landscape and Market Share

BigBear.ai operates in a competitive landscape dominated by large technology firms and specialized AI companies. However, its competitive advantages set it apart.

- Key Competitors: BigBear.ai faces competition from established players like Palantir Technologies and other AI specialists. Analyzing "BigBear.ai competitors" reveals its positioning within this dynamic environment.

- BigBear.ai's Unique Selling Propositions (USPs): BigBear.ai’s specialized expertise in national security, its strong government relationships, and its proprietary AI technologies provide significant competitive advantages. This "BigBear.ai technology" is a key differentiator in the market.

- Market Analysis: Understanding "AI market share" and BigBear.ai's position within it is vital for assessing its growth potential and long-term viability. Market research reports and financial analyses provide valuable data in this area.

Financial Performance and Risk Assessment

A thorough assessment of BigBear.ai's financial performance and potential risks is essential before making any investment decision.

Financial Statements Analysis

Reviewing BigBear.ai's financial statements – including "BBAI financial statements" – is paramount. Key metrics to analyze include:

- Key Financial Ratios: Examine profitability ratios (gross margin, net margin), liquidity ratios (current ratio, quick ratio), and leverage ratios (debt-to-equity ratio). These ratios reveal the company's financial health and stability.

- Profitability Analysis: Assess the company's ability to generate profits and its growth trajectory over time. This involves a deep dive into revenue growth, expense management, and profit margins.

- "BigBear.ai stock valuation": Analyzing the stock's valuation relative to its peers and its historical performance provides insights into its current market positioning.

Charts and graphs can effectively visualize these data points, offering a more accessible understanding of BigBear.ai's financial health.

Identifying Potential Risks

While the potential rewards of "Investing in BigBear.ai" are significant, several risks need consideration:

- Geopolitical Risks: BigBear.ai's reliance on government contracts exposes it to geopolitical uncertainties and potential changes in government spending priorities.

- Competition from Established Players: The intense competition within the AI sector poses a constant threat to BigBear.ai's market share and growth.

- Dependence on Government Contracts: A significant portion of BigBear.ai's revenue comes from government contracts, making it susceptible to shifts in government policy and budget allocations. Understanding this "BigBear.ai risk" is critical.

Future Outlook and Investment Strategies

Assessing the future outlook for BigBear.ai requires analyzing its growth projections and the broader AI market trends.

Growth Projections and Market Trends

The future of BigBear.ai is intertwined with the overall growth of the AI market.

- Predictions for AI Market Growth: Industry analysts offer projections for the future growth of the AI market, providing a backdrop for assessing BigBear.ai's potential.

- Anticipated Expansion for BigBear.ai: Based on its current trajectory and strategic initiatives, potential future growth for BigBear.ai can be projected.

- Potential for New Partnerships: New partnerships and collaborations can significantly boost BigBear.ai's growth and market reach. Analyzing "BigBear.ai future" requires understanding these strategic possibilities.

Investment Strategies for BigBear.ai

Several investment strategies can be employed when considering "Investing in BigBear.ai," each suited to different risk tolerances:

- Buy and Hold Strategy: This long-term strategy involves purchasing shares and holding them for an extended period, benefiting from potential long-term growth.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, mitigating the risk associated with market volatility.

- Diversification within a Portfolio: Diversifying your investment portfolio reduces overall risk by spreading investments across different assets. "BBAI trading strategies" are diverse, requiring an understanding of your risk tolerance.

Conclusion

Investing in BigBear.ai presents both opportunities and risks. While the company operates in a rapidly growing market and possesses unique competitive advantages, its financial performance and reliance on government contracts present inherent challenges. Whether now is the right time for Investing in BigBear.ai depends on your individual risk tolerance and investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The information provided is based on publicly available data and analysis and should not be considered a recommendation to buy or sell any securities.

Call to Action: While this article provides insights into whether now is the right time for investing in BigBear.ai, remember to conduct thorough research, review SEC filings, consult reputable financial news sources, and consult with a financial advisor before making any investment decisions. Thoroughly understand the risks involved before investing in BBAI or any other stock.

Featured Posts

-

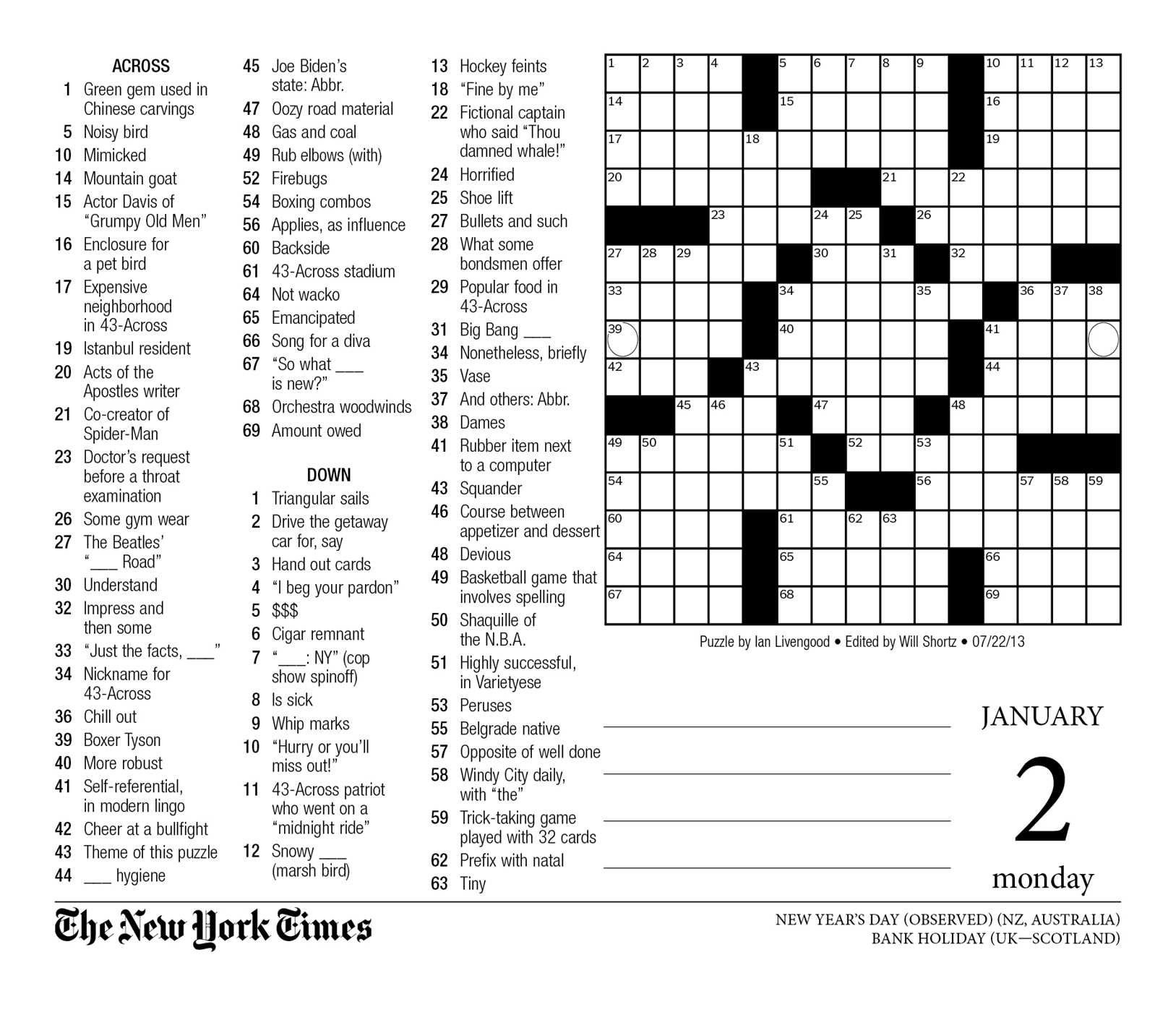

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 20, 2025

Solve The Nyt Mini Crossword March 5 2025 Hints And Solutions

May 20, 2025 -

Nyt Mini Crossword For Tuesday April 8 2025 Find The Solutions Here

May 20, 2025

Nyt Mini Crossword For Tuesday April 8 2025 Find The Solutions Here

May 20, 2025 -

Isabelle Nogueira Lanca Festival Da Cunha Imersao Cultural Na Amazonia

May 20, 2025

Isabelle Nogueira Lanca Festival Da Cunha Imersao Cultural Na Amazonia

May 20, 2025 -

Hrvatski Dramski Pisac Predstavlja Novu Dramu Prica O Patnji Nevinih

May 20, 2025

Hrvatski Dramski Pisac Predstavlja Novu Dramu Prica O Patnji Nevinih

May 20, 2025 -

La Famille Schumacher Accueille Une Petite Fille Un Nouveau Chapitre

May 20, 2025

La Famille Schumacher Accueille Une Petite Fille Un Nouveau Chapitre

May 20, 2025