Investing In Palantir: A 40% Potential Return By 2025?

Table of Contents

Palantir's Growth Potential and Market Position

Palantir Technologies is a leading provider of big data analytics platforms serving both government and commercial clients. Its unique position in the market, coupled with its innovative technology, fuels the potential for significant growth and substantial returns for investors.

Government Contracts and Revenue

Palantir enjoys a strong foothold in the government sector, securing significant contracts with various agencies worldwide. These contracts represent a substantial portion of its revenue and offer a stable base for future growth.

- Key Government Contracts: Palantir's contracts with the US intelligence community and various international defense departments contribute significantly to its revenue streams. These long-term agreements provide predictable income and demonstrate the value of its platform in high-stakes environments.

- Projected Growth Rates: Analysts predict continued growth in government spending on data analytics, directly benefiting Palantir. The increasing demand for advanced data solutions in national security and public safety translates to a robust pipeline of future contracts.

- Impact on Financial Performance: The stable revenue stream from government contracts helps to mitigate risk and provides a solid foundation for overall financial performance, supporting the potential for a high return on Palantir investment.

Commercial Market Expansion

Beyond its government focus, Palantir is actively expanding its presence in the commercial sector. Its Foundry platform, a powerful data integration and analytics tool, is gaining traction across various industries.

- Successful Commercial Partnerships: Palantir is forging partnerships with leading companies in sectors like healthcare, finance, and manufacturing. These collaborations broaden its market reach and demonstrate the platform's adaptability.

- Industry Verticals Targeted: Palantir is strategically targeting high-growth sectors where data analytics can deliver significant value. This targeted approach increases the likelihood of substantial returns on investment.

- Potential for Future Growth: The vast commercial market presents significant upside potential for Palantir. As more businesses recognize the power of its platform, its market share and revenue are likely to increase, potentially leading to a significant return on Palantir stock.

Technological Innovation and Competitive Advantage

Palantir’s technological prowess in big data analytics is a core driver of its success. Its Foundry platform provides a unique capability to integrate and analyze vast datasets, offering a significant competitive advantage.

- Key Technological Innovations: Continuous innovation in areas like artificial intelligence (AI) and machine learning (ML) strengthens Palantir's position and ensures its platform remains at the forefront of data analytics.

- Competitive Differentiation: Palantir's platform stands out due to its scalability, security, and ease of use, making it appealing to a wide range of clients in both the government and commercial sectors.

- Potential for Future Product Development: Ongoing research and development ensure Palantir remains competitive and adaptable, further enhancing its growth potential and the prospect of strong returns for Palantir investors.

Assessing Risk and Potential Downsides

While Palantir's potential is compelling, it's crucial to acknowledge potential downsides before making any investment decision.

Valuation and Stock Price Volatility

Palantir's stock price has shown significant volatility. Understanding its valuation metrics and historical price fluctuations is essential.

- Key Valuation Metrics: Analyzing metrics like the Price-to-Earnings (P/E) ratio helps assess whether Palantir's stock is currently overvalued or undervalued.

- Analysis of Historical Stock Price Fluctuations: Studying past price movements provides insights into the stock's volatility and potential risk.

- Potential Risks: High volatility means potential for both substantial gains and significant losses. Investors need to be comfortable with this inherent risk.

Dependence on Government Contracts

Palantir’s substantial reliance on government contracts presents a potential risk. Changes in government spending or policy could impact its revenue.

- Assessment of Risk Related to Government Contracts: Over-reliance on a single sector exposes Palantir to policy shifts and budget cuts. Investors need to assess this risk.

- Diversification Strategies: Palantir's expansion into the commercial sector helps mitigate this risk, but complete diversification is not yet achieved.

- Potential Mitigation Plans: Further diversification into new markets and client segments will lessen this risk in the future.

Competition and Market Saturation

The big data analytics market is competitive. Understanding the competitive landscape is vital.

- Identification of Key Competitors: Companies like AWS, Microsoft, and Google pose a competitive threat to Palantir.

- Assessment of Their Strengths and Weaknesses: Analyzing competitors' strengths and weaknesses helps gauge Palantir’s competitive advantages.

- Potential Impact on Palantir’s Market Share: Increased competition could potentially hinder Palantir's growth and market share, impacting potential returns.

Financial Projections and the 40% Return Prediction

The 40% return prediction by 2025 is based on several key assumptions and projections.

Revenue Growth Projections

Predicting Palantir's future revenue involves forecasting growth in both government and commercial sectors.

- Detailed Revenue Projections for the Next Few Years: These projections consider current market trends and Palantir's expansion strategies.

- Justification for Growth Rates: Assumptions about market growth, Palantir's market share, and pricing strategies underpin these projections.

- Consideration of Potential Upside and Downside Scenarios: Realistic projections account for various potential scenarios, including both positive and negative outcomes.

Profitability and Margin Analysis

Analyzing Palantir's profitability and margins is crucial for assessing its long-term value.

- Projected Profit Margins: These projections are linked directly to revenue projections and cost management strategies.

- Key Cost Drivers: Understanding key cost drivers—such as research and development, sales, and general administration—helps refine profitability estimates.

- Strategies for Improving Profitability: Palantir's strategies for improving operational efficiency will influence its profitability.

Path to 40% Return by 2025

The 40% return prediction relies on several key assumptions.

- Clear Statement of Assumptions: These assumptions include continued revenue growth, effective cost management, and successful market penetration.

- Key Drivers for Growth: Sustained innovation, successful partnerships, and expansion into new markets are essential drivers for achieving this target.

- Disclaimer Regarding Investment Risk: It’s crucial to reiterate that the prediction is not guaranteed, and actual returns may differ significantly.

Conclusion: Investing in Palantir: A Wise Decision?

Investing in Palantir presents a compelling opportunity for significant returns, potentially reaching 40% by 2025. However, it's crucial to acknowledge the risks associated with this high-growth, high-volatility stock. Its reliance on government contracts, competitive landscape, and inherent market volatility must be considered. A thorough understanding of Palantir's business model, financial projections, and the potential downsides is paramount before making any investment decisions. This article provides valuable insights, but it is not financial advice. Consider conducting further research and consulting with a financial advisor before investing in Palantir stock or exploring other Palantir investment opportunities. Remember, investing in Palantir, like any investment, carries inherent risk. Proceed with caution and conduct thorough due diligence.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be based on individual circumstances and thorough research. Consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost Since January 20 2017

May 10, 2025

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost Since January 20 2017

May 10, 2025 -

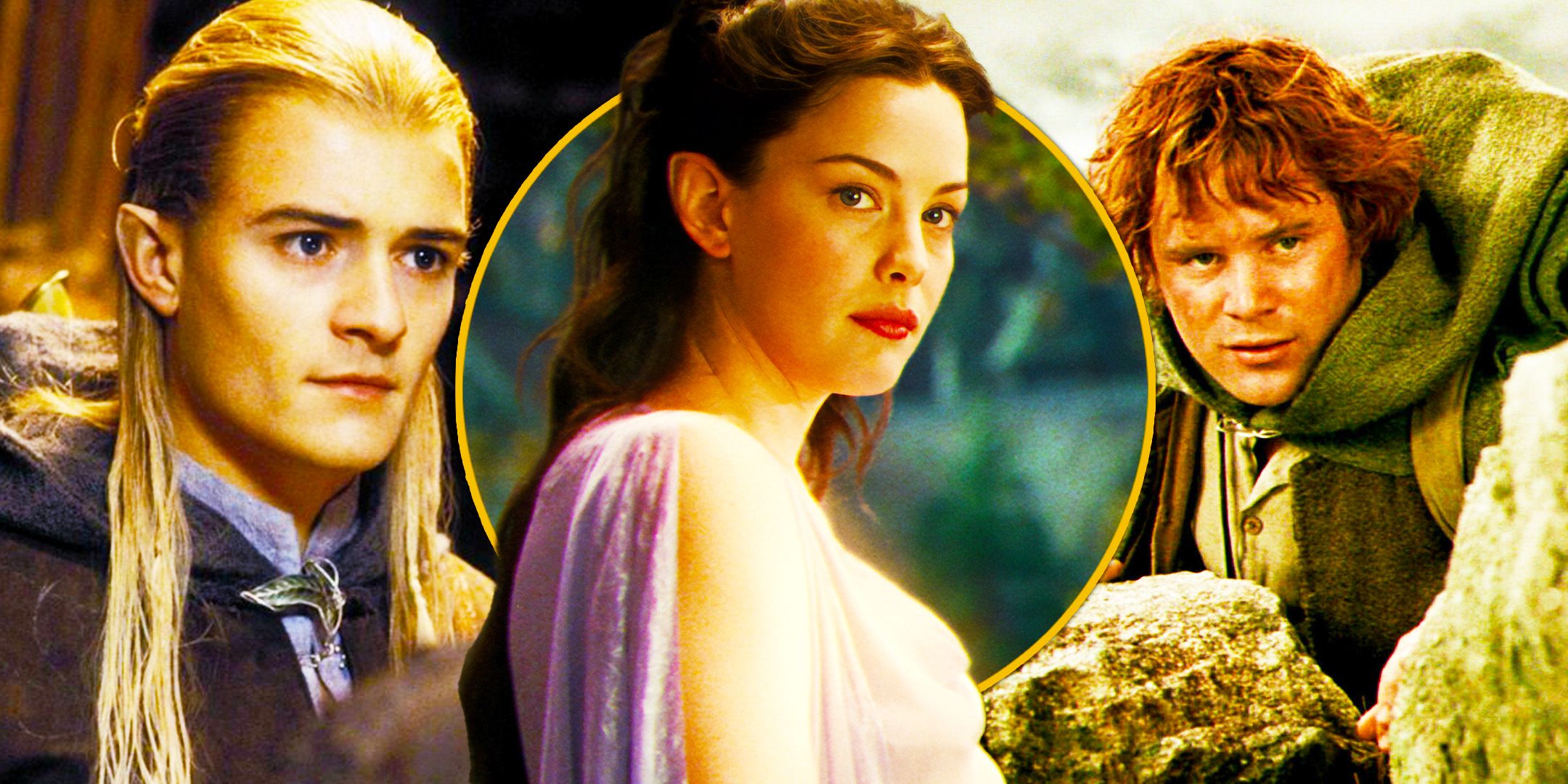

U S Federal Reserves Rate Decision Weighing Inflation And Growth

May 10, 2025

U S Federal Reserves Rate Decision Weighing Inflation And Growth

May 10, 2025 -

Council Approves Rezoning For Proposed Edmonton Nordic Spa

May 10, 2025

Council Approves Rezoning For Proposed Edmonton Nordic Spa

May 10, 2025 -

Elizabeth City Apartment Complex Car Break Ins Surge

May 10, 2025

Elizabeth City Apartment Complex Car Break Ins Surge

May 10, 2025 -

Putins Victory Day Ceasefire A Temporary Truce

May 10, 2025

Putins Victory Day Ceasefire A Temporary Truce

May 10, 2025

Latest Posts

-

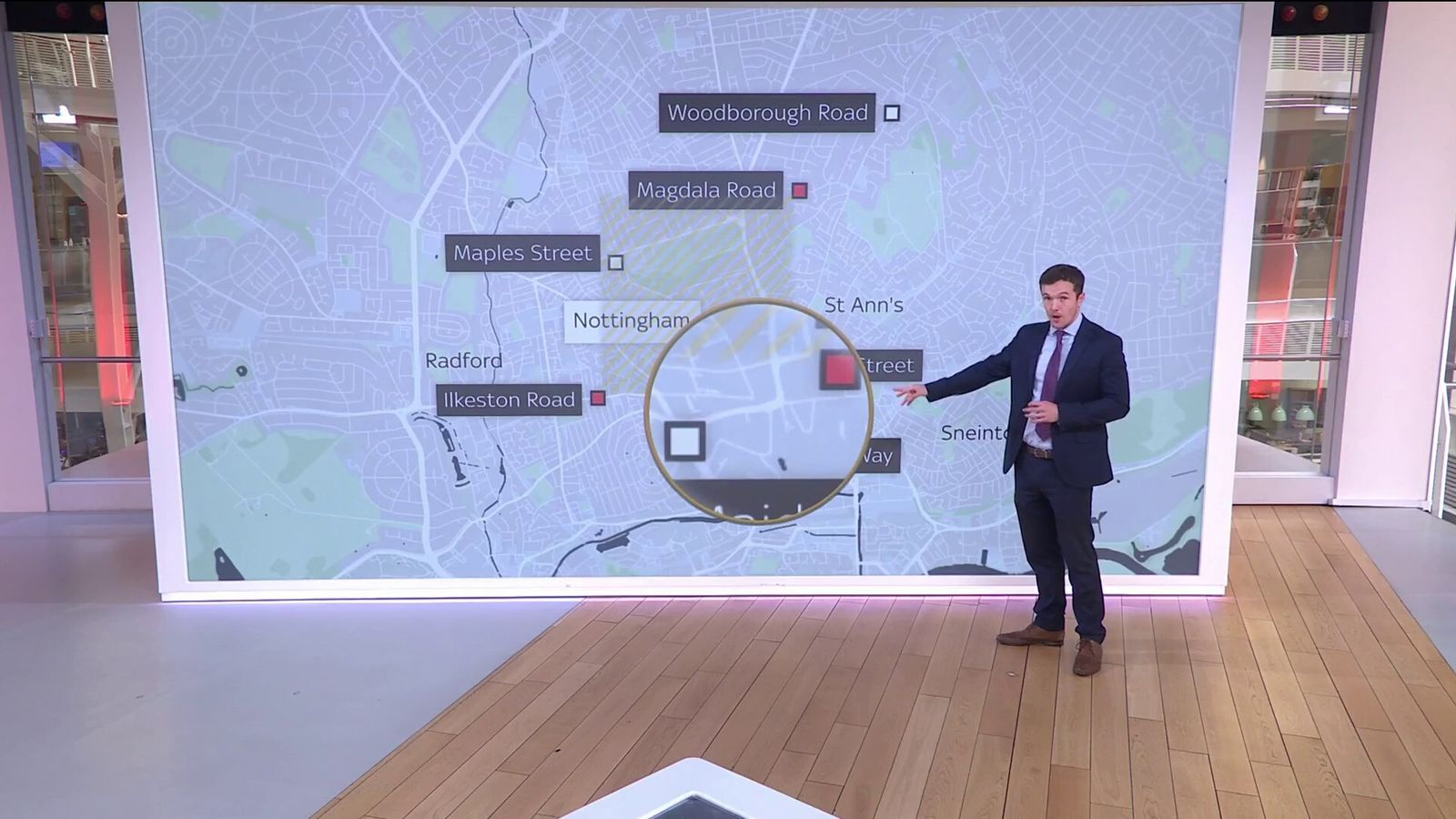

Nottingham Attacks Police Misconduct Meeting Scheduled

May 10, 2025

Nottingham Attacks Police Misconduct Meeting Scheduled

May 10, 2025 -

Joanna Pages Scathing Remarks About Wynne Evans During Bbc Show

May 10, 2025

Joanna Pages Scathing Remarks About Wynne Evans During Bbc Show

May 10, 2025 -

The Nottingham Attacks Survivors Recount Their Experiences

May 10, 2025

The Nottingham Attacks Survivors Recount Their Experiences

May 10, 2025 -

Nottingham Attacks Survivors Break Silence

May 10, 2025

Nottingham Attacks Survivors Break Silence

May 10, 2025 -

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 10, 2025

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 10, 2025