Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Table of Contents

What is Net Asset Value (NAV) and How Does it Relate to the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation reflects the total value of the underlying 30 Dow Jones Industrial Average stocks held by the ETF, less any expenses. This value is calculated daily by Amundi, the ETF provider.

The crucial difference between NAV and the market price of the ETF is that the market price can fluctuate throughout the trading day based on supply and demand, while the NAV reflects the intrinsic value of the ETF's holdings. Discrepancies between the two can occur due to market trading activity.

- NAV reflects the underlying asset value of the ETF. This means it directly mirrors the performance of the Dow Jones Industrial Average.

- Daily NAV calculations are published by Amundi. These publications provide investors with transparency on the ETF's performance.

- Tracking the NAV helps assess the ETF's performance against the Dow Jones Industrial Average. A close correlation indicates effective index tracking.

- Discrepancies between NAV and market price can occur due to supply and demand. These discrepancies are usually temporary and tend to converge over time.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is crucial for making informed investment decisions.

The most significant influence is the performance of the underlying 30 stocks that comprise the Dow Jones Industrial Average. Positive market trends, driven by economic growth, strong corporate earnings, or positive investor sentiment, generally lead to an increase in the NAV. Conversely, negative market trends can cause a decrease.

- Positive market trends generally increase NAV. Strong performance by the underlying stocks directly translates to a higher NAV.

- Negative market trends generally decrease NAV. Market downturns lead to a reduction in the value of the underlying assets.

- Currency fluctuations can impact the NAV if the underlying assets are denominated in a different currency. While this ETF tracks a US index, any currency exposure in the underlying holdings might impact NAV.

- Dividend payments typically reduce the NAV. When the underlying companies distribute dividends, the ETF receives these payments, which are then distributed to investors, resulting in a slight reduction in NAV.

Using NAV to Inform Your Investment Strategy with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed buy and sell decisions. However, it's critical to maintain a long-term perspective. Short-term NAV fluctuations are normal and should not trigger impulsive actions.

- Regularly review the ETF's NAV to track performance. Compare this to the Dow Jones Industrial Average to evaluate the ETF's tracking efficiency.

- Don't panic-sell based on short-term NAV drops. Market corrections are a normal part of investing; focus on your long-term investment goals.

- Consider dollar-cost averaging to reduce the impact of NAV volatility. Investing a fixed amount at regular intervals helps mitigate the risk of buying high and selling low.

- Diversify your portfolio to minimize overall risk. The Amundi Dow Jones Industrial Average UCITS ETF should be considered part of a broader investment strategy, not your sole investment.

Amundi Dow Jones Industrial Average UCITS ETF: A Diversification Tool

Diversification is a cornerstone of sound investment strategy. By spreading investments across different asset classes and sectors, you can reduce overall portfolio risk. The Amundi Dow Jones Industrial Average UCITS ETF provides exposure to a basket of leading US companies, contributing to the diversification of your portfolio. Its NAV, when considered alongside other investments, gives you a clear picture of the ETF's contribution to your overall portfolio performance. This ETF is useful as part of a wider investment strategy.

Conclusion

Understanding the Net Asset Value (NAV) is paramount when investing in the Amundi Dow Jones Industrial Average UCITS ETF. While short-term NAV fluctuations are inevitable, a long-term perspective and a well-diversified portfolio can help mitigate risks. By closely monitoring the NAV and understanding the factors influencing it, you can make informed investment decisions and effectively manage your exposure to the Dow Jones Industrial Average.

Call to Action: Learn more about effectively utilizing NAV to optimize your investments in the Amundi Dow Jones Industrial Average UCITS ETF and start building a robust portfolio today!

Featured Posts

-

Princess Road Incident Emergency Response To Pedestrian Accident

May 25, 2025

Princess Road Incident Emergency Response To Pedestrian Accident

May 25, 2025 -

European Shares Rise On Trumps Tariff Hints Lvmh Slumps

May 25, 2025

European Shares Rise On Trumps Tariff Hints Lvmh Slumps

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Net Asset Value Nav

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Net Asset Value Nav

May 25, 2025 -

Major Incident On Princess Road Pedestrian Struck By Car Live Updates

May 25, 2025

Major Incident On Princess Road Pedestrian Struck By Car Live Updates

May 25, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 25, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 25, 2025

Latest Posts

-

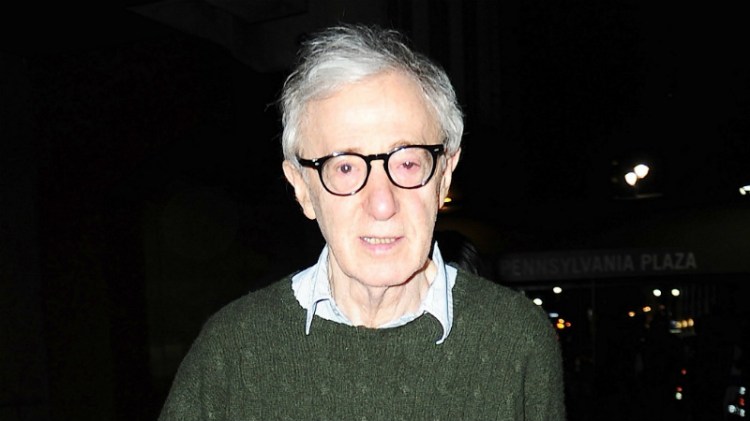

Public Figure Weighs In Sean Penns Stance On The Woody Allen Case

May 25, 2025

Public Figure Weighs In Sean Penns Stance On The Woody Allen Case

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Sexual Assault By Woody Allen

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Sexual Assault By Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Sean Penns Controversial Remarks On Dylan Farrow And Woody Allen

May 25, 2025

Sean Penns Controversial Remarks On Dylan Farrow And Woody Allen

May 25, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Doubts

May 25, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Doubts

May 25, 2025