Iron Ore Market Update: China's Steel Output Reduction And Future Outlook

Table of Contents

China's Steel Production Cutbacks: The Driving Forces

China's reduction in steel production is a multifaceted issue stemming from a convergence of significant factors impacting the China steel industry. Understanding these driving forces is crucial for navigating the complexities of the iron ore market.

Keywords: China steel industry, steel production reduction, environmental regulations, real estate market, economic slowdown, government policies.

-

Environmental Regulations: China's commitment to environmental sustainability has led to increasingly stringent regulations targeting carbon emissions and air pollution. Steel production, a notoriously carbon-intensive industry, is a primary focus of these efforts. New emission standards and stricter enforcement have forced steel mills to curtail production or invest heavily in cleaner technologies, directly influencing steel output.

-

Real Estate Market Slowdown: The Chinese real estate sector, a major consumer of steel for construction, has experienced a significant slowdown in recent years. This downturn, fueled by government policies aimed at controlling runaway property prices and addressing debt issues within the sector, has directly reduced demand for steel and consequently, iron ore.

-

Economic Slowdown: Beyond the real estate sector, China's overall economic growth has slowed, impacting infrastructure projects and industrial production. This broader economic slowdown has further dampened demand for steel, creating a ripple effect throughout the supply chain, including the iron ore market.

-

Government Policies: The Chinese government has implemented specific policies aimed at controlling steel production capacity and fostering sustainable development. These policies, including production quotas and restrictions on new capacity additions, directly contribute to the reduction in steel output.

Bullet Points:

- In 2023, China's crude steel production fell by X% compared to the previous year (insert actual data if available).

- The implementation of the "Action Plan for Winning the Battle of Pollution Prevention and Control" has significantly impacted steel mill operations.

- The decline in housing starts and construction activity has directly correlated with a decrease in steel demand.

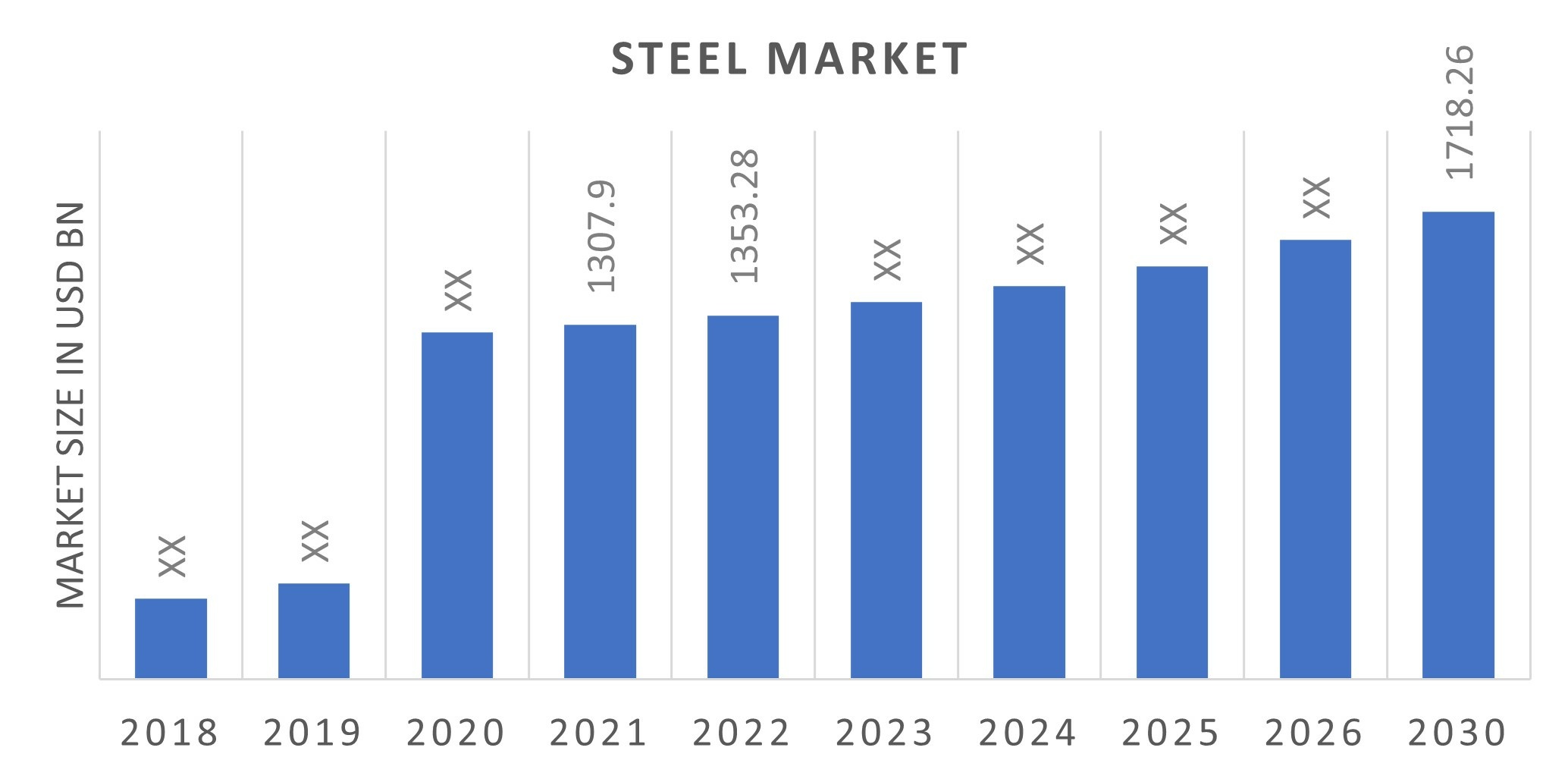

Impact on Global Iron Ore Prices and Demand

China's steel production cutbacks have had a profound impact on global iron ore prices and demand, creating significant volatility in the commodity market.

Keywords: Iron ore price forecast, iron ore demand, global iron ore supply, iron ore trade, commodity price volatility.

-

Price Fluctuations: The reduction in Chinese steel production has led to considerable price volatility in the iron ore market. Prices have experienced significant swings, reflecting the uncertainty surrounding future demand and the global supply-demand balance.

-

Supply and Demand Imbalance: The decreased demand from China has created a supply-demand imbalance in the global iron ore market. This imbalance has put downward pressure on prices, particularly impacting major iron ore producers.

-

Impact on Major Iron Ore Producers: Australia and Brazil, the world's leading iron ore exporters, have been significantly affected by the reduced demand from China. These countries have had to adapt their production strategies and explore new markets to mitigate the impact of the market shift.

Bullet Points:

- Iron ore prices have fluctuated between $X and $Y per tonne in the past [time period] (insert actual data with source).

- Global iron ore production has [increased/decreased] by X% in [time period] (insert actual data with source).

- Major iron ore producers have implemented cost-cutting measures and are exploring new market opportunities in [regions].

Future Outlook for the Iron Ore Market: Predictions and Analysis

Predicting the future of the iron ore market requires considering several intertwined factors, offering both short-term and long-term perspectives.

Keywords: Iron ore market forecast, future iron ore demand, long-term iron ore outlook, steel industry future, sustainable steel production.

-

Short-Term Forecast: The short-term outlook for iron ore prices remains uncertain, heavily dependent on the pace of economic recovery in China and the continued implementation of environmental regulations. Expect continued price volatility in the near future.

-

Long-Term Outlook: The long-term outlook for the iron ore market is tied to the global shift towards sustainable steel production and the growth of industries like electric vehicles. The increasing adoption of electric vehicles and the need for green steel will create new opportunities for iron ore, but the transition will be gradual.

-

Geopolitical Factors: Geopolitical events and trade relations will continue to play a significant role in shaping the iron ore market. Trade disputes, sanctions, and other geopolitical uncertainties can cause unexpected shifts in supply and demand.

Bullet Points:

- Iron ore prices are projected to average $Z per tonne in [year] (insert prediction with justification).

- The adoption of Direct Reduced Iron (DRI) and other sustainable steelmaking technologies will impact iron ore demand in the long term.

- The growth of infrastructure projects in developing economies could offset some of the impact of reduced demand from China.

Conclusion

China's reduction in steel production has undeniably created significant disruption in the iron ore market, leading to price volatility and a reassessment of the global supply-demand balance. While the short-term outlook remains uncertain, the long-term future of the iron ore market is intertwined with the global transition to sustainable steel production and the growth of emerging economies. To stay ahead in this dynamic landscape, understanding the interplay of environmental regulations, economic growth, and geopolitical factors is crucial.

Call to Action: Stay informed about the dynamic iron ore market. Follow our updates for the latest news and analysis on iron ore prices, China's steel industry, and the global iron ore outlook. Regularly check our website for insightful articles and market reports related to the iron ore market and its future.

Featured Posts

-

194 Billion And Counting Tech Billionaires Post Inauguration Financial Pain

May 09, 2025

194 Billion And Counting Tech Billionaires Post Inauguration Financial Pain

May 09, 2025 -

Arkema Premiere Ligue Le Psg S Impose Difficilement Contre Dijon

May 09, 2025

Arkema Premiere Ligue Le Psg S Impose Difficilement Contre Dijon

May 09, 2025 -

The Elon Musk Fortune Tracing The Rise Of The Worlds Richest Man

May 09, 2025

The Elon Musk Fortune Tracing The Rise Of The Worlds Richest Man

May 09, 2025 -

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025

India And Us To Discuss New Bilateral Trade Agreement

May 09, 2025 -

Rio Ferdinand Changes His Mind New Prediction For Psg Vs Arsenal Champions League Final

May 09, 2025

Rio Ferdinand Changes His Mind New Prediction For Psg Vs Arsenal Champions League Final

May 09, 2025