Is Apple Stock Headed To $254? Analyst Prediction And Buying Analysis

Table of Contents

Analyst Predictions and Their Rationale

Several financial analysts forecast Apple stock reaching $254. These predictions stem from a combination of factors:

-

Strong Product Sales: Apple consistently boasts impressive sales across its iPhone, Mac, iPad, and Wearables segments. These robust sales directly translate to higher revenue and profits. Analyzing quarterly earnings reports reveals consistent growth and market dominance. For example, the recent iPhone 14 launch demonstrated strong pre-orders and initial sales, suggesting continued momentum.

-

Services Revenue Growth: Apple's services sector (Apple Music, iCloud, Apple TV+, App Store, etc.) shows exceptional growth potential, providing a reliable and recurring revenue stream. This is less volatile than hardware sales, creating a more stable revenue base. The subscription model fosters customer retention and recurring income.

-

Innovation and Future Products: Apple's continuous innovation in augmented reality (AR), virtual reality (VR), and potential ventures like electric vehicles (EVs) fuel investor confidence. Analysts incorporate anticipated product launches and market penetration into their models. The rumored Apple Glasses, for instance, could significantly impact future revenue streams.

-

Market Share and Brand Loyalty: Apple maintains a significant market share and fiercely loyal customer base, ensuring predictable consumer demand regardless of economic fluctuations. This brand loyalty is a major factor in analyst projections. This strong brand image translates to premium pricing and consistent sales.

-

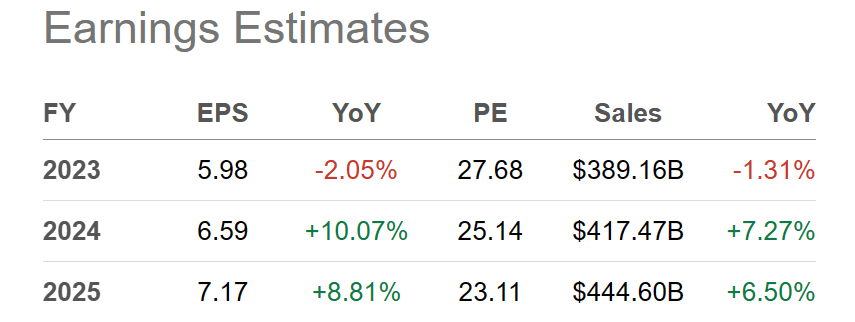

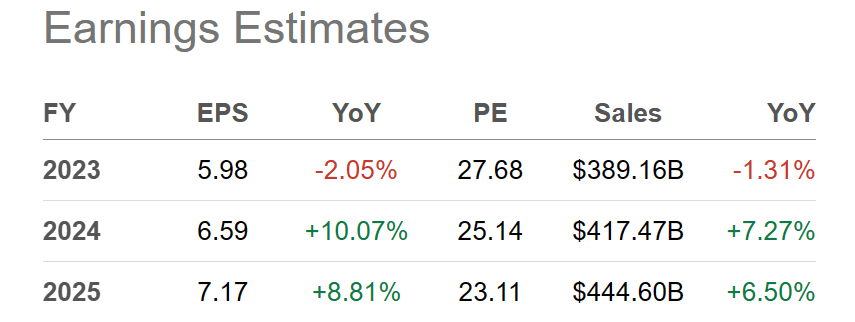

Buyback Programs: Apple's substantial stock buyback programs reduce the number of outstanding shares, boosting earnings per share (EPS) and potentially driving up the stock price. These programs signal confidence in the company's future and can artificially increase share value.

Factors that Could Support the $254 Target

Reaching $254 depends on several positive developments and continued strong performance:

-

Sustained High Demand: Maintaining consistent high demand across various demographics and geographic regions is crucial. This necessitates ongoing marketing initiatives and successful product launches that cater to evolving consumer needs.

-

Supply Chain Resilience: Smooth and uninterrupted supply chains are vital, especially given recent global disruptions. Analyst models must account for potential future disruptions and Apple's ability to mitigate them.

-

Favorable Economic Conditions: A robust global economy significantly benefits Apple's sales and investor sentiment. Economic downturns can negatively impact consumer spending on discretionary items.

-

Successful New Product Launches: The success of future products (new iPhones, Apple Glasses, etc.) is paramount. Positive market reception and strong sales are vital for reaching the $254 target. These launches need to resonate with consumers and meet market expectations.

-

Continued Innovation in Services: Continued growth and innovation within Apple's Services segment are critical. Expansion into new services and improvements to existing ones would bolster the projected value. This diversification reduces reliance on hardware sales alone.

Risks and Challenges to Reaching $254

While the $254 target is appealing, several factors could impede its achievement:

-

Increased Competition: Intense competition from tech giants, particularly in the smartphone market, poses a considerable challenge. Losing market share could negatively impact Apple's revenue growth. Samsung and other Android manufacturers are strong competitors.

-

Economic Slowdown: A global economic slowdown could significantly reduce consumer spending, impacting sales and negatively affecting the stock price. This could affect sales of high-priced Apple products.

-

Geopolitical Uncertainty: Geopolitical instability and trade disputes could disrupt Apple's global supply chains and sales. These uncertainties could lead to production delays and increased costs.

-

Regulatory Scrutiny: Increasing regulatory scrutiny regarding antitrust concerns and data privacy could affect Apple's operations and profitability. This could involve fines or other regulatory hurdles.

-

Overvaluation Concerns: The current Apple stock price might already reflect a significant portion of future growth, leading to potential overvaluation and limiting further price appreciation. Investors need to carefully assess the valuation metrics.

Conclusion

Whether Apple stock reaches $254 remains uncertain. Positive factors like strong sales, a growing services sector, and continued innovation support the prediction, but significant risks and challenges persist. Analyze the provided information, conduct your own research, and consider your risk tolerance before investing in Apple stock. The potential for Apple stock to reach $254 exists, but a careful assessment of the discussed factors is crucial before making any investment decisions regarding Apple stock. Remember to consult a financial advisor before making significant investment choices.

Featured Posts

-

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Leon Thomas And Flo The Best New R And B Music This Week

May 25, 2025

Leon Thomas And Flo The Best New R And B Music This Week

May 25, 2025 -

The Writers And Actors Strike Unprecedented Shutdown In Hollywood

May 25, 2025

The Writers And Actors Strike Unprecedented Shutdown In Hollywood

May 25, 2025 -

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025 -

European Shares Rise On Trumps Tariff Hints Lvmh Slumps

May 25, 2025

European Shares Rise On Trumps Tariff Hints Lvmh Slumps

May 25, 2025

Latest Posts

-

50 000 Promotions At Accenture A Six Month Delay Explained

May 25, 2025

50 000 Promotions At Accenture A Six Month Delay Explained

May 25, 2025 -

Selling Sunset Star Speaks Out La Fire Victims Face Price Gouging

May 25, 2025

Selling Sunset Star Speaks Out La Fire Victims Face Price Gouging

May 25, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

May 25, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

May 25, 2025 -

Chat Gpt And Open Ai The Ftc Investigation Explained

May 25, 2025

Chat Gpt And Open Ai The Ftc Investigation Explained

May 25, 2025