Is Jeanine Pirro Right? Her Advice To Avoid The Stock Market For Several Weeks

Table of Contents

Analyzing Jeanine Pirro's Reasoning

To understand Jeanine Pirro's advice, we need to examine the rationale behind her recommendation to avoid the stock market for several weeks. Unfortunately, precise details about the specific economic indicators or events she cited are often unavailable in mainstream media reporting. However, based on general market sentiment at the time of her statement, several factors could have contributed to her cautious outlook. These factors are often considered when assessing market risk:

-

Geopolitical Instability: Ongoing geopolitical tensions can significantly impact market stability, causing increased volatility and uncertainty. Events like international conflicts or political upheaval can trigger market corrections.

-

Inflationary Pressures: High inflation erodes purchasing power and can lead to interest rate hikes, which negatively affect stock valuations. Concerns about persistent inflation often drive investors to seek safer havens.

-

Potential Interest Rate Hikes: Central banks often raise interest rates to combat inflation. Higher interest rates can make borrowing more expensive for businesses, potentially slowing economic growth and impacting stock prices.

-

Upcoming Economic Reports: The release of significant economic data, such as employment figures or GDP reports, can cause short-term market fluctuations as investors react to the news. Anticipation of potentially disappointing reports could lead to caution.

The Risks of Ignoring Market Volatility

While Jeanine Pirro's caution is understandable given market uncertainty, it's crucial to acknowledge the inherent risks associated with attempting to time the market. Predicting short-term market movements with accuracy is notoriously difficult, even for seasoned professionals. Trying to perfectly time the market often results in missed opportunities and potentially worse outcomes than simply staying invested. Here are some key risks of delaying investment:

-

Missing Out on Potential Gains: Market rebounds can occur unexpectedly. Waiting on the sidelines means missing out on potential gains during periods of market recovery.

-

Increased Risk of Losing Purchasing Power due to Inflation: Delaying investments during inflationary periods means your money loses value faster than it would if invested.

-

Emotional Decision-Making: Fear-based decisions, driven by short-term market fluctuations, often lead to poor investment outcomes.

-

The Potential for Market Rebound Before Re-entry: The market may rebound before you feel comfortable re-entering, potentially resulting in a missed opportunity to capitalize on growth.

Alternative Investment Strategies During Market Uncertainty

Instead of trying to time the market based on short-term predictions like Jeanine Pirro's, investors can employ alternative strategies to navigate periods of uncertainty. These strategies prioritize stability and long-term growth over short-term gains.

-

Bonds: Bonds are generally considered less volatile than stocks and offer a fixed income stream.

-

Dividend-Paying Stocks: These stocks provide a regular stream of income, potentially mitigating some of the risk associated with price fluctuations.

-

Real Estate: Real estate investments can offer diversification and potential long-term growth, although they are generally less liquid than stocks.

-

Diversification Across Different Asset Classes: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) can help reduce overall portfolio risk.

-

Seeking Advice from a Financial Advisor: A qualified financial advisor can provide personalized guidance based on your individual risk tolerance, financial goals, and investment timeline.

The Importance of a Long-Term Investment Strategy

Rather than focusing on short-term market predictions, like Jeanine Pirro's advice, building a long-term investment strategy is significantly more effective for achieving financial goals. This approach focuses on consistent, disciplined investing over the long haul, enabling you to weather market fluctuations.

-

Riding Out Market Fluctuations: A long-term perspective allows you to ride out short-term market downturns, knowing that markets historically recover over time.

-

Compounding Returns Over Time: Compounding allows your investment returns to generate further returns over time, exponentially increasing your wealth.

-

Reducing Emotional Decision-Making: A well-defined long-term strategy reduces the temptation to make impulsive decisions based on short-term market noise.

-

The Potential for Greater Returns in the Long Run: Historically, long-term investments in the stock market have delivered significantly higher returns compared to short-term trading strategies. Dollar-cost averaging (DCA), a strategy of investing a fixed amount at regular intervals regardless of market conditions, is a prime example of a long-term approach.

Conclusion: Evaluating the Validity of Jeanine Pirro's Stock Market Advice and Your Next Steps

Jeanine Pirro's advice to avoid the stock market for several weeks highlights the inherent uncertainty in short-term market predictions. While caution is warranted during periods of market volatility, attempting to time the market is risky and often unproductive. The best approach for most investors is to focus on a diversified, long-term investment strategy aligned with their individual risk tolerance and financial goals. Remember to conduct thorough research, seek professional financial advice, and develop a long-term investment plan before making any decisions based on Jeanine Pirro's stock market advice or similar short-term predictions. Consider consulting a financial advisor to create a personalized investment plan tailored to your needs and risk tolerance.

Featured Posts

-

Stock Market Update Sensex Nifty 50 Unchanged Amidst Geopolitical Concerns

May 10, 2025

Stock Market Update Sensex Nifty 50 Unchanged Amidst Geopolitical Concerns

May 10, 2025 -

The Heartbeat Of Europe His Journey From Rejection To Triumph

May 10, 2025

The Heartbeat Of Europe His Journey From Rejection To Triumph

May 10, 2025 -

9 Maya Starmer Makron Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025

9 Maya Starmer Makron Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025 -

Tragic Fate Of Americas First Non Binary Person

May 10, 2025

Tragic Fate Of Americas First Non Binary Person

May 10, 2025 -

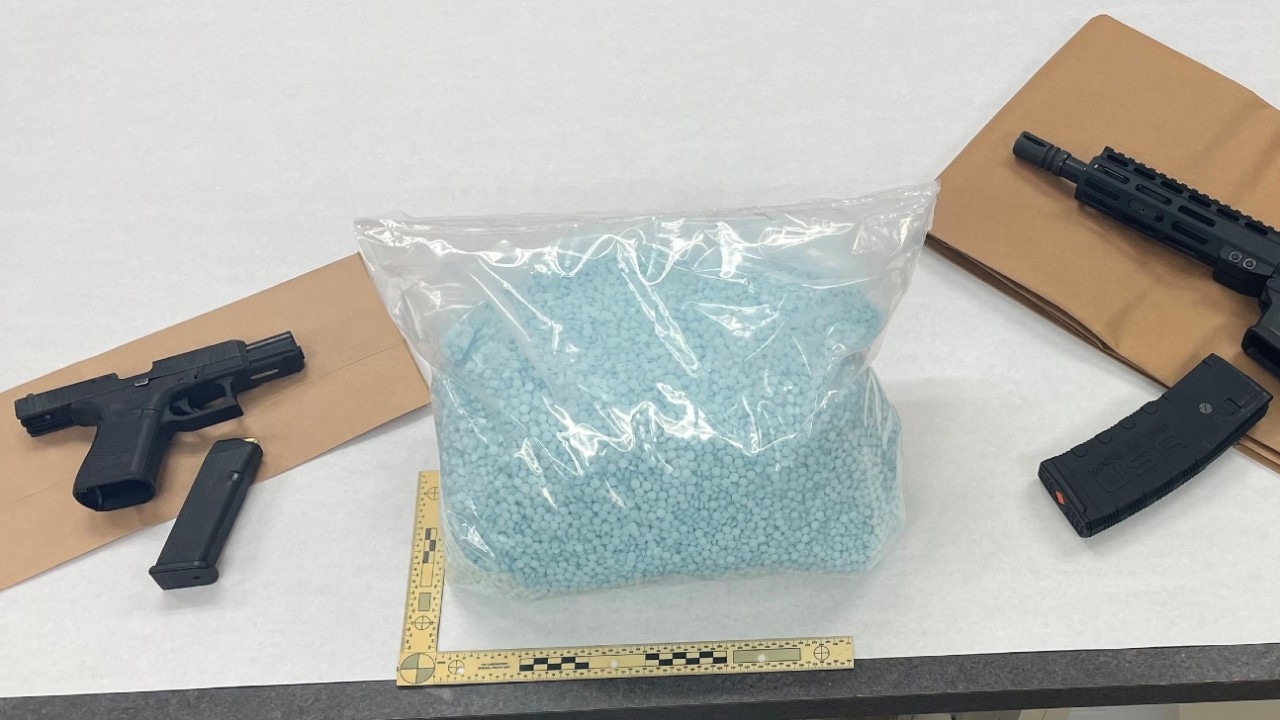

Record Breaking Fentanyl Seizure Details From Pam Bondi

May 10, 2025

Record Breaking Fentanyl Seizure Details From Pam Bondi

May 10, 2025

Latest Posts

-

Un Ministre Francais Propose Un Partage Du Bouclier Nucleaire Europeen

May 10, 2025

Un Ministre Francais Propose Un Partage Du Bouclier Nucleaire Europeen

May 10, 2025 -

Le Bouclier Nucleaire Francais Une Offre De Partage Selon Le Ministre Europeen

May 10, 2025

Le Bouclier Nucleaire Francais Une Offre De Partage Selon Le Ministre Europeen

May 10, 2025 -

Partage Du Bouclier Nucleaire La Proposition Du Ministre Francais

May 10, 2025

Partage Du Bouclier Nucleaire La Proposition Du Ministre Francais

May 10, 2025 -

Ministre Francais De L Europe Un Partage Du Bouclier Nucleaire

May 10, 2025

Ministre Francais De L Europe Un Partage Du Bouclier Nucleaire

May 10, 2025 -

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025