Is Live Nation Facing A Breakup Amidst Growing Pressure?

Table of Contents

Mounting Financial Pressures and Debt Burden

Live Nation's substantial debt load is a significant factor contributing to the "breakup" narrative. While the company enjoys a dominant market position, its profitability has been squeezed by a confluence of factors. Recent financial reports reveal a concerning trend:

- High debt-to-equity ratio: Live Nation's high leverage makes it vulnerable to economic downturns and interest rate hikes. A continued rise in interest rates could severely impact its ability to service its debt.

- Decreased profitability in recent quarters: Despite strong ticket sales in certain sectors, rising operational costs, particularly inflation impacting venue maintenance and artist fees, have eaten into profit margins.

- Impact of inflation on operational costs: Inflation has significantly increased the costs associated with running large-scale events, from staffing and security to venue upkeep and transportation. This has placed a strain on Live Nation's profitability.

- Potential difficulty in securing further financing: The current economic climate makes securing additional financing more challenging, potentially hindering future investments and expansion plans. This financial fragility fuels speculation about a potential restructuring or divestiture.

Antitrust Concerns and Regulatory Scrutiny

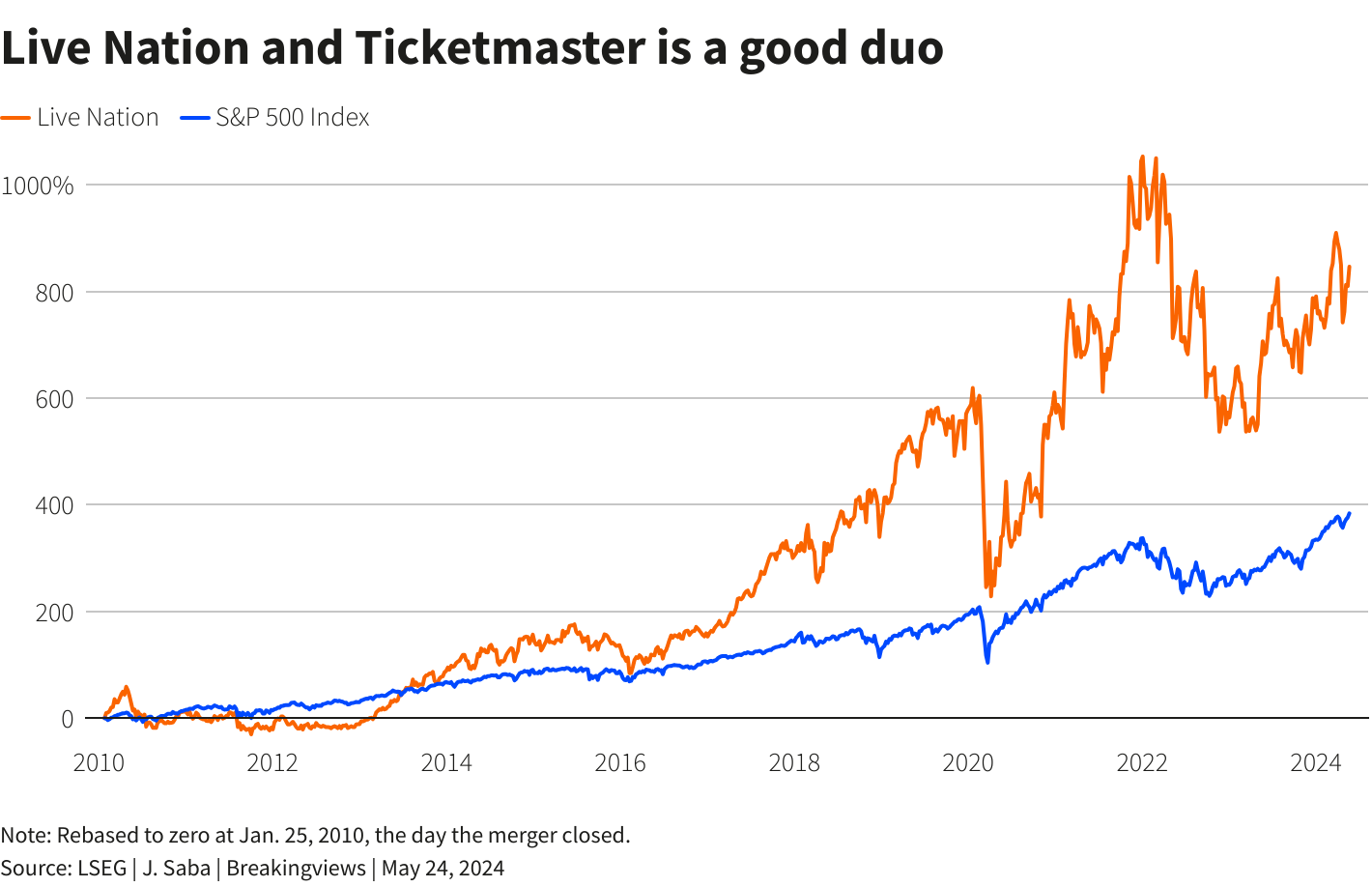

Live Nation's near-monopoly in the live music industry has drawn significant regulatory scrutiny and antitrust concerns. The company's control over ticketing, venue management, and artist representation has led to accusations of monopolistic practices.

- Market share analysis: Live Nation's overwhelming market share raises concerns about its ability to stifle competition and manipulate pricing. Independent promoters find it increasingly difficult to compete.

- Monopoly accusations and their potential consequences: These accusations could lead to significant legal challenges, potential fines, and even forced divestitures of certain assets. This uncertainty adds to the pressure for a potential breakup.

- Impact of government regulations: Increased government regulation designed to curb monopolistic behavior could further constrain Live Nation's operations and profitability, prompting strategic changes.

- Potential for forced divestitures or restructuring: Regulatory bodies may mandate the divestiture of specific assets or impose significant structural changes to foster a more competitive market.

Changing Consumer Behavior and Competition

The live entertainment industry is evolving rapidly. Changing consumer preferences and the emergence of new competitive forces are challenging Live Nation's traditional business model.

- Increased competition from smaller promoters: Smaller, niche promoters are gaining traction by catering to specific musical genres or offering more intimate, unique experiences. This fragmented market is eroding Live Nation's dominance.

- Shifting consumer demand for niche events: Consumers are increasingly seeking more curated and personalized experiences, leading to a demand for smaller, more specialized events, which are less profitable for Live Nation to manage.

- Impact of streaming services on live event attendance: The rise of streaming services has altered consumption habits, impacting attendance at some live events and putting pressure on ticket pricing strategies.

- The potential for innovative competitors to disrupt the market: New technologies and business models could disrupt the industry, potentially challenging Live Nation's existing infrastructure and market position.

Internal Conflicts and Leadership Changes

Internal dynamics within Live Nation also contribute to the uncertainty. Recent executive changes and potential internal conflicts raise questions about the company's long-term stability.

- Recent executive departures or appointments: Significant changes in leadership can signal underlying tensions or strategic shifts within the company, adding to the instability.

- Internal power struggles or disagreements: Internal conflicts can hinder effective decision-making and strategic planning, impacting the company's ability to respond to external pressures.

- Impact on strategic decision-making: Internal disagreements can lead to inconsistent strategies and a lack of clear direction, potentially exacerbating existing challenges.

- Potential for instability caused by internal friction: Internal conflicts can create uncertainty and instability, weakening the company's ability to navigate the challenges it faces.

Conclusion

Live Nation's future remains uncertain. The combination of significant debt, antitrust concerns, evolving consumer behavior, and potential internal conflicts creates a perfect storm. While a complete breakup might be drastic, a partial divestiture or significant restructuring seems increasingly likely. The company needs to strategically adapt to these challenges to maintain its market leadership. Follow the Live Nation breakup saga; stay informed about the growing pressure on Live Nation and learn more about the future of Live Nation by following industry news and analysis.

Featured Posts

-

Predicting Tottenham Vs Az Alkmaar Lineups Preview And Betting Odds

May 29, 2025

Predicting Tottenham Vs Az Alkmaar Lineups Preview And Betting Odds

May 29, 2025 -

Stranger Things 5 Release Date Speculation Cast Updates And Potential Episode Titles

May 29, 2025

Stranger Things 5 Release Date Speculation Cast Updates And Potential Episode Titles

May 29, 2025 -

Choosing The Right Plants For Your Living Fence Project

May 29, 2025

Choosing The Right Plants For Your Living Fence Project

May 29, 2025 -

Confirmed Full Liverpool Legends Squad For Anfield Charity Game

May 29, 2025

Confirmed Full Liverpool Legends Squad For Anfield Charity Game

May 29, 2025 -

Combs Threatens Kid Cudi Ex Employees Shocking Testimony In Diddy Trial

May 29, 2025

Combs Threatens Kid Cudi Ex Employees Shocking Testimony In Diddy Trial

May 29, 2025

Latest Posts

-

Susquehanna River Assault Case Moves Forward

May 30, 2025

Susquehanna River Assault Case Moves Forward

May 30, 2025 -

Guillermo Del Toros Frankenstein Horror Fans Baffled By Latest Movie Tease

May 30, 2025

Guillermo Del Toros Frankenstein Horror Fans Baffled By Latest Movie Tease

May 30, 2025 -

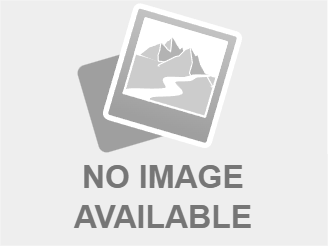

Giro D Italia 2024 Del Toros Stage 17 Win Vine And Plapps Abandonment

May 30, 2025

Giro D Italia 2024 Del Toros Stage 17 Win Vine And Plapps Abandonment

May 30, 2025 -

Guillermo Del Toros Frankenstein A Confusing New Tease And Its Surprising Theme

May 30, 2025

Guillermo Del Toros Frankenstein A Confusing New Tease And Its Surprising Theme

May 30, 2025 -

Del Toro Wins Stage 17 Solidifies Giro D Italia Lead Australian Riders Abandon Race

May 30, 2025

Del Toro Wins Stage 17 Solidifies Giro D Italia Lead Australian Riders Abandon Race

May 30, 2025