Is Palantir Stock A Buy In 2024? Projected 40% Growth By 2025

Table of Contents

Analyzing Palantir's Growth Potential

2.1. Palantir's Financial Performance and Projections

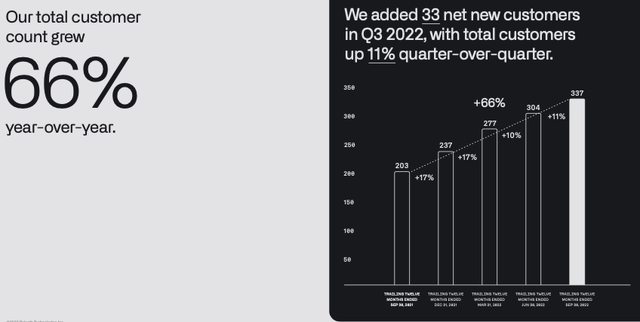

H3: Revenue Growth and Profitability: Palantir Technologies, a leader in big data analytics, has shown consistent revenue growth in recent years. Analyzing Palantir revenue reveals a steady upward trend, although profitability margins have fluctuated. While Palantir earnings haven't always met lofty expectations, the company's focus on expanding its customer base and increasing its recurring revenue streams suggests a positive trajectory. Detailed examination of Palantir's financial reports reveals a complex picture, requiring a nuanced understanding of its business model and long-term strategy. Accessing and analyzing recent quarterly and annual reports is crucial for a comprehensive assessment of Palantir revenue and profitability. Visual aids, like charts illustrating Palantir revenue growth over time, would aid in a clearer understanding.

H3: 40% Growth Projection: Realistic or Overly Optimistic?: The 40% growth projection for Palantir stock by 2025 is a bold claim, originating from a combination of analyst predictions and market speculation. While some analysts point to the increasing demand for data analytics solutions and Palantir's strong government contracts as supportive factors, others remain cautious, citing the competitive landscape and the company's dependence on a few key clients. Careful analysis of Palantir growth forecast is paramount. Understanding the methodology behind these predictions and the underlying assumptions is crucial for discerning whether this target is realistic or excessively optimistic.

- Key financial metrics: Revenue growth, earnings per share (EPS), operating margin, free cash flow.

- Comparison to competitors: Benchmarking Palantir's performance against companies like Snowflake, Databricks, and other data analytics providers offers valuable insights.

- Factors contributing to projected growth: Increased government spending on defense and intelligence, expansion into commercial markets (particularly in healthcare and finance), and the successful adoption of Palantir Foundry.

2.2. Government Contracts and Commercial Market Expansion

H3: Palantir's Government Contracts: Palantir's government contracts have been a cornerstone of its revenue stream. These contracts, often with intelligence agencies and defense departments, provide a stable, albeit sometimes unpredictable, source of income. Analyzing Palantir government contracts requires considering the ongoing geopolitical landscape and the potential for increased or decreased defense spending. Fluctuations in government priorities can significantly impact Palantir's revenue. The strength and duration of these contracts are pivotal to assessing the future of Palantir share price.

H3: Expansion into the Commercial Market: While government contracts provide a significant portion of Palantir's revenue, its expansion into the commercial market is crucial for long-term growth. The success of Palantir Foundry, its flagship data integration and analysis platform, is key to penetrating diverse commercial sectors. Identifying key Palantir commercial clients and understanding their satisfaction with the platform will highlight potential for sustained growth in this area. The data analytics market is fiercely competitive, so Palantir needs to continuously innovate and adapt to maintain its edge.

- Examples of significant government contracts: Identifying high-value, long-term contracts provides a clear picture of revenue stability.

- Key commercial clients and industry sectors: Assessing penetration into various markets (healthcare, finance, etc.) demonstrates the breadth of Palantir's commercial success.

- Analysis of market competition: Examining the competitive landscape and Palantir's ability to differentiate itself is crucial to assessing its long-term viability.

2.3. Risks and Challenges Facing Palantir

H3: Competition and Market Saturation: The data analytics market is intensely competitive. Palantir faces significant challenges from established players and emerging startups. Analyzing Palantir competitors and their market share reveals the intensity of the competition. The risk of market saturation and price wars cannot be overlooked. Innovation and a strong value proposition will be critical for Palantir to maintain its competitiveness.

H3: Dependence on Government Contracts: Palantir's heavy reliance on government contracts exposes it to political and budgetary risks. Changes in government spending priorities or shifts in geopolitical landscapes could dramatically affect the company's financial performance. This risk necessitates careful consideration when evaluating Palantir risk factors. Diversification into the commercial sector is a crucial mitigating factor.

- Key competitors and their market share: A comparative analysis will illustrate the competitive landscape and Palantir's position within it.

- Potential risks associated with government budget cuts or policy changes: Assessing the potential impact of such changes on Palantir's revenue is essential.

- Other challenges facing Palantir: Technological disruptions, regulatory hurdles, and the ongoing talent acquisition challenges within the tech sector.

Conclusion: Should You Buy Palantir Stock in 2024?

Palantir Technologies presents a compelling investment opportunity, driven by its strong growth potential and position in the burgeoning data analytics market. The projected 40% growth by 2025 is enticing, fueled by consistent revenue growth and expanding commercial ventures. However, the reliance on government contracts and intense competition pose considerable risks. A balanced assessment requires considering both Palantir's strengths and weaknesses. Before investing in Palantir stock, thorough due diligence, including a comprehensive analysis of its financial performance, competitive landscape, and inherent risks, is absolutely crucial. Consider your risk tolerance and investment goals before making any decisions regarding Palantir stock.

Featured Posts

-

Family Support For Dakota Johnson At Materialist La Premiere

May 10, 2025

Family Support For Dakota Johnson At Materialist La Premiere

May 10, 2025 -

Is Palantirs 30 Price Decrease A Good Entry Point

May 10, 2025

Is Palantirs 30 Price Decrease A Good Entry Point

May 10, 2025 -

4 Unexpected Randall Flagg Theories A New Look At Stephen Kings Universe

May 10, 2025

4 Unexpected Randall Flagg Theories A New Look At Stephen Kings Universe

May 10, 2025 -

How Jazz Cash And K Trade Are Making Stock Investment More Accessible

May 10, 2025

How Jazz Cash And K Trade Are Making Stock Investment More Accessible

May 10, 2025 -

Canadian Billionaire The Unexpected Heir To Warren Buffetts Legacy

May 10, 2025

Canadian Billionaire The Unexpected Heir To Warren Buffetts Legacy

May 10, 2025

Latest Posts

-

Nottingham Attacks Survivors Break Silence

May 10, 2025

Nottingham Attacks Survivors Break Silence

May 10, 2025 -

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 10, 2025

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 10, 2025 -

Tension On Bbc Joanna Pages Candid Assessment Of Wynne Evans

May 10, 2025

Tension On Bbc Joanna Pages Candid Assessment Of Wynne Evans

May 10, 2025 -

Nottingham Attack Survivors Speak Out A First Hand Account

May 10, 2025

Nottingham Attack Survivors Speak Out A First Hand Account

May 10, 2025 -

Dispute On Bbc Show Joanna Page Takes Aim At Wynne Evans Performance

May 10, 2025

Dispute On Bbc Show Joanna Page Takes Aim At Wynne Evans Performance

May 10, 2025