Is Palantir Stock A Good Investment Before May 5th?

Table of Contents

Palantir's Recent Performance and Market Sentiment

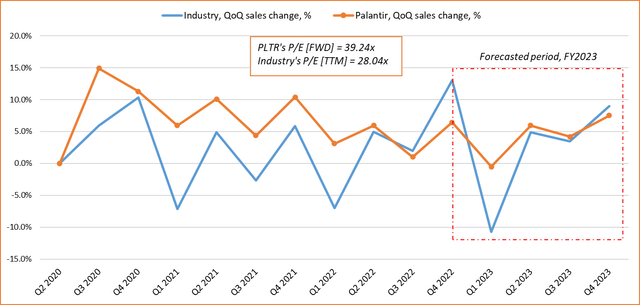

Understanding Palantir's recent performance is crucial for assessing its future potential. Analyzing the PLTR stock chart reveals considerable volatility over the past year, influenced by various factors including overall market sentiment, geopolitical events, and the company's own performance. Palantir's market cap fluctuates significantly, reflecting investor confidence.

- Review of PLTR stock price over the past year: A detailed chart analysis shows periods of both significant gains and losses, highlighting the inherent risk associated with the stock.

- Analysis of key financial metrics (revenue, profit margins, etc.): Examining Palantir's revenue growth, profit margins, and operating expenses provides insights into its financial health and sustainability. While revenue growth has been impressive in certain areas, profitability remains a key focus for investors.

- Discussion of analyst ratings and price targets: Consulting various analyst reports provides a diverse range of opinions on Palantir's future performance and associated price targets. However, it is important to note that analyst predictions are not guarantees.

- Examination of news and events affecting Palantir's stock price: Recent news, such as new contract wins, regulatory changes, or competitor activity, significantly impacts Palantir stock price. Staying informed on relevant news is critical for informed decision-making.

Analyzing Palantir's Upcoming Earnings Report (around May 5th)

The earnings report around May 5th will be a crucial moment for Palantir. Investors will be keenly watching for clues about the company's future trajectory. The Palantir earnings date is highly anticipated, and the Palantir earnings expectations are diverse among analysts.

- Consensus estimates for revenue and earnings per share (EPS): Analysts' predictions for revenue and EPS provide a baseline for evaluating the actual results. Surpassing or falling short of these estimates significantly influences the Palantir stock price.

- Key metrics to watch during the earnings call and subsequent filings: Investors should focus on key metrics like revenue growth, operating margins, customer acquisition costs, and any guidance provided by management for the coming quarters. The Palantir Q1 2024 earnings will set the tone for investor sentiment.

- Potential impact of positive or negative surprises on the stock price: A significant beat on expectations could lead to a sharp increase in the Palantir stock price, while a miss could trigger a sell-off. The PLTR earnings call will be closely scrutinized for any hints about future performance.

- Historical performance compared to earnings expectations: Reviewing Palantir's past performance against previous earnings expectations helps to gauge the reliability of predictions and understand market reactions.

Risks and Potential Rewards of Investing in Palantir Before May 5th

Before investing in Palantir stock, it is crucial to understand the inherent risks and potential rewards. Palantir stock is not without its challenges.

- Risk assessment: Volatility, competition, regulatory changes, dependence on specific clients: The high volatility of Palantir stock is a significant risk. Competition in the data analytics market, regulatory changes, and reliance on government contracts are additional factors to consider.

- Reward assessment: Potential for substantial growth, market leadership in key sectors: Palantir's potential for growth in the burgeoning big data market is a significant draw for investors. Its position in key sectors offers potential for long-term market leadership.

- Diversification strategies to mitigate risks: Diversifying your investment portfolio reduces the impact of potential losses in Palantir stock.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of its recent performance, the upcoming earnings report, and the inherent risks and rewards. The volatility of Palantir stock price makes thorough due diligence essential. While Palantir possesses significant growth potential, its high valuation and reliance on certain sectors pose risks. Before making any decisions on Palantir stock, before or after May 5th, carefully review financial reports, analyst ratings, and market trends. Consider consulting a financial advisor to determine if Palantir aligns with your investment strategy and risk tolerance. Remember to always invest responsibly and diversify your portfolio. Is Palantir stock right for your investment strategy?

Featured Posts

-

Planned Elizabeth Line Strikes Impact On February And March Services

May 10, 2025

Planned Elizabeth Line Strikes Impact On February And March Services

May 10, 2025 -

Two Dead After Pedestrian Accident On Elizabeth City Road Driver Involved

May 10, 2025

Two Dead After Pedestrian Accident On Elizabeth City Road Driver Involved

May 10, 2025 -

Family Support For Dakota Johnson At Materialist Film Premiere In La

May 10, 2025

Family Support For Dakota Johnson At Materialist Film Premiere In La

May 10, 2025 -

Strictly Scandal Wynne Evans Presents New Evidence In His Defense

May 10, 2025

Strictly Scandal Wynne Evans Presents New Evidence In His Defense

May 10, 2025 -

Queen Elizabeth 2s Stunning Makeover A Look Inside The Refurbished 000 Guest Ship

May 10, 2025

Queen Elizabeth 2s Stunning Makeover A Look Inside The Refurbished 000 Guest Ship

May 10, 2025

Latest Posts

-

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 10, 2025

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 10, 2025 -

Nyt Spelling Bee April 4th 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee April 4th 2025 Complete Gameplay Guide

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram Solutions

May 10, 2025

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram Solutions

May 10, 2025 -

Nyt Strands April 10th Game 403 Solutions And Clues

May 10, 2025

Nyt Strands April 10th Game 403 Solutions And Clues

May 10, 2025 -

Strands Nyt Complete Guide To Answers For Thursday April 10 Game 403

May 10, 2025

Strands Nyt Complete Guide To Answers For Thursday April 10 Game 403

May 10, 2025