Is Palantir Stock A Smart Investment Before May 5th? Wall Street's Take

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Understanding Palantir's financial health is crucial for any investment decision. Analyzing recent quarterly earnings reports reveals key insights into its revenue growth, profitability, and overall financial trajectory.

Revenue Growth and Profitability

Palantir's revenue growth has been a point of both optimism and concern among investors. Examining year-over-year comparisons provides a clearer picture.

- Year-over-Year Revenue Growth: [Insert data on recent year-over-year revenue growth from Palantir's financial reports. Example: "Palantir demonstrated a X% increase in revenue in Q4 2023 compared to Q4 2022."] This showcases the company's ability to expand its customer base and secure new contracts.

- Gross and Operating Margins: [Insert data on gross and operating margins. Example: "While gross margins remain healthy at approximately X%, operating margins continue to be a focus area for Palantir, currently sitting at Y%."] This is a key indicator of profitability and operational efficiency.

- Significant Contracts: [Mention any significant contract wins or losses that have influenced recent financial performance. Example: "The recent award of a major contract with [Client Name] significantly boosted Q4 revenue and reflects the growing demand for Palantir's data analytics solutions."] This highlights the impact of key partnerships and government/commercial contracts on Palantir revenue. Tracking Palantir revenue is vital to understanding its financial stability.

Government vs. Commercial Contracts

Palantir's revenue stream is derived from both government and commercial sectors. The balance between these two segments impacts future growth projections and carries different levels of risk.

- Revenue Breakdown: [Insert data showing the percentage of revenue derived from each sector. Example: "Currently, approximately Z% of Palantir's revenue comes from government contracts, while the remaining X% originates from the commercial sector."] This emphasizes the diversification (or lack thereof) of their revenue streams.

- Risk and Reward Analysis: Government contracts often offer long-term stability but can be subject to budgetary constraints and shifting political landscapes. Commercial contracts can offer faster growth but may be more competitive and less predictable. Understanding this dynamic is critical for any Palantir investment strategy.

- Long-Term Growth Potential: [Discuss the growth potential of each segment. Example: "The commercial sector is expected to drive significant future growth for Palantir, as more businesses adopt advanced data analytics solutions."] Analyzing the long-term prospects of both sectors is vital for assessing the overall potential of Palantir stock.

Wall Street Analyst Ratings and Price Targets

Wall Street's perspective on Palantir is multifaceted, with varying opinions and price targets reflecting the inherent complexities of the company's business model.

Consensus Opinion

The consensus opinion among Wall Street analysts provides a valuable snapshot of the overall sentiment surrounding PLTR.

- Buy, Hold, Sell Ratings: [Summarize the distribution of buy, hold, and sell ratings from various prominent analysts. Example: "Currently, X% of analysts rate Palantir as a 'buy,' Y% as 'hold,' and Z% as 'sell.'"] This provides an overview of market sentiment.

- Average Price Target: [Provide the average price target set by analysts. Example: "The average price target for PLTR is currently $[Price], suggesting a potential [Percentage]% upside from the current market price."] This gives investors an idea of potential future price movements.

- Recent Changes in Sentiment: [Discuss any significant shifts in analyst ratings or price targets in recent months. Example: "Recent upgrades from [Analyst Name] and [Analyst Name] reflect increasing confidence in Palantir's long-term prospects."] This signals any potential changes in market outlook. Analyzing Palantir analyst ratings is a crucial part of evaluating the stock.

Factors Influencing Analyst Opinions

Different analysts base their opinions on various factors, leading to varying ratings and price targets.

- Profitability Concerns: Some analysts express concerns about Palantir's path to sustained profitability, citing ongoing operating expenses and the need for further revenue growth.

- Competition: The competitive landscape in the data analytics market is intense, with established players and new entrants vying for market share. Analysts weigh Palantir's competitive advantages and disadvantages.

- Market Valuation: The current market valuation of Palantir is a key factor influencing analyst opinions. Some believe the stock is overvalued, while others see potential for further growth. Understanding the dynamics of Palantir valuation is key.

Market Conditions and Macroeconomic Factors

The broader market environment significantly impacts Palantir's stock price. Macroeconomic factors and competitive dynamics play a crucial role.

Overall Market Sentiment

The overall market sentiment towards technology stocks, and growth stocks in particular, influences investor behavior and can impact Palantir’s valuation.

- Market Trends: [Describe the current trends in the tech stock market. Example: "Current market trends suggest a cautious approach to growth stocks, given concerns about [mention relevant factors, e.g., inflation, interest rates]."] Understanding broader market movements is critical.

- Impact of Inflation/Recession: [Discuss the impact of macroeconomic factors like inflation and recessionary fears on the tech sector and Palantir. Example: "Rising interest rates and inflationary pressures could put downward pressure on tech stocks, including Palantir, as investors favor more defensive investments."] This highlights the sensitivity of Palantir's stock price to broader economic conditions.

- Correlation with Palantir's Performance: [Analyze any historical correlations between broader market movements and Palantir's stock price.] This helps to contextualize the potential influence of macroeconomic factors on PLTR.

Competitive Landscape

Palantir operates in a competitive market, facing challenges from established players and emerging competitors.

- Key Competitors: [Identify Palantir's key competitors, such as Microsoft, AWS, and other data analytics companies.] Understanding the competitive arena is critical.

- Competitive Advantages: [Highlight Palantir's competitive advantages, such as its proprietary technology, data, and strategic partnerships.] Palantir's strengths need to be highlighted.

- Threat from New Entrants: [Discuss the potential threat from new entrants and disruptive technologies.] This provides a realistic perspective on long-term sustainability.

Conclusion

Deciding whether to invest in Palantir before May 5th requires a thorough assessment of its financial performance, Wall Street's outlook, and broader market conditions. While Palantir shows promise in certain areas, concerns remain regarding profitability and the competitive landscape. The impact of macroeconomic factors also needs careful consideration. The analysis presented here emphasizes the need for a balanced perspective, factoring in both potential upside and downside risks. Remember to conduct your own due diligence and consult a financial advisor before investing in Palantir stock or any other security. This analysis is for informational purposes only and does not constitute financial advice. Do your own research before investing in Palantir.

Featured Posts

-

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025 -

Samuel Dickson Influence And Impact On The Canadian Lumber Industry

May 10, 2025

Samuel Dickson Influence And Impact On The Canadian Lumber Industry

May 10, 2025 -

Troubled Nhs Trust Chiefs Full Cooperation With Nottingham Attack Inquiry Pledged

May 10, 2025

Troubled Nhs Trust Chiefs Full Cooperation With Nottingham Attack Inquiry Pledged

May 10, 2025 -

Analyzing The 2025 Palantir Stock Projection Of 40 Growth

May 10, 2025

Analyzing The 2025 Palantir Stock Projection Of 40 Growth

May 10, 2025 -

The Dark Side Of Disaster Exploring The Reality Of Betting On The Los Angeles Wildfires

May 10, 2025

The Dark Side Of Disaster Exploring The Reality Of Betting On The Los Angeles Wildfires

May 10, 2025

Latest Posts

-

Snls Failed Harry Styles Impression His Response

May 10, 2025

Snls Failed Harry Styles Impression His Response

May 10, 2025 -

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025 -

Farcical Misconduct Nottingham Families Call For Proceedings Delay

May 10, 2025

Farcical Misconduct Nottingham Families Call For Proceedings Delay

May 10, 2025 -

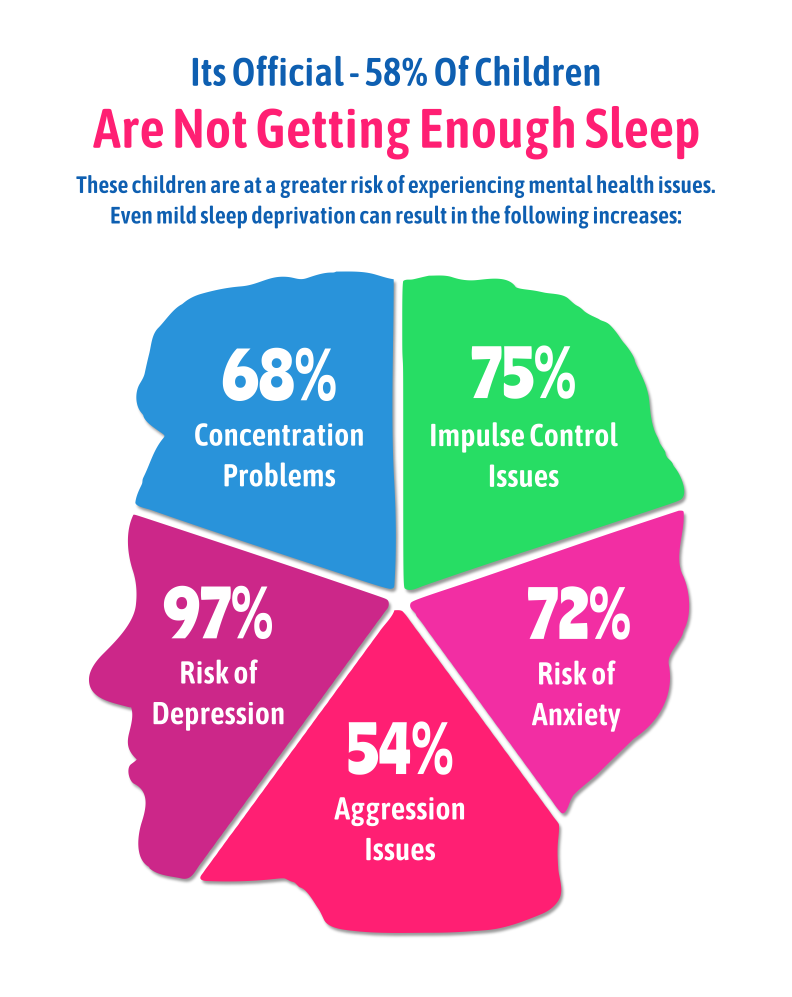

Understanding The Link Between Mental Health And Violence Where Academia Has Failed

May 10, 2025

Understanding The Link Between Mental Health And Violence Where Academia Has Failed

May 10, 2025 -

Academic Neglect Examining The Misconceptions Surrounding Mental Illness And Violent Crime

May 10, 2025

Academic Neglect Examining The Misconceptions Surrounding Mental Illness And Violent Crime

May 10, 2025