Is The Bank Of Canada Listening? Rosenberg Analyzes The Latest Canadian Employment Figures

Table of Contents

Rosenberg's Analysis of the Latest Canadian Employment Report

The most recent Canadian employment report revealed [insert actual data here, e.g., a 3% increase in employment, unemployment rate dropping to 5.2%, etc.]. While these figures might appear positive at first glance, Rosenberg's interpretation paints a more nuanced picture. He [state Rosenberg's overall stance – optimistic, pessimistic, cautious, etc.]. His analysis focuses on several key aspects:

-

Wage Growth and Inflation: Rosenberg highlights [insert specific data on wage growth from Rosenberg's analysis], arguing that [explain Rosenberg's argument on how wage growth impacts inflation – is it fueling inflation, or is it sustainable within the BoC's target?]. This directly impacts the BoC's inflation-fighting strategy.

-

Sustainability of Employment Levels: The analyst expresses concerns/optimism (depending on Rosenberg's actual view) regarding the sustainability of the current employment numbers. He points to [explain Rosenberg's specific concerns or reasons for optimism – e.g., potential for a slowdown, strength of specific sectors, etc.].

-

Predictions for Future Job Creation: Rosenberg predicts [insert Rosenberg's predictions about future job creation or potential job losses, citing specific data or reasoning if available]. This prediction is crucial for forecasting future economic growth and informing the BoC's policy decisions.

Implications for Bank of Canada Monetary Policy

Rosenberg's assessment significantly influences expectations surrounding the Bank of Canada's next interest rate decision. If his analysis of sustained wage growth and inflationary pressures holds true, it could lead the BoC to [explain potential BoC actions based on Rosenberg's analysis – e.g., maintain current rates, increase rates further, pause rate hikes, etc.]. The employment data's impact on inflation is paramount, as the BoC strives to meet its inflation target of [insert current BoC inflation target].

However, it's important to note that not all economists share Rosenberg's perspective. [Mention differing opinions and perspectives from other economists, providing citations if possible].

Potential scenarios include:

-

Maintaining Current Interest Rates: If the BoC perceives the employment situation as stable and inflation under control, it may choose to maintain its current interest rate policy.

-

Further Interest Rate Hikes: If the BoC deems inflationary pressures significant, driven by factors highlighted by Rosenberg or others, further interest rate hikes are a strong possibility.

-

Pause or Rate Cuts: Conversely, if the economic outlook deteriorates significantly, the BoC might choose to pause rate hikes or even consider rate cuts to stimulate economic activity.

Market Reactions and Investor Sentiment

The release of the Canadian employment report and Rosenberg's subsequent commentary have triggered notable reactions in financial markets. The Canadian dollar [explain the impact on the CAD exchange rate – appreciation, depreciation, stability], while government bond yields have [explain changes in bond yields – increased, decreased, remained stable]. The Toronto Stock Exchange (TSX) has shown [explain the impact on the TSX – gains, losses, or sideways movement].

Investor sentiment reflects a degree of [explain investor sentiment – optimism, pessimism, caution] based on Rosenberg's analysis and the overall employment figures. Rosenberg himself has identified [mention specific risks or opportunities highlighted by Rosenberg – e.g., potential for a recession, opportunities in specific sectors, etc.].

Key market reactions include:

-

Canadian Dollar: The CAD's reaction reflects investor confidence in the Canadian economy following the employment data release and Rosenberg's interpretation.

-

Bond Yields: Changes in government bond yields indicate shifts in investor expectations regarding future interest rates and economic growth.

-

Toronto Stock Exchange (TSX): The TSX's performance reveals how the market is valuing the employment data and its implications for corporate earnings.

Conclusion: The Bank of Canada's Next Move and the Importance of Canadian Employment Data

David Rosenberg's analysis of the latest Canadian employment figures provides a crucial lens through which to view the Bank of Canada's upcoming monetary policy decisions. His focus on wage growth, employment sustainability, and predictions for future job creation offers valuable insight into the complexities of the Canadian economy. Understanding the interplay between Canadian employment data, inflation, and the Bank of Canada's actions is vital for navigating the current economic climate. Monitoring Canadian employment figures remains critical for informed investment decisions and understanding the future direction of the Canadian economy. Stay informed about future analyses of Bank of Canada interest rate decisions and Canadian employment figures to make well-informed choices.

Featured Posts

-

Novak Djokovic In Essiz Rekoru Bir Ilke Imza Atti

May 31, 2025

Novak Djokovic In Essiz Rekoru Bir Ilke Imza Atti

May 31, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Allegations

May 31, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Allegations

May 31, 2025 -

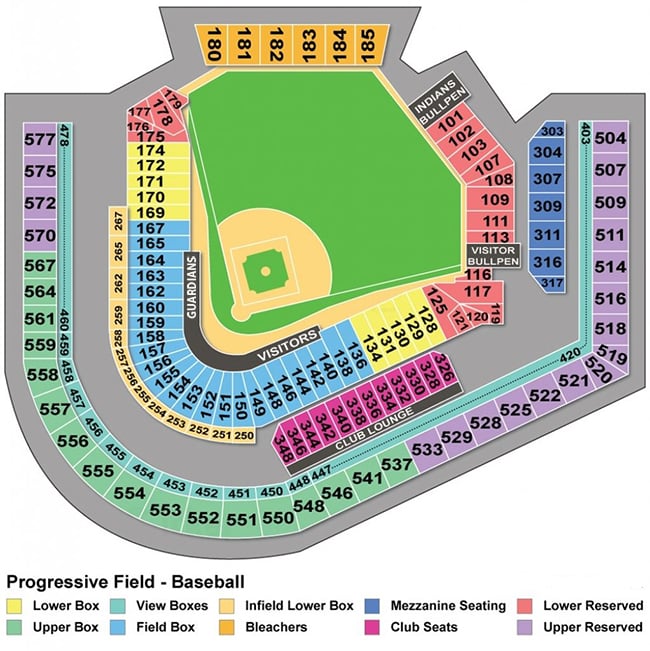

Guardians Opening Day A Historical Look At The Weather Conditions

May 31, 2025

Guardians Opening Day A Historical Look At The Weather Conditions

May 31, 2025 -

Jaime Munguia Wins Points Victory Over Bruno Surace In Riyadh Rematch

May 31, 2025

Jaime Munguia Wins Points Victory Over Bruno Surace In Riyadh Rematch

May 31, 2025 -

Investing In Banksy Six Screenprints And A Rare Tool

May 31, 2025

Investing In Banksy Six Screenprints And A Rare Tool

May 31, 2025