Is The 'Sell America' Trade Resurfacing As 30-Year Yields Hit 5%?

Table of Contents

Rising Interest Rates and Their Impact on the "Sell America" Trade

Higher interest rates, while seemingly positive for attracting foreign investment, present a complex picture regarding the "Sell America" trade. The logic suggests that increased yields on US Treasury bonds make them more attractive compared to bonds issued in other countries. This could potentially mitigate capital flight. However, the narrative is far from simple.

- Increased attractiveness of US dollar-denominated assets: Higher interest rates generally boost the appeal of US dollar-denominated assets, such as Treasury bonds and corporate debt, leading to increased demand from foreign investors.

- Potential for capital inflows despite higher yields: While higher rates attract investment, the speed and magnitude of the increase matter. A rapid surge can unsettle markets and potentially outweigh the positive effects of higher yields, contributing to a "Sell America" scenario.

- Comparison of US interest rates to global rates: The relative attractiveness of US assets depends on the differential between US interest rates and those offered in other major economies. If global rates rise significantly, the incentive for foreign investment in the US might diminish.

- Analysis of the impact of quantitative tightening (QT): The Federal Reserve's quantitative tightening (QT) policy, aimed at reducing its balance sheet, can influence interest rates and potentially contribute to a "Sell America" effect if implemented too aggressively. The reduction in liquidity can make investors seek alternative, safer havens outside the US.

The Role of the US Dollar in the "Sell America" Narrative

The US dollar's strength or weakness plays a pivotal role in determining foreign investment flows into the US. A strong dollar, while boosting the purchasing power of Americans, can ironically lead to a "Sell America" effect.

- Correlation between US dollar strength and capital flows: A strong US dollar makes US assets more expensive for foreign investors, potentially discouraging investment and triggering capital outflows.

- Impact of global economic uncertainty on the dollar's value: Periods of global economic uncertainty often lead to a flight to the safety of the US dollar, strengthening its value and, paradoxically, potentially fueling a "Sell America" trade due to increased expense for foreign buyers.

- Analysis of the US dollar index (DXY) and its implications: Monitoring the US dollar index (DXY), a measure of the dollar's value against other major currencies, is crucial for understanding the potential for a "Sell America" trade. A sustained rise in the DXY often coincides with capital outflows.

- Discussion of potential dollar devaluation and its effects: A weakening US dollar, on the other hand, could make US assets more affordable for foreign investors, potentially reversing the "Sell America" trend.

Geopolitical Risks and Their Contribution to the "Sell America" Trade

Geopolitical instability is a significant catalyst for the "Sell America" phenomenon. Uncertainty and conflict often prompt investors to seek safer havens, leading to capital flight from riskier markets, including the US.

- Impact of global conflicts and tensions on investor sentiment: Escalating geopolitical tensions can trigger risk aversion, prompting investors to move their assets to perceived safer havens.

- Analysis of the role of safe-haven assets (e.g., gold, Swiss franc): During periods of heightened geopolitical risk, investors often flock to safe-haven assets like gold or the Swiss franc, reducing investment in US assets.

- Examination of specific geopolitical events and their influence: Major geopolitical events, such as wars or significant political shifts, can directly impact investor confidence and fuel a "Sell America" trend.

- Discussion of the flight-to-safety phenomenon and its impact on US assets: The flight-to-safety phenomenon, where investors move to less risky assets during uncertain times, can lead to a significant decrease in demand for US assets and further contribute to a "Sell America" trade.

Specific Asset Classes Affected by a Potential "Sell America" Trade

A resurgence of the "Sell America" trade would likely impact various asset classes differently.

- Potential impact on US stock market indices (e.g., S&P 500, Dow Jones): A "Sell America" trade could lead to a decline in US stock market indices as foreign investors divest from US equities.

- Effect on US Treasury bond yields and prices: While higher interest rates initially attract investment, a sustained "Sell America" trend could push US Treasury bond yields down and prices up, as investors seek less risky investments.

- Consequences for the US real estate market: A reduction in foreign investment could negatively impact the US real estate market, particularly in areas heavily reliant on international buyers.

Conclusion

The 5% threshold on 30-year Treasury yields raises legitimate concerns about a potential resurgence of the "Sell America" trade. While higher interest rates can, in theory, attract foreign investment, factors like a strong US dollar and geopolitical instability can easily outweigh this effect and trigger substantial capital outflows. The impact on various asset classes will depend on the complex interplay of these factors. Understanding the nuances of the "Sell America" trade and its potential drivers is crucial for investors navigating the current market landscape. Stay informed about global economic developments and interest rate movements to make informed decisions in this dynamic environment. Continue to monitor the "Sell America" trade and its influence on your investment strategy. Ignoring the potential for a "Sell America" trade could significantly impact your portfolio's performance.

Featured Posts

-

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025 -

Aldhkae Alastnaey Yuhyy Aemal Ajatha Krysty Drast Halt

May 20, 2025

Aldhkae Alastnaey Yuhyy Aemal Ajatha Krysty Drast Halt

May 20, 2025 -

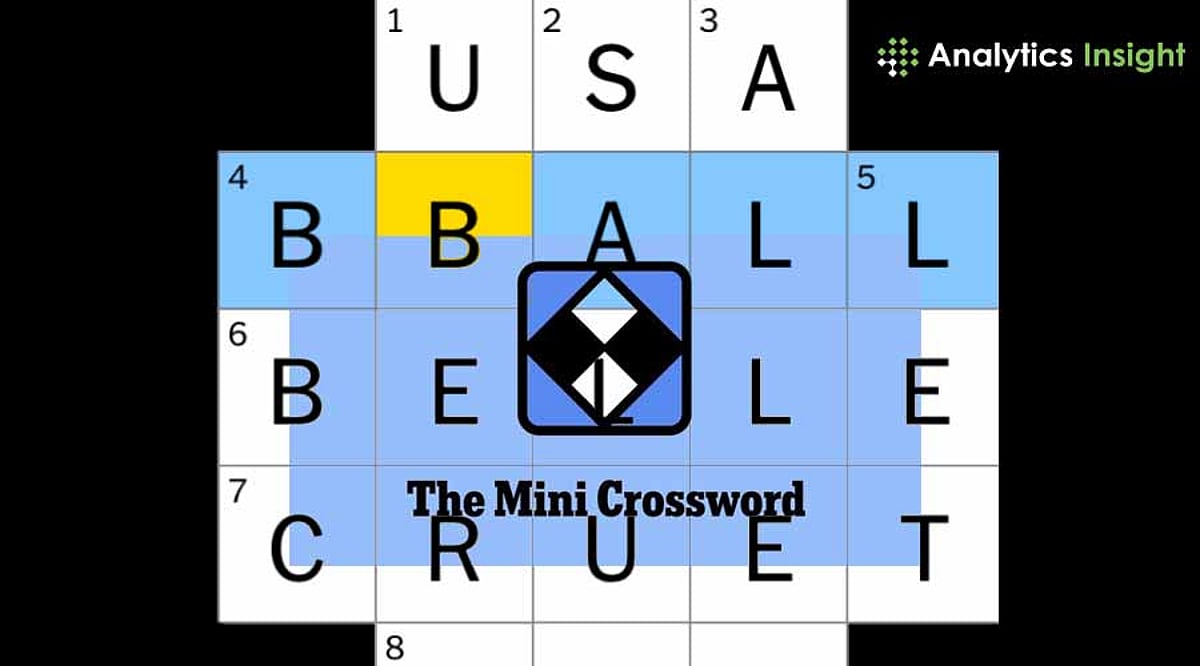

Todays Nyt Mini Crossword Answers April 13th

May 20, 2025

Todays Nyt Mini Crossword Answers April 13th

May 20, 2025 -

Jalkapallo Huuhkajien Kokoonpanossa Merkittaeviae Muutoksia

May 20, 2025

Jalkapallo Huuhkajien Kokoonpanossa Merkittaeviae Muutoksia

May 20, 2025 -

Hegseths Announcement New Us Missile System Deployed To Philippines

May 20, 2025

Hegseths Announcement New Us Missile System Deployed To Philippines

May 20, 2025