Is The Stock Market Overvalued? BofA Offers Reassurance To Investors

Table of Contents

BofA's Valuation Metrics and Their Interpretation

Bank of America employs a multifaceted approach to assess stock market valuation, utilizing several key metrics and comparing them to historical averages and current economic conditions. Their methodology incorporates:

-

Price-to-Earnings Ratio (P/E): BofA analyzes the P/E ratio of the S&P 500 and individual sectors, comparing current levels to historical averages. A high P/E ratio generally suggests a higher valuation. While they acknowledge elevated P/E ratios in certain sectors, their analysis suggests that the overall market isn't drastically overvalued compared to historical precedent, adjusted for current interest rates.

-

Market Capitalization: BofA considers the overall market capitalization of the stock market relative to GDP, a key metric for assessing overall valuation. Their findings suggest that while market capitalization is high, it's not at unprecedented levels.

-

Dividend Yield: The dividend yield, representing the annual dividend payment relative to the stock price, is another factor. A lower dividend yield can sometimes indicate higher valuations. BofA incorporates this metric into their comprehensive assessment.

-

Valuation Multiples: BofA uses a variety of other valuation multiples, including price-to-sales and price-to-book ratios, to develop a holistic view of market valuation. They consider these multiples across different sectors to identify potential overvaluations or undervaluations.

Key Findings: While BofA acknowledges elevated valuations in some sectors, their analysis doesn't conclude that the entire stock market is drastically overvalued. Their findings suggest that valuations are high but not necessarily unsustainable. For example, recent reports might show a P/E ratio of 20 for the S&P 500, which, while above the long-term average of 15, is not unprecedented considering prevailing interest rates and economic growth projections. However, they identify specific sectors, such as certain technology sub-sectors, showing higher valuations than others.

Limitations: It's crucial to remember that no valuation model is perfect. BofA's analysis, while comprehensive, relies on assumptions and projections that can be influenced by unforeseen events and economic shifts. The accuracy of their predictions hinges on the reliability of the underlying economic data and forecasting models.

Economic Factors Influencing BofA's Assessment

BofA's assessment of the stock market valuation is heavily influenced by various economic factors:

-

Inflation and Interest Rates: High inflation and subsequent interest rate hikes by the Federal Reserve significantly impact stock valuations. Higher interest rates generally reduce the present value of future earnings, leading to lower stock prices. BofA considers the likely trajectory of inflation and interest rates in their analysis.

-

Economic Growth Projections: BofA's outlook considers projections for economic growth. Slower economic growth typically translates to reduced corporate earnings, potentially leading to lower stock valuations. BofA's models factor in GDP growth forecasts.

-

Recession Risk: The possibility of a recession is a crucial consideration. A recession usually leads to lower corporate profits and stock market declines. BofA incorporates their assessment of recession risk into their valuation analysis, influencing their overall outlook and recommendations.

-

Geopolitical Risks: Geopolitical events, such as the war in Ukraine and energy crises, create uncertainty and volatility in the market, impacting investor sentiment and potentially influencing stock prices. BofA incorporates these risks into their analysis.

-

Consumer Confidence: Consumer spending is a significant driver of economic growth. BofA analyzes consumer confidence indices to gauge the strength of consumer spending, which impacts their view on overall market health.

BofA's Investment Recommendations and Strategic Advice

Based on their analysis, BofA generally recommends a long-term investment approach, emphasizing the importance of:

-

Portfolio Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigating risk. BofA emphasizes this strategy, particularly given the potential for sector-specific overvaluations.

-

Risk Management: Careful risk management is crucial in the current market environment. Investors should assess their risk tolerance and adjust their portfolios accordingly.

-

Sector Allocation: BofA may suggest focusing on sectors deemed less overvalued and more resilient to economic downturns. This might include defensive stocks in sectors like consumer staples or healthcare.

-

Long-Term Perspective: BofA stresses maintaining a long-term investment horizon. Short-term market fluctuations should not dictate long-term investment strategies.

-

Growth vs. Value: BofA's recommendations might lean towards value stocks (undervalued relative to their intrinsic value) or more defensive sectors, depending on their assessment of the economic outlook.

Alternative Perspectives and Counterarguments

While BofA offers a relatively positive outlook, it's important to acknowledge alternative perspectives. Some analysts hold a more pessimistic view, arguing that the market is significantly overvalued and anticipating a significant market correction or even a bear market. These analysts point to factors such as persistently high inflation, rising interest rates, and geopolitical risks as potential catalysts for a market downturn. They might emphasize the limitations of BofA's models and point out potential blind spots in their analysis, focusing on specific economic indicators they feel have not been adequately considered. The potential for unexpected economic shocks or unforeseen geopolitical events could also lead to a sharper decline than BofA predicts.

Conclusion

BofA's analysis suggests that while valuations are elevated in certain sectors, the overall stock market is not drastically overvalued. Their assessment is influenced by factors such as interest rate projections, inflation, economic growth forecasts, and geopolitical risks. They recommend a long-term investment strategy, emphasizing portfolio diversification and risk management. However, alternative perspectives exist, highlighting the potential for a market correction or bear market. Ultimately, whether the stock market is overvalued is a complex question with no definitive answer. While BofA offers reassurance, remember that thorough due diligence and a well-defined investment strategy are crucial when navigating the complexities of a potentially overvalued stock market. Conduct your own research, consider your risk tolerance, and consult with a financial advisor before making any significant investment decisions. Learn more about managing risk in a potentially overvalued stock market to make informed decisions about your investment portfolio.

Featured Posts

-

Analysis Of Aprils Jobs Report 177 000 Jobs Added 4 2 Unemployment

May 04, 2025

Analysis Of Aprils Jobs Report 177 000 Jobs Added 4 2 Unemployment

May 04, 2025 -

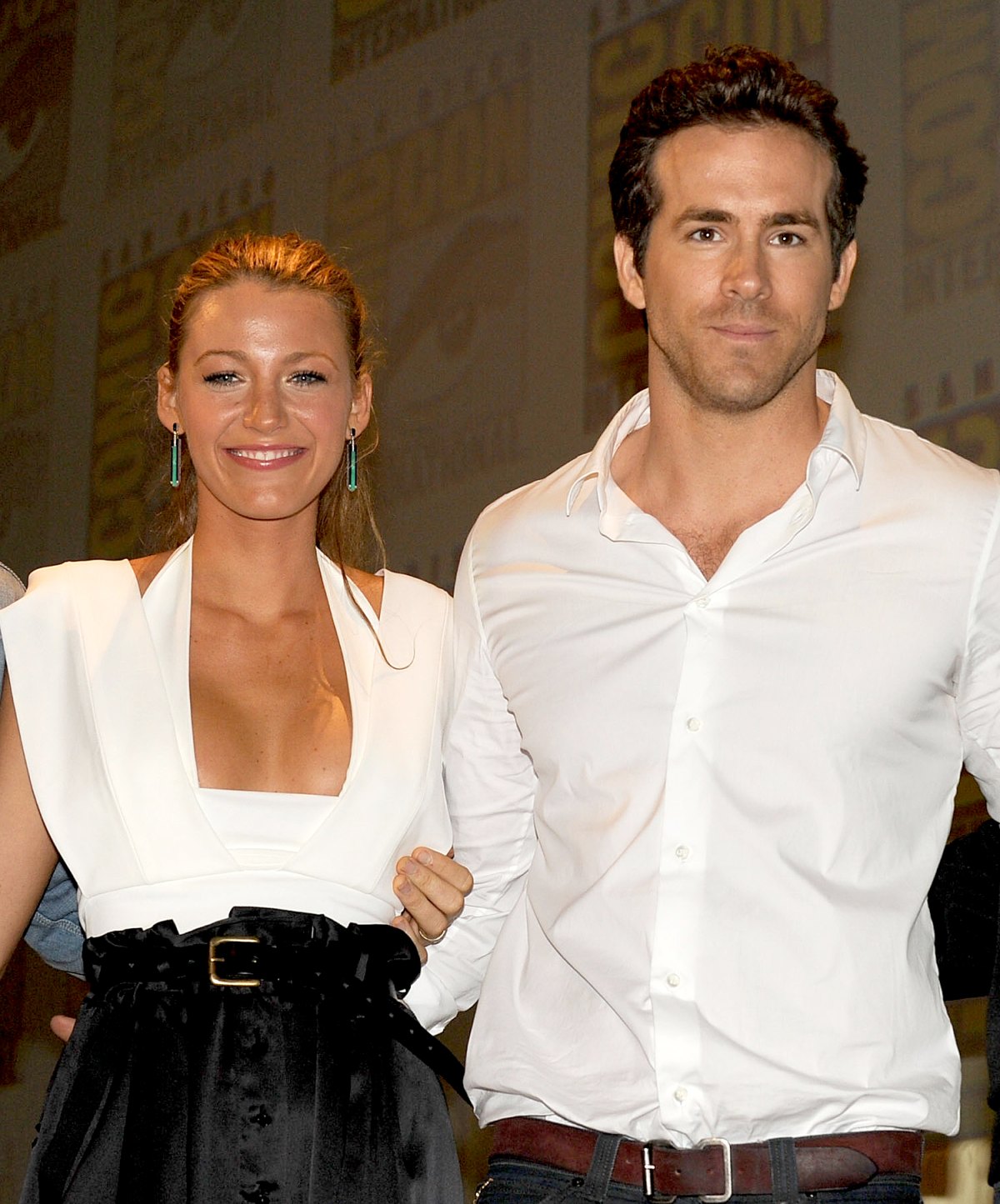

Analyzing The Reported Tension A Timeline Of Blake Lively And Anna Kendricks Relationship

May 04, 2025

Analyzing The Reported Tension A Timeline Of Blake Lively And Anna Kendricks Relationship

May 04, 2025 -

Rupert Lowe The Better Choice To Lead Reform Than Farage

May 04, 2025

Rupert Lowe The Better Choice To Lead Reform Than Farage

May 04, 2025 -

Lizzo Compares Britney Spears To Janet Jackson Fans React

May 04, 2025

Lizzo Compares Britney Spears To Janet Jackson Fans React

May 04, 2025 -

Analysis The Shifting Landscape Of Offshore Wind Farm Investment

May 04, 2025

Analysis The Shifting Landscape Of Offshore Wind Farm Investment

May 04, 2025

Latest Posts

-

Anna Kendrick And Blake Livelys Awkward Encounter At A Simple Favor Screening

May 04, 2025

Anna Kendrick And Blake Livelys Awkward Encounter At A Simple Favor Screening

May 04, 2025 -

New York City Faces Severe Weather Monday A Complete Guide

May 04, 2025

New York City Faces Severe Weather Monday A Complete Guide

May 04, 2025 -

Mondays Severe Weather What To Expect In New York City

May 04, 2025

Mondays Severe Weather What To Expect In New York City

May 04, 2025 -

Get Anna Kendricks Look The Perfect Shell Crop Top For Summer

May 04, 2025

Get Anna Kendricks Look The Perfect Shell Crop Top For Summer

May 04, 2025 -

Did Anna Kendrick Diss Blake Lively A A Simple Favor Premiere Incident

May 04, 2025

Did Anna Kendrick Diss Blake Lively A A Simple Favor Premiere Incident

May 04, 2025