Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Impact

Table of Contents

The Ripple-SEC Lawsuit: A Turning Point?

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has cast a long shadow over XRP's price and adoption. The outcome of this case will significantly influence XRP's regulatory landscape and its future prospects.

Recent Developments and Their Significance:

The Ripple vs. SEC case has seen several key rulings, shaping the narrative surrounding XRP's legal status. Understanding these developments is crucial for assessing XRP's potential.

- Summary of recent court decisions: Recent court decisions have offered some positive signs for Ripple, with certain arguments finding favor. However, the case remains complex and the final outcome is far from certain.

- Expert opinions: Legal experts offer varying perspectives on the case's trajectory. Some believe a settlement is likely, while others anticipate a protracted legal battle with potentially varied outcomes for different XRP sales.

- Potential outcomes: Potential outcomes range from a complete SEC victory, potentially severely impacting XRP's price, to a partial victory for Ripple, potentially leading to greater regulatory clarity and increased investor confidence.

- Effects on XRP's regulatory landscape: A favorable ruling could lead to increased regulatory clarity for XRP, potentially paving the way for greater institutional adoption and wider acceptance. Conversely, an unfavorable ruling could stifle growth and further limit its use. The definition of what constitutes a "security" remains a key point of contention, particularly regarding "programmatic sales" of XRP.

Impact on Institutional Investment:

The Ripple-SEC lawsuit's outcome will profoundly influence institutional investors' perception of XRP.

- Potential increase/decrease in institutional adoption: A positive resolution could trigger a surge in institutional investment, attracted by the improved regulatory clarity. Conversely, a negative outcome might deter institutional investors due to continued legal uncertainty.

- Effects on trading volume: Increased institutional interest could significantly boost XRP trading volume, driving price appreciation. A negative outcome might lead to decreased volume and price stagnation.

- The role of regulatory clarity: Regulatory clarity is paramount for institutional investors, who are generally risk-averse. A clear legal framework surrounding XRP would alleviate concerns and encourage greater participation. The focus on "institutional investors" and their participation is a key factor in determining the future of XRP.

The Potential Impact of XRP ETF Approvals

The approval of an XRP exchange-traded fund (ETF) could be a game-changer for the cryptocurrency.

The ETF Landscape and XRP's Position:

The cryptocurrency ETF landscape is rapidly evolving, with several Bitcoin and Ethereum ETFs already approved in various jurisdictions.

- Explain the benefits of ETF approval: ETF approval would grant XRP significantly increased liquidity, making it more accessible to a wider range of investors, including those accustomed to traditional financial markets. This increased accessibility is key for attracting institutional investment.

- Potential timeline for approval: The timeline for XRP ETF approval remains uncertain, depending on regulatory developments and the outcome of the SEC lawsuit. However, positive developments in the case could significantly accelerate this process. Competition from other cryptocurrencies like Bitcoin and Ethereum for ETF approval is a crucial factor.

Market Implications of an XRP ETF:

An XRP ETF approval could have significant implications for its price and market capitalization.

- Discuss price predictions (with caveats): While predicting price movements is speculative, an XRP ETF approval could potentially lead to a substantial price increase, although the extent of this increase remains uncertain and depends on multiple market factors.

- Increased market volatility: The initial period following ETF approval might be characterized by increased market volatility as investors react to the news.

- The potential for a "bull run": The approval could trigger a significant "bull run," driving considerable price appreciation and attracting further investment.

Beyond the Lawsuit and ETFs: Other Factors Influencing XRP's Price

Several other factors, independent of the lawsuit and ETF approvals, influence XRP's price.

Technological Advancements and Ripple's Ecosystem:

Ripple's continued technological development and ecosystem expansion play a vital role in XRP's long-term success.

- Highlight new partnerships: New partnerships with financial institutions expand RippleNet's reach and increase XRP's utility.

- Advancements in RippleNet: Improvements in RippleNet's speed, efficiency, and scalability enhance its appeal to financial institutions.

- Other relevant technological updates: Ongoing technological advancements solidify Ripple's position in the cross-border payments market.

Overall Market Sentiment and Crypto Winter's Influence:

The broader cryptocurrency market's sentiment significantly impacts XRP's price.

- Discuss the correlation between Bitcoin's price and XRP's: XRP's price often correlates with Bitcoin's, meaning that market trends influencing Bitcoin often impact XRP as well.

- The influence of macroeconomic factors: Macroeconomic factors like inflation and interest rates also play a role in shaping overall market sentiment toward cryptocurrencies.

- General market sentiment towards cryptocurrencies: The overall sentiment towards cryptocurrencies, whether positive or negative, directly affects XRP's performance.

Conclusion

The future of XRP remains uncertain, yet the convergence of the Ripple-SEC lawsuit's potential resolution and the possibility of ETF approvals presents a pivotal moment. While the legal battle continues to cast a shadow, positive developments could significantly boost XRP's price and market standing. The approval of an XRP ETF would undoubtedly be a catalyst for widespread adoption and increased liquidity. However, it's crucial to remember that the cryptocurrency market is inherently volatile, and investing in XRP, or any cryptocurrency, carries substantial risk. Therefore, thorough research and careful consideration are essential before making any investment decisions concerning XRP. Stay informed about further developments regarding the XRP and the wider cryptocurrency market to make informed decisions about this potentially transformative period for XRP. Continue to research the latest news surrounding XRP to fully understand its evolving potential.

Featured Posts

-

Royal Air Maroc Official Global Partner For Cafs Afcon Wafcon And More

May 07, 2025

Royal Air Maroc Official Global Partner For Cafs Afcon Wafcon And More

May 07, 2025 -

Steelers Wr George Pickens Trade Possibilities After Schultzs Comments

May 07, 2025

Steelers Wr George Pickens Trade Possibilities After Schultzs Comments

May 07, 2025 -

Fenty Beauty Paris Rihannas Chic Appearance And Fan Interaction

May 07, 2025

Fenty Beauty Paris Rihannas Chic Appearance And Fan Interaction

May 07, 2025 -

The Future Of European Transit Hydrogen Vs Battery Buses

May 07, 2025

The Future Of European Transit Hydrogen Vs Battery Buses

May 07, 2025 -

Ralph Macchio Lasting Love And A Long Term Marriage

May 07, 2025

Ralph Macchio Lasting Love And A Long Term Marriage

May 07, 2025

Latest Posts

-

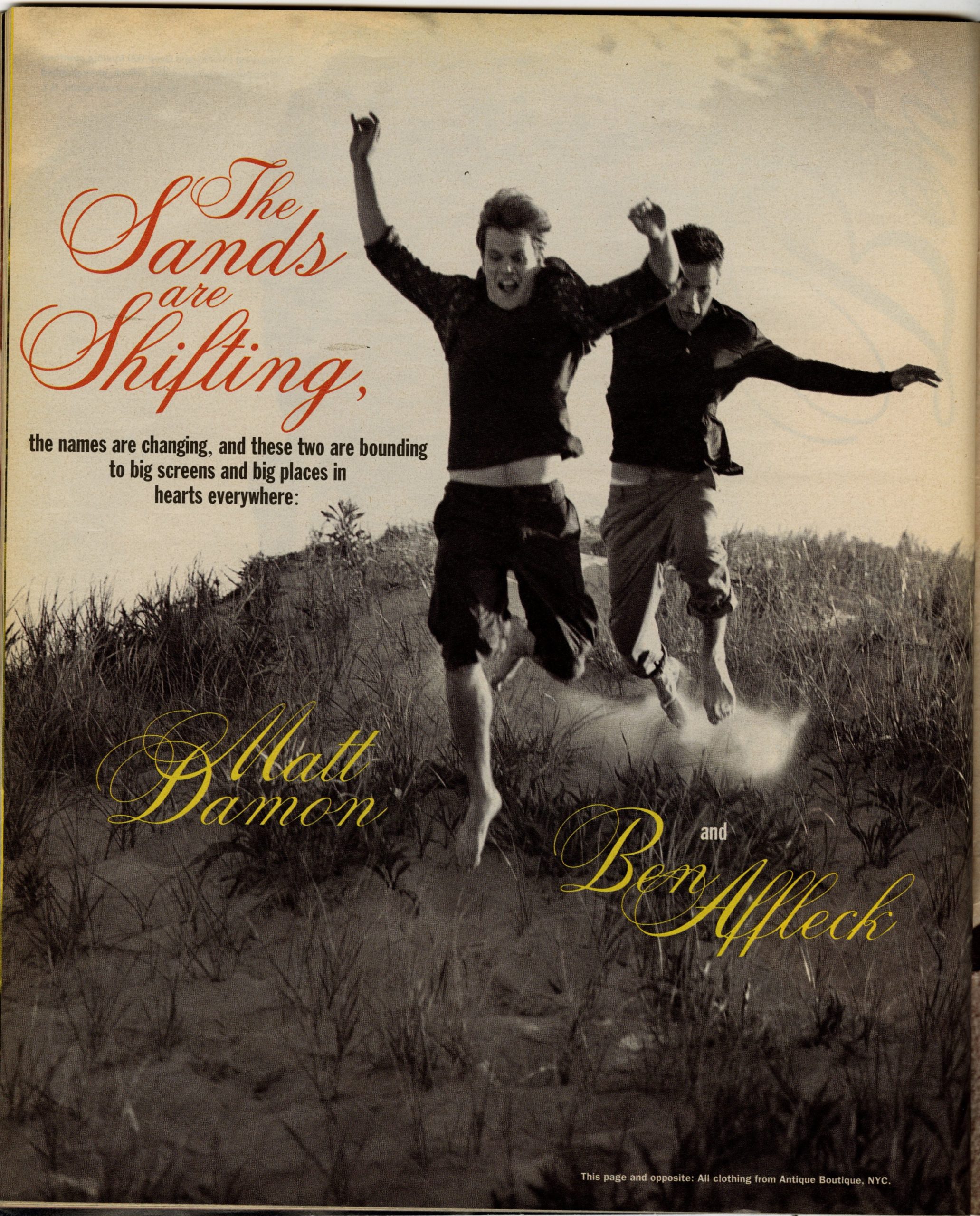

Ben Affleck On Matt Damons Strategic Approach To Acting Roles

May 08, 2025

Ben Affleck On Matt Damons Strategic Approach To Acting Roles

May 08, 2025 -

Matt Damons Calculated Career Ben Afflecks Insight

May 08, 2025

Matt Damons Calculated Career Ben Afflecks Insight

May 08, 2025 -

Ben Afflecks Praise For Matt Damons Smart Role Choices

May 08, 2025

Ben Afflecks Praise For Matt Damons Smart Role Choices

May 08, 2025 -

Unjustly Overlooked A Comprehensive List Of The Biggest Oscars Snubs

May 08, 2025

Unjustly Overlooked A Comprehensive List Of The Biggest Oscars Snubs

May 08, 2025 -

The Academy Awards Biggest Oversights A History Of Oscars Snubs

May 08, 2025

The Academy Awards Biggest Oversights A History Of Oscars Snubs

May 08, 2025