Is XRP (Ripple) A Smart Investment For Long-Term Financial Security?

Table of Contents

The allure of cryptocurrency investments is undeniable, promising the potential for significant returns and long-term financial security. However, navigating the volatile world of crypto requires careful consideration and a thorough understanding of the risks involved. XRP (Ripple), a cryptocurrency designed for facilitating cross-border payments, occupies a unique position in the market, offering intriguing possibilities but also presenting significant challenges. This article aims to provide a balanced analysis of XRP's suitability as a long-term investment for your financial security.

Understanding XRP and its Technology

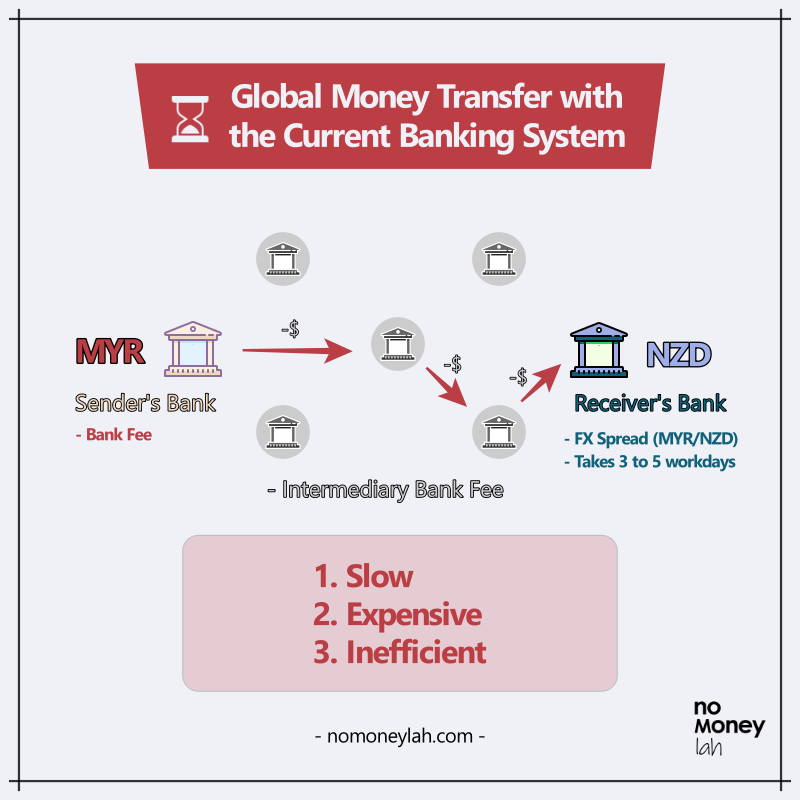

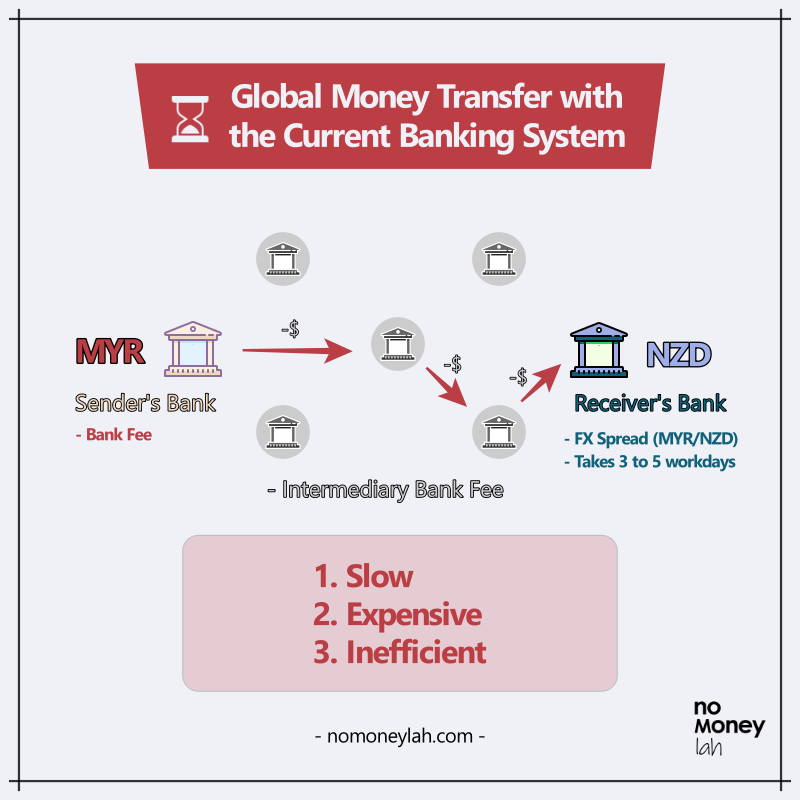

XRP's primary function is to enable fast, efficient, and low-cost cross-border payments through RippleNet, Ripple's payment network.

Ripple's Role in Cross-Border Payments

RippleNet utilizes XRP to significantly reduce transaction costs and processing times for international payments. Traditional methods often involve multiple intermediaries, leading to delays and high fees. RippleNet, with its use of XRP, streamlines this process, offering substantial improvements in transaction speed and lower fees. This efficiency is attracting significant interest from financial institutions worldwide looking to optimize their international payment operations. Keywords like "cross-border payments," "transaction speed," "low fees," and "RippleNet" are central to understanding XRP's core value proposition.

XRP's Utility and Functionality

XRP's utility extends beyond its role in RippleNet. Its design prioritizes transaction efficiency and scalability, crucial factors differentiating it from other cryptocurrencies. Compared to Bitcoin or Ethereum, XRP boasts significantly faster transaction times and lower energy consumption, making it an attractive option for high-volume transactions. This "energy-efficient cryptocurrency" aspect is becoming increasingly important in the context of growing environmental concerns surrounding crypto mining.

- Difference between XRP and Ripple: XRP is the cryptocurrency that powers RippleNet, while Ripple is the company that developed the technology and network.

- XRP's Consensus Mechanism: XRP uses a unique consensus mechanism that differs from Proof-of-Work (like Bitcoin) or Proof-of-Stake (like Ethereum). It aims for faster transaction confirmation times.

- Partnerships and Collaborations: Ripple has established partnerships with several major financial institutions, boosting XRP's potential for adoption and driving its value.

Assessing the Risks of Investing in XRP

While XRP offers potential benefits, understanding the associated risks is crucial for responsible investment decisions.

Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC (Securities and Exchange Commission) presents significant regulatory risk. The SEC's lawsuit alleges that XRP is an unregistered security, a claim that has created considerable uncertainty about XRP's future regulatory status. This "SEC lawsuit" and the resulting "legal uncertainty" can significantly impact XRP's price and overall viability as a long-term investment. Navigating this "regulatory risk" is a key consideration.

Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception. "Cryptocurrency volatility" and "price fluctuations" are common, potentially leading to significant losses. Investors need to understand and accept this inherent market risk. "Market risk" is a significant factor influencing XRP's price.

Technological Risks

Like all blockchain technologies, XRP faces technological risks. Vulnerabilities in the blockchain, "blockchain security," or successful "cybersecurity risks," including smart contract exploits, could negatively impact XRP's value and the entire ecosystem.

- Potential Downsides: Price volatility, regulatory uncertainty, competition from other cryptocurrencies.

- Impact of Market Sentiment: News, regulatory updates, and general market sentiment can heavily influence XRP's price.

- Diversification Strategies: Spreading investments across various asset classes helps mitigate risk.

XRP's Potential for Long-Term Growth

Despite the risks, several factors suggest potential for long-term growth.

Adoption by Financial Institutions

The increasing adoption of RippleNet by banks and other financial institutions is a significant positive factor. This "institutional adoption" indicates growing confidence in Ripple's technology and the potential for increased demand for XRP. The expansion of these "banking partnerships" and the development of a robust "global payments network" are key drivers of XRP's long-term potential.

Future Technological Developments

Ongoing developments within the Ripple ecosystem and advancements in blockchain technology could further enhance XRP's capabilities and value. "Future technology" and "blockchain innovation," including improvements in scalability and functionality, could attract more users and institutional adoption.

Comparison to Other Cryptocurrencies

Compared to Bitcoin and Ethereum, XRP offers advantages in transaction speed and energy efficiency, positioning it well in the niche of cross-border payments. However, its dependence on Ripple and the ongoing regulatory issues present unique challenges.

- Catalysts for Price Appreciation: Wider adoption, positive regulatory developments, successful technological upgrades.

- Long-Term Outlook for Cryptocurrency: The long-term outlook for the cryptocurrency market is uncertain but presents significant potential.

- Unique Selling Propositions (USPs): Speed, efficiency, low cost of transactions, focus on institutional adoption.

Building a Diversified Investment Portfolio

Investing in XRP should be part of a broader investment strategy.

Importance of Diversification

Diversification is critical for mitigating risk. "Risk management" and "portfolio diversification" through "asset allocation" are crucial for long-term financial security. Don't put all your eggs in one basket.

XRP's Place in a Balanced Portfolio

XRP can be a part of a diversified portfolio, but the allocation should reflect your "risk tolerance" and "financial goals." Consider your individual circumstances and risk appetite when deciding how much of your portfolio to allocate to XRP.

- Other Asset Classes: Stocks, bonds, real estate, precious metals.

- Determining Allocation to XRP: Consider your risk tolerance, investment timeline, and overall portfolio diversification.

- Professional Financial Advice: Seek advice from a qualified financial advisor before making any significant investment decisions.

Conclusion

Investing in XRP for long-term financial security presents both exciting opportunities and considerable risks. The potential for growth driven by increasing institutional adoption and technological advancements is balanced by the volatility of the cryptocurrency market and ongoing regulatory uncertainty. Thorough research and an understanding of your personal risk tolerance are paramount. It is crucial to conduct thorough due diligence before investing in any cryptocurrency.

Is XRP (Ripple) the right long-term investment for your financial security? Do your research and make an informed decision today!

Featured Posts

-

Rihannas Relaxed Look Dinner Date In Santa Monica

May 07, 2025

Rihannas Relaxed Look Dinner Date In Santa Monica

May 07, 2025 -

Karate Kid Legends A Legacy Forged In Family Honor And Tradition

May 07, 2025

Karate Kid Legends A Legacy Forged In Family Honor And Tradition

May 07, 2025 -

John Wick 5 Forget The High Table A New Direction For John Wick

May 07, 2025

John Wick 5 Forget The High Table A New Direction For John Wick

May 07, 2025 -

Challenges In The Chinese Auto Market Lessons From Bmw And Porsches Experiences

May 07, 2025

Challenges In The Chinese Auto Market Lessons From Bmw And Porsches Experiences

May 07, 2025 -

Tuesday Ticket Release Cavs Round 2 Playoffs

May 07, 2025

Tuesday Ticket Release Cavs Round 2 Playoffs

May 07, 2025

Latest Posts

-

7 Essential Steven Spielberg War Movies But Not Saving Private Ryan

May 08, 2025

7 Essential Steven Spielberg War Movies But Not Saving Private Ryan

May 08, 2025 -

Pierce Countys Historic Home Demolition And Park Transformation

May 08, 2025

Pierce Countys Historic Home Demolition And Park Transformation

May 08, 2025 -

Batman Returns Dc Comics Announces Relaunch And New Look

May 08, 2025

Batman Returns Dc Comics Announces Relaunch And New Look

May 08, 2025 -

Ranking Steven Spielbergs War Films Excluding Saving Private Ryan A Film Fans Guide

May 08, 2025

Ranking Steven Spielbergs War Films Excluding Saving Private Ryan A Film Fans Guide

May 08, 2025 -

Dcs Batman A Fresh Start With New Comic And Design

May 08, 2025

Dcs Batman A Fresh Start With New Comic And Design

May 08, 2025