Italy's Recordati Capitalizes On Tariff Uncertainty With Mergers And Acquisitions

Table of Contents

Recordati's M&A Strategy: A Proactive Response to Global Tariff Instability

Tariff uncertainty significantly impacts pharmaceutical companies. Fluctuating import and export duties can disrupt supply chains, increase production costs, and reduce profitability. For multinational pharmaceutical players like Recordati, navigating these challenges requires a flexible and adaptive strategy. Recordati's response has been proactive: leveraging mergers and acquisitions to mitigate risks and seize opportunities. Their approach focuses on diversifying both geographically and therapeutically, reducing reliance on single markets and bolstering resilience against tariff shocks.

-

Examples of specific acquisitions and their strategic rationale: Recordati's acquisitions haven't been random; each targets specific strategic goals. For example, an acquisition might provide access to a new, high-growth market less affected by specific tariffs, or bring a complementary product line, reducing dependence on products vulnerable to tariff changes. Analysis of individual acquisitions would reveal the specific rationale behind each deal.

-

Geographic diversification achieved through M&A: By strategically acquiring companies in diverse geographical regions, Recordati reduces its exposure to tariff changes in any single market. If tariffs increase in one region, sales in other regions can offset the impact.

-

Expansion into new therapeutic areas: Acquisitions allow Recordati to diversify its product portfolio across various therapeutic areas. This diversification lowers the risk associated with regulatory changes or market shifts affecting specific medications.

-

Strengthening of the product portfolio: Acquiring companies with strong product pipelines enables Recordati to expand its offerings and strengthen its market position, creating a more robust and less vulnerable business. This reduces the impact of potential tariff increases on individual products.

Analyzing the Success of Recordati's M&A Activities

Recordati's financial performance following its M&A activities provides strong evidence of the strategy's success. Careful analysis reveals significant gains in market share and revenue growth, particularly in regions where acquisitions have been strategically deployed. The integration process of acquired companies is crucial; Recordati's success here is evidenced by its ability to seamlessly incorporate new products and teams into its existing operations.

-

Key performance indicators (KPIs) showing success: Analysis of Recordati's financial reports would reveal substantial increases in revenue, profitability, and market share following specific M&A activities. These KPIs would serve as strong indicators of the strategy's effectiveness.

-

Challenges faced during integration and how they were overcome: Integrating acquired companies presents challenges, such as cultural differences and operational disparities. Recordati's success likely stems from a well-defined integration strategy, effective communication, and a focus on retaining key talent from acquired entities.

-

Long-term impact of acquisitions on Recordati’s overall strategy: The long-term impact of these acquisitions is evident in Recordati's sustained growth and its enhanced resilience to external shocks like tariff fluctuations. The strategic acquisitions have positioned the company for continued success in a volatile global market.

Future Outlook: Recordati's Continued Reliance on Mergers and Acquisitions

Recordati's future growth strategy will likely continue to rely heavily on mergers and acquisitions. The company is well-positioned to identify and acquire promising pharmaceutical companies in specific therapeutic areas and geographical regions. However, the pharmaceutical M&A landscape is competitive, and Recordati must carefully assess potential risks alongside opportunities.

-

Potential acquisition areas: Future acquisitions could focus on expanding into emerging markets, acquiring companies specializing in innovative therapies, or strengthening existing product lines. Specific therapeutic areas targeted might depend on market trends and regulatory developments.

-

Predictions for future market trends impacting Recordati’s M&A strategy: Future market trends, including technological advancements and changing healthcare policies, will influence Recordati's M&A decisions. Staying ahead of these trends will be essential for the continued success of its acquisition strategy.

-

Discussion of potential risks associated with future acquisitions: Risks associated with future acquisitions include integration challenges, regulatory hurdles, and the potential for overpaying for target companies. Careful due diligence and a robust integration plan will be crucial to mitigate these risks.

Conclusion: Recordati's Strategic Use of Mergers and Acquisitions - A Winning Formula?

Recordati's strategic use of mergers and acquisitions has proven to be an effective response to the challenges of global tariff uncertainty. Through carefully planned acquisitions, the company has achieved significant market expansion, product diversification, and cost efficiencies. The success of this strategy is demonstrably linked to Recordati's strong financial performance and enhanced resilience within a volatile market. While challenges remain, Recordati's proactive and well-executed M&A approach appears to be a winning formula for sustained growth in the pharmaceutical industry. To further explore Recordati's M&A activities and the broader impact of global tariff uncertainty on the pharmaceutical industry, we encourage readers to consult Recordati's financial reports and industry analyses. You can also contact Recordati directly for further information on their strategic initiatives.

Featured Posts

-

Eshaq Alraklyt Ysjlwn Rqma Qyasya Fy Mdynt Martyny Alswysryt

Apr 30, 2025

Eshaq Alraklyt Ysjlwn Rqma Qyasya Fy Mdynt Martyny Alswysryt

Apr 30, 2025 -

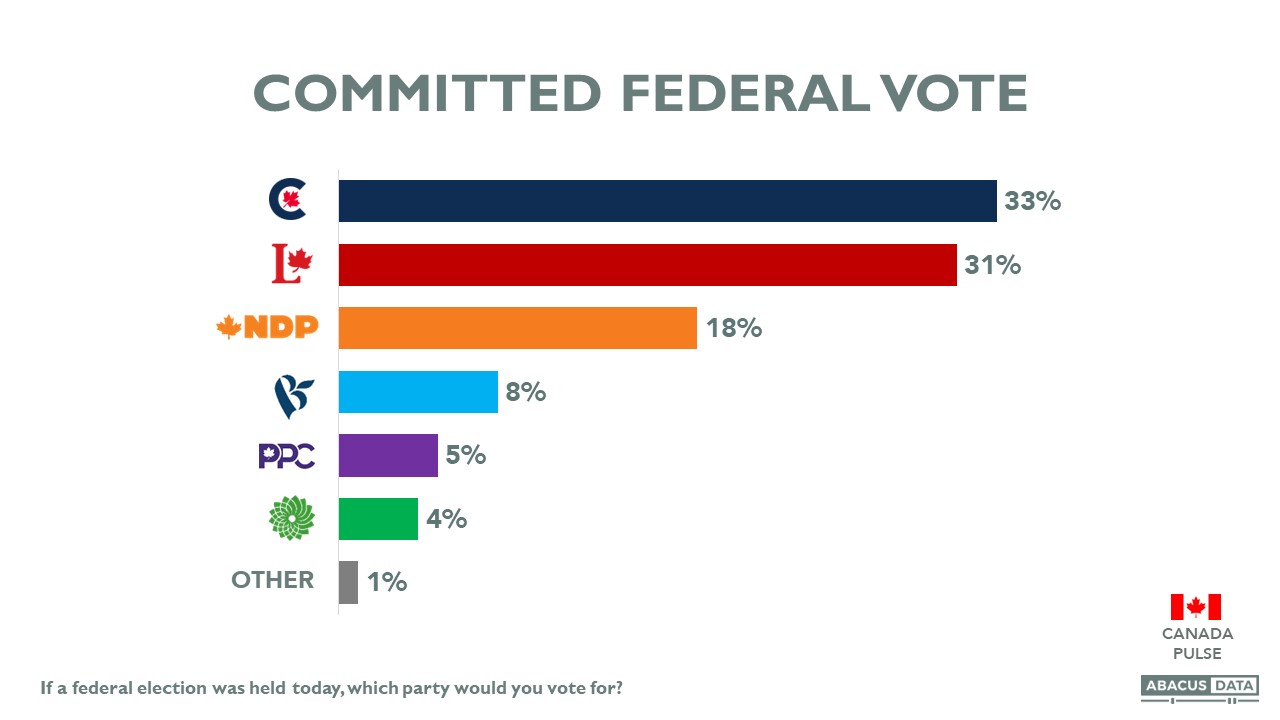

The 2024 Canadian Election Trumps Statements On Us Canada Ties

Apr 30, 2025

The 2024 Canadian Election Trumps Statements On Us Canada Ties

Apr 30, 2025 -

Martyny Tshhd Rqma Qyasya Jdyda Leshaq Alraklyt

Apr 30, 2025

Martyny Tshhd Rqma Qyasya Jdyda Leshaq Alraklyt

Apr 30, 2025 -

The 2025 Cruise Ship Lineup Key Features And Innovations

Apr 30, 2025

The 2025 Cruise Ship Lineup Key Features And Innovations

Apr 30, 2025 -

Complications Post Operatoires Des Hemorroides Experience Des Patients En Franche Comte

Apr 30, 2025

Complications Post Operatoires Des Hemorroides Experience Des Patients En Franche Comte

Apr 30, 2025

Latest Posts

-

Louisville Postal Service Mail Delays Expected To Conclude Soon

Apr 30, 2025

Louisville Postal Service Mail Delays Expected To Conclude Soon

Apr 30, 2025 -

Kentucky Storm Damage Assessments Delays And Reasons Explained

Apr 30, 2025

Kentucky Storm Damage Assessments Delays And Reasons Explained

Apr 30, 2025 -

Louisville Mail Delays End In Sight Says Postal Union Leader

Apr 30, 2025

Louisville Mail Delays End In Sight Says Postal Union Leader

Apr 30, 2025 -

Churchill Downs Emergency Preparedness For Severe Weather During Kentucky Derby Week

Apr 30, 2025

Churchill Downs Emergency Preparedness For Severe Weather During Kentucky Derby Week

Apr 30, 2025 -

Louisville Tornado Anniversary Community Strength And Future Preparedness

Apr 30, 2025

Louisville Tornado Anniversary Community Strength And Future Preparedness

Apr 30, 2025