Jerome Powell On Tariffs: A Threat To Fed Goals?

Table of Contents

Jerome Powell's Stance on Tariffs and Trade Wars

Jerome Powell has consistently expressed concerns about the economic consequences of tariffs and trade disputes. While he avoids directly criticizing specific trade policies, his statements reveal a cautious approach, emphasizing the uncertainties introduced by protectionist measures. His perspective highlights the inherent tension between the Federal Reserve's mandate to maintain price stability and full employment, and the unpredictable impact of tariffs on these key objectives.

- Specific quotes/paraphrases: Powell has often highlighted the uncertainty created by tariffs, stating that it makes it harder for businesses to plan and invest, hindering economic growth. He has warned about the potential for tariffs to lead to retaliatory measures, escalating trade tensions and further disrupting global supply chains.

- References to speeches/testimonies: Numerous press conferences and congressional testimonies from Powell contain discussions on the impact of tariffs on inflation and economic growth. These statements often reflect a nuanced understanding of the complex trade-offs involved.

- Concerns about uncertainty: Powell's consistent messaging underscores the negative influence of tariff-related uncertainty on business investment and consumer confidence. This uncertainty, he argues, makes it considerably more challenging for the Fed to accurately forecast economic conditions and set appropriate monetary policy.

The Impact of Tariffs on Inflation and Monetary Policy

Tariffs directly impact inflation through several mechanisms. Increased prices for imported goods, resulting from tariffs, lead to higher consumer prices. Furthermore, tariffs disrupt global supply chains, increasing the cost of inputs for many industries, and eventually impacting the final price of goods and services. This presents a significant challenge for the Federal Reserve, whose mandate includes maintaining price stability.

- Mechanisms through which tariffs affect inflation: Tariffs increase the cost of imported goods, reducing supply and potentially causing price increases. Supply chain disruptions due to trade wars further exacerbate this effect. These increased costs are passed onto consumers, leading to higher inflation.

- Fed's response to tariff-induced inflation: To combat tariff-induced inflation, the Fed might raise interest rates, slowing down economic growth to cool down inflation. However, this could negatively impact employment and economic expansion. Quantitative tightening is another potential tool.

- Trade-offs between controlling inflation and supporting growth: The Fed faces a difficult balancing act. Aggressive measures to control inflation might stifle economic growth, while inaction risks allowing inflation to spiral out of control. This makes navigating a tariff-affected economy significantly more challenging.

Uncertainty and the Fed's Decision-Making Process

The uncertainty generated by trade disputes and tariffs significantly complicates the Fed's already complex task of setting monetary policy. Predicting the long-term economic effects of tariffs is extremely difficult, making accurate economic forecasting nearly impossible.

- Difficulty in predicting long-term effects of tariffs: The economic consequences of tariffs can unfold gradually and are often subject to unpredictable retaliatory actions by other countries.

- Uncertainty leads to market volatility: Uncertainty creates volatility in financial markets as investors struggle to assess risk, impacting investment decisions and economic activity.

- Influence on interest rate setting: The Fed's approach to interest rate setting becomes more cautious in times of high uncertainty. They may opt for smaller adjustments or wait for clearer signals, potentially delaying necessary action.

Alternative Perspectives and Counterarguments

While the predominant view emphasizes the negative consequences of tariffs, alternative viewpoints exist. Some argue that tariffs can protect domestic industries and create jobs. Others maintain that the Fed possesses the tools to mitigate the negative effects of tariffs.

- Arguments suggesting positive economic effects: Proponents of protectionism believe tariffs can stimulate domestic production and employment by making imported goods more expensive.

- Viewpoints on Fed's ability to mitigate negative effects: Some economists believe the Fed's monetary policy tools are sufficient to address inflation caused by tariffs.

- Diverse perspectives from economists and policymakers: The economic impact of tariffs is a topic of ongoing debate amongst economists and policymakers, with a wide spectrum of opinions on their overall effect.

Conclusion

Jerome Powell's public statements consistently express concern about the negative economic consequences of tariffs. The uncertainty generated by trade wars complicates the Fed's ability to maintain price stability and achieve its dual mandate of full employment. Tariffs exert pressure on inflation and make economic forecasting exceedingly challenging. While some argue that tariffs can offer benefits, the prevailing view is that their negative effects outweigh any potential positives. The impact on economic uncertainty and the challenge to effective monetary policy are significant. Stay informed about Jerome Powell's views on tariffs and understand the impact of tariffs on the economy to navigate the ongoing debate surrounding Jerome Powell and tariffs.

Featured Posts

-

Prokuratorzy I Niewygodne Pytania Blamaz W Polsce24

May 26, 2025

Prokuratorzy I Niewygodne Pytania Blamaz W Polsce24

May 26, 2025 -

Mzahrat Mtwaslt Btl Abyb Mtalb Bitlaq Srah Alasra

May 26, 2025

Mzahrat Mtwaslt Btl Abyb Mtalb Bitlaq Srah Alasra

May 26, 2025 -

Sevilla Atletico Madrid 1 2 Mac Oezeti Goller Ve Oyun Raporu

May 26, 2025

Sevilla Atletico Madrid 1 2 Mac Oezeti Goller Ve Oyun Raporu

May 26, 2025 -

New Horror Film Sinners Set For Louisiana Theater Release

May 26, 2025

New Horror Film Sinners Set For Louisiana Theater Release

May 26, 2025 -

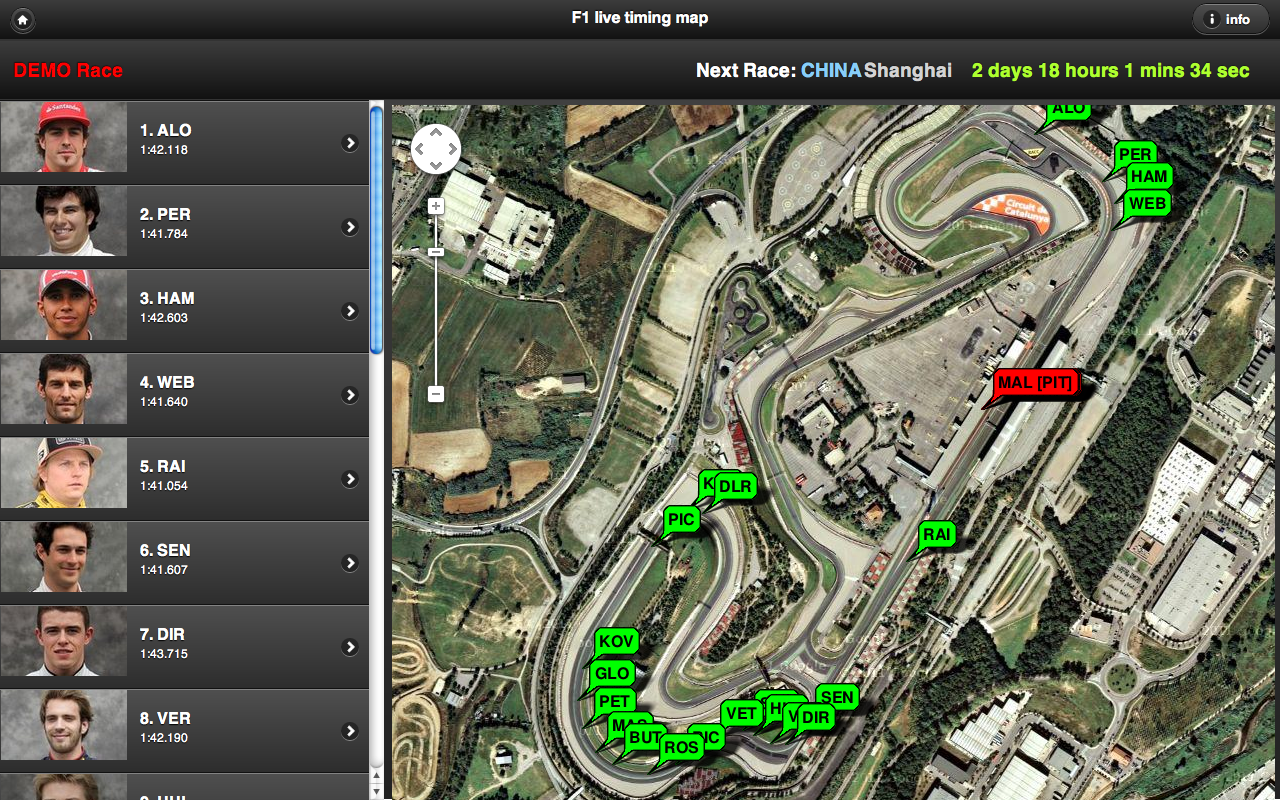

Monaco Grand Prix Follow The F1 Live Timing

May 26, 2025

Monaco Grand Prix Follow The F1 Live Timing

May 26, 2025

Latest Posts

-

Emotional Reaction Or Calculated Dismissal Russia Responds To Trump On Putin

May 29, 2025

Emotional Reaction Or Calculated Dismissal Russia Responds To Trump On Putin

May 29, 2025 -

Analysis Russias Response To Trumps Criticism Of Putin

May 29, 2025

Analysis Russias Response To Trumps Criticism Of Putin

May 29, 2025 -

French Consumer Spending Aprils Modest Increase Signals Economic Slowdown

May 29, 2025

French Consumer Spending Aprils Modest Increase Signals Economic Slowdown

May 29, 2025 -

Southwests Baggage Fee Changes A Threat To Punctuality

May 29, 2025

Southwests Baggage Fee Changes A Threat To Punctuality

May 29, 2025 -

Price Gouging Allegations Surface In La After Fires A Selling Sunset Perspective

May 29, 2025

Price Gouging Allegations Surface In La After Fires A Selling Sunset Perspective

May 29, 2025