Jim Cramer And CoreWeave (CRWV): Evaluating The Cloud Computing Contender

Table of Contents

CoreWeave's Business Model and Competitive Advantage

Focus on GPU-accelerated cloud computing

CoreWeave specializes in providing cloud computing resources heavily reliant on Graphics Processing Units (GPUs). This focus positions them ideally to serve the burgeoning needs of AI and high-performance computing applications.

- Key Applications: AI model training, machine learning, deep learning, video rendering, scientific simulations, and cryptocurrency mining.

- Growing Demand: The demand for GPU computing power is exploding, driven by the rapid advancement of artificial intelligence and the increasing complexity of data analysis tasks.

- Infrastructure: CoreWeave leverages a vast network of data centers and maintains strategic partnerships with leading GPU manufacturers like NVIDIA, ensuring access to the latest hardware and optimal performance. They focus on building and maintaining their own infrastructure, allowing for better control and optimization.

Differentiation from major cloud providers

While giants like AWS, Azure, and Google Cloud offer GPU-based cloud services, CoreWeave differentiates itself by focusing on a niche market and offering specialized services tailored to high-performance computing needs.

- Pricing Strategies: CoreWeave may offer competitive pricing models, particularly for users requiring massive GPU power for extended periods, potentially making them a more cost-effective option for specific workloads.

- Customer Base: CoreWeave targets customers with computationally intensive workloads, such as AI researchers, financial institutions, and visual effects studios, where the performance benefits of specialized GPU infrastructure are paramount.

- Unique Technologies and Partnerships: CoreWeave's focus on efficiency and specific technologies gives them a potential advantage over more generalized cloud platforms. Their partnerships could provide exclusive access to certain hardware or software.

Financial Performance and Investment Potential

Analyzing CoreWeave's Financials

CRWV's financial performance is a key factor in evaluating its investment potential. Analyzing revenue growth, profitability, and other key metrics provides valuable insights. While the company is relatively young and detailed financial information might be limited depending on its public listing status, key performance indicators like year-over-year revenue growth, customer acquisition costs, and operating margins should be carefully examined.

- Revenue Growth Rates: Examining historical and projected revenue growth rates is crucial for assessing the company's trajectory.

- Funding Rounds and Investments: Significant funding rounds often indicate investor confidence and growth potential.

- Financial Health: A comprehensive assessment of the company's financial health, considering factors such as debt levels, cash flow, and profitability, is critical.

Jim Cramer's perspective and market sentiment

Jim Cramer's opinions, while not a sole determinant of investment decisions, carry significant weight in shaping market sentiment. Understanding his perspective on CRWV and the overall market sentiment surrounding the stock is crucial.

- Analyst Ratings and Price Targets: Consulting reports from reputable financial analysts provides valuable insights into the overall market assessment of CoreWeave’s potential.

- News Articles and Commentary: Staying updated on news articles, financial blogs, and expert commentary will provide a balanced understanding of the stock’s market perception.

- Impact of Cramer's Opinions: Analyzing the historical impact of Cramer's recommendations on similar stocks can provide insight into the potential effects of his views on CRWV's share price.

Risks and Challenges Facing CoreWeave

Competition in the cloud computing market

The cloud computing market is fiercely competitive, with established giants and emerging players constantly vying for market share. CoreWeave must navigate this challenging landscape to maintain its position.

- Key Competitors: Analyzing the strengths and strategies of major competitors like AWS, Azure, Google Cloud, and other specialized cloud providers is essential.

- Threats to Business Model: Identifying potential threats such as technological advancements, shifts in market demand, and pricing pressures is crucial.

- Competitive Strategies: Understanding how CoreWeave plans to counter competition through innovation, strategic partnerships, or expansion into new markets is vital.

Scalability and infrastructure challenges

Scaling infrastructure to meet the ever-growing demand for GPU-accelerated computing presents significant challenges for CoreWeave. Securing sufficient GPU supply and managing energy costs are critical considerations.

- Capacity Limitations: Assessing potential limitations in terms of data center capacity, geographic reach, and the availability of specialized hardware is crucial.

- Technological Advancements: Keeping pace with the rapid pace of technological innovation in the GPU and cloud computing fields is vital for CoreWeave to remain competitive.

- Energy Costs and Sustainability: Managing energy consumption and environmental impact are increasingly important factors in the cloud computing industry.

Conclusion

CoreWeave (CRWV) presents an intriguing investment opportunity within the rapidly expanding cloud computing market. Its specialization in GPU-accelerated computing positions it well to capitalize on the growing demand for AI and high-performance computing resources. However, intense competition, the need to scale infrastructure effectively, and the inherent risks associated with investing in a relatively young technology company must be carefully considered. Jim Cramer's perspective and the overall market sentiment play a role, but shouldn't be the sole basis for investment decisions.

Ultimately, deciding whether CoreWeave (CRWV) is a worthwhile addition to your investment portfolio depends on your individual risk tolerance and investment strategy. Conduct further thorough research and consider consulting with a financial advisor before investing in CoreWeave or any other cloud computing stock. Remember to diversify your investments and understand the inherent risks involved before committing to any single stock, including CRWV.

Featured Posts

-

Remembering Adam Ramey Lead Singer Of Dropout Kings Dies At 32

May 22, 2025

Remembering Adam Ramey Lead Singer Of Dropout Kings Dies At 32

May 22, 2025 -

Exploring The Humor In David Walliams Gangsta Granny

May 22, 2025

Exploring The Humor In David Walliams Gangsta Granny

May 22, 2025 -

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 22, 2025

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 22, 2025 -

Late Snowfall Hits Southern French Alps Stormy Conditions Reported

May 22, 2025

Late Snowfall Hits Southern French Alps Stormy Conditions Reported

May 22, 2025 -

Real Madrid In Yeni Hocasi Kim Olacak Klopp Ve Diger Adaylar

May 22, 2025

Real Madrid In Yeni Hocasi Kim Olacak Klopp Ve Diger Adaylar

May 22, 2025

Latest Posts

-

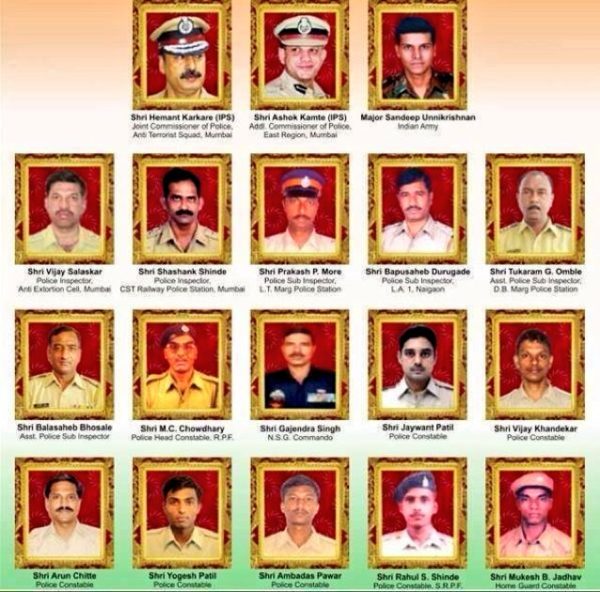

Names Of Israeli Embassy Attack Victims Released Couples Upcoming Engagement Revealed

May 22, 2025

Names Of Israeli Embassy Attack Victims Released Couples Upcoming Engagement Revealed

May 22, 2025 -

Ukrayina Reaktsiya Na Pidtrimku Rf Ta Pogrozi Senatora Grema

May 22, 2025

Ukrayina Reaktsiya Na Pidtrimku Rf Ta Pogrozi Senatora Grema

May 22, 2025 -

Washington D C Terror Attack Remembering Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Washington D C Terror Attack Remembering Yaron Lischinsky And Sarah Milgrim

May 22, 2025 -

Sibiga Ta Senatori S Sh A Pidsumki Vazhlivoyi Zustrichi

May 22, 2025

Sibiga Ta Senatori S Sh A Pidsumki Vazhlivoyi Zustrichi

May 22, 2025 -

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025