Jim Cramer's Investment Thesis: CoreWeave (CRWV) And The AI Revolution

Table of Contents

CoreWeave (CRWV): A Leader in AI Infrastructure

CoreWeave is making waves in the rapidly expanding AI infrastructure market. Its success is built on a solid foundation of innovative technology and strategic positioning within the industry.

CoreWeave's Business Model: Powering the AI Revolution

CoreWeave provides a cloud computing platform specifically designed to handle the massive computational demands of AI workloads. Its focus on high-performance computing (HPC) and GPU acceleration sets it apart.

- Nvidia GPU-Powered Infrastructure: CoreWeave leverages the power of Nvidia GPUs, offering unparalleled processing power for AI applications. This provides a significant advantage over competitors relying on less powerful hardware.

- Ease of Use and Scalability: The platform is designed for ease of use, allowing AI developers to quickly deploy and scale their applications without complex infrastructure management. This scalability is crucial for handling fluctuating workloads and rapid growth.

- Cost-Effectiveness: CoreWeave aims to deliver high-performance computing at a competitive price, making its services accessible to a broader range of AI developers and businesses. This cost efficiency is a significant draw for businesses looking to leverage AI without excessive capital expenditure.

- Strategic Partnerships: CoreWeave has forged partnerships with key players in the AI ecosystem, further strengthening its position and providing access to a wider range of resources and expertise. These partnerships often enhance the overall value proposition.

This combination of features positions CoreWeave as a leading provider of GPU cloud computing services, vital for the success of numerous AI initiatives.

The Growing Demand for AI Infrastructure: A Multi-Trillion Dollar Market

The demand for AI infrastructure is exploding, driven by the rapid adoption of AI across various sectors. Market analysts predict substantial growth in the coming years, and CoreWeave is ideally positioned to capitalize on this trend.

- AI Market Growth: The global AI market is projected to reach trillions of dollars in the coming years, according to several market research firms. This massive growth directly translates into a surging demand for the high-performance computing power that CoreWeave provides.

- Increasing AI Adoption: Industries like healthcare, finance, manufacturing, and entertainment are increasingly adopting AI for tasks ranging from drug discovery and fraud detection to personalized recommendations and automated processes. Each application requires significant computational resources.

- Need for Robust Computing Power: Training and deploying sophisticated AI models demands immense computing power. CoreWeave's specialized infrastructure directly addresses this need, offering a scalable and cost-effective solution.

Jim Cramer's Rationale for Investing in CRWV

Jim Cramer's endorsement of CoreWeave reflects a bullish outlook on both the company and the broader AI revolution.

Cramer's View on the AI Revolution: A Long-Term Growth Story

Cramer, known for his contrarian views and insightful market analysis, likely sees the AI revolution as a generational investment opportunity. His positive outlook on CRWV likely stems from a belief in the long-term potential of the AI market.

- Potential for Significant Market Share: CoreWeave's innovative technology and strategic partnerships position it to capture a significant share of the burgeoning AI infrastructure market. This potential for market dominance is a key factor in its investment appeal.

- Strong Management Team: A skilled and experienced management team is often cited as a factor contributing to a company’s success. Cramer's positive assessment likely includes consideration of CoreWeave's leadership.

- Technological Advantages: CoreWeave's focus on GPU acceleration and its ease-of-use platform give it a competitive edge in the market. This technological advantage is a critical component of its investment appeal.

Potential Risks and Challenges: Navigating the AI Landscape

While the prospects for CoreWeave are promising, investors should be aware of potential risks.

- Competition: The AI infrastructure market is becoming increasingly competitive. Established cloud providers and new entrants pose a challenge to CoreWeave's market share.

- Market Volatility: The technology sector is known for its volatility. Changes in investor sentiment or unexpected market downturns can significantly impact CRWV's stock price.

- Technological Disruption: Rapid technological advancements could render CoreWeave's current technology obsolete, requiring significant investment in research and development to maintain competitiveness.

Analyzing CoreWeave (CRWV) Stock: A Deeper Dive

A comprehensive investment analysis requires a thorough examination of CoreWeave's financial health and market performance.

Fundamental Analysis of CRWV: Examining the Financials

A detailed fundamental analysis of CRWV would include reviewing key financial metrics. (Note: Specific financial data is not provided here, as it changes rapidly. Investors should consult up-to-date financial reports from reliable sources.)

- Revenue Growth: Analyzing CoreWeave's revenue growth trajectory provides insights into the company's performance and its ability to capture market share.

- Profitability: Assessing CoreWeave's profitability (e.g., gross margin, net income) helps determine its financial strength and sustainability.

- Valuation Metrics: Key valuation metrics, such as the Price-to-Earnings (P/E) ratio, should be analyzed in comparison to industry peers to determine if the stock is overvalued or undervalued. This requires reference to current market data.

Technical Analysis of CRWV: Charting the Course (Optional)

Technical analysis provides another lens through which to examine CRWV stock performance. (Note: This section is optional, as technical analysis involves interpretation of charts and trading data and is not suitable for all investors).

- Chart Patterns: Examining historical price charts can reveal potential trends and patterns that may predict future price movements.

- Trading Volume: Monitoring trading volume helps gauge market interest and potential price momentum. High volume usually indicates a more significant price movement.

- Disclaimer: It's crucial to remember that technical analysis is not foolproof, and past performance is not indicative of future results.

Conclusion:

Jim Cramer's interest in CoreWeave (CRWV) highlights the company's potential within the rapidly expanding AI sector. The growing demand for AI infrastructure and CoreWeave's strong position in providing high-performance GPU cloud computing make it an intriguing investment opportunity. However, thorough due diligence, including careful consideration of the potential risks, is crucial before investing in CRWV stock. Further research into CoreWeave's financials and market positioning is strongly recommended. Remember to consult with a financial advisor before investing in any stock, including CoreWeave (CRWV), or other AI infrastructure companies.

Featured Posts

-

Nederlandse Bankieren Vereenvoudigd Van Bankrekening Tot Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Van Bankrekening Tot Tikkie

May 22, 2025 -

Gangsta Granny Activities And Crafts For Kids

May 22, 2025

Gangsta Granny Activities And Crafts For Kids

May 22, 2025 -

Taylor Swift Text Leak Allegation Blake Livelys Lawyer Under Scrutiny

May 22, 2025

Taylor Swift Text Leak Allegation Blake Livelys Lawyer Under Scrutiny

May 22, 2025 -

Vstup Ukrayini Do Nato Yevrokomisar Poperediv Pro Golovnu Zagrozu

May 22, 2025

Vstup Ukrayini Do Nato Yevrokomisar Poperediv Pro Golovnu Zagrozu

May 22, 2025 -

Enhanced Safety In Bear Country Partnerships Delivering Bear Spray And Expert Training

May 22, 2025

Enhanced Safety In Bear Country Partnerships Delivering Bear Spray And Expert Training

May 22, 2025

Latest Posts

-

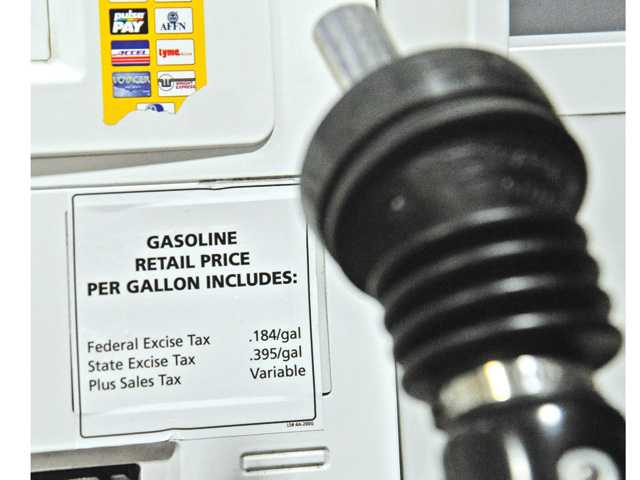

20 Cent Gas Price Hike Impact On Consumers And The Economy

May 22, 2025

20 Cent Gas Price Hike Impact On Consumers And The Economy

May 22, 2025 -

Lower Gas Prices In Virginia Gas Buddy Update

May 22, 2025

Lower Gas Prices In Virginia Gas Buddy Update

May 22, 2025 -

Pennsylvania Chicken Farm Suffers Major Loss In Devastating Barn Fire

May 22, 2025

Pennsylvania Chicken Farm Suffers Major Loss In Devastating Barn Fire

May 22, 2025 -

Route 15 On Ramp Closure Traffic Alert And Updates

May 22, 2025

Route 15 On Ramp Closure Traffic Alert And Updates

May 22, 2025 -

Accident On Route 15 Causes On Ramp Closure

May 22, 2025

Accident On Route 15 Causes On Ramp Closure

May 22, 2025