Late 2025 Deadline Predicted For Trump's 30% China Tariffs

Table of Contents

The 2025 Deadline: A Closer Look

Origin and Purpose of the Tariffs

The Trump administration implemented the 30% tariffs on various Chinese goods, primarily as a retaliatory measure against what it perceived as unfair trade practices by China. These included:

- Intellectual property theft: Protecting American innovation and technology from unauthorized appropriation.

- Forced technology transfer: Countering pressure on US companies to share proprietary technology in exchange for access to the Chinese market.

- Trade imbalances: Addressing the significant trade deficit between the US and China.

The initial impact was widespread, affecting a vast range of imported goods and triggering immediate market reactions.

Current Status and Potential Expiration

While no official statements definitively confirm the tariffs' removal, the late 2025 timeframe is widely anticipated as a potential expiration point. Several factors contribute to this prediction, including:

- Shifting geopolitical landscape: The current administration’s approach to China is evolving, potentially influencing decisions regarding the tariffs.

- Economic considerations: The economic consequences of maintaining these tariffs, particularly amid global inflation, are significant.

- Political pressures: Domestic lobbying efforts and pressure from businesses heavily reliant on imports from China play a role.

The potential for an extension or a phased removal remains, adding another layer of complexity for businesses to navigate.

Economic and Political Factors at Play

The decision regarding the future of these tariffs is intertwined with several complex economic and political factors:

- Inflationary pressures: Maintaining the tariffs contributes to higher import costs, fueling inflation and impacting consumer spending.

- Supply chain disruptions: The tariffs exacerbated existing supply chain vulnerabilities, forcing businesses to seek alternative sourcing strategies.

- US-China relations: The overall state of bilateral relations significantly impacts the likelihood of tariff removal or renegotiation.

- Domestic political considerations: The tariffs remain a politically charged issue, influencing decisions from both sides of the aisle.

Impact on Businesses and Consumers

Increased Import Costs and Price Inflation

The 30% tariffs directly increased import costs for businesses, which often passed these costs onto consumers through higher prices. Examples include:

- Electronics: Increased prices for smartphones, computers, and other electronics.

- Furniture: Higher costs for imported furniture and home goods.

- Apparel: Increased prices for clothing and footwear.

This cost pass-through mechanism significantly impacted consumer spending and purchasing power.

Supply Chain Disruptions and Restructuring

The tariffs forced businesses to reassess their supply chains, leading to:

- Sourcing alternatives: Companies actively sought alternative suppliers outside of China.

- Nearshoring/reshoring: Some companies opted to relocate manufacturing closer to the US.

- Diversification strategies: Businesses diversified their supplier base to reduce dependence on a single country.

Business Planning and Mitigation Strategies

Preparing for the potential removal or continuation of the tariffs requires proactive planning:

- Scenario planning: Businesses should develop plans for both scenarios – tariff removal and tariff continuation.

- Risk assessment: Conducting a thorough risk assessment to identify vulnerabilities and potential disruptions.

- Diversification of suppliers: Maintaining a diversified supplier base minimizes reliance on a single source.

- Lobbying efforts: Engaging in advocacy efforts to influence policy decisions concerning the tariffs.

Future of US-China Trade Relations

Potential Outcomes Post-2025

The future of these tariffs remains uncertain, with several potential outcomes after 2025:

- Complete removal: A complete removal of the tariffs could significantly impact market dynamics and trade flows.

- Partial removal: A phased or partial removal could offer a more gradual transition for businesses.

- Continued imposition: Continued imposition could perpetuate existing challenges for businesses and consumers.

- Renegotiation of trade agreements: The possibility exists for renewed trade negotiations between the US and China, potentially influencing tariff decisions.

Implications for Global Trade

The resolution of the 30% tariffs will have broader implications for global trade:

- Impact on other trading partners: The decision could influence trade relations between the US and other countries.

- Potential for trade disputes: The outcome might set precedents or spark new trade disputes with other nations.

- The future of bilateral trade agreements: The resolution will shape future bilateral trade agreement negotiations.

Conclusion

The 2025 deadline for the potential expiration of Trump's 30% China tariffs presents a critical juncture for businesses and the global economy. The potential impacts, ranging from increased import costs and supply chain disruptions to broader implications for US-China relations and global trade, are significant. Understanding these potential consequences is crucial for proactive planning. Businesses must engage in thorough risk assessment, develop contingency plans for various scenarios, and stay informed about developments concerning these tariffs. Proactive preparation is key to mitigating potential risks associated with the potential expiration of the China tariffs and navigating the evolving landscape of US-China trade relations. To stay updated on the 2025 deadline for these tariffs and related policy changes, regularly check the website of the Office of the United States Trade Representative (USTR). Understanding the impact of the 30% tariffs is paramount for long-term success.

Featured Posts

-

Uber One Kenya Everything You Need To Know About Free Deliveries And Discounts

May 19, 2025

Uber One Kenya Everything You Need To Know About Free Deliveries And Discounts

May 19, 2025 -

Wine List Of The Week Il Palagios Exquisite Selection At Four Seasons Firenze

May 19, 2025

Wine List Of The Week Il Palagios Exquisite Selection At Four Seasons Firenze

May 19, 2025 -

Mississippi Income Tax Elimination A Hernando Perspective

May 19, 2025

Mississippi Income Tax Elimination A Hernando Perspective

May 19, 2025 -

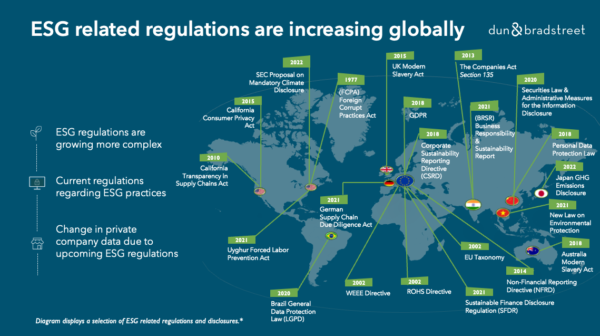

The Eus Tightening Regulations Are They Driving Europeans Away

May 19, 2025

The Eus Tightening Regulations Are They Driving Europeans Away

May 19, 2025 -

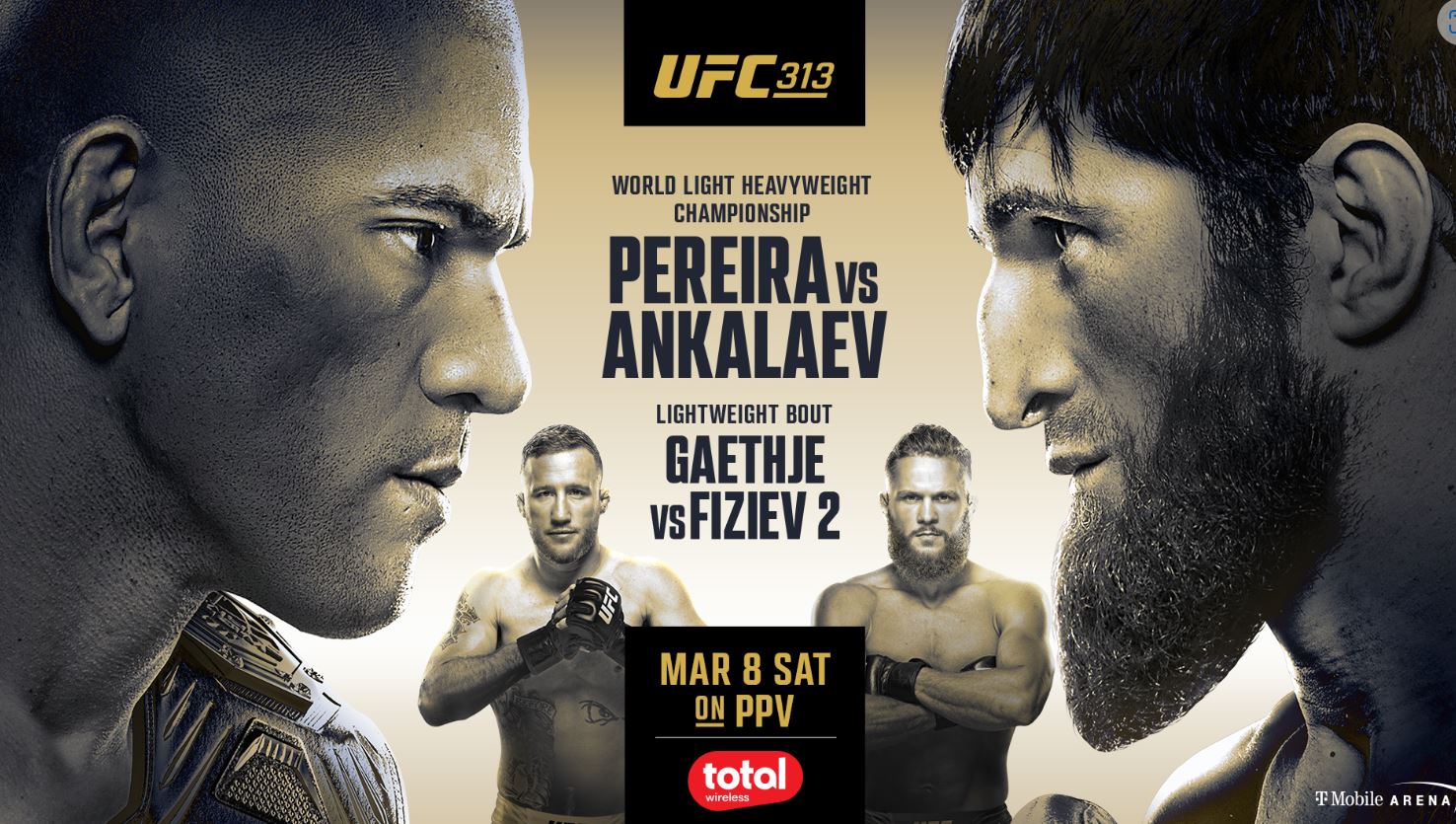

Ufc 313 Pereira Vs Ankalaev This Weekend Full Fight Card Breakdown

May 19, 2025

Ufc 313 Pereira Vs Ankalaev This Weekend Full Fight Card Breakdown

May 19, 2025

Latest Posts

-

Second Child For Jennifer Lawrence And Cooke Maroney

May 19, 2025

Second Child For Jennifer Lawrence And Cooke Maroney

May 19, 2025 -

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025 -

Cardinal Baseball News And Notes For Wednesday Afternoon

May 19, 2025

Cardinal Baseball News And Notes For Wednesday Afternoon

May 19, 2025 -

Jennifer Lawrences Baby Bump Nyc Outing

May 19, 2025

Jennifer Lawrences Baby Bump Nyc Outing

May 19, 2025 -

Cooke Maroney And Jennifer Lawrence Announce Second Childs Birth

May 19, 2025

Cooke Maroney And Jennifer Lawrence Announce Second Childs Birth

May 19, 2025