Live Nation Entertainment Stock (LYV): Analyzing Investment Options

Table of Contents

Understanding Live Nation's Business Model

Live Nation's success stems from its diversified business model, encompassing several interconnected segments: concert promotion, ticketing (through Ticketmaster), artist management, and sponsorships. This diversification mitigates risk and creates multiple revenue streams.

- Dominance in the live music industry: Live Nation holds a significant market share globally, giving it considerable pricing power and negotiating leverage with artists and venues.

- High barriers to entry: The scale and complexity of Live Nation's operations create significant barriers to entry for potential competitors, reinforcing its market dominance.

- Revenue streams diversified across multiple segments: This diversification reduces reliance on any single segment, providing resilience against economic fluctuations or sector-specific challenges.

- Dependence on global touring and event attendance: Live Nation's business is inherently tied to global travel and large gatherings. Factors like pandemics or geopolitical instability can significantly impact revenue.

- Potential for disruption from technological advancements: The rise of streaming and virtual concerts presents a potential challenge, although Live Nation is actively adapting to these changes through technological innovation in ticketing and fan engagement.

The interconnectedness of these segments is crucial to Live Nation's profitability. For example, Ticketmaster's ticketing services are essential for selling concert tickets promoted by Live Nation's concert promotion division, creating a synergistic effect. However, each segment also carries its own risks. Artist cancellations can impact concert revenue, while venue limitations can constrain growth. Live Nation’s market share in concert promotion is substantial, further solidifying its position and demonstrating its success in this core segment.

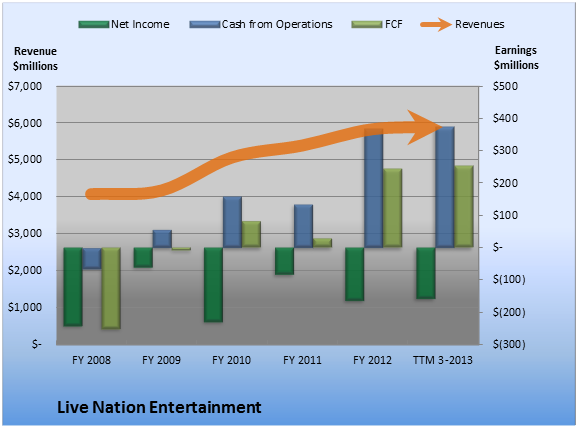

Analyzing Live Nation's Financial Performance

Analyzing Live Nation's financial performance requires examining both revenue growth and its financial health.

Revenue and Earnings Growth

Live Nation has historically demonstrated periods of significant revenue and earnings growth, driven by increasing concert attendance and expanding into new markets. However, this growth hasn't been consistent, with fluctuations influenced by external factors.

- Year-over-year revenue growth analysis: Examining past performance reveals trends and growth patterns. Periods of rapid growth are often followed by periods of slower growth or even decline, reflecting market cycles and unforeseen events.

- Profitability margins and their trends: Analyzing profit margins provides insight into operational efficiency and pricing power. Fluctuations in margins can indicate changes in cost structures or competitive pressures.

- Impact of economic factors (recessions, inflation) on LYV's financials: Economic downturns generally lead to reduced consumer spending on discretionary activities like concerts, impacting Live Nation's revenue and profitability. Inflation also affects costs, squeezing margins.

- Comparison with competitor financial performance: Comparing Live Nation's financial performance with that of its competitors provides valuable context and highlights its relative strengths and weaknesses.

Debt and Financial Health

Live Nation maintains a significant level of debt, a common characteristic of companies in the entertainment industry. Assessing its ability to manage this debt is crucial.

- Debt-to-equity ratio analysis: This ratio indicates Live Nation's financial leverage and its risk profile. A high ratio suggests greater financial risk.

- Interest coverage ratio: This ratio measures Live Nation's ability to meet its interest payments. A lower ratio indicates a higher risk of default.

- Cash flow analysis: Analyzing cash flow statements provides insights into Live Nation's ability to generate cash from its operations, which is crucial for debt servicing and future investments.

- Potential impact of high debt on future growth: High debt levels can constrain Live Nation's ability to invest in growth opportunities, such as acquisitions or technological upgrades.

Evaluating Investment Risks and Opportunities

Investing in Live Nation stock involves considering both potential risks and opportunities.

Market Risks

Several factors can negatively impact Live Nation's stock price.

- Sensitivity to economic cycles: Live Nation's business is cyclical, meaning its performance is closely tied to the overall economy. Economic downturns can significantly reduce demand for live events.

- Competition from smaller promoters and digital streaming services: While Live Nation dominates the market, competition from smaller promoters and the rise of digital streaming services pose a constant challenge.

- Impact of unexpected events (e.g., pandemics, terrorism): Unforeseen events can significantly disrupt live events, impacting revenue and potentially leading to stock price volatility.

Growth Opportunities

Despite the risks, Live Nation has several potential growth drivers.

- International expansion plans: Expanding into new international markets can unlock significant growth potential.

- Technological advancements in ticketing and fan engagement: Investing in technology to improve the fan experience and ticketing processes can enhance efficiency and revenue generation.

- Potential for mergers and acquisitions: Strategic acquisitions of smaller promoters or technology companies can further strengthen Live Nation's market position.

- Growth in specific music genres or demographics: Targeting specific music genres or demographics with tailored events and marketing can drive revenue growth.

Conclusion

Live Nation Entertainment stock (LYV) presents a compelling investment opportunity with significant potential for growth, driven by its dominant market position and diversified business model. However, its vulnerability to economic downturns, competition, and unforeseen events cannot be ignored. The company's high debt levels also represent a potential risk factor. A thorough analysis of its financial statements, along with a careful consideration of your risk tolerance, is crucial before investing in LYV stock. Thorough due diligence and diversification within your investment portfolio are paramount.

Call to Action: Before making any investment decisions regarding Live Nation Entertainment stock (LYV), conduct thorough due diligence and consider consulting a financial advisor. Further research into Live Nation's financial statements and industry trends will help inform your investment strategy for LYV stock. Remember to carefully assess your personal risk tolerance before investing in Live Nation Entertainment stock (LYV) or any other security.

Featured Posts

-

The Countrys New Business Hotspots Investment Opportunities And Growth Potential

May 29, 2025

The Countrys New Business Hotspots Investment Opportunities And Growth Potential

May 29, 2025 -

Buksza Kutatas Hogyan Talalhatunk Ertekes Targyakat Regi Holmijaink Koezoett

May 29, 2025

Buksza Kutatas Hogyan Talalhatunk Ertekes Targyakat Regi Holmijaink Koezoett

May 29, 2025 -

Tramp Analyontas Ta 10 Pio Simantika Gegonota Ton Proton Trion Minon Tis Deyteris Proedrias Toy

May 29, 2025

Tramp Analyontas Ta 10 Pio Simantika Gegonota Ton Proton Trion Minon Tis Deyteris Proedrias Toy

May 29, 2025 -

Neuer Kunst Und Vintagemarkt Attraktionen Auf Dem Coty Gelaende Koeln Bickendorf

May 29, 2025

Neuer Kunst Und Vintagemarkt Attraktionen Auf Dem Coty Gelaende Koeln Bickendorf

May 29, 2025 -

Bring Her Back First Reactions Call Talk To Me Directors New Horror Movie Terrifying

May 29, 2025

Bring Her Back First Reactions Call Talk To Me Directors New Horror Movie Terrifying

May 29, 2025

Latest Posts

-

Mas Claridad Sobre Los Precios De Boletos El Anuncio De Ticketmaster

May 30, 2025

Mas Claridad Sobre Los Precios De Boletos El Anuncio De Ticketmaster

May 30, 2025 -

Ticketmaster Aclara Sus Politicas De Precios Para Boletos

May 30, 2025

Ticketmaster Aclara Sus Politicas De Precios Para Boletos

May 30, 2025 -

Ticketmaster Virtual Venue Transforma La Experiencia De Compra De Boletos

May 30, 2025

Ticketmaster Virtual Venue Transforma La Experiencia De Compra De Boletos

May 30, 2025 -

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025 -

Virtual Venue De Ticketmaster Compra De Entradas Simplificada Y Digital

May 30, 2025

Virtual Venue De Ticketmaster Compra De Entradas Simplificada Y Digital

May 30, 2025