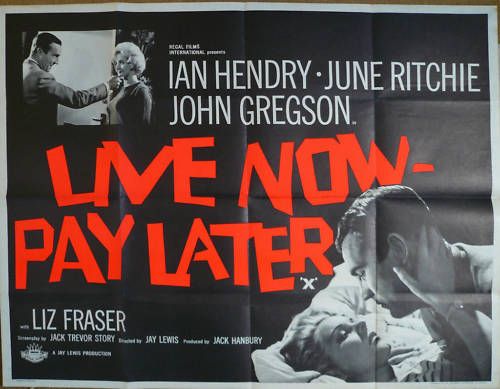

Live Now, Pay Later: Your Guide To Smart Spending

Table of Contents

Understanding Live Now, Pay Later (LNPL) Services

What are LNPL services?

Live now, pay later services are short-term financing options that allow you to purchase goods and services now and pay for them in installments over a short period, typically a few weeks or months. These services, often integrated directly into online checkouts, provide point-of-sale financing, making them incredibly convenient. Popular examples include Klarna, Afterpay, Affirm, and PayPal Credit. Each provider has its own terms and conditions, so it’s crucial to understand the specifics before signing up.

- LNPL services offer short-term financing for purchases.

- They typically involve splitting payments into installments over a few weeks or months.

- Interest may or may not be charged, depending on the provider and repayment terms. Some offer interest-free periods, while others charge interest if payments are not made on time.

- Late payments can result in fees, potentially impacting your credit score negatively. These late payment fees can significantly increase the overall cost of your purchase.

Benefits of Using Live Now, Pay Later Responsibly

Budget Management and Financial Flexibility

Used responsibly, LNPL can be a valuable tool for managing your finances. It can help you better manage your cash flow by spreading the cost of larger purchases, making them more affordable in the short term. This is particularly useful for unexpected expenses or when you need to spread the cost of a significant purchase, like new appliances or furniture.

- Allows for better cash flow management by breaking down large payments into smaller, manageable installments.

- Provides flexibility for unexpected expenses (e.g., car repairs, medical bills), preventing the need to use high-interest credit cards.

- Can help you avoid using high-interest credit cards for smaller purchases, thereby saving money on interest charges. This can be beneficial for budgeting and avoiding debt accumulation.

Building Credit (with caution)

Responsible use of LNPL can positively impact your credit score. On-time payments demonstrate responsible credit behavior to credit bureaus, potentially contributing to a higher credit score over time. However, it's crucial to remember that this only works if you make all your payments on time.

- On-time payments demonstrate creditworthiness to credit reporting agencies.

- Regular use with responsible repayment can boost your credit score over time. This can help you qualify for better interest rates on loans and credit cards in the future.

- Consistent late payments can severely damage your credit score, potentially making it difficult to access credit in the future.

Risks and Potential Downsides of Live Now, Pay Later

Overspending and Debt Traps

The convenience of LNPL can lead to overspending if not managed carefully. The ease of access to credit can tempt you into impulse buys, accumulating debt quickly across multiple LNPL accounts. Sticking to a strict budget is crucial to avoid this trap.

- Easy access can lead to overspending and accumulating debt quickly.

- Multiple LNPL accounts can become difficult to manage, leading to potential missed payments and increased fees.

- High fees and interest charges can accrue if payments are missed, significantly increasing the cost of your purchases.

Impact on Credit Score

Missed payments on your LNPL accounts will negatively affect your credit score. Late payments are reported to credit bureaus, potentially impacting your ability to obtain credit in the future.

- Late payments are reported to credit bureaus, resulting in a lower credit score.

- Negative marks can make it harder to secure loans or credit in the future, such as mortgages or auto loans.

- This can affect interest rates on other financial products, making borrowing more expensive.

Smart Strategies for Using Live Now, Pay Later

Budgeting and Financial Planning

Before using any LNPL service, create a detailed budget to ensure you can comfortably afford the repayments. Track your spending meticulously and only use LNPL for purchases that fit within your budget.

- Track your spending carefully and create a realistic budget that accounts for all your expenses.

- Only use LNPL for purchases you can afford to repay on time, without impacting other essential expenses.

- Set reminders for payment due dates to avoid missed payments and potential late fees.

Choosing the Right Provider

Research different LNPL providers thoroughly. Compare their fees, interest rates, repayment terms, and customer service before signing up.

- Compare interest rates and fees across various providers. Some providers may offer interest-free periods, while others charge interest from the outset.

- Read reviews and compare customer service to ensure a positive experience.

- Choose a provider that aligns with your financial needs and spending habits. Consider factors like repayment periods and available purchase limits.

Conclusion

Live now, pay later services offer a convenient way to manage finances, but only when used responsibly. By understanding the benefits and risks, and by implementing smart strategies like budgeting and choosing the right provider, you can leverage the power of "live now, pay later" for smart spending and avoid potential pitfalls. Remember, responsible use of LNPL can improve your financial flexibility, but neglecting repayments can severely damage your credit score. Start using live now, pay later services wisely today!

Featured Posts

-

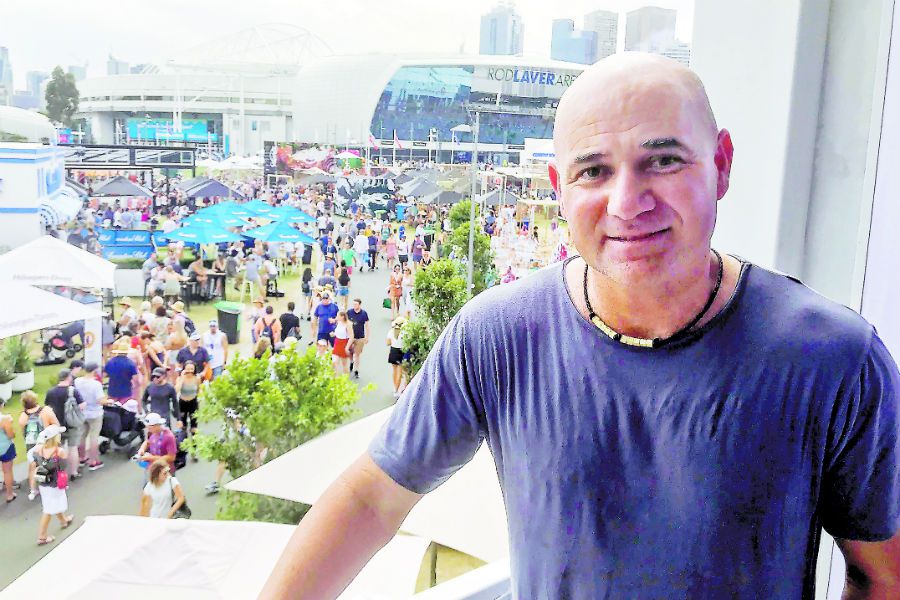

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025

El Recuerdo De Agassi Rios Una Bestia Sudamericana En La Cancha

May 30, 2025 -

Alasan Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025

Alasan Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025 -

Experience Gorillaz The House Of Kong 25th Anniversary Exhibition

May 30, 2025

Experience Gorillaz The House Of Kong 25th Anniversary Exhibition

May 30, 2025 -

Ticketmasters Improved Queue System For Taylor Swift Concert Tickets

May 30, 2025

Ticketmasters Improved Queue System For Taylor Swift Concert Tickets

May 30, 2025 -

Jessica Pegula Defeats Danielle Collins In Charleston Final

May 30, 2025

Jessica Pegula Defeats Danielle Collins In Charleston Final

May 30, 2025

Latest Posts

-

Building A Good Life Practical Steps For Happiness And Fulfillment

May 31, 2025

Building A Good Life Practical Steps For Happiness And Fulfillment

May 31, 2025 -

Building The Good Life Prioritizing Wellbeing And Purpose

May 31, 2025

Building The Good Life Prioritizing Wellbeing And Purpose

May 31, 2025 -

The Good Life Defining And Achieving Your Personal Best

May 31, 2025

The Good Life Defining And Achieving Your Personal Best

May 31, 2025 -

Finding Your Good Life A Journey Of Self Discovery

May 31, 2025

Finding Your Good Life A Journey Of Self Discovery

May 31, 2025 -

Finding The Good Life Practical Strategies For Happiness And Fulfillment

May 31, 2025

Finding The Good Life Practical Strategies For Happiness And Fulfillment

May 31, 2025