Malaysian Ringgit (MYR) Stability: Front-Loading And Exporter Confidence

Table of Contents

Understanding Front-Loading and its Impact on MYR Stability

What is Front-Loading in Economic Policy?

Front-loading, in the context of economic policy, refers to the strategy of accelerating the implementation of fiscal or monetary measures. Instead of gradually introducing changes, a government might undertake significant policy adjustments upfront to achieve a desired outcome more rapidly. This approach is often employed to counter anticipated economic downturns or to proactively address potential crises.

Examples of front-loading strategies implemented in Malaysia include:

- Fiscal Stimulus Packages: The government may introduce large-scale spending programs to boost economic activity and demand, thereby indirectly influencing the MYR.

- Early Interest Rate Adjustments: The central bank might aggressively adjust interest rates earlier than anticipated to preempt inflationary pressures or to stabilize the MYR.

The short-term goals of front-loading for the MYR typically involve:

- Strengthening the currency

- Boosting investor confidence

- Preventing a sharp depreciation

Long-term goals often focus on:

- Sustained economic growth

- Reduced economic volatility

- Improved macroeconomic stability

The Mechanism: How Front-Loading Affects the Malaysian Ringgit

Front-loading initiatives significantly influence investor sentiment and the foreign exchange markets. By implementing proactive measures, the government signals its commitment to maintaining macroeconomic stability, potentially attracting increased foreign direct investment (FDI). This inflow of capital can strengthen demand for the MYR, leading to an appreciation of the currency.

However, the effects of front-loading are complex and can have both positive and negative consequences:

- Positive Consequences: Increased FDI, reduced exchange rate volatility, improved investor confidence.

- Negative Consequences: Potential for inflation if fiscal stimulus is not carefully managed, unsustainable long-term effects if not complemented by structural reforms.

Exporter Confidence and the Malaysian Ringgit Exchange Rate

The Importance of a Stable MYR for Exporters

A stable MYR is crucial for Malaysian exporters. Exchange rate volatility introduces significant currency risk, making it difficult for businesses to accurately forecast revenue and plan for future investments. Fluctuations in the MYR can severely impact export competitiveness, as price variations can affect the affordability of Malaysian goods in international markets.

Challenges faced by exporters with a fluctuating MYR include:

- Difficulty in pricing products competitively

- Uncertainty in projecting profits

- Increased hedging costs

Front-Loading and its Effect on Exporter Confidence

A strengthened MYR, achieved through effective front-loading, significantly boosts exporter confidence. A stable exchange rate reduces uncertainty, allowing businesses to better manage their financial risks and focus on expanding their export markets. This stability can lead to increased export volumes and revenue, contributing to overall economic growth.

The correlation between MYR stability and export growth is evident:

- Stable MYR leads to increased price competitiveness.

- Predictable exchange rates improve export planning and investment.

- Reduced currency risk improves profitability.

Challenges and Risks Associated with Front-Loading for MYR Stability

Potential Negative Side Effects of Front-Loading

While front-loading can be effective in the short term, it's crucial to acknowledge potential negative side effects:

- Inflationary Pressures: Aggressive fiscal stimulus can lead to increased demand and inflation if not carefully managed.

- Unsustainable Growth: Front-loading may not be a sustainable long-term strategy without accompanying structural reforms.

- Debt Accumulation: Large-scale fiscal stimulus can increase government debt levels.

Alternative Strategies for MYR Stability

Other macroeconomic policies can contribute to MYR stability:

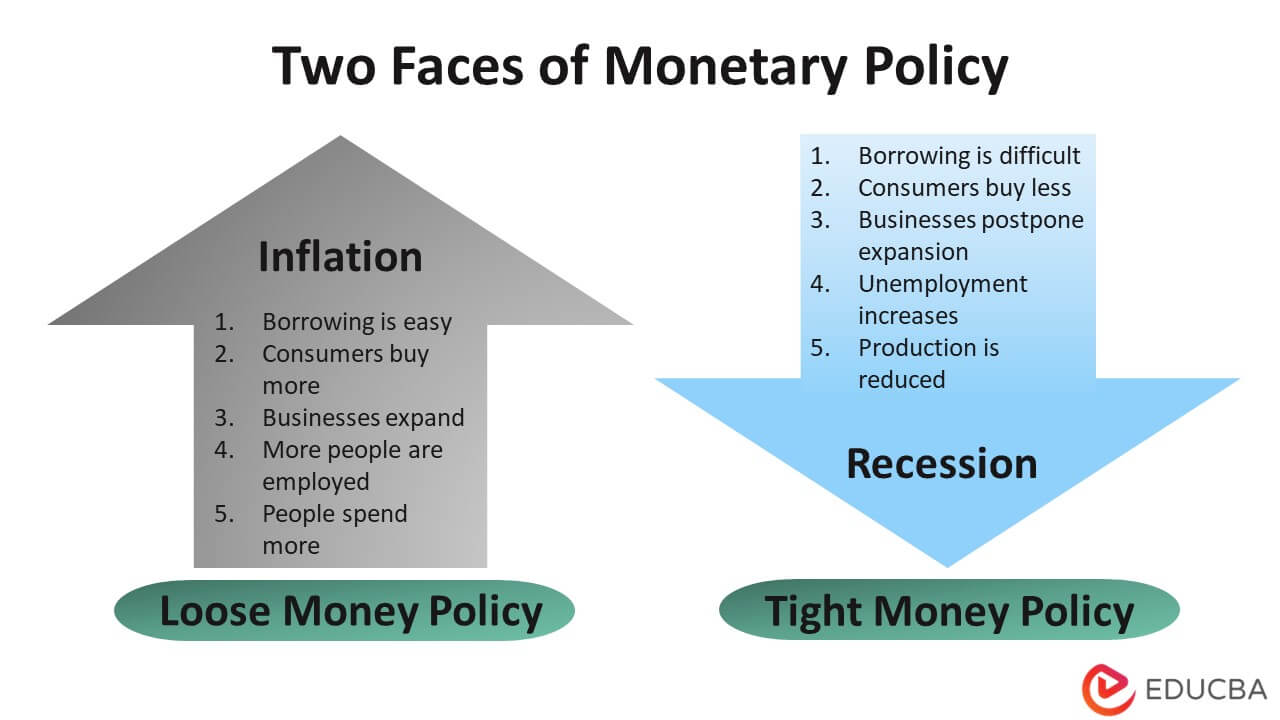

- Monetary Policy: Adjustments to interest rates by Bank Negara Malaysia.

- Fiscal Discipline: Maintaining a healthy government budget and controlling public spending.

Comparing front-loading with other strategies reveals:

- Front-loading: Quick impact, potential for unsustainable growth, risk of inflation.

- Gradual adjustments: Slower but potentially more sustainable, less risk of inflation.

Conclusion

This article explored the complex interplay between front-loading economic policies, Malaysian Ringgit (MYR) stability, and exporter confidence. While front-loading can be a useful tool for short-term MYR strengthening, careful management is crucial to avoid negative consequences such as inflation and unsustainable growth. A stable MYR remains paramount for bolstering exporter confidence and stimulating economic growth in Malaysia.

Understanding the dynamics of Malaysian Ringgit (MYR) stability is crucial for businesses and investors. Stay informed about Malaysian economic policies and their impact on MYR exchange rates to make informed decisions and capitalize on opportunities in this dynamic market. Continue learning about Malaysian Ringgit (MYR) stability and its implications for the future of the Malaysian economy.

Featured Posts

-

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025 -

Rihannas Engagement Ring And Stylish Cherry Red Heels A Style Icons Look

May 07, 2025

Rihannas Engagement Ring And Stylish Cherry Red Heels A Style Icons Look

May 07, 2025 -

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025 -

Julius Randle A Handful For The Lakers Timberwolves Appreciate His Physicality

May 07, 2025

Julius Randle A Handful For The Lakers Timberwolves Appreciate His Physicality

May 07, 2025 -

Tezyz Alrbt Aljwy Byn Afryqya Walsyn Mdhkrt Tfahm Byn Laram Wkhtwt Jnwb Alsyn Aljwyt

May 07, 2025

Tezyz Alrbt Aljwy Byn Afryqya Walsyn Mdhkrt Tfahm Byn Laram Wkhtwt Jnwb Alsyn Aljwyt

May 07, 2025

Latest Posts

-

How Chinas Lowered Rates And Easier Lending Combat Tariff Effects

May 08, 2025

How Chinas Lowered Rates And Easier Lending Combat Tariff Effects

May 08, 2025 -

50 Years On Indias Boldest Military Operation Against Pakistan

May 08, 2025

50 Years On Indias Boldest Military Operation Against Pakistan

May 08, 2025 -

Chinas Monetary Policy Shift Lower Rates And Increased Bank Lending

May 08, 2025

Chinas Monetary Policy Shift Lower Rates And Increased Bank Lending

May 08, 2025 -

T Mobile Data Breaches Result In 16 Million Fine

May 08, 2025

T Mobile Data Breaches Result In 16 Million Fine

May 08, 2025 -

Indias Deepest Strikes Into Pakistan In 50 Years A Detailed Analysis

May 08, 2025

Indias Deepest Strikes Into Pakistan In 50 Years A Detailed Analysis

May 08, 2025