March 6th: QNB Corp Investor Conference Presentation

Table of Contents

QNB Corp's Financial Performance Review (March 6th Presentation)

Financial Highlights & Key Metrics

The QNB Corp Investor Conference highlighted impressive financial results for the reporting period. Key metrics demonstrated strong performance across various areas:

-

Revenue Growth: QNB Corp reported a [Insert Percentage]% increase in revenue compared to the same period last year, reaching [Insert Amount] in total revenue. This substantial growth reflects the bank's success in expanding its market share and providing a diverse range of financial services. Keywords: QNB Corp financial results, QNB Corp revenue, QNB Corp profit

-

Net Profit: Net profit experienced a significant rise, reaching [Insert Amount], representing a [Insert Percentage]% increase year-on-year. This strong profitability underscores the bank's efficient operations and robust risk management strategies. Keywords: QNB Corp profit, QNB Corp earnings

-

Earnings Per Share (EPS): EPS showed a notable improvement, reaching [Insert Amount], reflecting increased profitability for shareholders. Keywords: QNB Corp earnings per share, QNB Corp shareholder return

-

Loan Growth: Loan portfolios experienced healthy growth, indicating strong demand for QNB Corp's lending products. A [Insert Percentage]% increase was reported. Keywords: QNB Corp loan growth, QNB Corp lending

The above metrics showcase QNB Corp's robust financial health and position for continued growth. The significant increases in revenue and net profit demonstrate successful execution of strategic initiatives and market opportunities.

Analysis of Key Financial Indicators

Analyzing key financial ratios provides further insight into QNB Corp's financial health and operational efficiency. Key highlights include:

-

Return on Equity (ROE): QNB Corp maintained a strong ROE of [Insert Percentage]%, indicating efficient use of shareholder capital and high profitability. Keywords: QNB Corp financial ratios, QNB Corp profitability, QNB Corp ROE

-

Return on Assets (ROA): The ROA of [Insert Percentage]% demonstrates efficient asset utilization and strong operational performance. Keywords: QNB Corp ROA, QNB Corp asset management

-

Loan-to-Deposit Ratio: The loan-to-deposit ratio remained at a healthy [Insert Percentage]%, indicating sound liquidity and risk management. Keywords: QNB Corp liquidity, QNB Corp financial ratios

These ratios showcase QNB Corp's financial strength and adherence to prudent risk management practices. The consistent performance across various indicators underlines the bank's stability and potential for continued success.

QNB Corp's Strategic Outlook and Growth Plans

Growth Strategies and Market Expansion

QNB Corp outlined several key strategies to drive future growth, encompassing both organic expansion and strategic acquisitions:

-

Geographic Expansion: QNB Corp plans to further expand its presence in [Mention specific regions or countries], leveraging its strong regional network and expertise. Keywords: QNB Corp growth strategy, QNB Corp market expansion, QNB Corp strategic initiatives

-

Product Diversification: The bank intends to broaden its product offerings to cater to evolving customer needs and market opportunities, including increased focus on [Mention specific product areas]. Keywords: QNB Corp product diversification, QNB Corp financial services

-

Strategic Partnerships: Collaborations and partnerships with key players in the financial sector are planned to enhance market reach and service capabilities. Keywords: QNB Corp strategic alliances, QNB Corp partnerships

QNB Corp's growth strategy emphasizes a balanced approach, combining organic growth with strategic acquisitions and partnerships to achieve sustainable, long-term success.

Investment in Technology and Digital Transformation

QNB Corp emphasized significant investments in technology and digital transformation to improve customer experience and operational efficiency:

-

Digital Platforms: QNB Corp is enhancing its digital platforms to provide seamless and convenient banking services, with a focus on improving mobile banking and online services. Keywords: QNB Corp digital transformation, QNB Corp technology investments, QNB Corp fintech

-

Data Analytics: Increased investments in data analytics will improve risk management, customer targeting and product development. Keywords: QNB Corp data analytics, QNB Corp risk management

-

Cybersecurity: Significant investments in cybersecurity infrastructure will ensure the protection of customer data and maintain a secure banking environment. Keywords: QNB Corp cybersecurity, QNB Corp data security

These technology investments reflect QNB Corp’s commitment to remaining at the forefront of the industry and providing customers with cutting-edge financial solutions.

Risk Assessment and Management

Key Risks and Mitigation Strategies

QNB Corp acknowledged key risks, including:

-

Geopolitical Risks: QNB Corp is actively monitoring and mitigating risks associated with geopolitical instability in key operating regions. Keywords: QNB Corp risk management, QNB Corp risk assessment

-

Economic Downturn: The bank is proactively managing its exposure to potential economic downturns by diversifying its portfolio and maintaining strong capital reserves. Keywords: QNB Corp risk management, QNB Corp economic outlook

-

Regulatory Changes: QNB Corp maintains a strong focus on regulatory compliance and actively adapts to evolving regulatory environments. Keywords: QNB Corp risk management, QNB Corp regulatory compliance

Mitigation strategies include diversification, robust risk monitoring, and a strong capital base.

Sustainability and ESG Initiatives

QNB Corp highlighted its commitment to Environmental, Social, and Governance (ESG) factors:

-

ESG Targets: The bank outlined specific targets for reducing its carbon footprint and promoting social responsibility within its operations. Keywords: QNB Corp ESG, QNB Corp sustainability, QNB Corp corporate social responsibility

-

Sustainable Finance: QNB Corp is increasing its commitment to sustainable finance initiatives, supporting projects that contribute to environmental protection and social development. Keywords: QNB Corp sustainable finance, QNB Corp green initiatives

QNB Corp's focus on ESG factors demonstrates its commitment to responsible and sustainable business practices.

Conclusion

This article summarized the key highlights from the March 6th QNB Corp Investor Conference presentation, covering financial performance, strategic outlook, and risk management. The presentation showcased QNB Corp's strong financial position, ambitious growth plans, and commitment to sustainable practices. For a more in-depth understanding of QNB Corp's performance and future prospects, access the full presentation materials on the QNB Corp investor relations website. Stay informed about future QNB Corp Investor Conferences and announcements by subscribing to their investor updates. Learn more about the latest developments in the QNB Corp Investor Conference presentations.

Featured Posts

-

The Truth Behind Zoe Kravitz And Noah Centineos Dating Rumors

Apr 30, 2025

The Truth Behind Zoe Kravitz And Noah Centineos Dating Rumors

Apr 30, 2025 -

Mstqbl Knda Ela Almhk Tramb Waetmad Knda Ela Alwlayat Almthdt

Apr 30, 2025

Mstqbl Knda Ela Almhk Tramb Waetmad Knda Ela Alwlayat Almthdt

Apr 30, 2025 -

Beyonce Blue Ivy Carter And Kendrick Lamar Triumph At Naacp Image Awards

Apr 30, 2025

Beyonce Blue Ivy Carter And Kendrick Lamar Triumph At Naacp Image Awards

Apr 30, 2025 -

Adidas Spring Sale 14 Slides Flying Off Shelves

Apr 30, 2025

Adidas Spring Sale 14 Slides Flying Off Shelves

Apr 30, 2025 -

Beyonse I Bolezn Materi Poslednie Novosti O Sostoyanii Zdorovya

Apr 30, 2025

Beyonse I Bolezn Materi Poslednie Novosti O Sostoyanii Zdorovya

Apr 30, 2025

Latest Posts

-

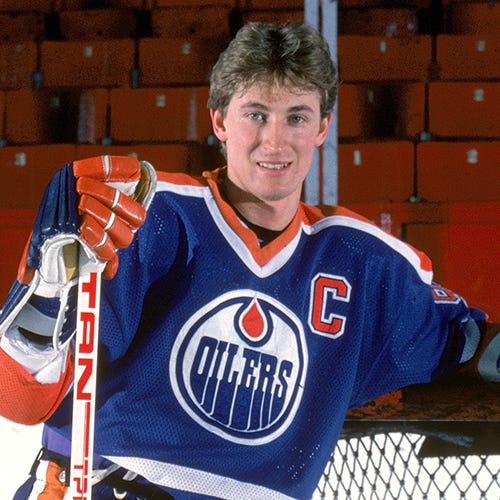

Wayne Gretzkys Fast Facts Records Achievements And Legacy

Apr 30, 2025

Wayne Gretzkys Fast Facts Records Achievements And Legacy

Apr 30, 2025 -

The Great One Wayne Gretzkys Quick Facts And Career Highlights

Apr 30, 2025

The Great One Wayne Gretzkys Quick Facts And Career Highlights

Apr 30, 2025 -

Wayne Gretzky Fast Facts A Comprehensive Overview

Apr 30, 2025

Wayne Gretzky Fast Facts A Comprehensive Overview

Apr 30, 2025 -

Wayne Gretzky Fast Facts And Key Stats

Apr 30, 2025

Wayne Gretzky Fast Facts And Key Stats

Apr 30, 2025 -

Los Angeles Kings Beat Dallas Stars Fialas Point Streak Extends

Apr 30, 2025

Los Angeles Kings Beat Dallas Stars Fialas Point Streak Extends

Apr 30, 2025