Market Rally: Sensex Up 200, Nifty Crosses 18,600

Table of Contents

Key Drivers of the Market Rally

This substantial market rally wasn't spontaneous; several significant factors converged to create today's positive market performance. Let's examine the key drivers:

-

Positive Global Cues: Global markets exhibited positive trends, injecting a significant dose of confidence into the investor landscape. This positive global sentiment had a ripple effect, spilling over into the Indian market and encouraging buying activity. The improved outlook in major global economies helped bolster investor confidence in emerging markets like India.

-

Strong Domestic Economic Data: Recent economic data releases painted a positive picture for India's economic future. For example, the latest manufacturing PMI (Purchasing Managers' Index) showed a robust expansion, exceeding expectations and indicating strong industrial activity. Similarly, positive GDP growth figures for the previous quarter reinforced optimism about India's economic trajectory. This positive outlook encouraged investors to increase their holdings, driving up market indices.

-

Sector-Specific Performance: Several sectors experienced exceptional gains, significantly contributing to the overall market rally. Strong quarterly results from key companies within these sectors also played a crucial role.

-

IT Sector: The IT sector witnessed a significant boost due to strong export orders and a generally positive global outlook for the technology industry. Increased demand for IT services fueled this sector's impressive performance.

-

Banking Sector: The banking sector also performed exceptionally well, driven by improved credit growth and positive regulatory changes that fostered a more conducive environment for lending and investment.

-

-

Foreign Institutional Investor (FII) Inflows: A significant increase in Foreign Institutional Investor (FII) investment flowed into the Indian market. This influx of foreign capital reflects a growing confidence in the Indian economy and its long-term growth potential. These inflows provided substantial support to the market rally, further boosting investor sentiment.

Nifty50 Crosses 18,600: Implications for Investors

The Nifty50 index crossing the 18,600 mark is a significant milestone, signifying a robust bullish trend in the Indian stock market. This achievement has several key implications for investors:

-

Increased Market Volatility: While the current trend is positive, investors should exercise caution and anticipate potential short-term volatility. Market corrections are a normal part of any growth cycle.

-

Long-Term Growth Potential: The sustained market rally suggests a positive long-term growth potential for the Indian stock market. This presents attractive opportunities for long-term investors.

-

Strategic Investment Decisions: This market rally presents both exciting opportunities and potential challenges. Investors need to conduct thorough portfolio analysis and adjust their investment strategies accordingly. Diversification remains a crucial risk management tool.

-

Sector-Specific Opportunities: Investors should carefully analyze high-growth sectors identified as key drivers of the rally, such as IT and banking, to identify potential investment opportunities. However, thorough due diligence is absolutely essential before making any investment decisions.

Analyzing Sensex Gains and Future Market Outlook

The Sensex's gain of over 200 points underscores the broader positive sentiment prevailing in the market. While this is undoubtedly positive, sustainable growth requires a continued favorable economic environment and careful consideration of several factors:

-

Geopolitical Factors: Global geopolitical events can significantly impact market sentiment. Keeping abreast of these developments is crucial for making informed investment choices.

-

Inflationary Pressures: Managing inflationary pressures remains paramount for sustaining positive market momentum. Closely monitoring central bank policies and economic data relating to inflation is vital.

-

Expert Opinions: Analyzing analysts' predictions and market forecasts can provide valuable insights into potential future market trends. However, it's crucial to remember that these are opinions and not guaranteed predictions.

Conclusion

Today's market rally, with the Sensex surging over 200 points and the Nifty50 index crossing 18,600, is a significant event driven by a confluence of positive global cues, robust domestic economic data, and strong sector-specific performance. While this positive trend is encouraging, investors should maintain vigilance and adopt a well-diversified investment strategy. Understanding the driving forces behind this market rally is crucial for making informed investment decisions. Stay informed about market developments and continue to monitor the Sensex and Nifty indices for valuable insights. Remember to consult with a qualified financial advisor before making any significant investment decisions.

Featured Posts

-

Elizabeth City Road Fatal Accident Leaves Two Dead

May 09, 2025

Elizabeth City Road Fatal Accident Leaves Two Dead

May 09, 2025 -

Nyt Spelling Bee April 9 2025 Unlocking The Days Clues And Spangram

May 09, 2025

Nyt Spelling Bee April 9 2025 Unlocking The Days Clues And Spangram

May 09, 2025 -

Abc Lakers Celtics Promo Tnt Announcers Epic Tatum Take Down

May 09, 2025

Abc Lakers Celtics Promo Tnt Announcers Epic Tatum Take Down

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

Understanding The Celebrity Antiques Road Trips Appraisal Process

May 09, 2025

Understanding The Celebrity Antiques Road Trips Appraisal Process

May 09, 2025

Latest Posts

-

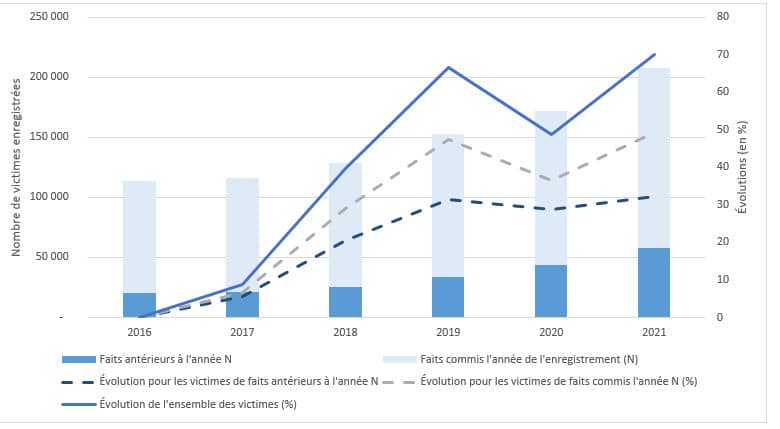

Affaire Latreche Violences Conjugales A Dijon Convocation Au Tribunal

May 10, 2025

Affaire Latreche Violences Conjugales A Dijon Convocation Au Tribunal

May 10, 2025 -

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 10, 2025

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 10, 2025 -

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 10, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 10, 2025 -

9 Maya Bez Makrona Starmera Mertsa I Tuska Kiev Ostanetsya Bez Vazhnykh Gostey

May 10, 2025

9 Maya Bez Makrona Starmera Mertsa I Tuska Kiev Ostanetsya Bez Vazhnykh Gostey

May 10, 2025 -

Dijon Proces Pour Violences Conjugales Contre Le Boxeur Bilel Latreche En Aout

May 10, 2025

Dijon Proces Pour Violences Conjugales Contre Le Boxeur Bilel Latreche En Aout

May 10, 2025