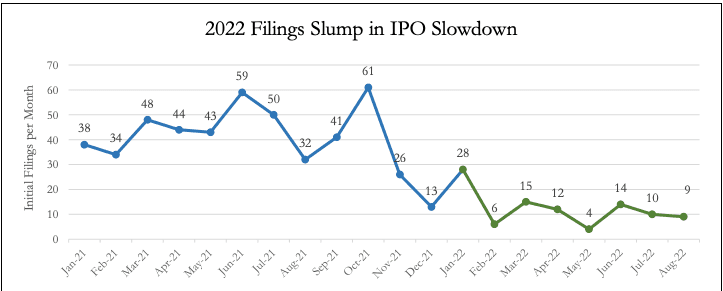

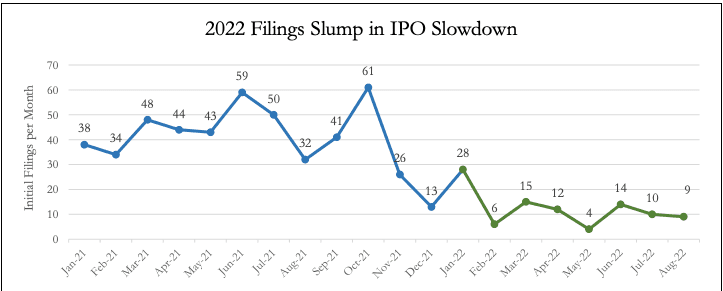

Market Volatility And The Freeze On IPO Activity: A Current Analysis

Table of Contents

The Impact of Market Volatility on Investor Sentiment

Market volatility significantly impacts investor sentiment, directly influencing the success or failure of IPOs. This is primarily due to two key factors: risk aversion and pricing challenges.

Risk Aversion and the Flight to Safety

Volatile markets trigger a natural response in investors: a flight to safety. This means investors shift away from riskier assets, like newly issued stocks in an IPO, and towards safer havens such as government bonds or established blue-chip companies.

- Increased market uncertainty leads to decreased investor confidence. The unpredictable nature of volatile markets makes it difficult to project future returns, discouraging investment in less established companies.

- Investors seek lower-risk, more established assets. The perceived safety of already-publicly traded companies becomes more attractive during periods of high volatility.

- Demand for IPOs drops significantly. Reduced investor appetite translates directly into lower demand for new stock offerings, making IPOs less attractive for companies.

Pricing Challenges in Uncertain Markets

Accurately pricing an IPO is always challenging, but market volatility exacerbates the difficulty. Fluctuating valuations make it incredibly hard to determine a fair price for a new company entering the public market.

- Difficult to establish a fair market value for new companies. The lack of historical trading data makes valuation inherently tricky, and volatility makes any projection highly uncertain.

- Risk of overvaluation or undervaluation leading to post-IPO price drops. An incorrectly priced IPO can lead to immediate price drops, damaging investor confidence and the company's reputation.

- Increased due diligence required from underwriters. Underwriters face increased pressure to accurately assess the risk associated with the IPO, leading to more thorough (and more expensive) due diligence.

Macroeconomic Factors Contributing to the IPO Freeze

Several macroeconomic factors contribute to the current market volatility and subsequent freeze on IPO activity. These include inflation, interest rate hikes, and geopolitical uncertainty.

Inflation and Interest Rate Hikes

Rising inflation forces central banks to increase interest rates to curb price increases. This has a significant impact on the attractiveness of IPOs.

- Higher interest rates increase borrowing costs for companies. Companies considering an IPO often need financing, and higher interest rates make borrowing more expensive and less appealing.

- Reduced investor appetite for riskier assets. Higher interest rates make safer, fixed-income investments relatively more attractive, further reducing the demand for riskier IPOs.

- Potential for decreased future earnings impacting valuations. Higher interest rates can stifle economic growth, potentially leading to lower future earnings for companies, impacting their IPO valuations.

Geopolitical Uncertainty and Global Economic Slowdown

Global events such as war, political instability, and economic slowdowns create substantial market uncertainty, dampening investor enthusiasm for IPOs.

- Uncertainty surrounding future economic growth. Geopolitical instability creates uncertainty about future economic growth, making investors hesitant to commit capital to new ventures.

- Increased market volatility due to global events. Global events often trigger significant market fluctuations, increasing the perceived risk associated with IPO investments.

- Companies postpone IPOs to wait for improved market conditions. Many companies choose to delay their IPOs until market conditions become more favorable and investor sentiment improves.

The Implications of Reduced IPO Activity

The decrease in IPO activity has significant implications for the broader economy and the financial markets.

Impact on Capital Formation

A significant consequence of the IPO freeze is a reduction in capital formation. Fewer companies are able to access public markets for funding, potentially hindering growth and innovation.

- Reduced access to capital for growth-stage companies. IPOs are a vital source of funding for many companies, and a freeze limits their access to crucial capital.

- Slowed innovation and economic growth. Reduced capital availability can stifle innovation and overall economic growth, as promising ventures struggle to secure funding.

- Potential for increased reliance on private equity funding. With public markets less accessible, companies might increasingly rely on private equity, potentially shifting the balance of power in the corporate landscape.

Effects on the Stock Market's Liquidity and Diversity

The reduced number of IPOs also affects the stock market's liquidity and the diversity of publicly traded companies.

- Reduced trading volume and market liquidity. Fewer IPOs mean fewer new stocks available for trading, potentially decreasing overall market liquidity.

- Less diverse range of investment options for investors. A smaller number of IPOs limits the diversity of investment choices available to investors.

- Potential for increased concentration of market power. If fewer companies go public, it could lead to increased concentration of market power among existing publicly traded firms.

Conclusion

The current freeze on IPO activity is a direct consequence of market volatility driven by a complex interplay of factors, including macroeconomic instability, investor risk aversion, and pricing challenges. The reduction in IPOs has significant implications for capital formation, economic growth, and market liquidity. Understanding the interplay between market volatility and the IPO freeze is crucial for investors and businesses alike. Staying informed about market trends and anticipating shifts in investor sentiment is paramount for navigating this challenging environment. To stay ahead of the curve and make informed decisions regarding investment in a volatile market, continue researching the dynamics between market volatility and IPO activity, and consider consulting with financial professionals.

Featured Posts

-

Ted Blacks Unexploited Ability In Suits La Episode 2

May 14, 2025

Ted Blacks Unexploited Ability In Suits La Episode 2

May 14, 2025 -

Eurovisions New Wave Cross National Artists Taking Center Stage

May 14, 2025

Eurovisions New Wave Cross National Artists Taking Center Stage

May 14, 2025 -

Suomi Juhlii 4 8 Miljoonan Eurojackpot Voitto

May 14, 2025

Suomi Juhlii 4 8 Miljoonan Eurojackpot Voitto

May 14, 2025 -

Eden Golan Israels Eurovision Vote Announcer

May 14, 2025

Eden Golan Israels Eurovision Vote Announcer

May 14, 2025 -

Figmas Post Adobe Rejection Ipo Filing

May 14, 2025

Figmas Post Adobe Rejection Ipo Filing

May 14, 2025