Market Wrap: CAC 40's Week-End Performance - March 7, 2025

Table of Contents

Key Movers and Shakers

This week saw a mixed bag of performance within the CAC 40, with some stocks surging while others experienced significant declines. Analyzing both the top gainers and losers provides valuable insights into the market's dynamics.

Top Performing Stocks

Several companies within the CAC 40 index showcased impressive gains this week. Their success can be attributed to a combination of strong earnings reports, positive industry trends, and overall market sentiment.

- LVMH (Moët Hennessy Louis Vuitton): +5.2%. Strong luxury goods sales fueled by robust demand in Asia drove this significant increase.

- Hermès International: +4.8%. Continued growth in its high-end handbag and apparel sales contributed to its impressive week.

- TotalEnergies: +3.9%. Rising oil prices and a positive outlook on the energy sector boosted the company's performance.

- Kering: +3.5%. Growth in the luxury sector, driven by strong demand for Gucci and Yves Saint Laurent, propelled Kering's stock higher.

- Airbus SE: +3%. Increased aircraft orders and a positive outlook for the aerospace industry contributed to the company's positive performance.

Worst Performing Stocks

On the other hand, several CAC 40 stocks experienced substantial losses this week. Understanding the reasons behind their underperformance is critical for investors.

- BNP Paribas: -2.7%. Concerns regarding the global banking sector and rising interest rates weighed on the stock.

- Société Générale: -2.3%. Similar concerns to BNP Paribas regarding the banking sector and interest rate hikes contributed to the decline.

- Sanofi: -1.8%. Disappointing sales figures for a key drug impacted investor confidence.

- Renault: -1.5%. Concerns about the automotive sector's outlook in the face of economic uncertainty contributed to the decline.

- Stellantis: -1.2%. Lower-than-expected sales figures and production challenges impacted investor sentiment.

Sectoral Performance

Analyzing the performance of different sectors within the CAC 40 reveals key trends and opportunities.

Winning Sectors

Several sectors exhibited strong performance during the week.

- Luxury Goods: +4.5% average increase. Strong demand from Asian markets and a positive outlook for the luxury sector contributed to significant growth.

- Energy: +3.2% average increase. Rising oil prices significantly benefited energy companies.

- Technology: +2.8% average increase. Positive investor sentiment towards tech stocks, coupled with strong earnings reports from some key players, contributed to the gains.

Underperforming Sectors

Conversely, certain sectors struggled during this period.

- Financials: -1.9% average decrease. Concerns about rising interest rates and global economic uncertainty impacted investor confidence in the financial sector.

- Automotive: -1.1% average decrease. Concerns about slowing economic growth and potential supply chain disruptions weighed on the automotive sector.

- Healthcare: -0.8% average decrease. While generally a stable sector, some disappointing drug sales figures led to a slight decline.

Macroeconomic Factors Influencing CAC 40 Performance

Several global and French macroeconomic factors influenced the CAC 40's performance.

Global Economic News

- Interest Rate Hikes: Concerns about further interest rate hikes by central banks globally continue to put pressure on equity markets, impacting investor sentiment.

- Inflation Data: Persistent inflation, although showing signs of easing in some regions, remains a major concern, impacting consumer spending and business investment.

- Geopolitical Instability: Ongoing geopolitical tensions continue to create uncertainty in global markets, leading to volatility.

French Economic Indicators

- Unemployment Figures: Slightly improved unemployment numbers in France offered some positive sentiment, but concerns remain.

- Consumer Confidence: Consumer confidence remains relatively stable but shows signs of weakening due to rising inflation.

- Manufacturing PMI: A slightly lower-than-expected manufacturing PMI index added to concerns about economic slowdown in France.

Conclusion

This week's CAC 40 performance reflects a complex interplay of factors, with some sectors thriving while others faced headwinds. Strong performance in the luxury and energy sectors contrasted with underperformance in the financial and automotive sectors. Global economic uncertainty and rising interest rates significantly impacted investor sentiment, while French economic indicators offered a mixed picture. The CAC 40 analysis highlights the importance of staying informed about both global and local economic events for successful investment strategies within the French stock market. Stay tuned for next week's market wrap to stay updated on the latest CAC 40 performance, analysis of trends, and key drivers affecting the future CAC 40 performance.

Featured Posts

-

Voorspelling Vervolg Snelle Marktbeweging Europese Aandelen Tegenover Wall Street

May 24, 2025

Voorspelling Vervolg Snelle Marktbeweging Europese Aandelen Tegenover Wall Street

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025 -

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 24, 2025

Latest Posts

-

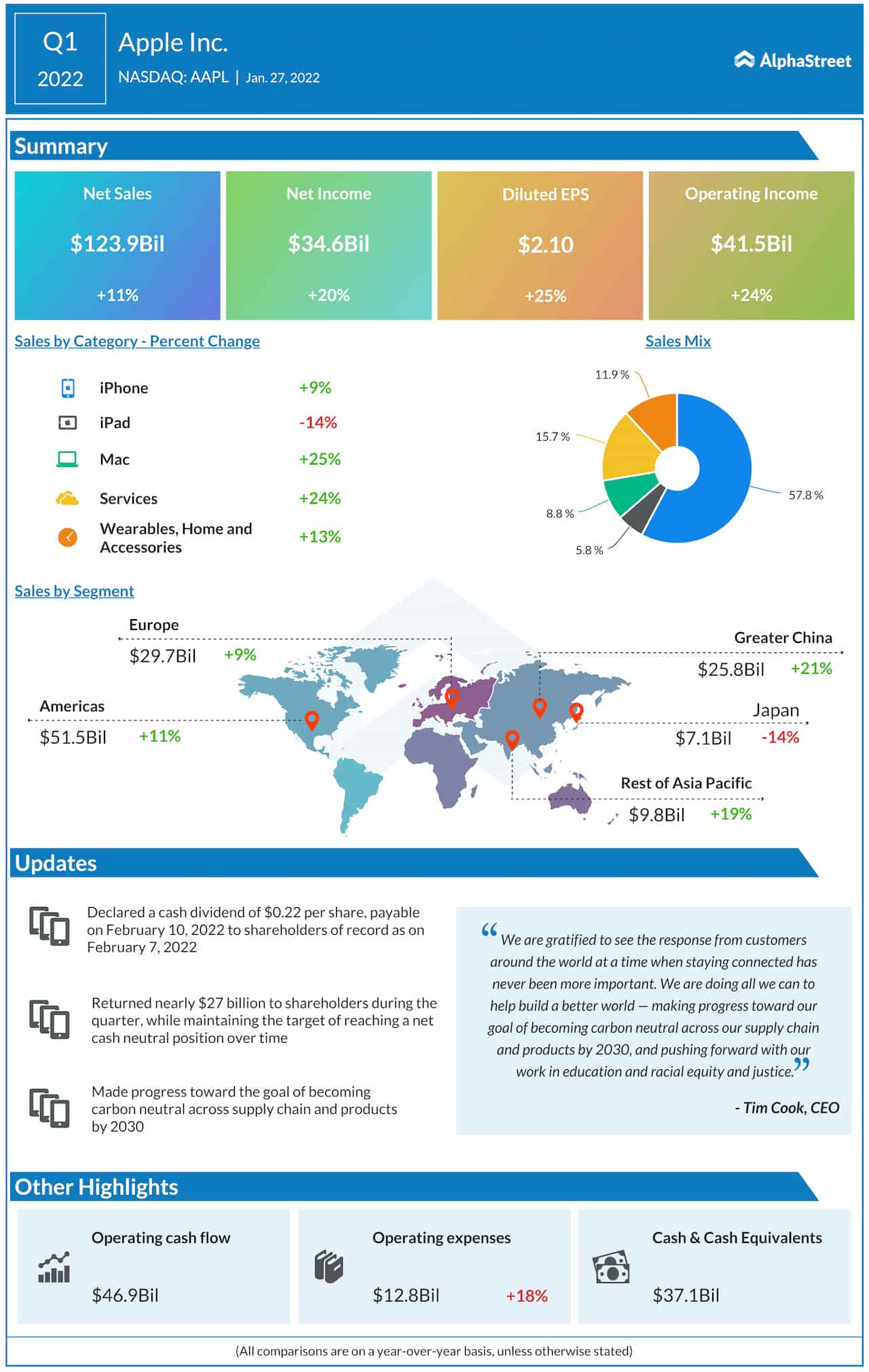

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025 -

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025 -

I Phone Ai I Phone

May 24, 2025

I Phone Ai I Phone

May 24, 2025 -

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025