MicroStrategy Or Bitcoin: The Smarter Investment Strategy For 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has made headlines for its aggressive Bitcoin acquisition strategy. Understanding their approach is crucial for evaluating the investment potential.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business revolves around providing enterprise analytics and mobility software. However, its foray into Bitcoin has fundamentally altered its investment profile. The company has amassed a substantial Bitcoin treasury, making it one of the largest corporate holders of the cryptocurrency. Their rationale centers on Bitcoin as a long-term store of value and a hedge against inflation.

- Size and Fluctuation: The precise market value of MicroStrategy's Bitcoin holdings fluctuates wildly depending on Bitcoin's price. This represents both a significant opportunity for profit and a considerable risk.

- Risks of Reliance: MicroStrategy's heavy reliance on Bitcoin exposes it to substantial volatility. A significant drop in Bitcoin's price could negatively impact the company's balance sheet and stock price.

- Stock Performance vs. Bitcoin: MicroStrategy's stock price shows a strong correlation with Bitcoin's price, although not always a perfectly mirrored one. Understanding this relationship is key to assessing the risk-reward profile.

- Recent Events: Keep an eye on news and announcements regarding MicroStrategy's Bitcoin purchases, any potential divestment strategies, and overall company performance. These events can significantly impact stock prices.

Analyzing Bitcoin's Potential in 2025

Bitcoin's long-term potential remains a subject of intense debate, but its underlying technology and growing adoption warrant careful consideration.

Bitcoin's Technological Fundamentals

Bitcoin's decentralized nature, limited supply (21 million coins), and robust cryptographic security are key factors contributing to its appeal as a store of value and a potential alternative to traditional financial systems.

- Halving Events: Bitcoin's halving events, which reduce the rate of new Bitcoin creation, are often cited as potentially bullish factors, impacting price by decreasing supply.

- Institutional Adoption: The increasing adoption of Bitcoin by institutional investors, such as corporations and investment funds, signals growing mainstream acceptance and potential for price appreciation.

- Regulatory Landscape: Government regulations and legal frameworks surrounding Bitcoin continue to evolve globally. Clearer regulations could potentially boost adoption and price, while overly restrictive measures could hinder growth.

- Mainstream Payment: The potential for Bitcoin to become a widely accepted form of payment remains a key driver for its future value. Increased adoption in this area could significantly boost its price.

Comparative Analysis: MicroStrategy vs. Direct Bitcoin Investment

Choosing between investing in MicroStrategy stock and directly investing in Bitcoin involves carefully weighing risk tolerance and investment goals.

Risk Tolerance and Investment Goals

Both options present significant risks and potential rewards, but their risk profiles differ considerably.

- Correlation: MicroStrategy's stock price exhibits a significant correlation with Bitcoin's price, meaning that investing in MicroStrategy offers less diversification than direct Bitcoin investment.

- Diversification: Direct Bitcoin investment offers no diversification within the cryptocurrency market. MicroStrategy offers some diversification since it’s also a publicly traded company with its own revenue streams.

- Return Potential: Direct Bitcoin investment has the potential for higher returns but also carries a substantially higher risk.

- Transaction Costs: Consider brokerage fees, trading commissions, and capital gains taxes associated with both investment options.

Factors Influencing the Decision

Predicting the future price of Bitcoin and MicroStrategy's stock is inherently speculative, but analyzing market trends and expert opinions can provide valuable insights.

Market Predictions and Expert Opinions

Numerous market analysts and cryptocurrency experts offer forecasts on the future performance of both Bitcoin and MicroStrategy. These predictions, however, should be considered with caution.

- Expert Quotes: Seek out reputable sources and understand the basis for their predictions.

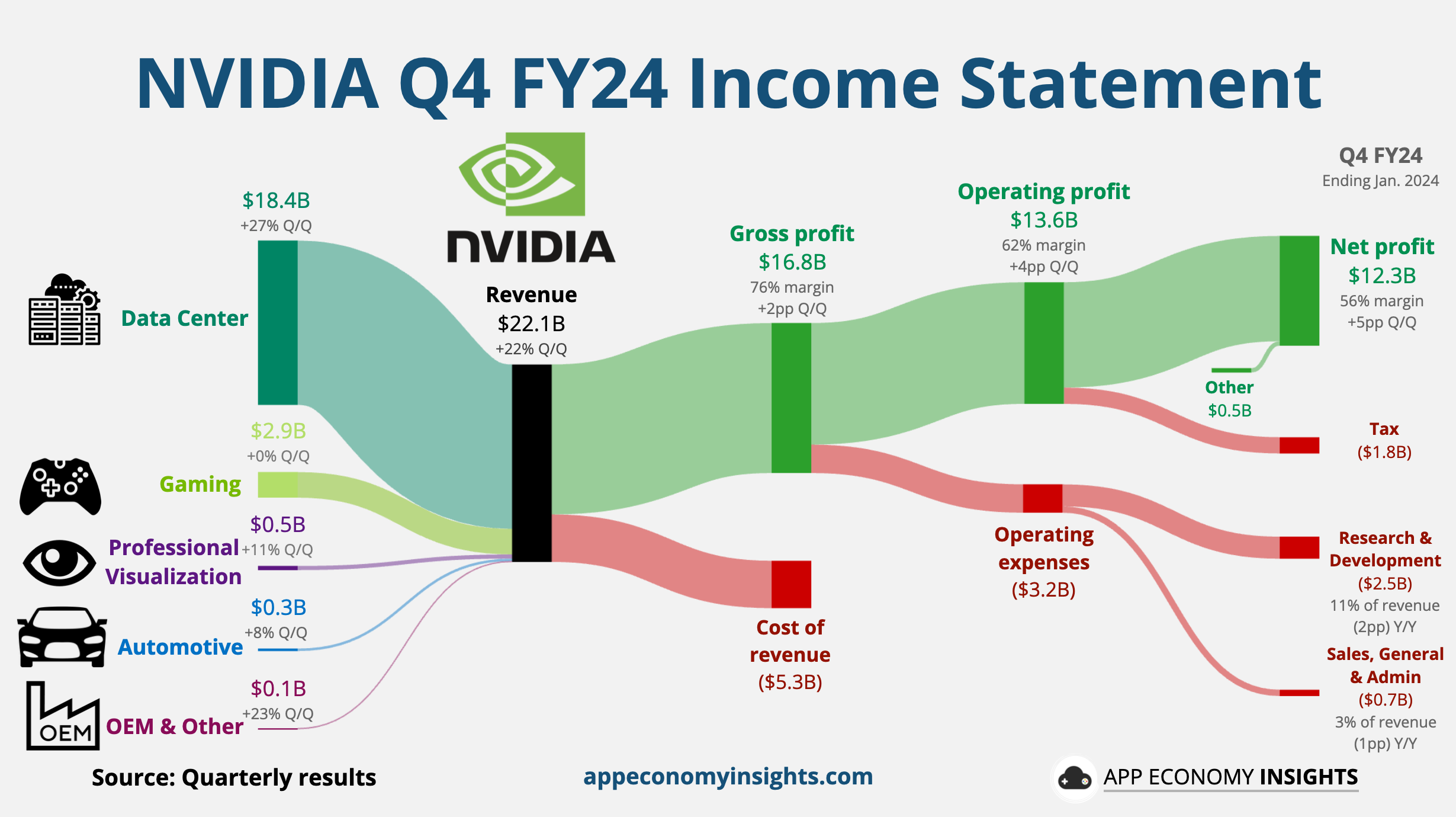

- Market Data: Analyze relevant market data, including Bitcoin's price history, MicroStrategy's financial reports, and macroeconomic indicators.

- Macroeconomic Factors: Global economic conditions, inflation rates, and regulatory changes can significantly impact both investments.

- Inherent Uncertainty: Remember, long-term investment strategies always involve a degree of uncertainty.

Conclusion

Choosing between MicroStrategy and Bitcoin for investment in 2025 requires careful consideration of your risk tolerance, investment horizon, and understanding of the inherent volatility of both assets. MicroStrategy offers a degree of diversification through its core business, albeit with a strong dependence on Bitcoin's price. Direct Bitcoin investment offers higher potential returns but also significantly greater risk.

We recommend conducting thorough research, considering the factors outlined in this article, and consulting with a qualified financial advisor before making any investment decisions. This analysis is not financial advice; it's a comparative overview. Remember to revisit this article periodically for updated information on MicroStrategy or Bitcoin, as the landscape of the cryptocurrency market is constantly evolving.

Featured Posts

-

Palantir Q1 Earnings Report Key Insights Into Government And Commercial Business

May 09, 2025

Palantir Q1 Earnings Report Key Insights Into Government And Commercial Business

May 09, 2025 -

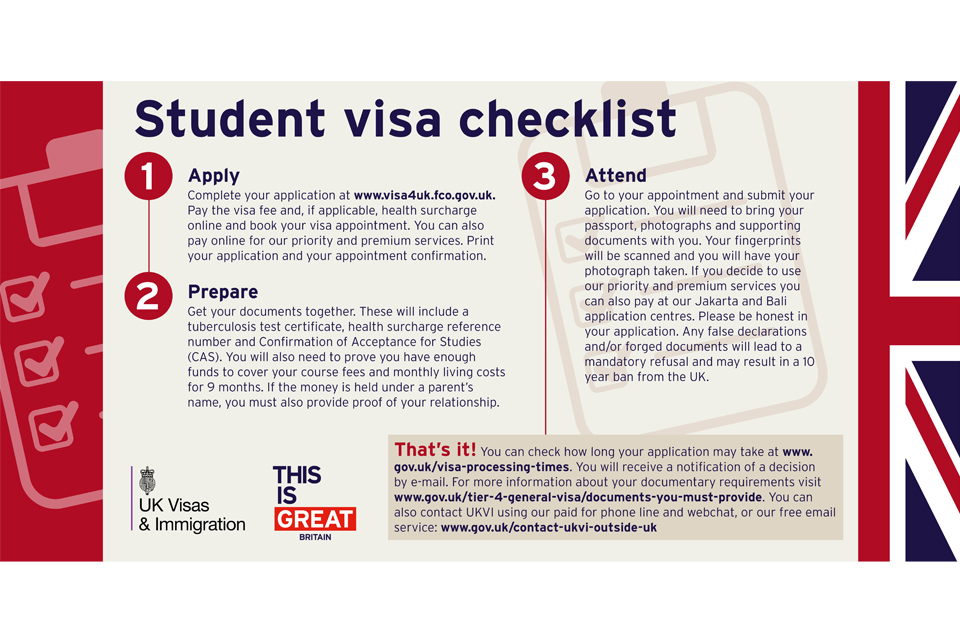

Uk Student Visas New Restrictions For Pakistani Students And Asylum Implications

May 09, 2025

Uk Student Visas New Restrictions For Pakistani Students And Asylum Implications

May 09, 2025 -

February 15th Nyt Strands Answers Game 349

May 09, 2025

February 15th Nyt Strands Answers Game 349

May 09, 2025 -

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 09, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 09, 2025 -

Beyonces Cowboy Carter Streams Surge After Tour Launch

May 09, 2025

Beyonces Cowboy Carter Streams Surge After Tour Launch

May 09, 2025