Microsoft Among Top Software Stocks For Tariff-Proof Portfolios

Table of Contents

Microsoft's Global Reach and Diversified Revenue Streams

Microsoft's dominance isn't confined to a single product or region. Its diversified portfolio, encompassing Windows, Office 365, Azure, LinkedIn, and Xbox, significantly reduces its vulnerability to tariffs impacting specific sectors. This diversification across various geographic regions and business segments is a cornerstone of its tariff resilience.

- Revenue Diversification: Microsoft generates revenue from numerous sources, minimizing dependence on any single product or market. A decline in one area can be offset by growth in another.

- Reduced Dependence: This multifaceted approach significantly diminishes the impact of potential tariffs on specific product lines or geographical markets.

- Strong International Presence: Microsoft's global presence ensures that it's not overly reliant on any single nation's economy, shielding it from the brunt of localized tariff impacts. Revenue streams are spread across North America, Europe, Asia, and other key regions.

- Examples: The success of Azure in the cloud computing market, the continued growth of Office 365 subscriptions worldwide, and the strong performance of LinkedIn in professional networking all contribute to this diversified revenue model.

The Strength of Microsoft's Software as a Service (SaaS) Model

Microsoft's heavy investment in SaaS offerings like Azure and Office 365 provides inherent resilience against tariff fluctuations. Unlike physical goods subject to import duties, SaaS products are delivered digitally, circumventing many of the traditional trade barriers.

- Predictable Revenue: The subscription-based model of SaaS offers more predictable and stable revenue streams, less sensitive to short-term tariff shocks.

- Global Access: Cloud services like Azure are accessible globally, eliminating the reliance on physical goods and the associated transportation costs and tariffs.

- Scalability and Adaptability: SaaS models are inherently scalable and adaptable, allowing Microsoft to quickly respond to changing market conditions and economic volatility.

- Global Reach of SaaS: Microsoft's cloud services operate across numerous data centers globally, ensuring accessibility and minimizing the impact of localized trade restrictions.

Microsoft's Competitive Advantage and Market Dominance

Microsoft's enduring success stems from its powerful competitive advantages and market leadership. This established position translates to greater resilience during periods of economic uncertainty, including those driven by trade disputes.

- Brand Recognition and Loyalty: The Microsoft brand enjoys unparalleled recognition and customer loyalty, making it a preferred choice even in challenging times.

- Technological Innovation: Continuous investment in research and development fuels ongoing product improvement and innovation, maintaining a competitive edge.

- Network Effects: Microsoft's extensive ecosystem of products and services creates strong network effects, reinforcing its market dominance.

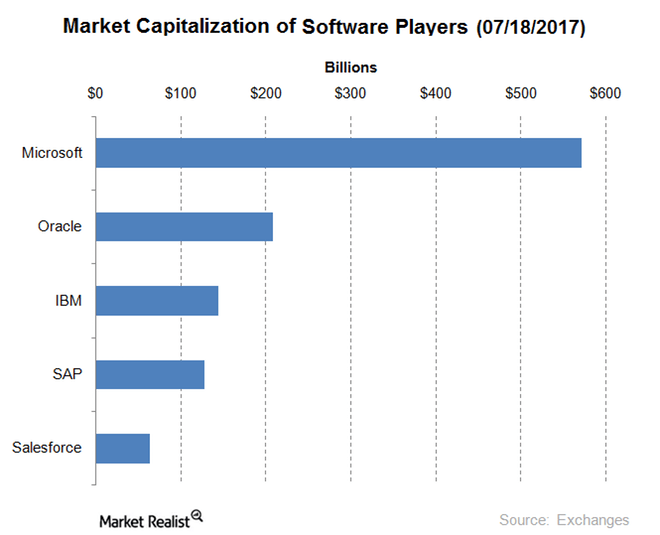

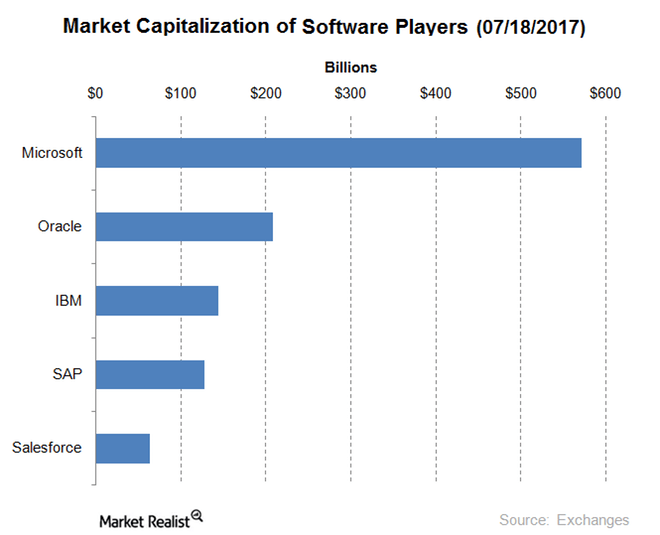

- Market Share: Microsoft holds significant market share in operating systems, productivity software, and cloud computing, providing a strong buffer against economic downturns.

Analyzing Microsoft's Stock Performance in Relation to Tariff Events

Analyzing Microsoft's historical stock performance during periods of tariff uncertainty reveals a relative stability compared to other sectors more directly affected by trade restrictions.

- Comparative Analysis: Comparing Microsoft's stock performance to other tech stocks or traditional manufacturing and import-dependent industries during previous tariff periods highlights its resilience.

- Performance Trends: Charts and graphs illustrating Microsoft's stock price fluctuations during periods of tariff uncertainty can be used to demonstrate its relative stability. (Note: Specific data and charts would need to be included here from reliable financial sources.)

- Data Sources: Data for this analysis should come from reputable sources like the NASDAQ, financial news outlets, and investment research firms.

- Relative Stability: The analysis should demonstrate that Microsoft's stock price has shown less volatility compared to companies more heavily reliant on international trade and susceptible to tariff impacts.

Conclusion: Building a Tariff-Proof Portfolio with Microsoft

Microsoft's diverse revenue streams, robust SaaS model, and dominant market position make it a compelling addition to any portfolio aiming for tariff resilience. Its proven ability to weather economic storms and its consistent performance during periods of tariff uncertainty solidify its place as a top choice for investors seeking to mitigate risk. By incorporating Microsoft into your long-term investment strategy, you can significantly enhance your portfolio's resilience against the unpredictable impacts of global trade policies. Consider Microsoft among top software stocks for tariff-proof portfolios – but remember diversification is key. Explore other tech giants and sectors to further strengthen your portfolio's resilience. For further research on Microsoft's financials and stock performance, consult reputable financial news sources and investment platforms.

Featured Posts

-

Best Black Decker Steam Irons Top Picks And Reviews

May 16, 2025

Best Black Decker Steam Irons Top Picks And Reviews

May 16, 2025 -

The Tom Cruise And Tom Hanks 1 Debt A Hollywood Anecdote

May 16, 2025

The Tom Cruise And Tom Hanks 1 Debt A Hollywood Anecdote

May 16, 2025 -

Le Marche Du Travail Des Gardiens Perspectives Et Defis

May 16, 2025

Le Marche Du Travail Des Gardiens Perspectives Et Defis

May 16, 2025 -

Ai Therapy And Surveillance Exploring The Ethical Concerns

May 16, 2025

Ai Therapy And Surveillance Exploring The Ethical Concerns

May 16, 2025 -

Kim Kardashian Recounts Near Death Experience During Robbery Trial

May 16, 2025

Kim Kardashian Recounts Near Death Experience During Robbery Trial

May 16, 2025

Latest Posts

-

Tramp Gi Obvinuva Mediumite I Na Avuva Chistka Vo Sudstvoto

May 16, 2025

Tramp Gi Obvinuva Mediumite I Na Avuva Chistka Vo Sudstvoto

May 16, 2025 -

Full Interview Jill Biden On The View

May 16, 2025

Full Interview Jill Biden On The View

May 16, 2025 -

Na Ava Za Chistka Tramp Gi Napa A Mediumite I Sudovite

May 16, 2025

Na Ava Za Chistka Tramp Gi Napa A Mediumite I Sudovite

May 16, 2025 -

Tramp Napadi Na Mediumi I Zakani Za Chistka Vo Sudstvoto

May 16, 2025

Tramp Napadi Na Mediumi I Zakani Za Chistka Vo Sudstvoto

May 16, 2025 -

Your Guide To Betting On Nba And Nhl Round 2 Playoffs

May 16, 2025

Your Guide To Betting On Nba And Nhl Round 2 Playoffs

May 16, 2025