Navigating The Private Credit Boom: 5 Key Do's And Don'ts For Job Seekers

Table of Contents

Do: Highlight Relevant Skills and Experience

Landing a job in the competitive private credit industry requires showcasing the right skills. Your resume and cover letter are your first impression, so make them count.

Tailor your resume and cover letter:

Focus on skills directly applicable to private credit, such as financial modeling, credit analysis, portfolio management, and due diligence. Quantify your achievements whenever possible to demonstrate your impact.

- Emphasize experience with financial statements analysis: Highlight your proficiency in analyzing balance sheets, income statements, and cash flow statements to assess creditworthiness.

- Showcase proficiency in Excel, Bloomberg Terminal, and other relevant software: Demonstrate your technical skills with specific examples of how you've used these tools in previous roles. Mention proficiency in databases and financial modeling software like Argus.

- Quantify your contributions using metrics (e.g., increased efficiency by X%, reduced risk by Y%): Use numbers to show the value you brought to previous employers. This makes your accomplishments more impactful and memorable.

- Highlight any experience with alternative lending or private debt strategies: Mention any familiarity with direct lending, mezzanine financing, distressed debt, or other niche areas within private credit.

Network strategically:

Networking is paramount in the private credit space. Leveraging your connections and building new ones can significantly improve your job search prospects.

- Join relevant professional organizations (e.g., CFA Institute, ASA): These organizations provide networking opportunities and access to industry insights.

- Attend conferences and workshops related to private credit and alternative investments: These events are great places to meet potential employers and learn about the latest industry trends.

- Actively engage in online communities and forums: Participate in online discussions related to private credit and finance to demonstrate your expertise and network with professionals.

- Informational interviews can provide valuable insights and connections: Reach out to professionals in the field for informational interviews to learn about their experiences and gain valuable insights into the industry.

Do: Research Firms and Opportunities Thoroughly

Before applying for private credit jobs, thorough research is crucial. Understanding the firm's investment strategy and culture will greatly enhance your application.

Understand the firm's investment strategy:

Different private credit firms focus on varying strategies (e.g., direct lending, distressed debt, mezzanine financing). Aligning your skills and experience with the firm's specific focus significantly increases your chances of success.

- Research the firm's portfolio companies and investment performance: Understanding their investment approach allows you to tailor your application to demonstrate relevance.

- Understand the firm's culture and values: Look beyond just the financial performance. Is it a collaborative environment? What are their priorities? Finding a good cultural fit is essential for job satisfaction.

- Identify key decision-makers within the firm: Knowing who makes hiring decisions enables you to target your application and networking efforts effectively.

Prepare targeted applications:

Generic applications rarely succeed. Tailoring your resume, cover letter, and interview responses to each specific firm and role is critical.

- Highlight the aspects of your experience that are most relevant to the specific job description: Don't just list your responsibilities; explain how they relate to the requirements of the target role.

- Demonstrate your understanding of the firm's investment strategy and target market: Show that you've done your homework and are genuinely interested in their work.

- Showcase your enthusiasm for the specific opportunity and the firm's work: Your passion for the role and the company will shine through in your application materials.

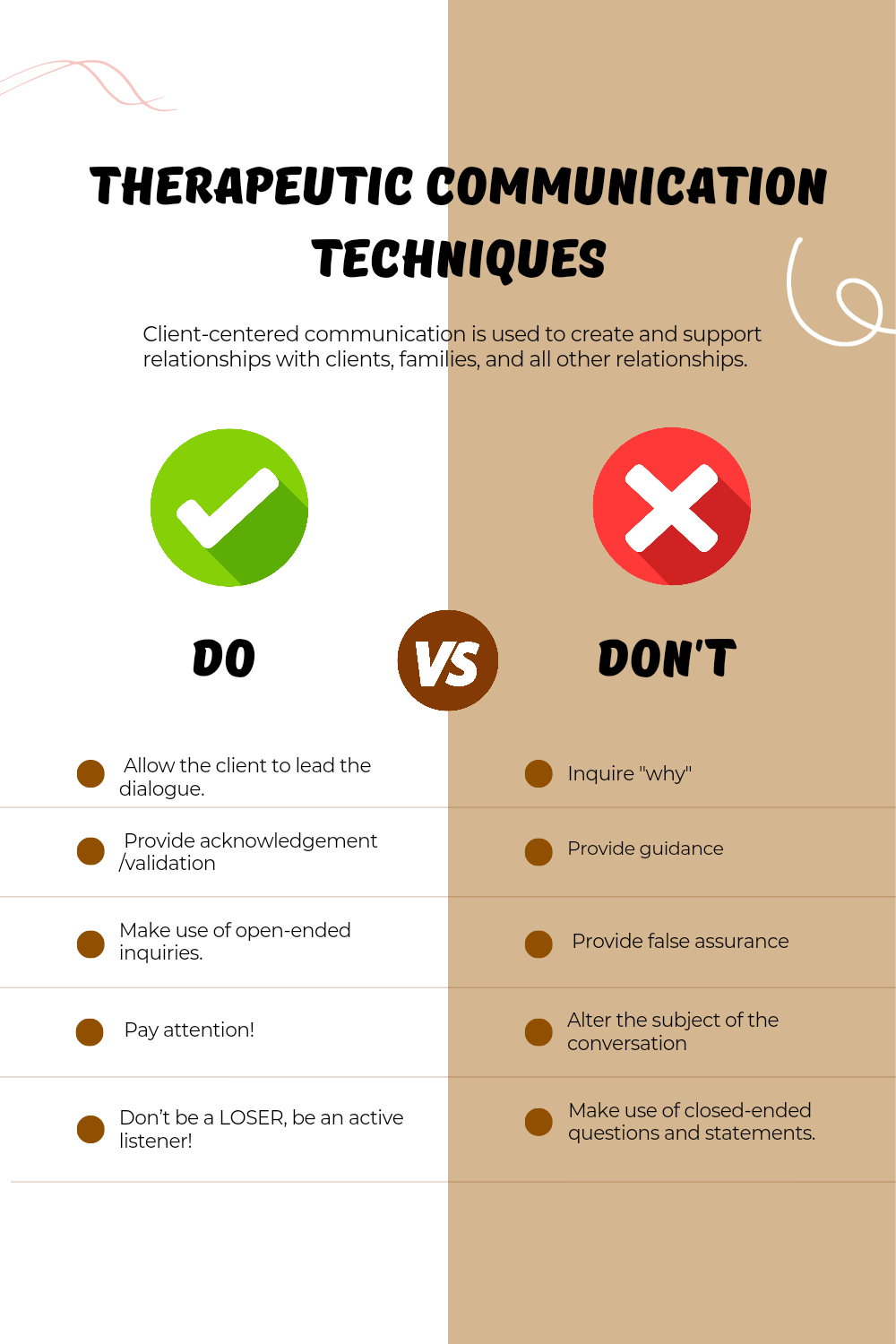

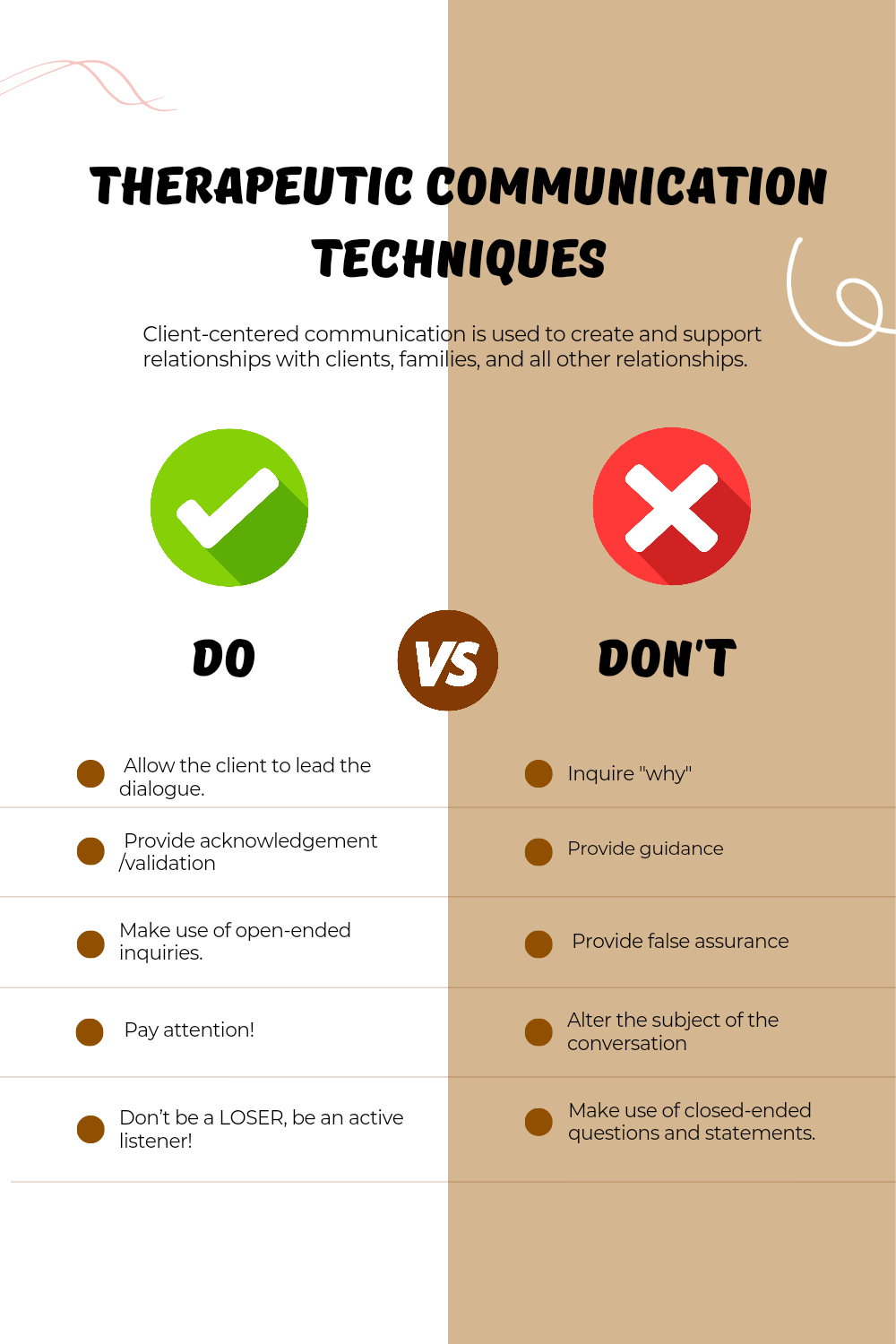

Don't: Neglect Soft Skills

While technical skills are crucial, soft skills are equally important in the collaborative world of private credit.

Emphasize teamwork and communication:

Private credit often involves collaboration with various stakeholders, including portfolio companies, investors, and internal teams. Highlighting strong teamwork and communication skills is crucial.

- Provide examples of successful teamwork experiences: Use the STAR method (Situation, Task, Action, Result) to illustrate your collaborative skills.

- Showcase your ability to communicate complex financial information clearly and concisely: Demonstrate your ability to explain intricate financial concepts to a non-technical audience.

- Highlight your experience in presenting to senior management or clients: This showcases confidence and the ability to communicate effectively in high-pressure situations.

Underestimate the importance of networking:

Networking isn't just about finding a job; it's about building lasting relationships within the industry.

- Attend industry events and conferences: This is a great way to meet professionals and learn about new opportunities.

- Leverage LinkedIn to connect with professionals: Engage with their posts, join relevant groups, and send personalized connection requests.

- Participate in online forums and discussions: Sharing your expertise and engaging in conversations helps you build your reputation and network.

Don't: Overlook the Importance of Due Diligence

Due diligence applies to your job search as much as it does to investment decisions.

Thoroughly research the firm:

Before applying, research the firm's reputation, investment strategy, and cultural fit to ensure it aligns with your career goals.

- Check online reviews and ratings: See what current and former employees have to say about their experiences.

- Read news articles and press releases about the firm: Stay up-to-date on their recent activities and performance.

- Network with individuals who work or have worked at the firm: Gain firsthand insights into the company culture and work environment.

Neglect salary research:

Knowing the typical salary range for similar roles in your location will help you negotiate effectively.

- Use online salary calculators and resources: These tools provide a general idea of salary expectations.

- Network with professionals to gain insights into salary expectations: Informational interviews are a valuable resource for understanding salary ranges.

- Prepare to justify your desired salary based on your experience and qualifications: Having a clear understanding of your worth will give you confidence during salary negotiations.

Don't: Settle for the First Offer

The private credit market is competitive, but don't rush into accepting the first offer.

Evaluate multiple offers:

If you receive multiple job offers, carefully compare the compensation, benefits, career growth potential, and company culture before making a decision.

- Don't rush into accepting the first offer you receive: Take your time to weigh the pros and cons of each opportunity.

- Consider the long-term career prospects and growth opportunities: Choose a company that will help you achieve your long-term career goals.

- Evaluate the overall compensation package, including salary, benefits, and bonuses: Don't just focus on the base salary; consider the entire compensation package.

Conclusion

The private credit boom presents a wealth of opportunities for ambitious job seekers. By following these do's and don'ts, you can significantly improve your chances of securing a rewarding career in this dynamic sector. Remember to highlight your relevant skills, research firms thoroughly, and cultivate your network. Don't hesitate to reach out to professionals in the field and leverage your skills and experience to navigate the competitive landscape of private credit jobs. Start your search today and seize the opportunities this booming market offers!

Featured Posts

-

Hotel Fire Tweet Leads To Jail For Tory Councillors Wife Appeal In Progress

May 22, 2025

Hotel Fire Tweet Leads To Jail For Tory Councillors Wife Appeal In Progress

May 22, 2025 -

Impact Of Stormy Weather On Southern French Alps Late Snowfall Details

May 22, 2025

Impact Of Stormy Weather On Southern French Alps Late Snowfall Details

May 22, 2025 -

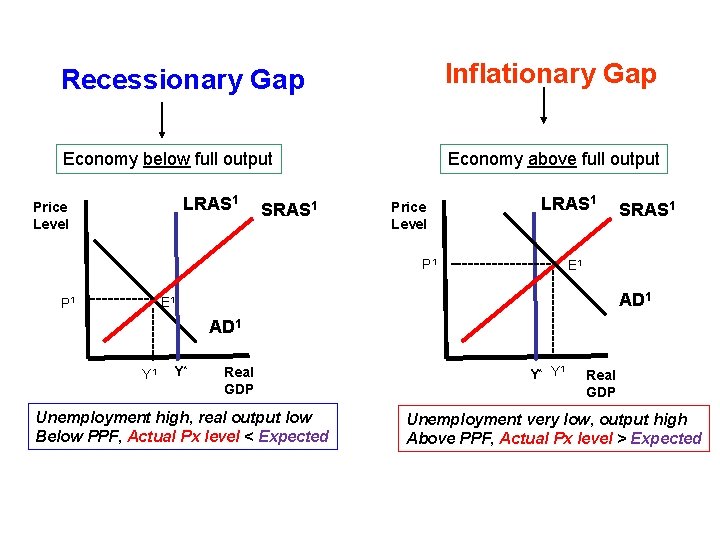

Grocery Bills Climb Inflationary Gap Widens For Third Month Running

May 22, 2025

Grocery Bills Climb Inflationary Gap Widens For Third Month Running

May 22, 2025 -

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Is Coming

May 22, 2025

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Is Coming

May 22, 2025 -

From Reddit Post To Hollywood Sydney Sweeneys Potential Starring Role In Warner Bros Film

May 22, 2025

From Reddit Post To Hollywood Sydney Sweeneys Potential Starring Role In Warner Bros Film

May 22, 2025

Latest Posts

-

Casper Boat Owner Finds Massive Zebra Mussel Colony

May 22, 2025

Casper Boat Owner Finds Massive Zebra Mussel Colony

May 22, 2025 -

A Turning Point For Otter Management In Wyoming Conservation Efforts And Future Prospects

May 22, 2025

A Turning Point For Otter Management In Wyoming Conservation Efforts And Future Prospects

May 22, 2025 -

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025 -

Casper Residents Unexpected Boat Lift Discovery Thousands Of Zebra Mussels

May 22, 2025

Casper Residents Unexpected Boat Lift Discovery Thousands Of Zebra Mussels

May 22, 2025 -

Protecting Wyomings Otters A Critical Shift In Conservation Efforts

May 22, 2025

Protecting Wyomings Otters A Critical Shift In Conservation Efforts

May 22, 2025