Navigating The VusionGroup AMF CP Document: 2025E1029754 Explained

Table of Contents

Deciphering Key Sections of the VusionGroup AMF CP Document 2025E1029754

The VusionGroup AMF CP Document 2025E1029754, like most AMF CP documents, is a rich source of information regarding the financial health and performance of VusionGroup. Let's break down the key sections:

Understanding the Executive Summary

The executive summary provides a high-level overview of the document's content. This is your first stop for a quick grasp of the key findings. Look for these critical elements:

- Financial Highlights: Key performance indicators (KPIs) such as revenue growth, profitability, and return on equity.

- Key Risks: A summary of potential risks that could impact the company's financial performance, including market risks and operational risks.

- Investment Objectives: A statement outlining the investment goals of VusionGroup and how they intend to achieve them.

Jargon such as "EBITDA" (Earnings Before Interest, Taxes, Depreciation, and Amortization) or "net asset value" may be used. Understanding such terminology is critical to fully grasping the executive summary.

Analyzing Financial Statements within the VusionGroup AMF CP Document 2025E1029754

The heart of the document lies in its financial statements: the balance sheet, income statement, and cash flow statement. These statements offer a detailed breakdown of VusionGroup's financial position. Analyze these using key ratios:

- Balance Sheet: Focus on liquidity ratios (e.g., current ratio, quick ratio) to assess the company's ability to meet its short-term obligations.

- Income Statement: Examine profitability ratios (e.g., gross profit margin, net profit margin) to understand VusionGroup's efficiency and earnings power.

- Cash Flow Statement: Analyze cash flow from operations, investing, and financing activities to assess the company's cash management and investment strategies.

Red Flags: Look for inconsistencies between the statements, unusual fluctuations in key metrics, or significant increases in debt levels. These might signal potential problems.

Interpreting Risk Factors in the VusionGroup AMF CP Document 2025E1029754

The risk factors section is crucial for assessing potential downsides. Carefully examine the identified risks, understanding their potential impact on VusionGroup's financial performance. Look out for:

- Market Risk: The risk of losses due to changes in market conditions, such as interest rate changes or economic downturns.

- Credit Risk: The risk of losses from borrowers failing to repay their debts.

- Liquidity Risk: The risk of not being able to meet immediate financial obligations.

Assessing the significance requires considering the probability of each risk occurring and its potential impact on the company's financial health.

Using the VusionGroup AMF CP Document 2025E1029754 for Informed Decision-Making

The information contained within the VusionGroup AMF CP Document 2025E1029754 is invaluable for making informed investment decisions.

Comparing the VusionGroup AMF CP Document 2025E1029754 to other investment options

This document provides a benchmark for comparing VusionGroup to other investment opportunities. Key metrics for comparison include:

- Return on Investment (ROI): Compare the potential return on investment in VusionGroup with other investment options.

- Risk Profile: Assess the risk associated with investing in VusionGroup compared to other investments. A higher potential return often comes with a higher risk.

Selecting the best option requires carefully weighing the potential returns against the risks involved.

Practical Applications of the Information in the VusionGroup AMF CP Document 2025E1029754

For example, the document might reveal a decline in profitability. This could lead an investor to re-evaluate their investment strategy or seek clarification from VusionGroup. Alternatively, a strong cash flow from operations might indicate a robust and stable company, increasing investment confidence.

Conclusion: Mastering the VusionGroup AMF CP Document 2025E1029754

Understanding the VusionGroup AMF CP Document 2025E1029754 is essential for making informed investment decisions. By carefully analyzing the key sections and utilizing the information provided, investors can better assess the financial health, risks, and potential returns associated with VusionGroup. Remember to utilize the strategies and insights outlined above to confidently navigate not just this specific document, but any similar AMF CP reports. Ready to confidently navigate complex financial documents? Master the VusionGroup AMF CP document 2025E1029754 and similar reports by applying the strategies outlined above.

Featured Posts

-

Ftc Challenges Microsofts Activision Blizzard Buyout Legal Battle Ahead

Apr 30, 2025

Ftc Challenges Microsofts Activision Blizzard Buyout Legal Battle Ahead

Apr 30, 2025 -

Blue Ivy Carters Stunning Grammys Appearance Supporting Beyonce In A Strapless Gown

Apr 30, 2025

Blue Ivy Carters Stunning Grammys Appearance Supporting Beyonce In A Strapless Gown

Apr 30, 2025 -

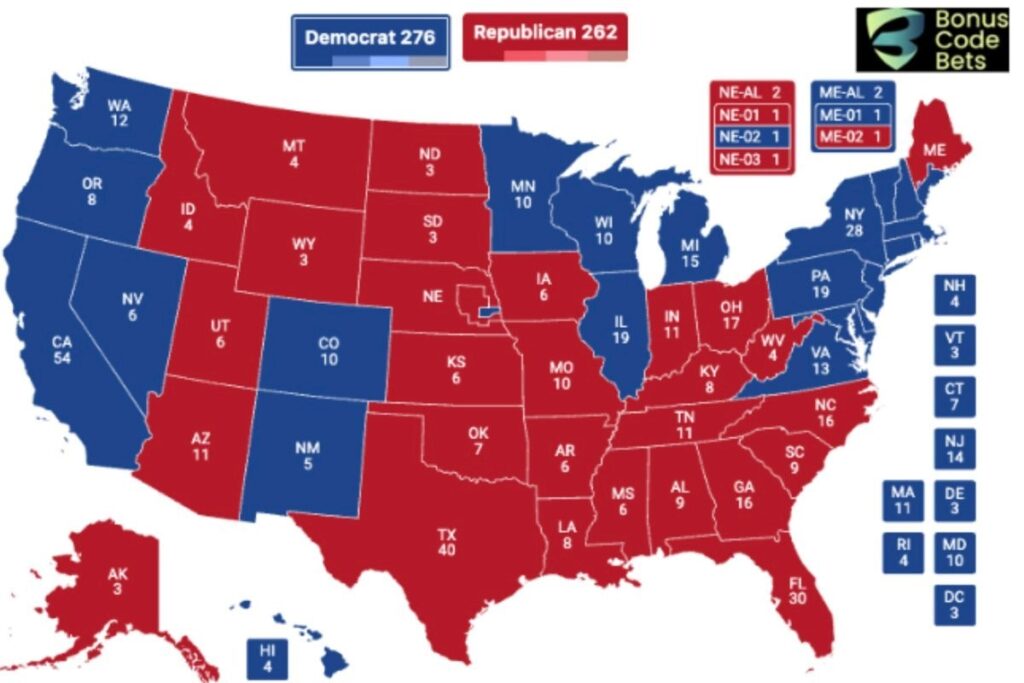

Knda Walwlayat Almthdt Thlyl Ltsryhat Tramb Hwl Aldem Alamryky

Apr 30, 2025

Knda Walwlayat Almthdt Thlyl Ltsryhat Tramb Hwl Aldem Alamryky

Apr 30, 2025 -

Rak Na Grdata Preventsiya I Sport Sbitie Na 8 Mart

Apr 30, 2025

Rak Na Grdata Preventsiya I Sport Sbitie Na 8 Mart

Apr 30, 2025 -

Channing Tatum Dating Australian Model Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025

Channing Tatum Dating Australian Model Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025

Latest Posts

-

Canadas Federal Election Mark Carneys Liberals Triumph Over Trumps Influence

Apr 30, 2025

Canadas Federal Election Mark Carneys Liberals Triumph Over Trumps Influence

Apr 30, 2025 -

Car Crash At Afterschool Program Video Shows Aftermath Of Deadly Incident

Apr 30, 2025

Car Crash At Afterschool Program Video Shows Aftermath Of Deadly Incident

Apr 30, 2025 -

Carneys Liberals Win Canadas Election Results And Trumps Response

Apr 30, 2025

Carneys Liberals Win Canadas Election Results And Trumps Response

Apr 30, 2025 -

At Least Four Children Dead After Car Crashes Into Afterschool Program

Apr 30, 2025

At Least Four Children Dead After Car Crashes Into Afterschool Program

Apr 30, 2025 -

A Pregnancy Craving A Chocolate Bar And A Global Inflationary Problem

Apr 30, 2025

A Pregnancy Craving A Chocolate Bar And A Global Inflationary Problem

Apr 30, 2025