NCLH: Earnings Beat And Raised Guidance Drive Stock Higher

Table of Contents

NCLH Earnings Beat Expectations: A Deep Dive into the Financials

Revenue Surpasses Analyst Estimates

NCLH's revenue significantly exceeded analyst estimates for the [Specify Quarter/Year], demonstrating robust growth in the cruise industry. The company reported revenue of [Insert Specific Revenue Figure], surpassing the consensus analyst forecast of [Insert Analyst Forecast Figure] by [Insert Percentage Difference]. This represents a [Insert Percentage] increase compared to the same period last year.

- Strong Bookings: A key driver of this revenue surge was the unexpectedly high number of bookings across various cruise itineraries.

- Increased Onboard Spending: Passengers demonstrated increased spending on onboard amenities and activities, contributing significantly to the revenue growth.

- Effective Pricing Strategies: NCLH's strategic pricing adjustments, successfully balancing occupancy rates with revenue maximization, also contributed to the positive results.

Profitability Improves

The improved revenue translated into enhanced profitability for NCLH. The company reported a net income of [Insert Net Income Figure], exceeding expectations and marking a significant improvement compared to [Insert Previous Period's Net Income]. Earnings per share (EPS) reached [Insert EPS Figure], significantly higher than the anticipated [Insert Analyst EPS Forecast]. Operating margins also saw a considerable improvement, reaching [Insert Operating Margin Percentage].

- Cost-Cutting Measures: Effective cost-cutting initiatives across various operational areas played a crucial role in boosting profitability.

- Operational Efficiency: Streamlined operations and enhanced efficiency across the NCLH fleet contributed to the positive bottom line.

Key Financial Metrics Analysis

Analyzing key financial metrics paints a positive picture for NCLH. Occupancy rates exceeded expectations, reaching [Insert Occupancy Rate Percentage], reflecting strong demand for cruises. The average daily rate (ADR) also increased to [Insert ADR Figure], demonstrating the company's pricing power and ability to command higher fares. These metrics collectively indicate strong operational performance and a healthy financial outlook for NCLH.

Raised Guidance Signals Strong Future for NCLH

Upward Revision of Full-Year Outlook

NCLH significantly raised its full-year guidance, further bolstering investor confidence. The company now projects [Insert New Full-Year Revenue Projection] in revenue, a substantial increase from its previous projection of [Insert Previous Full-Year Revenue Projection]. Similarly, the EPS projection has been upgraded to [Insert New EPS Projection] from the previous estimate of [Insert Previous EPS Projection].

- Strong Booking Trends: Continued strong booking trends, extending beyond the reported quarter, fueled the upward revision in guidance.

- Anticipated Demand: The company anticipates sustained high demand for cruises throughout the remainder of the year.

- Pricing Power: NCLH expects to maintain its pricing power, allowing it to offset any potential cost increases and maintain profitability.

Implications for Investors

The raised guidance signifies a positive outlook for NCLH stock. This increase in projected earnings reinforces investor confidence and suggests potential for further stock price appreciation. Several analysts have raised their price targets for NCLH stock, reflecting this positive sentiment. However, it's crucial to acknowledge potential risks and uncertainties.

- Global Economic Conditions: Uncertainties in the global economy could impact consumer spending and demand for cruises.

- Fuel Prices: Fluctuations in fuel prices can significantly impact operating costs for cruise lines.

- Geopolitical Events: Geopolitical instability or unforeseen events could affect travel demand.

Market Reaction and Investor Sentiment

Immediate Stock Price Surge

Following the release of the earnings report and revised guidance, NCLH stock experienced a sharp increase, rising by [Insert Percentage Increase] in a single trading session. Trading volume also surged, indicating strong investor interest and excitement surrounding the positive news.

Analyst Ratings and Recommendations

Several prominent financial analysts have responded positively to NCLH's performance, upgrading their ratings and raising their price targets.

- [Analyst Name]: Upgraded rating to [Rating] with a price target of [Price Target].

- [Analyst Name]: Maintained a [Rating] rating, raising the price target to [Price Target].

- [Analyst Name]: Issued a positive commentary, highlighting the company's strong performance and future outlook.

Conclusion: NCLH Stock: A Promising Outlook Based on Strong Earnings and Guidance

NCLH's exceeding earnings, coupled with a significantly raised full-year guidance, has sent a powerful message to the market. The strong market reaction underscores investor confidence in the company's future prospects. While risks and uncertainties exist, the positive financial results and upward trajectory suggest a promising outlook for NCLH stock. Stay informed on the latest developments in NCLH stock and the cruise industry. Consider adding NCLH to your watchlist or conducting further research before making any investment decisions. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Dasmoi Trump I Ekklisi Toy Galloy Ypoyrgoy Gia Ethniko Oikonomiko Metopo

Apr 30, 2025

Dasmoi Trump I Ekklisi Toy Galloy Ypoyrgoy Gia Ethniko Oikonomiko Metopo

Apr 30, 2025 -

Premature Le Dimissioni Di Becciu Le Preghiere Dei Fedeli E La Situazione Attuale

Apr 30, 2025

Premature Le Dimissioni Di Becciu Le Preghiere Dei Fedeli E La Situazione Attuale

Apr 30, 2025 -

Document Amf Kering Informations Cles Du Rapport 2025 E1021784 24 02 2025

Apr 30, 2025

Document Amf Kering Informations Cles Du Rapport 2025 E1021784 24 02 2025

Apr 30, 2025 -

Yate To Bristol And Gloucester Train Service Changes

Apr 30, 2025

Yate To Bristol And Gloucester Train Service Changes

Apr 30, 2025 -

Disneys Restructuring 200 Layoffs Hit Tv And Abc News

Apr 30, 2025

Disneys Restructuring 200 Layoffs Hit Tv And Abc News

Apr 30, 2025

Latest Posts

-

Il Venerdi Santo Secondo Feltri Un Analisi

Apr 30, 2025

Il Venerdi Santo Secondo Feltri Un Analisi

Apr 30, 2025 -

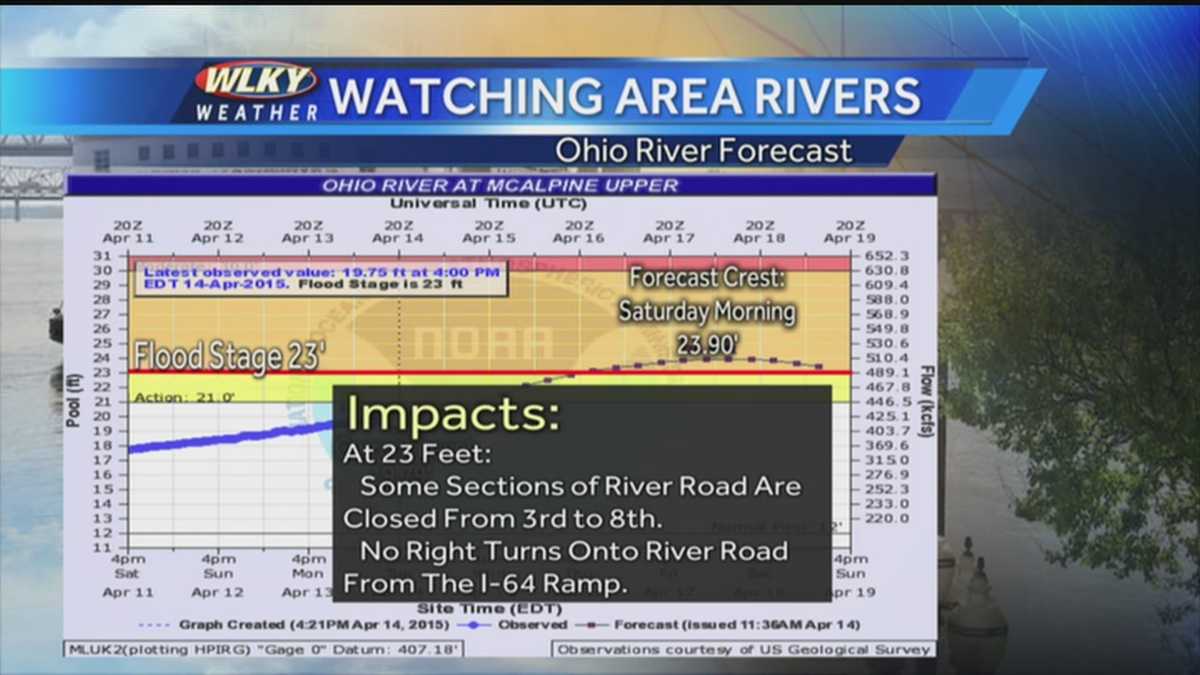

Severe Weather Emergency Louisville Battered By Tornado Major Flooding Imminent

Apr 30, 2025

Severe Weather Emergency Louisville Battered By Tornado Major Flooding Imminent

Apr 30, 2025 -

Ohio River Flooding Leads To Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Leads To Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025 -

Feltri Il Venerdi Santo E La Crocifissione Di Cristo

Apr 30, 2025

Feltri Il Venerdi Santo E La Crocifissione Di Cristo

Apr 30, 2025 -

Louisville Declares State Of Emergency Tornado Damage And Major Flooding Expected

Apr 30, 2025

Louisville Declares State Of Emergency Tornado Damage And Major Flooding Expected

Apr 30, 2025