Nigel Farage And NatWest Settle De-banking Dispute

Table of Contents

The Core of the Dispute

The Nigel Farage NatWest de-banking dispute began when NatWest closed Mr. Farage's personal and business accounts. This action ignited a firestorm of controversy, with Mr. Farage alleging that the closure was politically motivated, a claim NatWest vehemently denied. The timing of the closure, coinciding with Mr. Farage's outspoken political views, fueled accusations of political bias within the UK banking sector.

- NatWest's stated reasons for closing the accounts: NatWest initially cited concerns related to Mr. Farage's business activities and compliance with anti-money laundering regulations. The exact details remained unclear initially, fueling speculation.

- Farage's counter-arguments and allegations: Mr. Farage countered that the stated reasons were insufficient and that the closure was a direct result of his political views and associations. He claimed this amounted to censorship and a violation of his rights.

- Public reaction and media coverage of the event: The event attracted significant media attention and sparked a wider public debate about the potential for political bias in banking practices. Many questioned the independence and impartiality of UK financial institutions.

- Involvement of regulatory bodies: While there wasn't immediate direct regulatory intervention, the case brought scrutiny to the Financial Conduct Authority (FCA) and its oversight of bank de-banking practices. The event highlighted potential gaps in regulation.

Details of the Settlement

The terms of the settlement between Nigel Farage and NatWest remain partially confidential. However, it's understood that NatWest made a significant financial settlement to Mr. Farage. While a public apology wasn't explicitly issued, NatWest acknowledged the distress caused to Mr. Farage.

- Key aspects of the agreement: The specific financial amount remains confidential, but reports suggest a substantial sum was paid. The settlement also covered legal costs.

- Confidentiality clauses: Significant portions of the settlement are subject to confidentiality clauses, limiting public disclosure of details.

- Admission of guilt or wrongdoing: Neither party publicly admitted guilt or wrongdoing, leaving room for continued debate regarding the underlying reasons for account closure.

- Statements released by both parties: Following the settlement, both parties issued carefully worded statements, each emphasizing their perspective on the outcome. Mr. Farage focused on vindication, while NatWest highlighted their commitment to regulatory compliance.

Implications and Wider Context

The Nigel Farage NatWest de-banking dispute carries significant implications for the UK banking sector and the broader issue of freedom of speech.

- Impact on public trust in banks: The case has undoubtedly eroded public trust in the impartiality of some banking institutions. Many now question whether banks are acting solely on financial grounds or if political considerations influence their decisions.

- The debate surrounding de-banking and political neutrality: The case intensified the debate around the responsibilities of banks regarding de-banking customers based on their political views or affiliations.

- Potential legislative changes or regulatory reviews: The controversy may trigger parliamentary inquiries or regulatory reviews into de-banking practices, potentially leading to changes in legislation to ensure fairness and transparency.

- Similar cases of de-banking and their outcomes: The Farage case is not unique. Other instances of de-banking have raised similar concerns. This settlement might influence future approaches to similar disputes.

- Discussion of potential future legal challenges related to de-banking practices: The precedent set by this case may encourage more individuals to challenge bank decisions through legal channels, potentially leading to further legal challenges and refinements to de-banking processes.

The Future of De-banking in the UK

The Nigel Farage NatWest de-banking settlement could significantly impact future banking regulations. It may lead to increased scrutiny of de-banking processes, stricter guidelines, and greater transparency to prevent similar disputes. The long-term effects remain to be seen, but it is likely that the UK banking sector will face increased pressure to demonstrate political neutrality and transparency in its decision-making.

Conclusion

The Nigel Farage NatWest de-banking dispute highlights the complex interplay between financial regulation, freedom of expression, and political neutrality within the UK banking system. The settlement, while partially confidential, signals the significant impact of this case and its potential to reshape banking practices. The financial repercussions for NatWest and the broader public discussion surrounding the implications of de-banking practices underscore the importance of continued vigilance and debate. The Nigel Farage NatWest de-banking dispute highlights important issues surrounding financial freedom and political neutrality in the UK banking system. Stay informed on the evolving landscape of de-banking regulations and continue to follow the implications of this landmark case. Further research into the impact of this Nigel Farage NatWest de-banking settlement is crucial for understanding the future of financial regulation.

Featured Posts

-

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 03, 2025

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 03, 2025 -

Lotto Results Wednesday April 9th Winning Numbers Announced

May 03, 2025

Lotto Results Wednesday April 9th Winning Numbers Announced

May 03, 2025 -

April 12th Lotto Jackpot Results Check Your Numbers

May 03, 2025

April 12th Lotto Jackpot Results Check Your Numbers

May 03, 2025 -

La Nouvelle Loi Sur Les Partis En Algerie Impact Sur Le Pt Le Ffs Le Rcd Et Jil Jadid

May 03, 2025

La Nouvelle Loi Sur Les Partis En Algerie Impact Sur Le Pt Le Ffs Le Rcd Et Jil Jadid

May 03, 2025 -

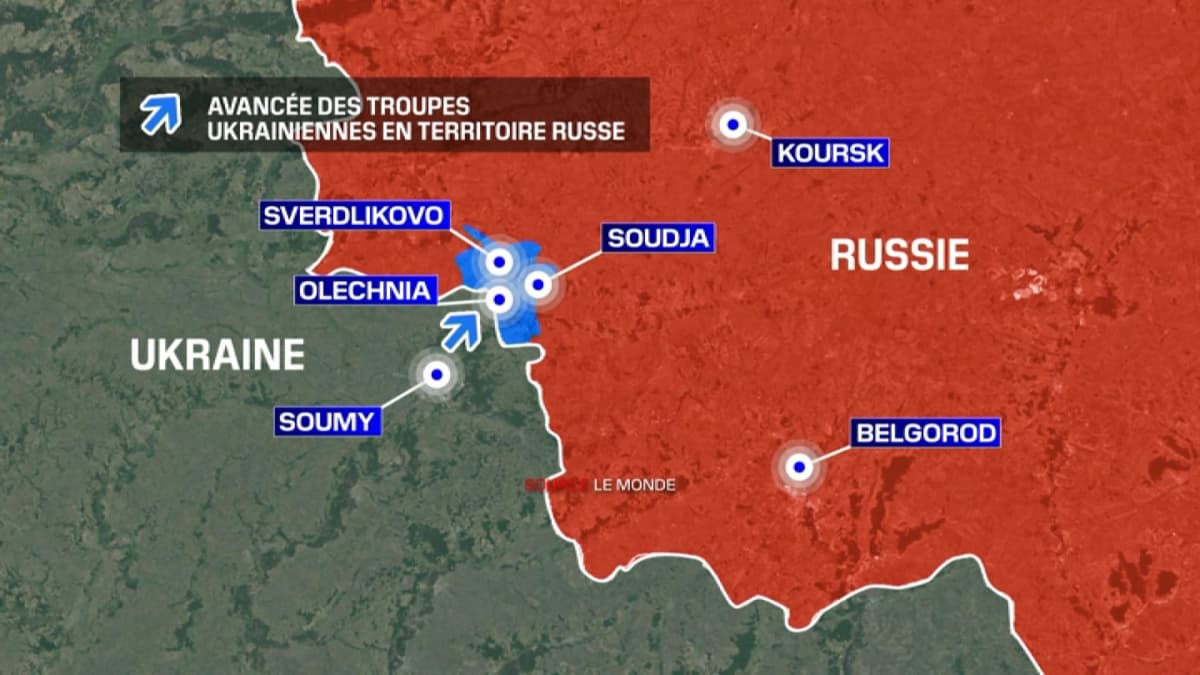

Macron Intensifie La Pression Sur La Russie Les Decisions A Venir

May 03, 2025

Macron Intensifie La Pression Sur La Russie Les Decisions A Venir

May 03, 2025