Nippon-U.S. Steel Deal: Trump's Decision And Market Reaction

Table of Contents

Trump's Intervention and the Rationale Behind It

The Trump administration's intervention in the proposed Nippon Steel and U.S. Steel merger was driven by a complex interplay of national security concerns, economic considerations, and political pressures.

National Security Concerns

The administration argued that allowing a foreign entity, particularly one from a country like Japan with a strong industrial base, to acquire significant U.S. steel assets posed a threat to national security.

- Potential vulnerability of critical infrastructure: The administration expressed concerns about the potential for foreign control over steel used in critical infrastructure projects, such as bridges, pipelines, and defense facilities.

- Impact on defense production: The acquisition could have jeopardized the timely and reliable supply of steel needed for national defense production, potentially undermining the U.S. military's capabilities.

- Relevant executive orders and legislation, such as those focused on protecting critical infrastructure and domestic manufacturing, likely informed the administration's decision-making process. While specific executive orders directly impacting this deal may not have existed, the overall policy environment shaped the response.

Economic Considerations

Beyond national security, the administration cited economic arguments to justify its intervention.

- Job losses: Concerns were raised about potential job losses in the U.S. steel industry if the merger resulted in plant closures or reduced production. Specific statistics on U.S. steel employment and the potential impact were likely considered.

- Impact on domestic steel production: The administration may have worried about a decrease in domestic steel production, potentially increasing reliance on foreign suppliers and harming the U.S. economy's competitiveness. Economic reports and analyses on the domestic steel industry's health likely informed this assessment. Data from organizations like the American Iron and Steel Institute might have been reviewed.

Political Pressures and Lobbying

The decision was undoubtedly influenced by significant political pressure from within the U.S. steel industry and its lobbying efforts.

- Key players and their influence: Steel industry representatives and lobbyists actively voiced their concerns about the merger, emphasizing its potential negative impacts on American workers and the domestic steel sector. Their influence on lawmakers and the administration is undeniable.

- Potential impact of public opinion: Public sentiment regarding job security and the importance of the domestic steel industry likely played a role in shaping the administration's response to the proposed merger.

Market Reaction to Trump's Decision

Trump's intervention had immediate and long-term consequences for the steel industry and broader markets.

Immediate Stock Market Response

The announcement immediately impacted the stock prices of both Nippon Steel and U.S. Steel. (Note: Insert charts and graphs here illustrating the stock market fluctuations following the announcement. Data sources should be cited.) Investor reactions were largely negative, with significant sell-offs observed in the short term. Analyst comments reflected concerns about the increased uncertainty in the steel industry following the intervention.

Long-Term Implications for the Steel Industry

The long-term consequences of the decision are still unfolding.

- Potential impact on competition: The blocking of the merger likely altered the competitive landscape of the global steel industry, potentially affecting pricing, market share, and innovation.

- Impact on investment: Uncertainty surrounding future mergers and acquisitions could deter investment in the steel industry, potentially hindering growth and modernization.

- Future of mergers and acquisitions: The administration's intervention set a precedent, raising questions about the future of mergers and acquisitions in the steel industry and the increased scrutiny that foreign acquisitions might face.

Impact on International Trade Relations

Trump's decision strained U.S.-Japan relations and had broader implications for international trade.

- Retaliatory measures or trade disputes: Although no direct retaliatory measures from Japan were reported concerning this specific deal, it further contributed to the tense trade environment between the two nations during that period.

- Implications for global trade policy: The intervention reinforced the protectionist stance of the Trump administration and contributed to global uncertainties concerning trade policy, influencing negotiations and impacting business confidence.

Conclusion: Understanding the Nippon-U.S. Steel Deal's Legacy

President Trump's intervention in the Nippon Steel and U.S. Steel merger was a significant event driven by a combination of national security concerns, economic considerations, and political pressures. The decision resulted in immediate stock market reactions and long-term implications for the global steel industry and international trade relations. The deal serves as a case study on the complex interplay of economic, political, and national security factors influencing major mergers and acquisitions. Stay updated on the evolving landscape of the steel industry and the lasting effects of this landmark Nippon-U.S. steel deal. Understanding the intricacies of this acquisition is crucial for navigating the complexities of global trade and the future of the steel market.

Featured Posts

-

Did Michael Schumachers Dominance Create Unfair Advantages

May 26, 2025

Did Michael Schumachers Dominance Create Unfair Advantages

May 26, 2025 -

Elegantnist Naomi Kempbell Bila Tunika Na Svitskomu Zakhodi U Londoni

May 26, 2025

Elegantnist Naomi Kempbell Bila Tunika Na Svitskomu Zakhodi U Londoni

May 26, 2025 -

Globi Za Mertsedes Vozachi Pred Bakhreinskata Trka

May 26, 2025

Globi Za Mertsedes Vozachi Pred Bakhreinskata Trka

May 26, 2025 -

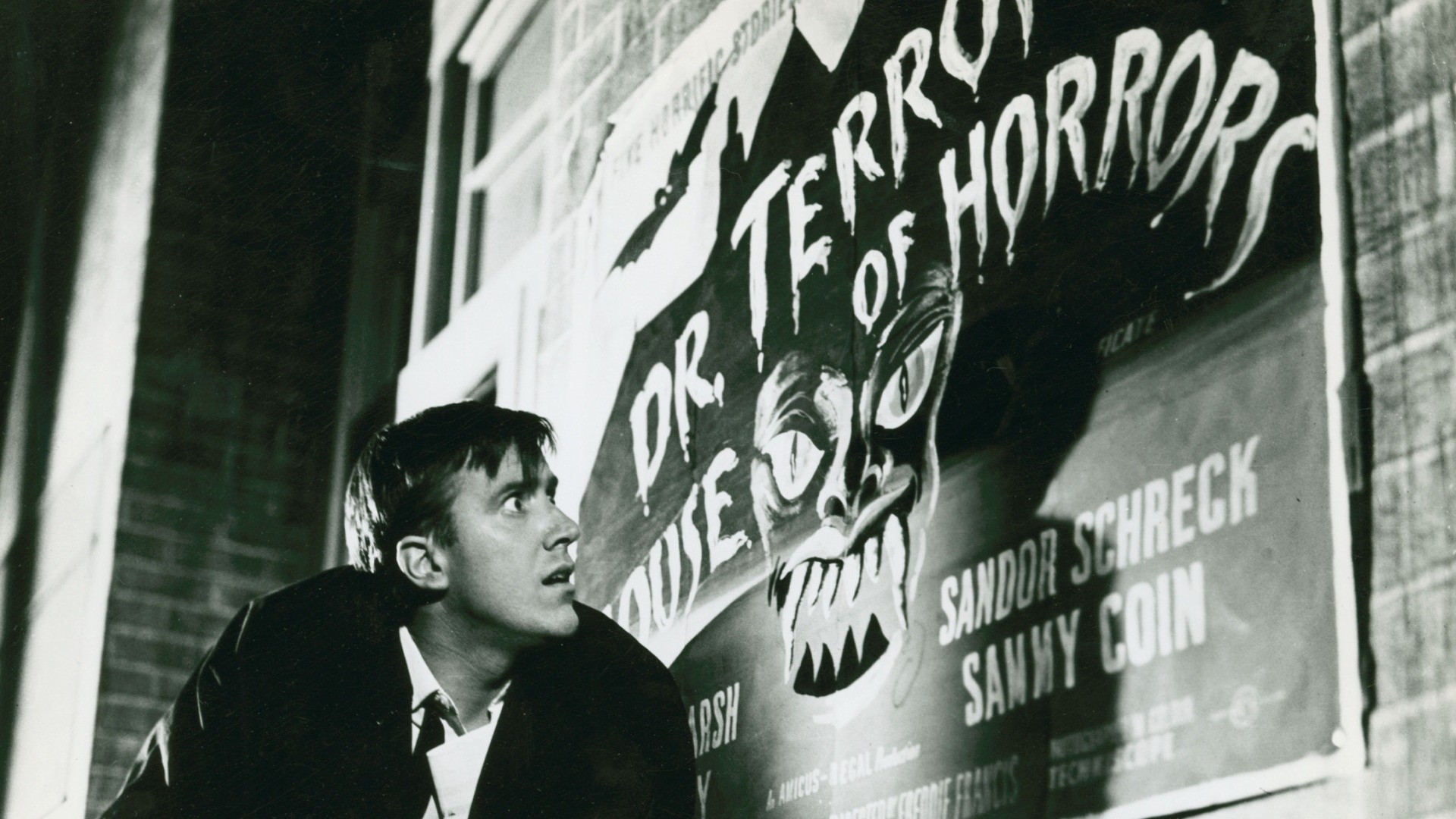

Dr Terrors House Of Horrors Is It Right For You A Detailed Look

May 26, 2025

Dr Terrors House Of Horrors Is It Right For You A Detailed Look

May 26, 2025 -

Mathieu Van Der Poels Custom Canyon Aeroad At Tirreno Adriatico

May 26, 2025

Mathieu Van Der Poels Custom Canyon Aeroad At Tirreno Adriatico

May 26, 2025

Latest Posts

-

Man City Transfer News Update On Kevin De Bruynes Contract Situation

May 28, 2025

Man City Transfer News Update On Kevin De Bruynes Contract Situation

May 28, 2025 -

Man City Transfer Battle Viana Challenges Napoli For Serie A Star

May 28, 2025

Man City Transfer Battle Viana Challenges Napoli For Serie A Star

May 28, 2025 -

Kevin De Bruyne Contract Talks Man City Chief Confirms Key Issue

May 28, 2025

Kevin De Bruyne Contract Talks Man City Chief Confirms Key Issue

May 28, 2025 -

Leeds United News Progress On Phillips Transfer And Second Summer Recruit

May 28, 2025

Leeds United News Progress On Phillips Transfer And Second Summer Recruit

May 28, 2025 -

Man City Transfers Kevin De Bruynes Future Uncertain Amidst Contract Talks

May 28, 2025

Man City Transfers Kevin De Bruynes Future Uncertain Amidst Contract Talks

May 28, 2025