Nvidia And The Geopolitical Landscape: Assessing Risks Beyond China

Table of Contents

H2: The US-China Tech War and its Ripple Effect on Nvidia

The US-China tech war has profoundly impacted Nvidia, significantly affecting its sales and strategic direction. Export controls imposed by the US government on the sale of high-end GPUs to China have forced Nvidia to adapt its business model and explore alternative markets.

H3: Export Controls and Supply Chain Disruptions

- Impact on Revenue: The restrictions on sales to China have undeniably impacted Nvidia's revenue, forcing them to recalibrate their financial projections and explore new revenue streams.

- Alternative Markets Explored: Nvidia has actively pursued diversification strategies, focusing on markets less affected by US-China tensions, including Europe, India, and other regions in Asia. This includes strengthening partnerships with data centers and cloud service providers in these regions.

- Implications for R&D: The need to adapt to changing geopolitical realities has also influenced Nvidia's R&D investments. The company is likely investing more in technologies that circumvent export restrictions or cater to the specific needs of different markets.

Keywords: US-China trade war, semiconductor export controls, supply chain resilience, diversification strategy, revenue diversification, alternative markets, geopolitical risk mitigation.

H3: Geopolitical Uncertainty and Investment Decisions

The ongoing geopolitical uncertainty significantly influences investor sentiment towards Nvidia. Fluctuations in the global political climate directly impact stock market volatility and investor confidence in long-term growth projections.

- Stock Market Volatility: News related to US-China relations or other significant geopolitical events can cause short-term fluctuations in Nvidia's stock price.

- Investment Strategies: Investors are increasingly incorporating geopolitical risk into their investment strategies, carefully analyzing the potential impacts on Nvidia's future performance.

- Impact on Long-Term Planning: Nvidia's long-term strategic planning must now incorporate a higher degree of flexibility and adaptability to account for unforeseen geopolitical shifts.

Keywords: Geopolitical risk, investor sentiment, market volatility, long-term investment, risk assessment, strategic planning, financial forecasting.

H2: Regional Conflicts and their Impact on Nvidia's Operations

The impact of geopolitical instability extends beyond the US-China relationship. Regional conflicts and evolving regulatory landscapes in various parts of the world pose significant challenges and opportunities for Nvidia.

H3: European Union's Regulatory Landscape

The EU's Chips Act and other regulations significantly impact Nvidia's European operations. Compliance with these regulations adds to operational costs and may influence market access.

- Compliance Costs: Meeting the EU's stringent data privacy regulations (GDPR) and other compliance requirements entails substantial costs for Nvidia.

- Potential Market Access Limitations: Failure to comply with EU regulations could limit Nvidia's access to the European market, hindering growth opportunities.

- Opportunities Presented by EU Initiatives: The EU's focus on boosting domestic semiconductor production through initiatives like the Chips Act could, however, create new opportunities for Nvidia to partner with European companies and expand its presence in the region.

Keywords: EU Chips Act, regulatory compliance, European semiconductor market, data privacy regulations, GDPR, market access, European Union, regulatory landscape.

H3: Emerging Market Challenges and Opportunities

Expanding into emerging markets presents both significant opportunities and substantial risks for Nvidia. Infrastructure limitations, political instability, and regulatory hurdles pose challenges to market penetration.

- Market Entry Strategies: Careful market research and tailored market entry strategies are crucial to overcome these challenges.

- Political Risks: Political instability and uncertainty in emerging markets can disrupt operations and negatively impact investment returns.

- Infrastructure Limitations: Inadequate infrastructure in some emerging markets can hamper the deployment and adoption of Nvidia's technologies.

- Growth Potential: Despite the challenges, emerging markets represent a significant growth potential for Nvidia, offering access to a vast and expanding customer base.

Keywords: Emerging markets, market penetration, geopolitical instability, infrastructure development, market entry strategy, political risk analysis, growth opportunities.

H2: Beyond Geopolitics: Other Key Risk Factors for Nvidia

While geopolitical factors are significant, Nvidia also faces internal and industry-specific challenges that impact its long-term viability.

H3: Competition and Technological Advancements

The semiconductor industry is highly competitive. Nvidia faces constant pressure from competitors like AMD and Intel to maintain its technological edge.

- Competitor Analysis: Maintaining a competitive edge requires continuous innovation and significant investments in R&D.

- R&D Investments: Nvidia must dedicate significant resources to R&D to stay ahead of the competition and develop cutting-edge technologies.

- Technological Breakthroughs: Disruptive technologies from competitors could pose a serious threat to Nvidia's market share.

- Potential for Disruption: The rapid pace of technological change necessitates agility and adaptability to avoid disruption.

Keywords: Competitive landscape, technological innovation, R&D spending, disruptive technologies, AMD, Intel, competitive advantage.

H3: Talent Acquisition and Retention

Attracting and retaining highly skilled engineers and specialists is a critical challenge for Nvidia in a competitive global talent market.

- Global Talent Competition: Nvidia competes with other tech giants for a limited pool of skilled workers.

- Talent Acquisition Strategies: Nvidia must develop robust talent acquisition strategies to attract top talent.

- Employee Retention: Offering competitive compensation and benefits packages is crucial for retaining skilled employees.

- Skills Gap: Addressing skills gaps through training and development programs is essential.

Keywords: Talent acquisition, skilled labor, workforce development, employee retention strategies, human capital, talent management.

3. Conclusion

Nvidia's success is inextricably linked to the stability and predictability of the global geopolitical landscape. While the US-China tech war presents significant headwinds, the challenges extend far beyond this specific conflict, encompassing regulatory hurdles in Europe, risks in emerging markets, and intense competition in the tech sector. Understanding these multifaceted risks is crucial for investors and industry analysts alike. The key takeaways highlight the need for Nvidia to maintain agility, diversify its operations, and continually invest in innovation to navigate these complex geopolitical and competitive pressures. To stay informed about the evolving geopolitical landscape and its impact on Nvidia and other tech giants, consider following industry experts and subscribing to specialized newsletters focused on semiconductor technology and geopolitical analysis. Understanding Nvidia and the geopolitical landscape is critical for anyone interested in the future of the technology industry.

Featured Posts

-

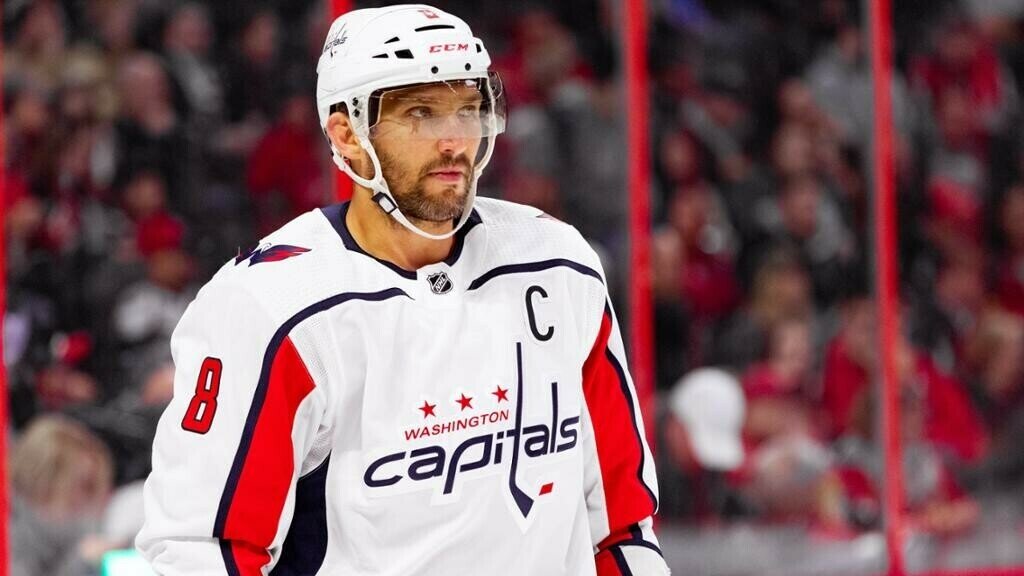

Kogda Ovechkin Pobet Rekord Grettski N Kh L Daet Noviy Prognoz

Apr 30, 2025

Kogda Ovechkin Pobet Rekord Grettski N Kh L Daet Noviy Prognoz

Apr 30, 2025 -

Truong Dh Ton Duc Thang Linh An Tien Phong Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025

Truong Dh Ton Duc Thang Linh An Tien Phong Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025 -

Nclh Stock What Hedge Fund Activity Reveals About Its Future

Apr 30, 2025

Nclh Stock What Hedge Fund Activity Reveals About Its Future

Apr 30, 2025 -

Beyond China A Deeper Dive Into Nvidias Geopolitical Risks

Apr 30, 2025

Beyond China A Deeper Dive Into Nvidias Geopolitical Risks

Apr 30, 2025 -

This Offseasons Top 20 Nfl Trade Targets

Apr 30, 2025

This Offseasons Top 20 Nfl Trade Targets

Apr 30, 2025

Latest Posts

-

Matas Buzelis Tyli Po Savo Vardo Turnyro Vilniuje

Apr 30, 2025

Matas Buzelis Tyli Po Savo Vardo Turnyro Vilniuje

Apr 30, 2025 -

Analyzing The Cleveland Cavaliers Week 16 Performance Trade And Rest Impact

Apr 30, 2025

Analyzing The Cleveland Cavaliers Week 16 Performance Trade And Rest Impact

Apr 30, 2025 -

Bet Mgm 150 Bonus Rotobg 150 Promo Code For Nba Playoffs

Apr 30, 2025

Bet Mgm 150 Bonus Rotobg 150 Promo Code For Nba Playoffs

Apr 30, 2025 -

Nba Playoffs Betting 150 Bonus With Bet Mgm Code Rotobg 150

Apr 30, 2025

Nba Playoffs Betting 150 Bonus With Bet Mgm Code Rotobg 150

Apr 30, 2025 -

Cleveland Cavaliers Post Trade And Rest Period Assessment Week 16

Apr 30, 2025

Cleveland Cavaliers Post Trade And Rest Period Assessment Week 16

Apr 30, 2025