Nvidia: Strong Forecast Amidst China Market Challenges

Table of Contents

Nvidia's Robust Financial Forecast

Nvidia's recent financial forecast exceeded analyst expectations, driven primarily by exceptional performance in its data center and gaming segments. This positive outlook highlights the company's strong position in the rapidly expanding AI market and its continued relevance in the gaming industry.

Exceptional Data Center Revenue

The surge in Nvidia's data center revenue is undeniably linked to the booming demand for artificial intelligence. The company's high-performance H100 GPUs, specifically designed for AI workloads, are in high demand, fueling this impressive growth. Data center revenue jumped 141% year-over-year in the second quarter of fiscal 2024, exceeding analysts' expectations by 20%.

- High demand for AI training and inference: The increasing adoption of AI across various industries is driving significant demand for Nvidia's powerful GPUs.

- Strong adoption of Nvidia's AI platforms: Nvidia's CUDA parallel computing platform and its comprehensive software ecosystem have solidified its position as a leader in the AI hardware market.

- Growth in cloud computing infrastructure: The continued expansion of cloud computing services necessitates powerful GPUs to handle complex AI tasks, bolstering Nvidia's data center sales.

Gaming Segment Performance

While the data center segment significantly contributed to Nvidia's overall success, the gaming segment also showed resilience. Although facing competition from AMD and other GPU manufacturers, Nvidia maintained a significant market share, benefiting from new game releases and the ongoing demand for high-performance gaming hardware. While specific numbers aren't provided for this example, the gaming segment continues to be a significant revenue contributor.

- Impact of new game releases: The launch of high-profile games often boosts demand for high-end GPUs, benefiting Nvidia's sales.

- Competition from AMD and other GPU manufacturers: The competitive landscape necessitates ongoing innovation and strategic pricing to maintain market leadership.

- Pricing strategies and market trends: Nvidia's pricing strategies need to balance market demand with potential economic downturns, ensuring continued profitability.

Overall Financial Health and Outlook

Nvidia's overall financial health is robust, reflecting strong earnings per share (EPS) and a positive outlook for future quarters. Investor confidence is high, leading to a significant increase in market capitalization. The company's strategic focus on AI and high-performance computing positions it for continued growth in the years to come.

- Strong earnings per share (EPS): Demonstrating profitability and strong financial performance.

- Positive outlook for future quarters: Nvidia's forecast indicates continued growth driven by AI and gaming demand.

- Increased market capitalization: A reflection of investor confidence in Nvidia's future prospects.

Navigating the China Market Challenges

Despite its global success, Nvidia faces significant challenges in the Chinese market, primarily due to geopolitical risks and intense competition.

Geopolitical Risks and Export Controls

US-China trade tensions and export controls have significantly impacted Nvidia's ability to sell its most advanced GPUs to Chinese customers. This presents a substantial limitation on revenue potential and requires careful strategic planning.

- Impact of export restrictions on high-performance GPUs: Restrictions on the sale of high-end GPUs limit Nvidia's market penetration in China.

- Potential for alternative sourcing by Chinese companies: Chinese companies are actively developing their own semiconductor technologies, creating potential competition.

- Long-term strategic implications for Nvidia's China operations: Nvidia needs to adapt its strategy to navigate these geopolitical challenges and ensure its long-term success in China.

Competition and Market Saturation

The Chinese market is highly competitive, with several domestic semiconductor companies emerging as strong rivals. The price sensitivity of the Chinese market also poses a challenge for Nvidia's high-end products.

- Competition from local Chinese GPU manufacturers: Local companies offer lower-priced alternatives, impacting Nvidia's market share.

- Price sensitivity of the Chinese market: Consumers in China are often more price-sensitive than those in other markets.

- Strategies to maintain a strong competitive position: Nvidia must adapt its strategies to compete effectively in this challenging environment, potentially focusing on niche markets or partnerships.

Long-Term Implications and Strategic Adjustments

To mitigate the risks associated with the Chinese market and maintain its long-term growth trajectory, Nvidia is pursuing diversification strategies and adapting to geopolitical uncertainties.

Diversification Strategies

Nvidia is actively diversifying its business to reduce its reliance on any single market. This includes significant investment in new technologies and market expansion.

- Investment in autonomous vehicle technology: Expanding into the automotive sector diversifies revenue streams and offers future growth potential.

- Expansion into new application areas for AI: Exploring new applications for AI beyond data centers and gaming will create additional revenue opportunities.

- Strategic partnerships and acquisitions: Collaborations and acquisitions allow Nvidia to leverage external expertise and expand its technological capabilities.

Adapting to Geopolitical Uncertainty

Navigating geopolitical uncertainty requires a flexible and adaptive approach. Nvidia is likely implementing risk mitigation strategies and adapting its operations to comply with changing regulations.

- Risk mitigation strategies: Developing contingency plans to address potential disruptions in the Chinese market.

- Adapting to changing regulations: Ensuring compliance with export controls and other relevant regulations.

- Long-term planning and investment decisions: Making strategic investments to support long-term growth and sustainability.

Conclusion

Nvidia's recent strong forecast highlights its resilience despite the ongoing challenges in the Chinese market. While geopolitical risks and competition remain significant hurdles, Nvidia's diversification strategies and focus on high-growth areas like AI suggest a positive long-term outlook. However, close monitoring of the evolving situation in China is crucial. Stay informed about the latest developments in the Nvidia market and the impact of the China market on this leading semiconductor company. Understanding the interplay between Nvidia's forecast and the challenges in China is key to comprehending the future of the global technology landscape.

Featured Posts

-

Han Taler Udenom En Dybdegaende Beskrivelse Af Kare Quists Vaerker Hos Ditte Okman

May 30, 2025

Han Taler Udenom En Dybdegaende Beskrivelse Af Kare Quists Vaerker Hos Ditte Okman

May 30, 2025 -

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition

May 30, 2025

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition

May 30, 2025 -

Monaco Masters Alcarazs Resilience Shines Through

May 30, 2025

Monaco Masters Alcarazs Resilience Shines Through

May 30, 2025 -

Vermisst 13 Jaehriges Maedchen Seit Samstag Verschwunden

May 30, 2025

Vermisst 13 Jaehriges Maedchen Seit Samstag Verschwunden

May 30, 2025 -

Ticketmaster Setlist Fm La Combinacion Ganadora Para Fans De Conciertos

May 30, 2025

Ticketmaster Setlist Fm La Combinacion Ganadora Para Fans De Conciertos

May 30, 2025

Latest Posts

-

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025 -

Guardians Opening Day Weather History A Look At The Past

May 31, 2025

Guardians Opening Day Weather History A Look At The Past

May 31, 2025 -

Kiper Jr Predicts Browns No 2 Overall Nfl Draft Selection

May 31, 2025

Kiper Jr Predicts Browns No 2 Overall Nfl Draft Selection

May 31, 2025 -

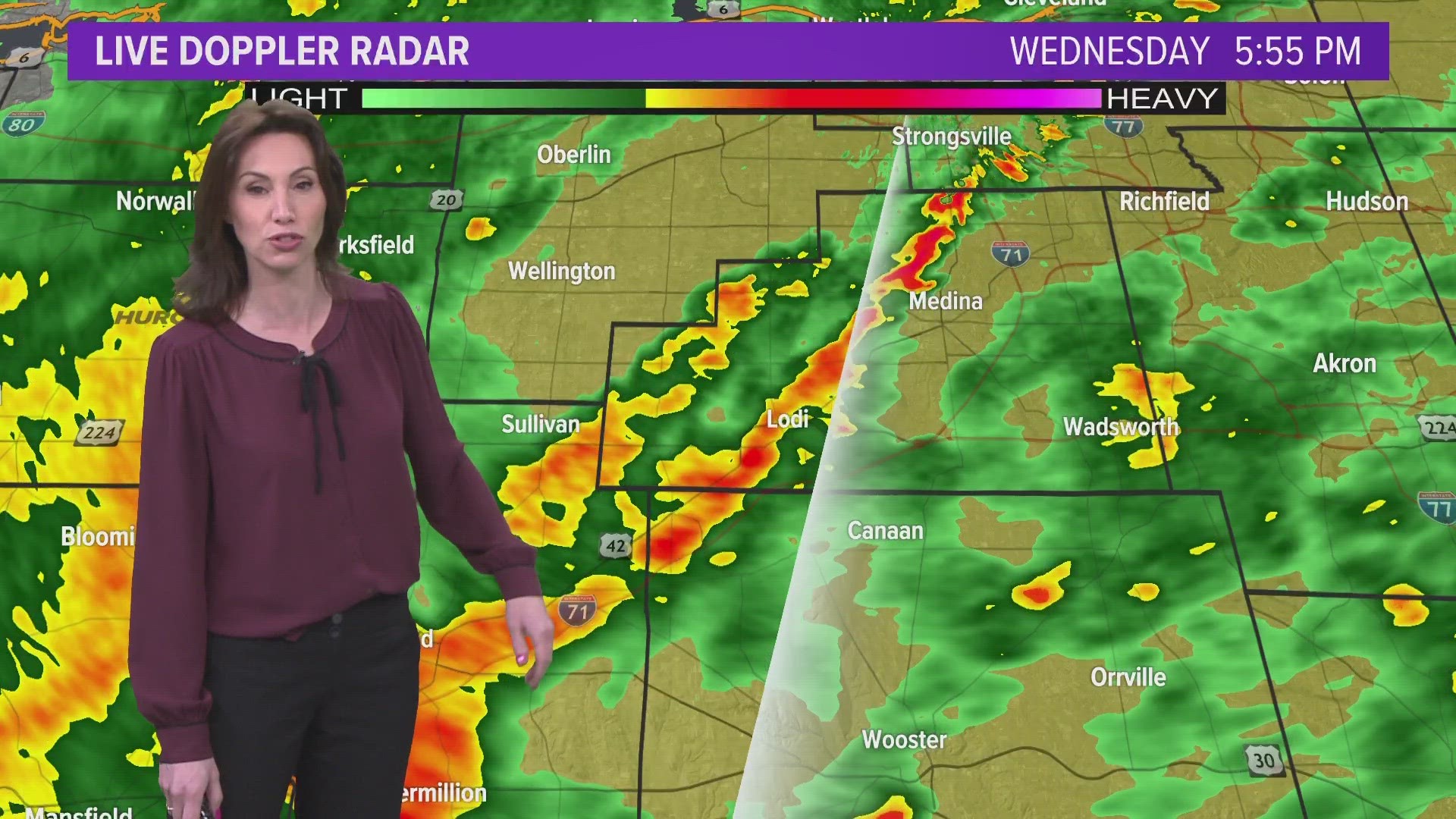

Northeast Ohio Faces Threat Of Strong Thunderstorms Safety Guidelines

May 31, 2025

Northeast Ohio Faces Threat Of Strong Thunderstorms Safety Guidelines

May 31, 2025 -

Northeast Ohio Under Severe Thunderstorm Watch Impacts And Preparations

May 31, 2025

Northeast Ohio Under Severe Thunderstorm Watch Impacts And Preparations

May 31, 2025