Nvidia's Upbeat Forecast Despite China's Slowdown

Table of Contents

Nvidia's Q2 Earnings and Revenue Surpass Expectations

H2: Strong Q2 Performance: Nvidia's Q2 2024 results significantly exceeded analysts' expectations, demonstrating remarkable financial strength. The company reported a substantial increase in both revenue and earnings per share (EPS). Specific numbers will be crucial here, once available, showcasing the percentage growth compared to the previous quarter and the same period last year. For example, a statement like "Revenue soared by X%, reaching $Y billion, exceeding analyst predictions by Z%," will add concrete evidence.

- EPS: [Insert actual EPS figure and percentage change]

- Revenue Growth: [Insert actual revenue growth percentage]

- Gross Margin: [Insert actual gross margin and percentage change]

H3: Data Center Revenue as a Key Driver: A significant contributor to Nvidia's stellar Q2 performance was its data center business. The surging demand for high-performance computing (HPC) and AI solutions fueled this growth. The increasing adoption of AI across various industries, from cloud computing to autonomous vehicles, is a major factor.

- Increased demand for Nvidia's A100 and H100 GPUs in AI development and deployment.

- Strategic partnerships with major cloud providers like AWS, Microsoft Azure, and Google Cloud.

- Successful implementation of Nvidia's AI platform in various enterprise solutions.

H3: Gaming Revenue Performance: While the data center segment drove much of the growth, the gaming sector also played a role. [Insert information about whether gaming revenue met or exceeded expectations, include percentage changes if possible]. The market is competitive; mention if any new product releases or competitor actions impacted results.

- Sales figures for key gaming GPUs (e.g., GeForce RTX series).

- Impact of new game releases and esports on GPU demand.

- Analysis of competitive landscape and market share.

Positive Forecast Despite China's Economic Slowdown

H2: China's Economic Challenges and Their Impact on Tech: China's economic growth has recently slowed, presenting challenges for many technology companies, including those in the semiconductor industry. Geopolitical tensions and potential trade restrictions add further uncertainty.

- Impact of reduced consumer spending in China on GPU sales.

- Potential implications of trade restrictions on Nvidia's supply chain.

- Analysis of the competitive landscape within the Chinese semiconductor market.

H2: Nvidia's Resilience and Future Projections: Despite these headwinds, Nvidia remains optimistic, projecting continued growth. This confidence stems from several strategic initiatives: a focus on high-growth areas such as AI, strategic partnerships, and ongoing investments in R&D.

- Nvidia's projected revenue and earnings growth for the next quarter and fiscal year.

- Planned investments in research and development for next-generation GPUs and AI technologies.

- Expansion plans into new markets and diversification strategies to mitigate risks.

H3: The Role of Artificial Intelligence (AI): The explosive growth of the AI sector is a crucial factor in Nvidia's positive outlook. The demand for Nvidia's high-performance GPUs in AI development and deployment is a key driver.

- The increasing adoption of AI in various industries (healthcare, finance, etc.).

- Nvidia's leading position in the AI hardware market.

- Potential for future revenue streams from AI-related software and services.

Conclusion: Nvidia's Strong Position in a Challenging Market – Investing in the Future of AI

Nvidia's strong Q2 performance and upbeat forecast demonstrate the company's resilience even amid China's economic slowdown. The surging demand for its GPUs, particularly in the rapidly growing AI sector, is a primary driver of its success. This positions Nvidia favorably for continued growth in the foreseeable future. The company's strategic investments in R&D and expansion into new markets further solidify its position as a leader in the tech industry. The strong performance signals significant opportunities for investors interested in the future of AI. Consider further researching Nvidia's performance and the implications for Nvidia's stock and the broader AI market.

Featured Posts

-

Watch Pete Munteans Experience Air Traffic Control Failure On Cnn

May 30, 2025

Watch Pete Munteans Experience Air Traffic Control Failure On Cnn

May 30, 2025 -

Manchester United Elogia Bruno Fernandes O Magnifico Portugues

May 30, 2025

Manchester United Elogia Bruno Fernandes O Magnifico Portugues

May 30, 2025 -

111 Degree Heat Expected In Texas Urgent Warning Issued

May 30, 2025

111 Degree Heat Expected In Texas Urgent Warning Issued

May 30, 2025 -

Explosive Growth In The Vaccine Packaging Market Key Drivers And Opportunities

May 30, 2025

Explosive Growth In The Vaccine Packaging Market Key Drivers And Opportunities

May 30, 2025 -

Iowa School Cell Phone Restrictions The Impact Of The New Legislation

May 30, 2025

Iowa School Cell Phone Restrictions The Impact Of The New Legislation

May 30, 2025

Latest Posts

-

Nyt Mini Crossword Answers March 24 2025 Full Solutions And Hints

May 31, 2025

Nyt Mini Crossword Answers March 24 2025 Full Solutions And Hints

May 31, 2025 -

Solve The Nyt Mini Crossword Answers And Clues For March 24 2025

May 31, 2025

Solve The Nyt Mini Crossword Answers And Clues For March 24 2025

May 31, 2025 -

March 24 2025 Nyt Mini Crossword Complete Answers And Help

May 31, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Help

May 31, 2025 -

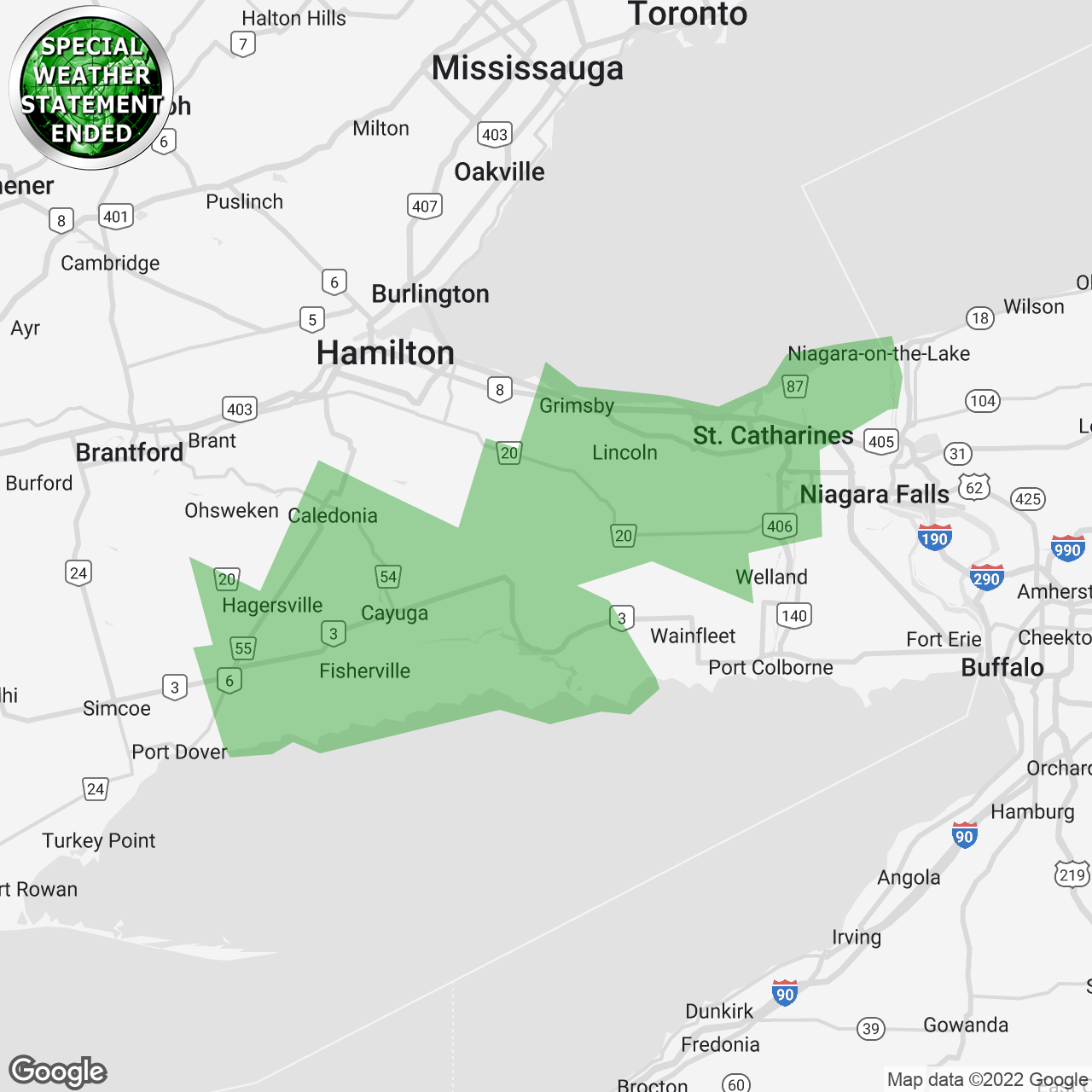

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025 -

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025

Thursday April 10th Nyt Mini Crossword Solutions

May 31, 2025