NYSE Parent ICE's Q1 Earnings Surpass Estimates On Robust Trading Activity

Table of Contents

Exceeding Expectations: A Detailed Look at ICE Q1 Earnings

ICE's Q1 2024 financial performance significantly outpaced analyst predictions. The company reported exceptional growth across various key metrics. Let's break down the numbers:

- Revenue: ICE reported Q1 2024 revenue of [Insert Actual Revenue Figure], exceeding the consensus analyst estimate of [Insert Analyst Estimate]. This represents a [Percentage]% increase compared to Q1 2023 revenue of [Insert Q1 2023 Revenue].

- Earnings Per Share (EPS): ICE's EPS reached [Insert Actual EPS Figure], surpassing the anticipated [Insert Analyst EPS Estimate]. This marks a [Percentage]% increase year-over-year and demonstrates strong profitability.

- Key Metrics: Other key metrics, including [mention specific metrics like operating margin, net income, etc.], also showed significant improvement, indicating a healthy financial position for the company. The positive surprise in these areas further cemented the strength of the ICE Q1 earnings.

- Positive Surprises: A notable positive surprise was the [mention specific unexpected area of growth, e.g., strong performance in a particular geographical market or product segment]. This unexpected boost to the ICE Q1 earnings highlights the company's adaptability and market responsiveness.

Robust Trading Activity: The Engine of ICE's Q1 Success

The robust trading activity across ICE's various markets was the primary driver of its exceptional Q1 performance. Several segments contributed significantly to this success:

- Equities Trading: The NYSE, a cornerstone of ICE's business, experienced a [Percentage]% increase in trading volume compared to Q1 2023. This surge can be attributed to [mention specific factors, e.g., increased market volatility, strong investor sentiment].

- Futures and Options: Trading volume in futures and options contracts also saw substantial growth, with a [Percentage]% increase year-over-year. This reflects increased hedging activity and speculation amidst [mention relevant market events].

- Market Volatility: Increased market volatility, driven by [mention specific geopolitical or economic factors], played a crucial role in boosting trading activity across all segments. This volatility led to higher trading volumes and, consequently, increased revenue.

- Year-over-Year Comparison: Comparing the ICE Q1 earnings to Q1 2023, the increase in trading volume is readily apparent, showcasing a significant improvement in market activity and overall performance.

Data & Analytics Segment Performance: A Growing Revenue Stream

ICE's data and analytics division continues to be a significant contributor to overall earnings, demonstrating strong growth potential.

- Revenue: The data and analytics segment generated [Insert Revenue Figure] in revenue during Q1 2024, representing a [Percentage]% increase compared to the same period last year.

- Growth Rate: This impressive growth rate reflects the increasing demand for ICE's data and analytics products and services across various sectors.

- New Products and Partnerships: The launch of [mention new products or services] and strategic partnerships with [mention key partners] have further fueled the growth of this segment.

- Long-Term Potential: The long-term growth potential of this segment remains substantial, given the growing reliance on data-driven decision-making in the financial industry.

Future Outlook and Investor Implications of ICE Q1 Earnings

ICE's Q1 2024 results paint a positive picture for the remainder of the year, though challenges remain.

- Future Projections: ICE has provided guidance for the rest of 2024, projecting [Summarize ICE's projections for the year].

- Potential Risks: Potential risks include [mention potential risks, e.g., geopolitical instability, regulatory changes, increased competition].

- Impact on Stock Price: The strong Q1 earnings are likely to have a positive impact on ICE's stock price, enhancing investor confidence.

- Investment Strategies: Investors may consider [suggest potential investment strategies based on the Q1 results, e.g., holding or increasing their positions in ICE stock].

Conclusion

ICE's Q1 2024 earnings report significantly exceeded expectations, primarily driven by robust trading activity across its markets. The impressive performance of the data and analytics division further solidified the company's financial strength. These strong ICE Q1 earnings, coupled with positive future projections, suggest a promising outlook for investors. However, potential risks should be carefully considered.

Call to Action: Stay informed on future ICE Q1 Earnings announcements and market analysis to make informed investment decisions. Follow [your website/platform] for the latest updates on ICE and other key market players. Understanding the nuances of ICE Q1 earnings and subsequent reports is crucial for successful investing in the financial sector.

Featured Posts

-

Tentative D Intrusion Dejouee A Toulon Un Individu Sous Oqtf Et L Intervention D Un Policier

May 14, 2025

Tentative D Intrusion Dejouee A Toulon Un Individu Sous Oqtf Et L Intervention D Un Policier

May 14, 2025 -

Teammate Confirms Liverpool Summer Signing Imminent

May 14, 2025

Teammate Confirms Liverpool Summer Signing Imminent

May 14, 2025 -

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025 -

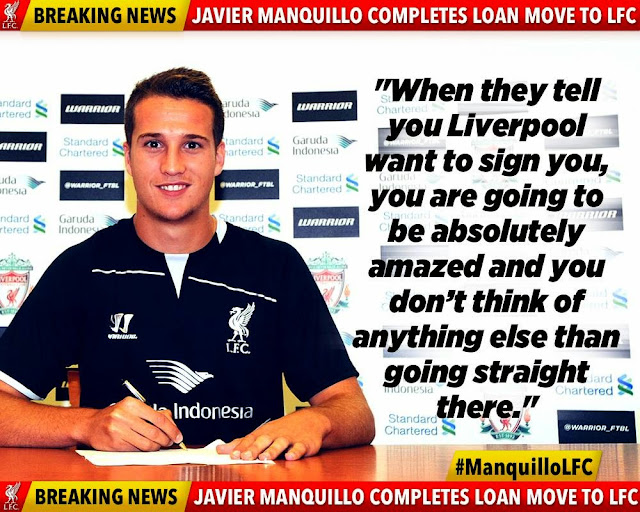

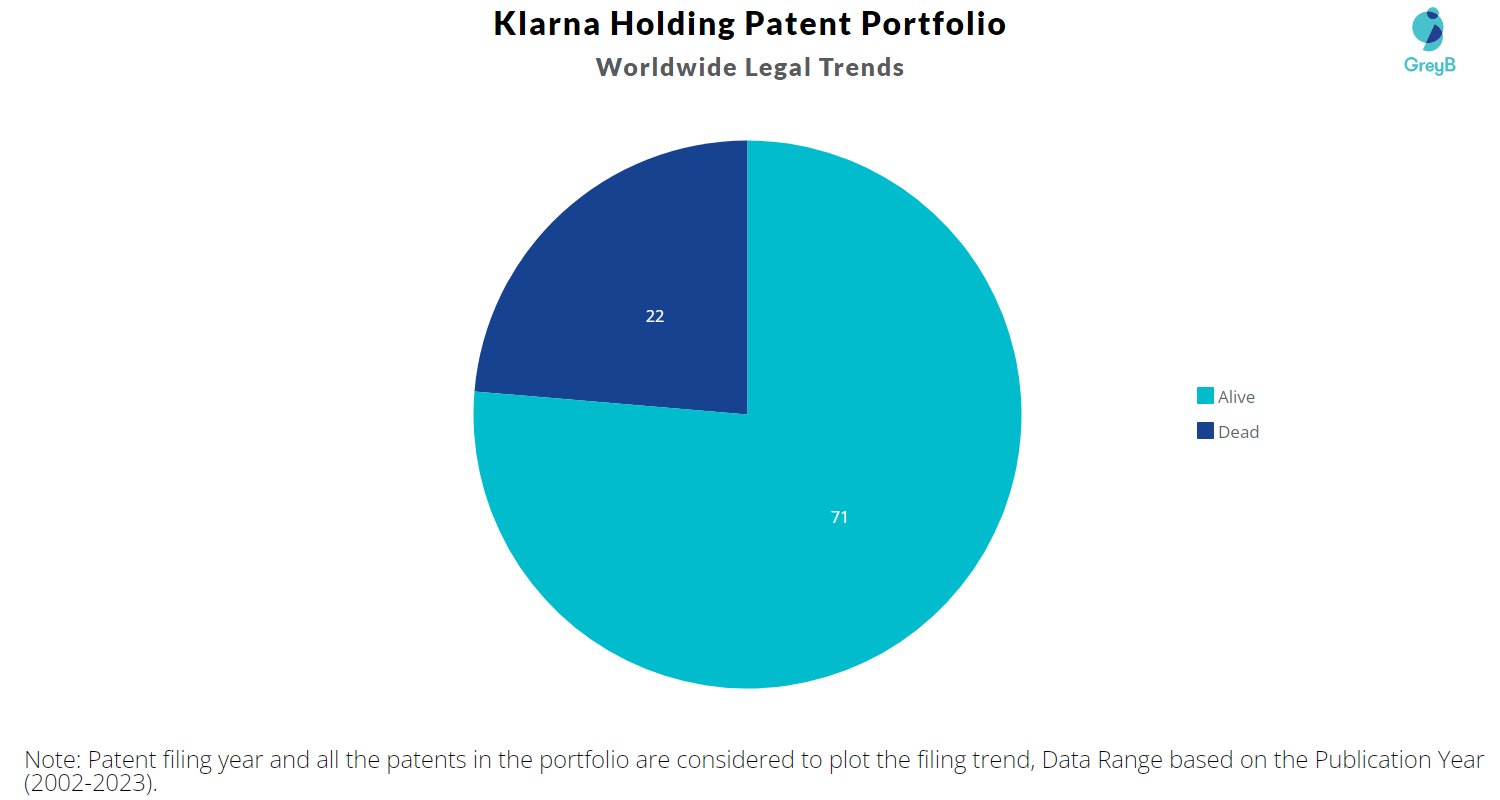

Klarna Aims For 1 Billion Ipo As Early As Next Week

May 14, 2025

Klarna Aims For 1 Billion Ipo As Early As Next Week

May 14, 2025 -

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

May 14, 2025

Auto Dealers Double Down On Resistance To Electric Vehicle Regulations

May 14, 2025