Oil Market Update: Key Developments And Price Analysis For May 16

Table of Contents

Global Crude Oil Supply and Demand Dynamics

The global oil market is a delicate balancing act between supply and demand. Several factors heavily influence this equilibrium, impacting crude oil prices like Brent and WTI.

OPEC+ Production Decisions and Impact

OPEC+ meetings regularly shape global oil supply. On May 16th (replace with actual date and details if available), the cartel's decision to (insert actual decision regarding production quotas – increase, decrease, maintain) significantly influenced market sentiment. For instance, if OPEC+ chose to reduce production, this would likely lead to a tightening of the market and upward pressure on prices. Specific countries like Saudi Arabia and Russia play crucial roles in these decisions, impacting global crude oil supply and therefore, oil demand. Analyzing their individual production levels is vital in understanding overall market dynamics and predicting future oil price trends.

- Saudi Arabia's role: (Insert details about Saudi Arabia's production and its impact on the May 16th oil prices).

- Russia's influence: (Insert details about Russia's production and its geopolitical impact on the oil market).

- Impact on global supply: The collective decisions of OPEC+ members directly translate to changes in the global oil supply, influencing the overall price.

Geopolitical Events and Their Influence on Oil Prices

Geopolitical instability is a primary driver of oil price volatility. Events such as wars, sanctions, or political unrest in major oil-producing regions can significantly disrupt supply chains and influence investor sentiment. On May 16th, (insert specific geopolitical events impacting oil prices, e.g., ongoing conflicts, sanctions on specific countries). These events created uncertainty in the market, leading to price fluctuations.

- Specific geopolitical event 1: (Describe the event and its impact on oil prices.)

- Specific geopolitical event 2: (Describe the event and its impact on oil prices.)

- Impact on supply chains: Disruptions to oil transportation routes or refinery operations due to geopolitical tensions directly impact the availability of crude oil, leading to price increases.

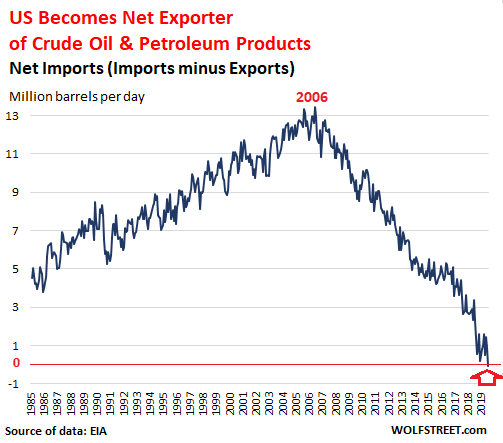

US Shale Oil Production and its Role

US shale oil production plays a significant role in the global oil market. The current state of US shale oil production and its responsiveness to price changes influence global supply and demand dynamics. On May 16th, (Insert information on US shale oil production levels and their influence on the day's oil price movements). Changes in US shale oil production can act as a buffer to price shocks caused by geopolitical events or OPEC+ decisions.

- Production levels: (Provide data on US shale oil production for May 16th.)

- Impact on global prices: (Analyze how US shale oil production influenced global oil prices on that day.)

- Future production outlook: (Offer a brief outlook on the future trajectory of US shale oil production and its potential impact on global markets.)

Oil Price Analysis for May 16

This section provides a detailed analysis of oil price movements on May 16th.

Price Movements and Trends

On May 16th, Brent crude oil prices (insert price) and West Texas Intermediate (WTI) crude oil prices (insert price) experienced (insert description – increase, decrease, fluctuation). (Insert chart or graph illustrating price movements). The price changes reflected the combined effect of the factors discussed above.

Factors Influencing Price Changes

Several interconnected factors influenced the price changes on May 16th:

- OPEC+ decisions: (Reiterate the impact of OPEC+'s production decisions.)

- Geopolitical events: (Summarize the effect of geopolitical instability on market sentiment and prices.)

- US shale oil production: (Discuss the role of US shale production in moderating price movements.)

- Economic indicators: (Mention any relevant economic indicators, e.g., global growth forecasts, that impacted oil demand and prices.)

- Investor sentiment: (Analyze market sentiment and how it influenced trading activity and price direction.)

Short-Term and Long-Term Price Outlook

Based on the current market conditions, the short-term outlook for oil prices is (insert short-term outlook – bullish, bearish, neutral) due to (explain the reasons). The long-term outlook is (insert long-term outlook) primarily influenced by (explain the factors influencing the long-term outlook). This outlook is subject to change based on future events and shifting market dynamics.

Impact on Related Sectors

Fluctuations in oil prices have a significant ripple effect on several related sectors.

Impact on the Transportation Sector

Changes in crude oil prices directly impact fuel prices, affecting transportation costs for airlines, trucking companies, and consumers. Higher oil prices translate to increased fuel costs, potentially leading to higher transportation costs and inflation. On May 16th, the (increase/decrease) in oil prices had a (positive/negative) impact on the transportation sector.

Impact on the Petrochemical Industry

The petrochemical industry, which relies heavily on oil as a feedstock, is significantly affected by oil price fluctuations. Price increases in crude oil translate to higher production costs for plastics, fertilizers, and other petrochemical products. The petrochemical industry's profitability is intrinsically linked to oil price stability.

Conclusion: Key Takeaways and Future Outlook for the Oil Market

The oil market on May 16th saw significant price movements driven by a combination of OPEC+ decisions, geopolitical events, and the performance of US shale oil production. The interplay of these factors resulted in (summarize the net effect on oil prices). Understanding these dynamics is crucial for investors, businesses, and policymakers.

Stay informed on future oil market updates by subscribing to our newsletter or checking back regularly for the latest oil price analysis. Understanding oil market trends and price fluctuations is vital for making informed decisions in a constantly evolving global energy landscape.

Featured Posts

-

Canadas Tsx Composite Index Reaches New Intraday Peak

May 17, 2025

Canadas Tsx Composite Index Reaches New Intraday Peak

May 17, 2025 -

Middle Management Their Crucial Role In Company Performance And Employee Development

May 17, 2025

Middle Management Their Crucial Role In Company Performance And Employee Development

May 17, 2025 -

Section 230 And Banned Chemicals A Recent Legal Decision Affecting E Bay

May 17, 2025

Section 230 And Banned Chemicals A Recent Legal Decision Affecting E Bay

May 17, 2025 -

Venezia Vs Napoles En Vivo Y En Directo

May 17, 2025

Venezia Vs Napoles En Vivo Y En Directo

May 17, 2025 -

Crude Oil Market Report News And Insights For May 16 2024

May 17, 2025

Crude Oil Market Report News And Insights For May 16 2024

May 17, 2025

Latest Posts

-

Hondas Canada Plant Beneficiary Of Us Trade Policy Changes

May 17, 2025

Hondas Canada Plant Beneficiary Of Us Trade Policy Changes

May 17, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Cost Increase

May 17, 2025

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Cost Increase

May 17, 2025 -

Us Tariffs On Honda Shifting Production To Canada

May 17, 2025

Us Tariffs On Honda Shifting Production To Canada

May 17, 2025 -

Brunson Weighs In Thibodeaus Future With The Knicks

May 17, 2025

Brunson Weighs In Thibodeaus Future With The Knicks

May 17, 2025 -

1 050 Price Increase For V Mware At And T Sounds The Alarm On Broadcoms Acquisition

May 17, 2025

1 050 Price Increase For V Mware At And T Sounds The Alarm On Broadcoms Acquisition

May 17, 2025