Ontario Invests In Manufacturing: Tax Credit Expansion In The Budget

Table of Contents

Key Highlights of the Expanded Manufacturing Tax Credit

The expanded Ontario manufacturing tax credit offers substantial incentives for businesses to invest in growth and modernization. Understanding the details of this enhanced program is crucial for manufacturers looking to capitalize on this opportunity. Here are the key highlights:

-

Percentage of Eligible Expenses Covered: The exact percentage will be specified in official government documentation (replace with actual percentage once available). This percentage reflects a significant increase compared to previous programs, making the incentive more attractive.

-

Eligible Manufacturing Businesses: A wide range of manufacturing businesses are eligible, including but not limited to automotive parts manufacturers, food processing plants, advanced manufacturing facilities specializing in robotics or AI, and other related industries. Specific industry classifications will be detailed in the official program guidelines.

-

Investment Thresholds: To qualify for the full tax credit, businesses may need to meet specific investment thresholds. These thresholds will vary depending on factors like company size and type of investment. Details on these thresholds will be available on the official government website.

-

Duration of the Program: The expanded tax credit program is designed to run for [Insert duration, e.g., three years], providing long-term support for manufacturing investments. This long-term commitment provides businesses with the certainty needed for long-term planning and investment.

-

Changes to Previous Programs: This expansion builds upon previous manufacturing tax incentive programs, often incorporating improvements based on feedback and aiming to streamline the application process. Specific changes from previous iterations should be clearly outlined in the official program guidelines.

Benefits for Ontario Manufacturers

The expansion of these Ontario manufacturing tax credits translates to numerous benefits for businesses across the province. These incentives are designed to stimulate growth and enhance Ontario's competitive edge in the global marketplace.

-

Increased Profitability and Competitiveness: The substantial tax relief allows manufacturers to reinvest profits, leading to improved efficiency, innovation, and increased profitability. This enhanced competitiveness allows Ontario manufacturers to compete more effectively on a national and global scale.

-

Attracting New Investments and Expanding Operations: The attractive tax incentives make Ontario a more appealing destination for new manufacturing investments and encourage existing businesses to expand their operations within the province. This leads to increased production capacity and economic growth.

-

Creation of High-Skilled Jobs: Investments facilitated by the tax credits often translate into the creation of well-paying, high-skilled jobs in the manufacturing sector. This strengthens the local workforce and helps to build a thriving and sustainable economy.

-

Modernization and Upgrading of Facilities: The tax credits incentivize manufacturers to upgrade their facilities with cutting-edge technologies, boosting productivity and efficiency. This modernization ensures Ontario businesses remain at the forefront of global manufacturing advancements.

-

Strengthening Ontario’s Position as a Global Manufacturing Hub: By providing a supportive environment for manufacturers, Ontario strengthens its position as a key player in the global manufacturing landscape, attracting investment and talent from around the world.

How to Apply for the Ontario Manufacturing Tax Credit

The application process for the Ontario manufacturing tax credit is designed to be straightforward and accessible. Here’s a step-by-step guide:

-

Application Forms: The application forms and detailed instructions can be found on the official website of the Ontario government [Insert Link Here].

-

Required Documentation: Be prepared to submit supporting documentation such as financial statements, proof of investment, and other relevant information. Detailed lists of required documents are available on the application website.

-

Submission Deadlines: There will be deadlines for submitting applications, so it's important to review the guidelines carefully to ensure timely submission. Keep an eye out for any announced deadlines on the government website.

-

Contact Information: If you have any questions or need assistance with the application process, contact information for support and inquiries is available on the government website.

Comparison with Other Provincial Manufacturing Incentives

While other provinces offer manufacturing incentives, Ontario's expanded tax credit program stands out due to its [Insert specific advantages here, e.g., generous percentage of eligible expenses covered, broad range of eligible businesses, streamlined application process]. A detailed comparison with programs in other provinces would require further research, consulting official government resources from each province.

Conclusion

The expanded Ontario manufacturing tax credits represent a significant investment in the future of Ontario’s manufacturing sector. By offering substantial tax relief and encouraging investment, this program will fuel economic growth, create high-skilled jobs, and strengthen Ontario's position as a global manufacturing leader. These Ontario manufacturing tax incentives are a vital tool for businesses looking to thrive in a competitive marketplace. Take advantage of Ontario's expanded manufacturing tax credits today – visit [Insert Link Here] to learn more and apply! Boost your Ontario manufacturing business with these expanded tax credits. Apply now!

Featured Posts

-

Commerce Advisor Highlights Governments Focus On Successful Ldc Graduation

May 07, 2025

Commerce Advisor Highlights Governments Focus On Successful Ldc Graduation

May 07, 2025 -

Rsmssb Recruitment 2025 26 Exam Schedule And Notification

May 07, 2025

Rsmssb Recruitment 2025 26 Exam Schedule And Notification

May 07, 2025 -

Explore Rihannas Savage X Fenty Wedding Night Lingerie

May 07, 2025

Explore Rihannas Savage X Fenty Wedding Night Lingerie

May 07, 2025 -

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 07, 2025

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 07, 2025 -

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025

Latest Posts

-

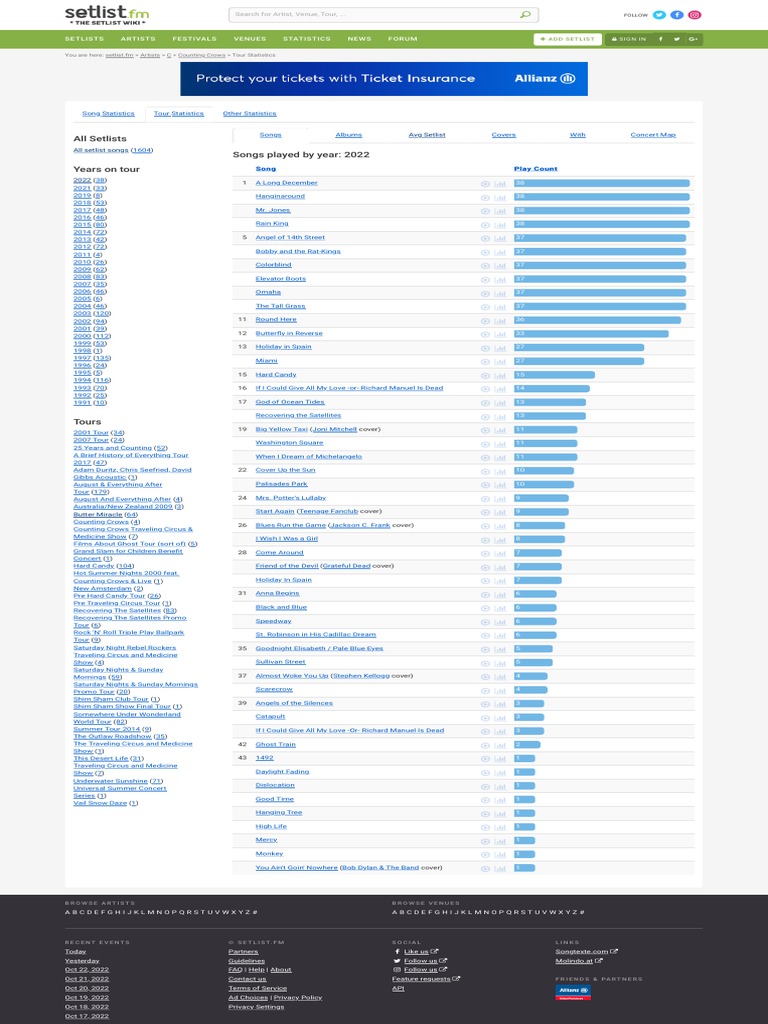

Counting Crows Snl Appearance A Turning Point In 1995

May 08, 2025

Counting Crows Snl Appearance A Turning Point In 1995

May 08, 2025 -

Top Nba Playoffs Triple Doubles Leaders A Challenging Quiz

May 08, 2025

Top Nba Playoffs Triple Doubles Leaders A Challenging Quiz

May 08, 2025 -

Potential Counting Crows Setlist For 2025 Concerts

May 08, 2025

Potential Counting Crows Setlist For 2025 Concerts

May 08, 2025 -

Are You An Nba Playoffs Triple Doubles Expert Take Our Quiz

May 08, 2025

Are You An Nba Playoffs Triple Doubles Expert Take Our Quiz

May 08, 2025 -

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025